New Listing: Designer Perfect Townhouse- 2922 Montana Ave.

OPEN SUNDAY 2/27/11 1pm to 4pm

Property Web-Site: http://www.2922MontanaAve.com/

Designer perfect 2 bed/2.5 bath tri-level townhouse across from the Brentwood Country Club and steps to the best the Westside has to offer. One of only 5 units, you will be immediately drawn to the soaring ceiling and amazing natural light.

Designer perfect 2 bed/2.5 bath tri-level townhouse across from the Brentwood Country Club and steps to the best the Westside has to offer. One of only 5 units, you will be immediately drawn to the soaring ceiling and amazing natural light.

Property Web-Site: http://www.2922MontanaAve.com/

List Price: $1,149,000

Designer perfect 2 bed/2.5 bath tri-level townhouse across from the Brentwood Country Club and steps to the best the Westside has to offer. One of only 5 units, you will be immediately drawn to the soaring ceiling and amazing natural light.

Designer perfect 2 bed/2.5 bath tri-level townhouse across from the Brentwood Country Club and steps to the best the Westside has to offer. One of only 5 units, you will be immediately drawn to the soaring ceiling and amazing natural light.

Features include gourmet kitchen, exotic wood floors, wrought iron banisters & railings, double sided fireplace, phenomenal loft space perfect for a home office, luxurious master bath, outdoor space on every l evel and a private two car garage with room for storage.

evel and a private two car garage with room for storage.

This is all topped off with a stunning and spacious rooftop deck that provides ocean and city light views. Come by and check it out. Please call us (310) 255-3447 for more information or to schedule a showing.

OFF THE BEATEN PATH – Top 3 Deli’s in Santa Monica

Every so often we are going to include a non real estate related item in the blog that we thought you might enjoy…Here are our picks for the top 3 deli’s in Santa Monica.

#1- Bay Cities Italian Deli (www.baycitiesitaliandeli.com/) 1517 Lincoln Blvd. Santa Monica, CA (310) 395-8279: Simply put the best subs around and that is why they are getting the #1 ranking. The line can sometimes go 50 deep at lunch for their famous subs. They also provide great pasta, an outstanding selection of olive oils, 20 different brands of hot sauce and delicious baked breads to go with top of the line meat selections.

#2- Izzy’s Deli (www.izzysdeli.com)- 1433 Wilshire Blvd., Santa Monica, CA (310) 394-1131: About 10% more expensive than Fromin’s but you get a better overall scene and comfort to go along with slightly better food in our opinion. The expansive menu features overstuffed sandwiches and features most traditional Jewish foods. Good kids menu. They do a great job with breakfast items and it is known as the deli to the stars so who knows who you might run into. Open 24 hours.

#3- Fromin’s Deli– 1832 Wilshire Blvd. Santa Monica, CA (310) 829-5443: Similar menu to Izzy’s but Fromin’s has a wider selection of products in the take-out section and it is known for being more traditionally Jewish. They have a well known fish platter and the steak sandwich is delicious and easily serves two people. For $12 it is a great meal for two…

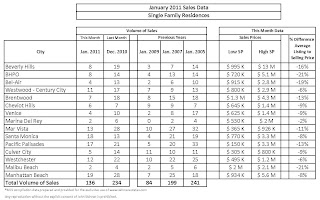

In-depth look at January Sales Data

It was chilly month for sales volume in January on the Westside and in Manhattan Beach compared to the previous few months of sales. This can be attributed to the holiday slow-down with people waiting to start really looking for a home in January and February and the inventory of available homes not being very strong.

Sales in January are definitely quite a bit stronger than during the start of the Great Recession with a solid 39% increase over January 2009 sales. However, sales are still down 32% compared to 2007 and 43% compared to the market hay-day of 2005.

When analyzing the sales data for the month and eliminate extremes in Original List Price vs. Sales Price, we find the gap is shrinking to 5 to 7%, whereas the difference was about 10% in mid 2010.

A few notes on areas and individual sales:

Santa Monica – As I mentioned in a previous blog post, 848 23rd St. a tear-down on an 8K lot was listed at an auction price and received over 20 offers and ended up selling 40% higher at $1,385,000.

On the flip side, 22 Latimer Road a 4 bed/4 bath, 2,800 sq. ft. home was originally on the market for $2.99M and sold 30% lower then asking price after being on the market for a year and having several price reductions.

The majority of homes in Santa Monica sold for 7% below list price to 3% above list price. 720 Georgina a 5 bed/3 bath sold slightly over asking price at $3.009M and was only on the market for 2 weeks before going into escrow.

The majority of homes in Santa Monica sold for 7% below list price to 3% above list price. 720 Georgina a 5 bed/3 bath sold slightly over asking price at $3.009M and was only on the market for 2 weeks before going into escrow.

Pacific Palisades- 387 Arno Way a 2400 sq. ft. 4 bed/ 2.75 bath home was listed at $1.485M in July and sold 2% above listing price at $1.513M.

621 Amalfi Dr., 4 bed/4 bath, 4,094 sq. ft. with a lot size 14,240 sq. ft. was originally listed at $3.995M and sold for 2.6M, 28% below list price. It was on the market 9 months.

**The low-end 150K sale price for the Palisades was for the sale of an attached mobile home off PCH.

Manhattan Beach- 3116 Manhattan Beach Ave. a 3,293 sq. ft., 3bed/3 bath home was originally listed at $3.1M and eventually sold for $2.0M, 35% below the original list price. The majority of single family residences sold for 7% less than the original list price.

Opportunity Knocks – 2808 Arizona Ave., Santa Monica

Open Sunday 2/27/11 1pm to 4pm

Property Web-Site: http://www.2808arizona.com/

List Price: $749,000

Stunning Tri-level Townhouse located in a prime Santa Monica location just south of Wilshire. One of only four units, this hard to find 3 bed/2.5 bath with soaring ceilings captures a ton of natural light.

Stunning Tri-level Townhouse located in a prime Santa Monica location just south of Wilshire. One of only four units, this hard to find 3 bed/2.5 bath with soaring ceilings captures a ton of natural light. Features include a remodeled kitchen with granite counters, Indonesian oak hardwood floors, fireplace in the living room and master, plantation shutters, spacious loft perfect for a home office, private roof top deck, side by side parking in gated garage,  security system, wetbar with wine frig and indoor laundry. Please contact us if you would like more information (310) 255-3447.

security system, wetbar with wine frig and indoor laundry. Please contact us if you would like more information (310) 255-3447.

IMPORTANT ALERT:

Conforming Loan Limit to drop from $729,500 to $625,000 or possibly $417,000…not good news for mid-level Westside and South Bay housing.

According to an article in this last week’s Washington Post and confirmed by California Association of Realtors President Leslie-Appleton Young, the Obama administration will suggest the higher conforming loan rate that Fannie Mae and Freddie Mac has of $729,500 (referred to as high balance conforming loans) be lowered to $625,000 and possibly even all the way down to $417,000. The current limits are set to expire at the end of September.

At a meeting with Westside Prudential Real Estate agents this week, Young was adamant the current high balance conforming loan limit will be lowered to start weaning the housing market off of government support. The National Association of Realtors will fight this tooth and nail but it sounds like they will not be able to drum up enough support to win the fight.

Presently, the government backs about 95 percent of all new mortgage originations in one way or another. By letting the high balance conforming limit fall the administration hopes it will entice private investors to fund these larger loans again.

There are strong concerns that withdrawing government support too quickly could destabilize the already weak housing market, especially in areas like the Westside and South Bay where these loans are used a majority of the time. This will also potentially eliminate many FHA buyers in the $750K price range who only have to put 3.5% down to purchase an approved property.

Currently there are few private investors in the high balance conforming sector because they are either unwilling or unable to match the mortgage rates that Government backed securities are able to provide.

It is going to be interesting to see what ultimately happens with a sharp divide between Democrats and Republicans on the issue. Both Buyers and Sellers need to be aware that this is a strong possibility and reality for this market. Homes and condos in the $800K to $1.3M price range will be impacted and the impacted price range will grow if the loan limit is cut all the way back to $417K. Young is fearful the compromise to $625K could be passed up.

Those that are on the fence to either buy or sell in this price range might want to think long and hard about getting into the game with interest rates still bouncing around historically low numbers. A change like this will lead to higher rates…potentially quite a bit higher.

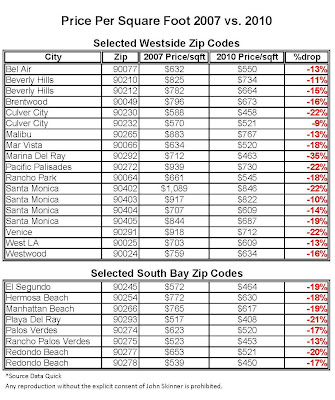

Westside and South Bay price per square foot analysis: 2007 vs. 2010

Check out the graph below which provides the price per square foot in 2007 vs. 2010 in most Westside and South Bay zip codes. Overall, we see about a 20% drop over the three year period. Most of these zip codes hit their peak in 2006/2007 so this is a good indicator of how far these areas have fallen from the inflated peak. Zeroing in on specific zip codes is also very important since most Westside/South Bay markets operate in a “micro” fashion. For instance, the 90402 zip code in Santa Monica (North of Montana) is down 22% while 90403 (South of Montana) is only down 10%. Please note these numbers are a combination of Single Family Homes and Condominiums and price per square foot is only one of quite a few ways to value a property.

*click on image for larger view

*click on image for larger view

Brentwood Glen – short sale – bank wants to move it!

11344 Albata Street now offered @ $1,069,000…Take advantage of the situation. Feel the character and warmth of this 3 bed/1.75 bath Spanish style home while enjoying modern day amenities such as a recently remodeled kitchen, remodeled bathroom, air conditioning and updated electrical system. The home boasts sizable bedrooms, tons of storage and a walk-in closet in the master bedroom. It is further enhanced by newer hardwood floors and desirable features such as a  living room w/fireplace, formal dining room, spacious breakfast area, custom wrought iron work, coved ceilings, private front porch and a backyard shaded by a prolific avocado tree. Great home for a young family and close to everything the Westisde has to offer.

living room w/fireplace, formal dining room, spacious breakfast area, custom wrought iron work, coved ceilings, private front porch and a backyard shaded by a prolific avocado tree. Great home for a young family and close to everything the Westisde has to offer.

living room w/fireplace, formal dining room, spacious breakfast area, custom wrought iron work, coved ceilings, private front porch and a backyard shaded by a prolific avocado tree. Great home for a young family and close to everything the Westisde has to offer.

living room w/fireplace, formal dining room, spacious breakfast area, custom wrought iron work, coved ceilings, private front porch and a backyard shaded by a prolific avocado tree. Great home for a young family and close to everything the Westisde has to offer.

*Please note the home is tenant occupied through June 30th, 2011. However, with the amount of time it will probably take in dealing with the bank the tenancy should not be much of an issue.

Please contact us for more information and to set up an appointment

Shadiness at 525 25th Street?…Multiple offer hysteria hits 848 23rd Street

Something isn’t right…or is it? 522 25th Street, SM, CA 90402- You gotta love the people who try and cash in on a difficult situation. With short sales and REO’s in full swing, shady activities by potential buyer’s and agents seem to be in vogue. Now, I have absolutely NO EVIDENCE that is the case with this North of Montana property but it is fishy that this property was never active on the Multiple Listing Service. The listing went into effect on the 19th but was not posted until the 27th shielding it from the market at large. It was listed at the bargain-basement price of $2,995,000 which would have commanded a ton of interest for a home built in 2006 featuring 5 bed+7 bath 6,397 sq. ft. on a 8,700 sq ft lot.

This is troubling as an impartial observer. You would think this type of square footage built in 2006 would be north of $3.5 million. However, it is important to note the house has had previous mold issues, needs landscaping and has some construction defects that need to be addressed. It will be interesting to track what happens with this property. . .

Multiple Offer Hysteria Hits for 848 23rd Street, SM, CA 90403- Listed at an unbelievably low price in Late December, this tear-down attracted a ton of offers with a $989,000 list price.

Essentially, the goal of the seller was to make it a bidding process with the hope the psychology of winning the bid would overcome the rationality of the lot’s true value. The tactic worked for the most part. We felt the price of this lot was worth around $1.285-1.315 and it sold for $1.385. Probably would have been better off pricing it around $1.2 and not wasting time with a segment of buyers who really had no chance…but congratulations to the seller’s for moving the property quickly at a slightly above market price during the holiday season.

The fascinating life of 720 Almar takes another turn

The fascinating life of 720 Almar in the El Medio area of the Palisades has written yet another chapter. One of the investors who was fortunate to purchase the home from the bank at the bargain basement price of $2.150M has decided to move-in to the property after it didn’t sell in an ill-fated flip attempt at $2.695, $500K more than what it was purchased for in August. The roller coaster ride for this property is finally slowing down for the time being.

The current owner made a very good buy at $2.150M but in a market where the only word that seems to come out of a buyer’s mouth is “Value” it is extremely difficult to flip home for such a substantial profit especially when the perception of the home has been slanted due to water intrusion issues it faced while being on the market for such a long period of time.

Quick recap: Built in 2008, the home first appeared on the market in late 2008 for $3.749M. The house spent all of 2009 on a rather steep decline in asking price to $2.995M as rumors began to perculate about some construction issues with the home. Once the builder saw the writing on the wall, the house was essentially stripped of most appliances and fixtures and the house went back to the bank in 2010. It appeared back on the market as an REO for $2.345 which seemed like a great deal. However, the bank put in some cheap appliances, negative rumors persisted about the house and the listing agent was known for being unwilling to work with other real estate agents. Eventually the home sold to the current owner at $2.150 in all cash offer.

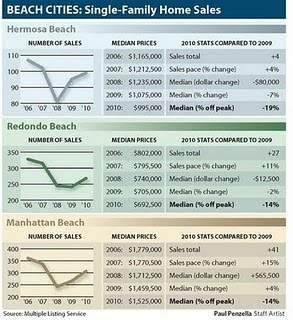

A quick look at Manhattan Beach sales in 2010

2010 was a rebound year in Manhattan Beach with more sales and a slightly higher median price than 2009.

The sales activity citywide in Manhattan Beach was up 15% for the year and the median price, at $1.525m, was up 4% over 2009. Manhattan Beach is down 14% from the full-year median-price peak in 2006.

Please see the graph below that was published in the Daily Breeze a few weeks ago.

(*Sources: Daily Breeze, Manhattan Beach Confidential)