443 14th sells for $3.1M…230K less than 2005 purchase price…Hockey Star takes 400K+ hit in Manhattan Beach

In Santa Monica, 443 14th Street a 4+5.5 bath, 4,071 sq. ft. house on a 7,550 lot constructed in 2002 sold for $3.1M, an 18% drop from the original list price. The home was featured in the LA Times Home Section and Domino Magazine.

This seller finally realized they wouldn’t get close to the original listing price of $3.795M in September 2010 and within a month reduced to $3.475 and again to $3.295M. It seems like a quick drop of the price but more research shows they have been trying to market the property off and on since 2008 with the astronomical list price of $4,250,000…

In Manhattan Beach, The Calgary Flames Craig Conroy sold his Manhattan Beach home located at 1221 6th street for $1,965,000($464 per sq. ft.) on March 23rd. He bought the home in 2005 for $2,495,000, representing about a 23% drop in value. The Craftsman-style house, built in 2005, is a 5+5 with 4,230 sq. ft. of living space. Conroy and family were smart sellers that understood the market. They listed the home at $1,999,000 and were in escrow with a strong buyer immediately. According to Lauren Beale of the LA Times, Conroy retired earlier this year to become a special assistant to the Flames’ general manager. The center had played since 1994 including a stint with the Los Angeles Kings.

In Manhattan Beach, The Calgary Flames Craig Conroy sold his Manhattan Beach home located at 1221 6th street for $1,965,000($464 per sq. ft.) on March 23rd. He bought the home in 2005 for $2,495,000, representing about a 23% drop in value. The Craftsman-style house, built in 2005, is a 5+5 with 4,230 sq. ft. of living space. Conroy and family were smart sellers that understood the market. They listed the home at $1,999,000 and were in escrow with a strong buyer immediately. According to Lauren Beale of the LA Times, Conroy retired earlier this year to become a special assistant to the Flames’ general manager. The center had played since 1994 including a stint with the Los Angeles Kings. Earthquake insurance worth the cost?

Japan’s massive earthquake has created a surge of interest in quake insurance in a place more than 5,000 miles away — California.

Only about 12% of Californians with home insurance have quake coverage. And the percentage of people who buy quake insurance in other states — including those with active faults — is far lower.

Should you buy quake coverage?

There’s no clear answer. The problem is that quake coverage is costly and limited. Experts say that it takes careful analysis to decide whether the expense is worth the potential benefits.

Here is a good article from the LA Times exploring the cost and feasibility: Is quake insurace worth the cost?

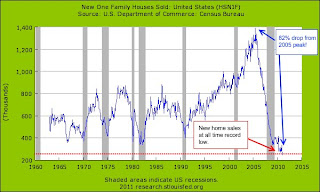

National Note:New Home Sales drop 82% since 2005…Worse than Great Depression

New home sales fell Eighty percent from 1929 to 1932, an infamous time in US history where the economy imploded in spectacular fashion thanks to Wall Street speculation and massive debt leverage.

In comparison, during the recent Great Recession, new home sales have fallen an astonishing Eighty Two percent from there 2005 peak. See the graph below regarding new home sales since 1960 and the free-fall ride since 2006.

*source: doctor housing bubble

*source: doctor housing bubble

Mortgage rates creep higher this week

Freddie Mace said Thursday that the average rate on 30-year fixed mortgages rose to 4.81% from 4.76% the previous week. It hit a 40-year low 4.17% in November.

The average rate on 15-year fixed mortgages increased to 4.04% from 3.97%. It reached 3.57% in November, the lowest level on records dating back to 1991.

The rates do not include add-on fees, known as points. One point is equal to 1% of the total loan amount. The average fee for 30-year fixed loans and 15-year fixed loans in Freddie Mac’s survey was 0.7 point. The average fee for five-year ARMs and 1-year ARMs was 0.6 point.

*source: Associated Press

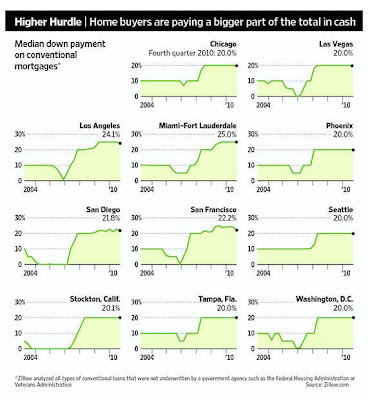

Lots of Cash Buyers on the Westside

Approximately 25% of the purchases on the Westside above $900,000 are all cash buyers. Unfortunately, they almost have to be. As you can see from the above graph, 24.1% is the average down payment for a home in Los Angeles. It’s a shame the banks were stupid enough (how bankers have not gone to jail for it is disgusting) to allow the average down payment to literally drop to almost 0% in 2006-2007. Are you kidding me? We are going to pay for this insanity for a long time with over 670,000 California homeowners underwater by more than 50% according to Mooney’s analytics.

If people actually have the financial discipline to save 20 percent then it is likely they have more of a buffer to ride out any storms in housing. Plus it is a lot harder to walk away from that type of savings.

REO in Manhattan Beach sells for almost 300K over asking…

3121 Alma (3br/3ba, 2600 sq. ft.), an REO that came on the market just after Christmas created a storm of interest with over 20 offers at the “let’s auction it off” list price of $1.147.

The sale closed on Feb. 23rd for $1.425m which still was not a bad buy considering the size, views and condition. However, the home was stripped of all appliances and though the bank did some “cheap” work to it, the new buyer will need to fix some things up. When you take that into account the house ultimately sold for around what it should have.

In July 2006, Alma sold for $650k more at $2.075m in July 2006 – before a remodel was undertaken …down about 20% since 2005…sounds about right.

(*sources: MLS, Manhattan Beach Confidential)

Notes on a Realtor’s Scorecard

Median LA County home price down 10% since September: In September of 2010 the median LA home was going for $340,000 so we are now down over 10 percent in a matter of four months.

Case and Shiller disagree about the future: The widely followed Standard & Poor’s/Case-Shiller Index, which tracks the real estate market in 20 major U.S. cities, has differing opinions. According to a recent New York Times piece, Case calls the current state of the market a “rocky bottom with a down trend,” but doesn’t seem to think the sky will fall. Shiller, on the other hand, sees “‘a substantial risk’ of declines of ’15 percent, 20 percent, 25 percent'” from here.

Standards for loans will continue to rise and create negative issues: A wind-down of government-controlled Fannie Mae and Freddie Mac, as proposed by the Obama administration in February will make home buying more difficult and add pressure to the real estate market. It won’t have as dramatic of an effect on the Westside as it will in less well-to-do areas like the Inland Empire but you can definitely expect a jump in interest rates and even tighter lending standards which will cut down on what Westside buyers can afford. This coinciding with the conforming high limit loan balance dropping from $729,500 to $625,000 at the end of October is not a good recipe for homes worth around a million dollars.

Market anxiety subsides: While 53 percent of Americans said they are “very concerned” or “somewhat concerned” about having the money to make their monthly mortgage or rent payment, according to a recent Washington Post poll, 61 percent believe it is a good time to buy a house…

California Realtors: Only three out of five short sale transactions close

by CalculatedRisk on 3/09/2011 11:35:00 PM

After contacting a bank on a daily basis to get a short sale approved and getting no response, I thought I would update our readers on the continued difficulty of getting a short sale approved in a timely fashion. The frustrating thing is in the initial stages the banks are very responsive but once the file is forwarded to a negotiator the process becomes a nightmare since the banks are completely understaffed and short sale negotiators receive over 300-400 e-mails a day from agents like me wondering what is going on with a file.

Unfortunately, many homeowners are unable to successfully negotiate a short sale. According to a recent survey of 2,150 California REALTORS® who have assisted clients with a short sale, only three out of five transactions closed – even with an interested and qualified buyer.

Here are the reasons besides the banks being overwhelmed: For one, no two mortgage agreements are the same, so it can be difficult to standardize short sale processes and procedures. Many homeowners have second mortgages, which further complicate matters. Then there’s the challenge of convincing multiple parties to take a financial loss or, in the case of loan servicers, to forego fees they otherwise might earn during the course of the foreclosure process.

Poor and slow service by many banks and servicers has only exacerbated the problem. Horror stories abound from potential homebuyers and REALTORS® forced to wait 90 or more days for a response to a purchase offer or being required to fax short sale applications or other paperwork as many as 50 times. These delays discourage potential homebuyers and sales agents.

Buyers Turn Fussy…Underwater Mortgages rise

Buyers are becoming fussier and fussier. A new report found that 87% of first time houme-buyers said “finding a move-in ready home is important.”

Check out this informative article about what the majority of buyer’s are looking for:

LA Times Article First-time buyers turn fussy about ‘move-in ready’ homes

Underwater mortgages rise: We still have quite a few issues to work out even though we have seen some signs of stability: LA Times Article Underwater mortgages rose at end of 2010 as home prices fell

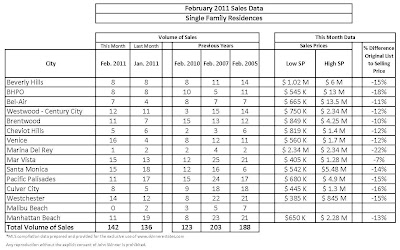

In Depth Look at February Sales Data

As reported in a few weeks ago in the Skinny, the gap between Original List Price (“OLP”) and the eventual sales price seemed to be closing according to January sales data for the Westside and Manhattan Beach.

However, we see a strong reversal of that trend with the February sales numbers for Single Family Homes. Every area with the exception of Mar Vista (7%) had a double digit difference between OLP and sale price. We like to use the OLP number because when homes are re-listed or taken off the market and then re-introduced the MLS, will only use the new list price and it skews the reality of the market.

The bottom line is that sellers and buyers are still distant in terms of where the market is functioning.

The good news is that February sales were stronger this year than last by about 12% but still quite a bit below the sales numbers of 2007 and 2005.

A quick glance at some selected recent sales and a few examples of re-sales from 2008 and 2005:

Brentwood: 2618 Westridge Road, a 3,675 sq. ft., 5 bed/4 bath home with lot size of 12,744 sold on 2/22/11 for $1.788M 5% above the list price…In 2005, the house sold for $2.316M – constituting a 23% drop…

Pacific Palisades: 545 Amalfi Dr., 5 bed/5.5 bath, 4,900 sq. ft. with a lot size 14,980, originally listed at $3.795M and sold for $2.95M, 22% below list price. It  was on the market 8 months and ended up being a short sale that garnered multiple offers. This was a solid buy.

was on the market 8 months and ended up being a short sale that garnered multiple offers. This was a solid buy.

Santa Monica: 135 Palisades Ave., 6 bed/7.5 bath, 4,099 sq. ft. home with a lot size of 17,498, sold for $5.48M, 21%  below it’s original price of $6.95M. It was only on the market for four months and kudos to the seller for recognizing that trying to chase a falling knife doesn’t work.

below it’s original price of $6.95M. It was only on the market for four months and kudos to the seller for recognizing that trying to chase a falling knife doesn’t work.

Rare sale in Beverly Park: 14 Beverly Park a 13,638 sq. ft, 7 bdrm/7bath home with a lot size of 13,638 sold for  $12.9M which was 18% below it’s original asking price of $15.9M. It was on the market for 5 months. Beverly Park is one of the most exclusive places to live in the world.

$12.9M which was 18% below it’s original asking price of $15.9M. It was on the market for 5 months. Beverly Park is one of the most exclusive places to live in the world.

Manhattan Beach: 2 homes recently closed in Manhattan Beach (West of Sepulveda) that sold three years ago. In both cases, sellers lost 12-16% of their homes’ value after about 3 years. 742 33rd (5br/5ba, 3975 sq. ft.) a nice Cape Cod sold for $2.275m, down $425k (-16%) from 2008 sale price of $2.7M.

742 33rd (5br/5ba, 3975 sq. ft.) a nice Cape Cod sold for $2.275m, down $425k (-16%) from 2008 sale price of $2.7M.

473 31st (4br/5ba, 4000 sq. ft.) custom modern home sold for $2.450M, down $350k (-12.5%) from the 2008 sale price of $2.8M.