Tight inventory and record low rates making it tough for Westside buyers

You can characterize the Westside real estate inventory as pretty tight these days. There’s plenty to choose from in some categories and at some price points, but much of what is available has some kind of issue – from location to price – that causes buyers to put on the breaks and if we were playing Monopoly it is like the seller is being sent to jail.

On the flip side, quality offerings priced appropriately usually see multiple offers and pretty easy escrows thanks to record low interest rates and buyers from all over the world seeking property in this particular market.

We are seeing quite a bit of purchasing activity in price points that can be considered “entry level” depending on the micro market. Entry level for the 90402 zip code in Santa Monica for a non-tear down home is usually around 2-million (give or take based on sq. ft.) while in the 90066 zip code of Mar Vista north of Venice and West of Centinela it is around 750K. –Quick insert: With the current conforming loan limit dropping from $729,500 to $625,500 on October 1st look for markets like Mar Vista, Culver City and South Santa Monica to lose some buyers who will no longer be able to afford the higher payment.

Due to many potential sellers being financially handcuffed and unable to sell their homes the inventory that is available to buyers throughout the Westside is minimal leading to some segments of the market seeing a 5-10% uptick over the past 12 months, despite the economy. High-end buyers are taking advantage of a 15-20% drop in price from the height of the market along with record low interest rates around 4%. They feel it is a tremendous buying opportunity with some real estate analysts calculating that if you take the current interest rates combined with the drop in value of the past five years in actuality you have more like a 40-45% drop in Westside real estate value from the heights of 2005.

The best way to track value: A look at recent re-sales in SM and the Palisades

Though we have seen an uptick in the market as of late due to the factors mentioned in a previous post we still have seen quite a bit of price erosion. One of the best ways to look at value in certain market segments is to look at homes that have sold twice in the past 7 years that are in similar condition. Here are some great examples from the Pacific Palisades and North Santa Monica markets:

215 24th Street, Santa Monica- 9.8% drop in value since 2009 purchase- This beautiful 3K sq. ft. Spanish style home on a 8,700 sq. ft. lot recently sold f or $2.3905M after debuting on the market for $2.745M in February of this year with a different broker. Unfortunately for the seller the home seemed to fall out of escrow on two different times before finally settling on a buyer. This leads us to believe that the home may have had some type of inspection issue pop up. The home is updated and light/bright. It features a pool/spa and was a good buy at this price. The home was sold in 2009 for $2.650M.

or $2.3905M after debuting on the market for $2.745M in February of this year with a different broker. Unfortunately for the seller the home seemed to fall out of escrow on two different times before finally settling on a buyer. This leads us to believe that the home may have had some type of inspection issue pop up. The home is updated and light/bright. It features a pool/spa and was a good buy at this price. The home was sold in 2009 for $2.650M.

Ouch- 1436 Floresta, Pacific Palisades, sells for 25% less than 2007 purchase price and well below 2005 purchase price- This 4 bed/4 bath, 5,130 sq. ft. home on a 16K sq. ft. lot recently sold for $2.580M after being originally listed for $2.795M. It was on the market for 48 days. The same house was purchased for $3.450M in July of 2007. It was sold in 2005 for $3.130M so the home has dropped to around its 2003/2004 value.

On the upswing- 458 Toyopa, Pacific Palisades– sells for more than 2010 purchase price- This 6 bed/9 bath, 9K sq. ft. house on a 24,742 sq. ft. lot (home sq. ft. not reported) built in 2008 featuring many high end amenities including huge master with his/her’s baths, pool, spa and putting green recently sold for $9.8 Million after being on the market for 161 days. The house was sold in 2010 for $8,750,000 resulting in over a 10% increase in sales price. Even after brokerage fees not a bad return for a 1 year investment in a bad economy. Further proof that inventory is not great on the Westside and we have seen prices increase for properties of this nature.

710 23rd Street, Santa Monica- 9% drop since 2008 with only one agent involved- The seller got a fair price at $2.650M for this home but did it get exp osed to the whole market? It was pretty difficult to set up a showing and a little surprised they would take a $250K reduction and go into escrow after only being on the market for 11 days. However the list price was high and the reduction in purchase price may have taken the place of repairs that are needed.

osed to the whole market? It was pretty difficult to set up a showing and a little surprised they would take a $250K reduction and go into escrow after only being on the market for 11 days. However the list price was high and the reduction in purchase price may have taken the place of repairs that are needed.

This is a 4 bed/4 bath, remodeled architectural style home that is 2,848 sq. ft. on a 8,851 sq. ft. lot with a pool and Gourmet kitchen. It was purchased in April of 2008 for $2.9M.

942 Galloway, Pacific Palisades- Still worth more than 2004 purchase price- The Palisades definitely functions as a micro market. On one hand you have a house in the Marquez Knolls dropping below its 2004 price point but this house in the alphabet street is still holding its value about its late 2004 purchase price. This 4 bed/3 bath home on a 5,200 sq. ft. lot (sq. ft. of house not reported) was on the market for just 13 days and sold in late August for $2.120M above its $1.965M purchase in price in November of 2004.

functions as a micro market. On one hand you have a house in the Marquez Knolls dropping below its 2004 price point but this house in the alphabet street is still holding its value about its late 2004 purchase price. This 4 bed/3 bath home on a 5,200 sq. ft. lot (sq. ft. of house not reported) was on the market for just 13 days and sold in late August for $2.120M above its $1.965M purchase in price in November of 2004.

SELLER AND BUYER BEWARE: buyer non-representation can lead to a myriad of issues.

After closely examining closed transactions on the Westside over the past few months the occurrence of the same sales agent(s) representing both sides of the deal stood out. This trend is a little alarming to some seasoned real estate agents and hope buyers an d sellers understand the substantial risks involved with dual agency to try and save a few bucks.

d sellers understand the substantial risks involved with dual agency to try and save a few bucks.

The seller and buyer will argue they can potentially drop the commission amount and it can be beneficial for both sides of the transaction. Furthermore, the agent will state it is easier for them to manage the deal as it eliminates another agent and they can “control” things more easily. Everybody will save money and the agent will pocket more money meaning everyone is happy is right? Not so fast.

Oftentimes these deals can get quite messy for a myriad of reasons. First and foremost the agent has a fiduciary responsibility to both sides of the transaction and a duty to disclose all facts and be honest and deal in good faith with loyalty. How can an agent who was initially employed by the seller (and will be paid by the seller) fulfill its fiduciary responsibility to the buyer? How can they be loyal to both sides when they have conflicting interests?

When an agent representing both sides of a transaction discusses a purchase price with the buyer and what they are willing to pay, wouldn’t that provide the agent intimate knowledge of where they can get a deal with the seller even though the buyer/seller might be willing to pay more? How does an agent properly juggle that? Throw in the fact the agent will make at least 1% to 2% more by getting the deal done as opposed to having another agent involved or even worse not properly disclosing known facts.

Where does the agent’s priority lay? On a typical $1.5 million dollar purchase on the Westside the difference to the agent could be an extra $15-20k.

The agent will literally have to walk the line perfectly to pull this off and many of the agents who are partaking in this are not the types to do this and frankly most have a reputation for being greedy. Many will justify their actions and say they referred the buyer to a buyer’s agent in their office. In this case the agent is getting a major cut of the “buyer’s agent” commission which still leads you to wonder where the fiduciary responsibility lies.

The language of the Real Estate Agency Relationships Disclosure is somewhat fuzzy when it comes to this. After being in this business for over 8 years I find it fascinating that one sales agent can represent both sides. In legal cases does the same lawyer represent both sides? In the case of referring the buyer to a buyer’s agent it is the same thing. Would the other side of a case go to an associate working under the partner who has the other side?

In the end it is the agent that ends up with the best deal and the buyer and seller in a potential lawsuit as lawsuit occurrences where one agent is involved is much higher than in a normal transaction.

A good buyer’s agent will earn their commission and also give the seller piece of mind that they have been properly represented.

Anybody who is looking to list a home with a sales agent should always ask the sales agent how they feel about representing both sides and how frequent they do it. Be wary of agents who tout the ability to represent both sides. A few successful Westside agents have a reputation for not making properties readily available for other agents to show to clients and have also gone to the lengths of not even presenting offers to the seller that were made by other agents. This is especially prevalent with short sales and lender owned properties where the listing agent is dealing with a negotiator on the other end that is working on 100 other transactions.

As a seller you have to completely trust that your agent is presenting every offer and most importantly that other agents want to show your property since they might be prejudicial toward your agent due to the “shelving” of contracts in the past.

Unfortunately greed is king in real estate and as much as I hate to say it this industry is full of people who will stop at nothing to take advantage of a situation where they can control everything and make more money doing it without much concern for either side.

Many reputable agents do not represent both sides in a transaction unless explicitly told to do so by the seller. We applaud those agents who understand the fiduciary responsibility they have to their clients and do not let greed interfere.

**Please note this only pertains to sales agent’s and not brokerage houses. Many brokerage houses like Prudential employ thousands of agents as Independent Contractors so having a company like Prudential represent both sides is not the issue. The issue is having the same sales associate represent both sides.

Typical 30 year Mortgage back above 4%

Blink and you may have missed it — the average rate on a 30-year fixed mortgage rate has crept higher since plunging to a record low of less than 4% late last week.

On Thursday Freddie Mac stated the 30-year loan was being offered at 4.01% on average for solid borrowers who paid 0.7% of the loan balance upfront in lender fees and points.

In the Western U.S., including California, the typical rate was lower at 3.95% early this week. Both figures are record lows.

*Source: LA Times

Sales volume increases in Manhattan Beach but median price down 6%

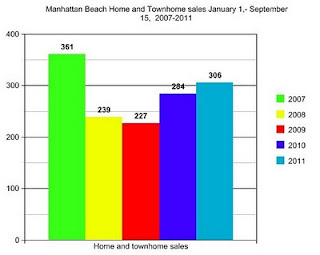

Sales volume is the highest it has been in Manhattan Beach since 2007 despite the tight inventory of appropriately priced listings. The rise in sales volume doesn’t mean prices have gone up as the median price was down 6% for the city compared to last year. Check out the sales volume graph below comparing the past four years:

Source: Manhattan Beach Confidential

Source: Manhattan Beach Confidential

Governator’s old compound in Pacific Palisades back on the market

14209 West Evans Road-Pacific Palisades- The Pacific Palisades home once owned by Former Governor Arnold Schwarzenegger and soon to be ex-wife Maria Shriver is back on the market with another broker but interestingly at a much higher price. This 9 bed/9 bath 10k sq. ft. house on approximately 2.5 acres has been on a pricing roller coaster since it was listed in 2006 for $26 Million. For the past five years the house has traded brokers and zig zagged on price. The house dropped to a list price of $23M and then again to 21.9M in late 2007 to 18.9M in 2009 and then dropped to $15.9M later that year and then up to $23.5M early this year and now dropped once again to $19.5M…umm, if it didn’t sell at $15.9M doesn’t common sense say that listing it at this price is a waste of time??

14209 West Evans Road-Pacific Palisades- The Pacific Palisades home once owned by Former Governor Arnold Schwarzenegger and soon to be ex-wife Maria Shriver is back on the market with another broker but interestingly at a much higher price. This 9 bed/9 bath 10k sq. ft. house on approximately 2.5 acres has been on a pricing roller coaster since it was listed in 2006 for $26 Million. For the past five years the house has traded brokers and zig zagged on price. The house dropped to a list price of $23M and then again to 21.9M in late 2007 to 18.9M in 2009 and then dropped to $15.9M later that year and then up to $23.5M early this year and now dropped once again to $19.5M…umm, if it didn’t sell at $15.9M doesn’t common sense say that listing it at this price is a waste of time??

A titanic drop in Malibu

31634 Sea Level Dr- Malibu- This ocean front Architectural modern on a gated street off Broad Beach is a 4 bed/4 bath home built in 2008. Designed by David Grey this home originally appeared on the market at the crazy high price of $15M in early 2009 when the Malibu Beach market was absolutely dead. Over the next year and a half the list price was reduced all the way down to $6.495M before going into foreclosure and falling into the banks hands. The property was listed by the bank in May for $5.750M and finally sold in late August for $5.350M.

31634 Sea Level Dr- Malibu- This ocean front Architectural modern on a gated street off Broad Beach is a 4 bed/4 bath home built in 2008. Designed by David Grey this home originally appeared on the market at the crazy high price of $15M in early 2009 when the Malibu Beach market was absolutely dead. Over the next year and a half the list price was reduced all the way down to $6.495M before going into foreclosure and falling into the banks hands. The property was listed by the bank in May for $5.750M and finally sold in late August for $5.350M.

Dropping almost 300% from its original list price this is a prime example of the greed and non-rational thinking that touched every segment of the real estate market.

Important real estate articles you should be aware of

Conforming Loan Limit Officially Drops to $625,500 October 1st: The loan limit officially drops October 1st.

Troubled Homeowners, Beware of “Mass Joinder” Lawsuit Invitations: All trouble homeowners should read.

Federal Agencies 20% down plan faces political hurdles: Legislation requiring all purchases to have 20% down will face a ton of opposition.