Quotes from Industry Leaders on the $1M+ Home Market

“The traditional market weak spot – homes in the $1 million-$2.5 million range – has come back to life,” said Tom Dunlap, general manager at Prudential California Realty in Beverly Hills. “There is a lot of cash parked on the sidelines and the price is coming down now to where people who have been watchful are coming off the sidelines.”

Leslie Appleton-Young, chief economist at the California Association of Realtors in Los Angeles, sees the movement in luxury homes as the next phase in the recovery of the housing market, which started its collapse as subprime loans soured. The problems took longer to reach affluent home buyers, who had enough assets and income to wait out the market. But now even the owners in swanky neighborhoods need to sell and have dropped their asking prices significantly, especially as job losses have taken their toll on all wage groups.

“You’re seeing values at the high end,” Appleton-Young said. “Also, the spread of foreclosures starting a year ago has affected the high end. You’re seeing more nondiscretionary sellers now than earlier in the recession.”

*Sources: Los Angeles Business Journal

750K and Below Market Update

For homes selling for less than $670,000 that qualify for Federal Housing Administration-backed loans are seeing multiple offers and are being overbid by as much as 10% in some cases due to a lack of inventory.

This week, I submitted an offer on behalf of my clients for a 3 bed/2 bath remodeled house in the Holly Glen/Del Aire area with a listing price of $569,000. The offer was well over asking with short contingency periods and my clients didn’t get the property. They received 8 offers and only 1 of them was under the asking price. Many of the buyers were putting over 30% down. This type of demand will continue unless inventory significantly picks up and liberal FHA loan terms remain in effect.

Notes on a Realtor’s Scorecard

(i.e.- weekly neighborhood notes, school info, random real estate news, etc):

*In the ritzy 90402 Santa Monica zip code, the cost of buying a home (based on a 20% downpayment and 5.5% interest rate) is about double the cost of renting. . .

*The Santa Monica City Council unanimously approved St. Monica’s development plan which includes adding a new 27,500 sq. ft. community center, 7,700 sq. ft. of new classrooms, three levels of subterranean parking and renovating the auditorium and athletic facilities. They hope to begin the project sometime next year and should take three to four years to complete. Please read more at www.smdp.com . This will be great for the community and help St. Monica’s schools continue to improve their academic reputation. However, this project combined with the California Incline project means serious traffic issues for North of Wilshire residents.

*Manhattan Beach’s sand dune hill (extremely popular with fitness enthusiasts and sports teams) will finally re-open but with restrictions requiring people to reserve online and expected to pay a $3-5 usage fee. The fee will be used to help maintain the area and it will also cut down on usage by 70% to appease the neighbors…don’t be surprised if a similar fee is enacted at the Santa Monica stairs in the next few years…fitness enthusiasts beware.

*Prudential Southern California had 1700 transactions in March which is the best March the company has had since 2005. In fact, the company is already profitable for the year, two months earlier than last year.

* Foreclosure Radar reports that notices of default (NODs) recorded in California for February amounted to 31,004, a jump of 20% from the 25,904 in January. Notice of trustee’s sales (NOTS) filed in February increased by 4% to 28,195, from 27,220 in January. Both the increases in NODs and NOTS reverse the three-month trend of decreases seen since the November cyclical slowdown in foreclosures at the end of each year.

A Day At An LA County Foreclosure Auction…

If you’ve never been to an L.A. County foreclosure auction, it’s a sobering experience. The auctioneer, who would identify himself only by his first name (could be a flashpoint to anyone bent on revenge), first reads off a ton of addresses and why those properties’ auctions were either postponed (mutual agreement was often the reason) or canceled (bankruptcy was a common cause). That leaves about 20 properties on the docket for the day’s auction. The scenario is repeated five days a week both in Pomona and at the county courthouse in Norwalk.

The auction has a start time of 10:00 or 10:30 a.m. but it’s more like 10:50/11:10 before the action begins due to the cancellations. The regulars bring collapsible canvas chairs and carry cashier’s checks to make their purchases. Some read books during the wait or make phone calls as the day doesn’t usually end until about 4 pm.

In the pecking order of the auction, the front row is usually reserved for registered bidders and the order of the auction is determined by the auctioneer.

In less than a minute, ownership of a property can revert back to the lender. Successful bidders must have cashier’s checks ready in the amount they are willing to pay for the property. Most seasoned veterans bring a cashier’s check for the minimum bid and cashier’s checks in smaller amounts up to the amount they are willing to pay for the properties they want.

You must have cash to purchase the property and you are buying it without the right to rescind. A buyer can really get burned if they do not know what they are doing and understand the neighborhood they are buying in. However, companies and individuals that specialize in these types of purchases can make out like a thief and turn a 50% profit in as little as three months. Quite a bit of homework must be done by the purchaser. Don’t think this is your typical auction…

*Sources: Los Angeles Business Journal and Dan Gura

Looking Back at the 1st Quarter of 2010

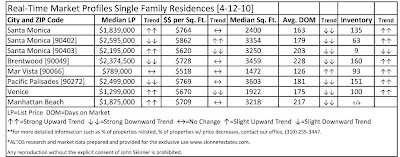

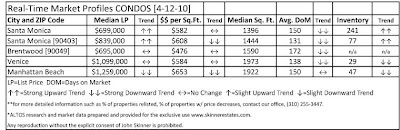

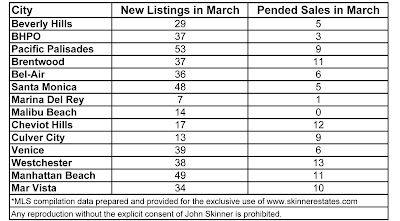

The first quarter of 2010 was the busiest 1st quarter in a long time for most of the Southern California market, especially the Westside and South Bay. As you can see from the numbers posted on this blog, activity is way up thanks to the convergence of three main factors:

1) Sellers pricing more realistically (at least 15% off market heights)

2) Low inventory

3) Low interest rates/fear of higher rates

Reminiscent of days in 2003-2006, we saw quick sales, multiple offers, cash buyers and people getting asking prices and beyond. The micro markets of the Westside/South Bay definitely did not match what was going on in other parts of the nation where sales were flat or down year-over-year. We are definitely seeing what the value of wonderful weather and having an international fascination with your city can do to stabilize housing prices.

What the Westside/South Bay saw in the first quarter did seem to be more typical of higher-end housing markets in several parts of the U.S., as reported by CNBC and others last week.

“People are not as uptight as they were a year ago,” says mortgage lending company exec Steve Habetz. “It seems as if they are more comfortable in thinking the high end housing market is not collapsing. Home values have stabilized and it’s been a matter of following the leader. One person sees others buy or sell and they join in. That’s been happening.”

Simply put, this confidence has created some stabilization in housing prices on the high end which has been struggling while other Westside/South Bay locales under a million dollars were recovering.

With realtors fielding quite a few calls from both sellers and buyers seriously inquiring about the market, activity should stay strong through the second quarter but the market will probably cool down some with the government beginning to quiet its involvement in the market (Federal Tax credit expires April 30th and no longer buying mortgage backed securities) and interest rates beginning to climb.

As the finance and economic blog Calculated Risk (I highly suggest book-marking this site- great source for constantly updated economic news) noted this Monday, a strong drop in refinancing’s is to be expected now: “With the yield on the Ten Year Treasury increasing to 4%, and the end of the Fed MBS purchase program last week, mortgage rates will probably rise and refinance activity will fall sharply.”

However, rates aren’t the only thing that drives the market. It might bring prices down but as long as the overall economy continues to recover, the market will probably not see a major double dip which some economists are predicting…Who knows, if I had a crystal ball I wouldn’t be writing this blog right now and would be playing golf at Pebble Beach:)

Remember, if you are thinking of buying or selling real estate you should call our office. More than ever it is important that you align yourself with a real estate professional that is trustworthy, hard working, covers the details and truly understands the market. We pride ourselves on exactly that.

LAUSD Rescinds Permit Change For Now

Some 12,000 students and panicked parents won a reprieve on Tuesday when Los Angeles schools Supt. Ramon C. Cortines said most students who attend schools outside of the district can continue to do so next year, a retreat from a recent, more restrictive policy that provoked an outcry from parents, other school districts and some members of his own Board of Education.

But whether students who live in the Los Angeles Unified School District will be allowed to continue to attend schools elsewhere after the 2010-11 school year remains unresolved. Cortines said he expects to return to the board in September with a new policy.

Last year, L.A. Unified released more than 12,200 students to 99 other Southern California school districts, including 945 to Beverly Hills, over 700 to Santa Monica, 1,700 to Torrance, 1,400 to Culver City and 1,400 to Las Virgenes.

Please see full articles below:

Daily Breeze

LA Times

Dogtown Station Condo Project Update

The pricey (*still a bit overpriced in my opinion) Dogtown Station condominium project at 700 Main St. in Venice is undergoing an ownership change. The developer RAD Ventures, LLC is going to buy out its equity partner, California Public Emplpyees’ Retirement System “Calpers” after a dispute in how to handle lagging sales. RAD is also in final steps to getting a new mortgage for the project.

“Calpers would have been happy to accelerate sales and get out of the project and move on. I am more interested in taking my time,” said RAD Managing Partner Robert D’Elia, who opted to not lower prices, which range from $575 to $600 per square foot. “It’s a delicate balance between maximizing price and the cost of money.”

The $40 million dollar 35-unit project was completed in January 2009.

Dogtown has found some recent success with a marketing campaign that highlights how the units can serve both as residences and offices. Units are built with open floor plans and include rooftop patios or balconies. The high ceilings and loft layouts have attracted live-work occupants.

75 percent of buyers have said they will use the lofts as live-work spaces. Owners include artists; producers; and actors, such as Dylan McDermott, who will house his production company there.

(*Source: Full Article: Los Angeles Business Journal – Daniel Miller)

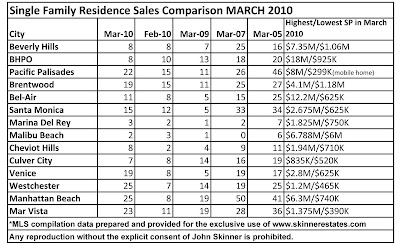

March Sales Data for Single Family Homes + Analysis

*The most expensive listing sold in March for $18 million, reduced significantly from its original listing price in July 2009 of $29.9 million. This 8 bedroom, 11 bath mansion sits on more 4 acres in BHPO. Even this remarkable estate shows that now is the time to buy for a steal of a deal.

*Sales were up significantly in the month of March. A large jump up in the Manhattan Beach area, but still down 50% from 2007 and the height of the market. Significant upward sales trends also in Westchester, Venice, Mar Vista, and Pacific Palisades, but again much smaller numbers than 2005 and 2007.

- ‹ Previous

- 1

- 2

- 3

- Next ›