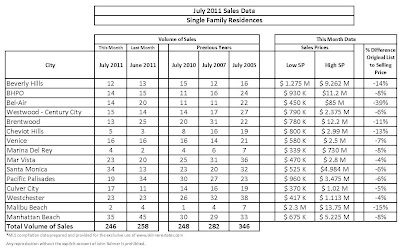

In-Depth Look at Single Family Home Sales Data for July

The summer keeps humming along on the Westside and in Manhattan Beach. Sales were down slightly compared to last month but thanks to record low interest rates and tight inventory, multiple offers are still the buzz. The overall average difference between original list price and selling price was -8.33%, which is lower than last months’ -10.07%.

The summer keeps humming along on the Westside and in Manhattan Beach. Sales were down slightly compared to last month but thanks to record low interest rates and tight inventory, multiple offers are still the buzz. The overall average difference between original list price and selling price was -8.33%, which is lower than last months’ -10.07%.

Both of those numbers are inflated by sales on the ultra high end that were way overpriced. For instance, you will notice that in Bel-Air the % difference between the original list price to the selling price is an alarming -39%. This is due to one sale that occurred @ 594 S. Mapleton Drive between heiress Petra Eccelstone and Caro Spelling. This huge 14 bedroom, 27 bath, 56,500 sq ft. house was listed on 9/1/10 for $150M and sold on 7/14/11 for $85M. If you dismiss some of these larger sales that should have never been listed at the current list price, the difference between original list price and sale price shrinks to around -6.5% which is close to the -5% in a healthy market.

Both of those numbers are inflated by sales on the ultra high end that were way overpriced. For instance, you will notice that in Bel-Air the % difference between the original list price to the selling price is an alarming -39%. This is due to one sale that occurred @ 594 S. Mapleton Drive between heiress Petra Eccelstone and Caro Spelling. This huge 14 bedroom, 27 bath, 56,500 sq ft. house was listed on 9/1/10 for $150M and sold on 7/14/11 for $85M. If you dismiss some of these larger sales that should have never been listed at the current list price, the difference between original list price and sale price shrinks to around -6.5% which is close to the -5% in a healthy market.

Sales dropped slightly from the previous month, however, most areas stayed consistent with last months’ numbers with the following exceptions:

Santa Monica had a great month with 21 more sales then last month. Half of the homes sold within 60 days of the list price, and the average% difference between the original list price and the selling price was only 6%. Almost all the homes in Santa Monica that sold for more than $2.5M sold within two weeks of coming on the market.

Culver City sales were also up from last month with the average% difference between the original list price and the selling price only 5%.

On the other side of the spectrum, Pacific Palisades sales were lower than last month with the majority of properties selling within 90 days of the listing date. Brentwood sales were considerably lower as well and the average % difference between the original list price and the selling price was much higher at 11% with properties on the market for a longer period of time.

Though Manhattan Beach and Mar Vista dipped against last month’s numbers they are still holding strong in terms of volume. In fact this is the second straight month that Manhattan Beach outpaced sales for the month compared to 2007 and 2005.

Mortgage Rates Down in the Basement Again

The typical rate on a 30-year fixed mortgage fell this week to 4.39%, the lowest level since November, according to home finance giant Freddie Mac, while other popular loans were at all-time lows in Freddie’s weekly survey of lenders.

That trend drove the yield on the 10-year Treasury note to 2.58% Thursday morning — it had been above 3.7% in February — and home lending rates followed suit.

The record lows were for 15-year fixed mortgages, a popular option for people refinancing their homes, and for loans with a fixed rate for five years that then become variable. The previous records for these mortgages also were set in November.

Lenders were offering the 15-year loan at an average of 3.54%, down from last week’s 3.66% and eclipsing the previous low of 3.57% in the Freddie Mac survey.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.18% this week, down from 3.25% a week earlier, which had tied the previous low.

The average offering rate for 30-year fixed-rate mortgages had briefly dropped below 4.2% in the survey last fall. The 4.39% rate that Freddie reported Thursday was sharply below last week’s 4.55%.

Borrowers would have paid less than 1% of the loan amount in upfront lender fees to obtain the rates, Freddie Mac said. Solid borrowers often can find slightly better rates by shopping around, and it’s also possible to lower mortgage rates by paying more upfront.

The Freddie Mac survey asks lenders what terms they are offering to borrowers with good credit ratings who have 20% down payments or 20% equity in their homes.

Source: USA Today

Articles You Should Read

More home buyers are walking away from signed contracts – According to the National Assn. of Realtors, 1 in 6 realty agents polled in June reported having signed contracts canceled before closing, up from just 1 in 25 the month before. The surging numbers of pending short sales clogging local markets are another cause of contract cancellations…

Debunking popular real estate myths – Read about popular misconceptions and myths

Home prices rise again, but experts are unimpressed – The Standard & Poor’s/Case-Shiller index of home prices in 20 metropolitan areas rose 1% from April to May. Some economists dismiss the uptick as seasonal.

Homeowners who want to trade up are stuck waiting – Before the bust, rising prices fueled the housing market, enabling buyers to start small and climb the ladder. Now that promise of upward mobility is on shaky ground and many potential sellers are underwater and can’t afford to sell

Homeowners are Optimistic Amid Mixed Signals

A recent survey conducted by the Home Buying Institute showed that homebuyers expected marked improvements in home prices over the next few years. Activity on the Westside is certainly showing optimism with open houses buzzing with people and multiple offers being the buzz phrase throughout the summer. At our first open house two weeks ago in Westwood on Fairburn Ave., we had over 60 parties attend and we were in escrow with multiple offers within a week of hitting the market.

The summer survey by HBI asked 25,000 consumers how they felt about the value of their homes, and an overwhelming 69 percent stated that they expected their home price to rise in the next 24 months. Some of this optimism could be due to a brighter Standard & Poor’s Case/Shiller Home Price Index, according to HBI.

The most current S&P Home Index stated that home prices had risen for the second consecutive month in several cities.

“This is a seasonal period of stronger demand for houses, so monthly price increases are to be expected and were seen in 16 of the 20 cities,” explained Index Committee chairman David Blitzer.

However, an abundance of foreclosure and shadow properties could curb rising home values. The vast number of bank-owned properties may continue to drag home prices down, as demand lags behind inventory in many regions.

Unsteady unemployment rates and increased difficulty qualifying for mortgages may also work against these positive housing market indicators, the source reports.

Source: Home Buying Institute

Buyers Should be Aware of Mortgage Fees

Record low interest rates are helping to spur a little bit of a housing comeback. Who knows whether the comeback will last but one this is for sure: record low interest rates are helping create a ton of buzz in the residential market. However, consumers must be aware that what you see advertised may not necessarily be the case and buyers should be aware of mortgage fees that could bump up their monthly payments.

Those that provide homebuyer education stress that fees can make a considerable difference in the cost of a home loan, and that buyers should be educated on how they impact a sale. Savvy individuals should look not just at the interest rate, but also at the APR, or annual percentage rate.

Consumers should also be aware that many of these fees are negotiable. While closing procedures differ in every region, some fees can be paid by or split with the sellers, according to The Federal Reserve Board.

If you have any further questions about this topic, please feel free to call our office at 310-255-3447.