Notes on a Realtors Scorecard- Hot market persists despite some realtors slowing down…is your title insurance up to date…Future housing realities in SM…3 quick sales in Mar Vista

Hot market but cooling off for some realtors: While talking to colleagues that represent many of the different brokerages that service the Westside, the majority noted they have slowed down compared to 2014. Last year was great for many of us so a slow-down is understandable yet the market is still appreciating and sales volume overall is higher, making it puzzling that many of these reputable/high producing agents have slowed down. The reasons given for the slow-down are the lack of inventory, frustrated buyers deciding to step away from the market and more competition from out of area agents. It will be interesting to see if this trend sticks as we expect the market to continue to appreciate and see multiple offers on market price homes through the rest of this year.

Future housing realities in Santa Monica?: Check out this opinion piece, “Housing Realities in the Bel-Air by the Sea“, which appeared in the Santa Monica Daily Press about the amount of housing being built and what Santa Monica can actually handle. Very interesting…sounds like traffic could get even worse in #gridlockcity.

Is your title insurance up to date? A common mistake we see is when owners voluntarily transfer title to other family members or entities like Trusts, LLC’s, Partnerships and Corporations. If the title company insuring the owner/property is not notified and asked to insure the transfer into the entity through a policy endorsement 107.9, then the title insurance is nullified. This is something that can be easily fixed through a policy endorsement which generally ranges from $50-100 depending on the insurer. If you come across this scenario, please contact your title representative, or, if you don’t have one, please contact our office and we will get you connected with the right person.

The skinny on three homes that just went into escrow in Mar Vista:

3330 Keeshen Drive- Located on Mar Vista hill, this 4,220 sq. ft. 2007 built Traditional on a 5,786 sq. ft. lot, hit the market on June 11th for $2.689M and promptly went into escrow after the broker caravan. The rumor is they had a solid offer come in right off the bat and the seller accepted it. The home features high-end finished throughout, cook’s kitchen, huge master bed/bath with city views and a backyard with a fire pit and built-in barbecue. We were a little surprised this sold as fast as it did with a small yard but it is tough to find homes in Mar Vista that are over 4,000 sq. ft.

3568 Veteran– This brand new Cap Code Westside Village home hit the market on June 10th with a list price of $1.795M. They immediately received a very strong offer the day after the first open house and accepted it on June 15th, despite telling agents that offers were due on the 17th. The house is a 5 bed/6 bath consisting of 3,611 sq. ft. on a 6,174 sq. ft. lot. It is a great family home with high-ceilings, large living room, cook’s kitchen and each bedroom has its own bathroom.

3540 Ashwood Avenue– This simple 3+3, 1,508 sq. ft. home sitting on only a 4,900 sq. ft. lot was listed on June 4th and received nine offers at the $1.295M list price. The listing agent countered the top five initial bidders with a price of $1.4M and no appraisal contingency period. A response to this counter offer was accepted a few days later. If the $1.4M counter was accepted, this charming south of Palms home with an open floor plan, sold for over $925 a sq. ft.! Wow!

A look at the numbers- Venice

Thanks to tight inventory and some sellers listing their property too high, the sales volume for Venice is down 41% when comparing May 2015 vs. May 2014. According to the MLS, 16 single family residences “SFR” sold this year, with eight selling for over asking, while May of last year had a whopping 27 sales with 14 going for over asking. Despite a few properties sitting on the market, the average days on market has dropped 19%, from 38 in May 2014 to 31 in May of this year. The average days on market was as high as 63 in March and has been on major downward trajectory over the pasty two months.

The median sales price is up 46% from $1.450M in May 2014 to $2.120M. This dramatic jump shows more high-end and newer construction homes sold this May compared to last year. The median sales price in the 1st quarter of 2015 is up 55% since the 1st quarter of 2012.

The skinny on a few of the sales-2004 Louella Avenue- This 3+2 on a 5,462 sq. ft. lot was sold for land value and made the neighbors pretty happy considering it sold for $200K over the asking price! The property was listed at $1.199M and they immediately received multiple offers. It was sold to an all-cash investor with a very short contingency period for $1.405M!

The skinny on a few of the sales-2004 Louella Avenue- This 3+2 on a 5,462 sq. ft. lot was sold for land value and made the neighbors pretty happy considering it sold for $200K over the asking price! The property was listed at $1.199M and they immediately received multiple offers. It was sold to an all-cash investor with a very short contingency period for $1.405M!

214 South Venice– Despite being located in an extremely busy area, this one of a kind 3+3, 3,284 sq. ft. architectural on a 4,337 sq. ft. lot sold for $3.425M, $326K over the $3,099M asking price. The made for an entertainer property was recently renovated with high-end finishes and features an expansive split-level roof-top deck with a fire-pit and full outdoor kitchen. The 1 bed/1 bath guest unit is a great income producing opportunity and the property offers a four car garage with three extra parking spots which is extremely valuable for the location.

A look at the the numbers- Culver City

According to the MLS, the number of single family residential “SFR” sales in May was 15, with 9 over the asking price. In May of 2014, 17 SFR’s sold with 13 selling for over asking. The sales volume is down slightly with sellers being a little more aggressive with the list price compared to May 2014, in which over 75% of the homes sold for over the asking price.

The median sales price is up 25% from $810,000 to $1.010M. The median sales price is up 79% over a three-year period when comparing the 1st quarter median sales price of 2012 vs. 2015. Despite having so many homes sell for over asking in May of last year, the average days on market dropped to 21 this year compared to 36 last year. This is the lowest monthly average days on market in the last 12 months. Inventory is picking up this month so we expect the average days on market to increase.

Crazy sale of the month- 3330 Cattaragus– This 3+2, 1,590 sq. ft. Spanish home on a 4,797 sq. ft. lot was listed at only $999,000 to create a ton of initial interest. The listing agent also asked for highest and best right off the bat with no counters. They received quite a few offers with the winning bid coming in all-cash at $1.3M, with no appraisal contingency. The house has an open floor plan with a chef’s kitchen, hardwood floors and a garage converted into a living space.

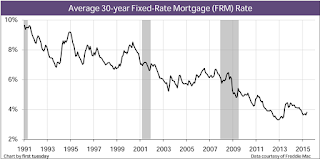

Mortgage rates tick down slightly to 4%

Average fixed mortgage rates moved lower from the previous week’s new highs for 2015 while housing data was generally positive, according to the latest from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.00% with an average 0.7 point for the week ending June 18, 2015, down from last week when it averaged 4.04%. A year ago at this time, the 30-year FRM averaged 4.17%. The 15-year FRM this week averaged 3.23% with an average 0.5 point, down from last week when it averaged 3.25%.

A year ago at this time, the 15-year FRM averaged 3.30%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.00% this week with an average 0.4 point, down from last week when it averaged 3.01%. A year ago, the 5-year ARM averaged 3.00%.

(Source: Housingwire)

A look inside the numbers- Pacific Palisades sales volume drops slightly compared to last month but up compared to last year… the median sales price continues to climb.

The number of single family sales per the Multiple Listing Service (MLS) in the Palisades for May of this year decreased slightly compared to last month (36 to 33). However, it was an increase from the 29 that were sold in May of 2014.

The median sales price is up over 8% compared to last May, and the 1st quarter median sales price is 73% higher than the median in the first quarter of 2012.

The average days on market (DOM) for properties sold was 47 compared to 54 last May. The drop in DOM has been substantial since February of this year when it was 79! Tightening inventory while entrenched in the spring/summer selling season with buyers trying to get a mortgage before rates continue to increase is the double whammy creating this market dynamic.

Let’s take a look at a few examples- 735 Alma Real Drive– This 5+5, 3,534 sq. ft. traditional on a 7,151 sq. ft. lot in the sought after Huntington Palisades was listed for $3,595M ($1,017 per sq. ft.) and promptly received 7 offers. It is currently in escrow with two strong back-up offers. The accepted offer was well over the asking price.

750 Chapala Drive is a recently built (2008) 6+6, 5,948 sq. ft. Traditional on a large 11K lot. It is located on one of the most sought after streets in the Huntington and it had no shortage of buyers. They received over 6 offers at the $6.995M list price and it sold to an all-cash buyer for $7.915M…$1,330.00 a sq. ft!

A contrast in sales on Sunset Blvd– The harm of pricing your home incorrectly- 14300 W. Sunset Blvd. is almost an acre of prime land with a 4+3, 2,346 sq. ft. home (remodel or tear down candidate). It sold for $3.7M…However, it was on the market for 116 days and was originally listed for $4.7M before having to finally be reduced to $3.9M before receiving an offer. If this property was originally listed at $3.9M it may very well have sold for that if not a little bit more…lots of this size are not easy to find in the Palisades.

13946 W. Sunset Blvd. is a beautiful 4+6 5,100 sq. ft. Spanish revival on a 15K sq. ft. lot. The property was listed for $5.329M and received multiple offers and sold with short contingency periods at $5.8M! It is an ultimate family home that would also appeal to an entertainer.

Mortgage Rates remain near 2015 high- insightful charts included

Average fixed mortgage rates remained near their highest level of the year with the 30-year fixed-rate mortgage (FRM) averaging 3.87% with an average 0.6 point for the week ending June 4, 2015, unchanged from last week.

A year ago at this time, the 30-year FRM averaged 4.14%. The 15-year FRM this week averaged 3.08% with an average 0.5 point, down from last week when it averaged 3.11%. A year ago at this time, the 15-year FRM averaged 3.23%.

Sources- Housing Wire and First Tuesday

Focus on the home- Money-saving do-it yourself projects; ways to get rid of weeds and six things you should do when moving into a house

Houselogic.com has released some timely articles with good ideas and tips in time for summer projects around the house:

If you do a minor bathroom facelift (5 ft x 7 ft) on your own it will cost you around $6,900…however, if you hire someone it can be around $16,500. Read about this and four other do it yourself projects.

Best money-saving do-it-yourself projects

Did you know that vinegar can be used to kill the weeds in your yard? Here are seven natural remedies to get rid of weeds.

Seven killer ways to get rid of weeds

Moving into a new house? Here are six things you should do once you get the keys.

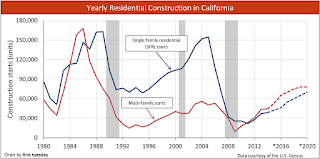

Articles you should read- do you overestimate your home’s value? Rising trend in Cali construction

A new statistical study, published in the journal of Housing Economics, found that homeowners on average overestimate the value of their properties by about 8%.

Why homeowners often overestimate their home market’s value

Single family residential (SFR) starts for the six-month phase ending April 2015 rose 11% over one year earlier, compared to the 17% rise in Multi-family construction. This reflects a higher demand for multi-family rentals compared to new SFRs. A very insightful article with predictions on the future of California home and multi-family construction.