Notes on a Realtors Scorecard – Buyers staying longer, the Chinese aren’t just buying, prepare for El Nino and more!

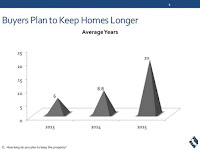

Buyers plan to stay put longer and the process of finding a home is taking more time– A recent survey of buyers by the California Association of Realtors “CAR” stated that buyers are planning to stay longer in their homes…for an average of 20 years! This is far above the six years that home buyers were forecasting in 2013. The survey also noted the process of buying a home is the longest it has been since CAR has been tracking the statistic. Even before contacting agents, buyers spent an average of 14 weeks exploring properties and neighborhoods. Once they engaged an agent, the process took an average of 12 weeks to get a home in escrow. The process is typically taking even longer in the nicer areas of Los Angeles due to low inventory.

Mar Vista closing the gap on South Santa Monica but not on the high-end:The popularity of Mar Vista with the young families and the Silicon Beach crowd has resulted in 17 homes in Mar Vista selling for over $2M in the first half of 2015. Only 10 sold for over $2M in the first half of 2014. No sales were made above $3M. In comparison, South Santa Monica (90405) had only 16 home sell for over $2M the first half of this year but five sold for over $3M. The average sale price was $2.658M while it was only $2.358M in Mar Vista. The appeal of Santa Monica’s school system, city services and better walk score will always create a value difference despite Mar Vista’s surge in popularity.

Chinese investors have been very busy purchasing property in LA, but some are selling…is this a sign?- For the past three years the international buyer, especially the Chinese, have made a big impact on Los Angeles real estate. In 2014, $22 billion in Southern California real estate was purchased by the Chinese. We are still seeing strong purchase activity from China but not at the rate we were seeing a year ago. With the Chinese stock market on shaky ground, we have seen an uptick of luxury homes being sold by Chinese property owners. With the financial markets in China predicted to continue to struggle, will this begin to negatively impact the So Cal housing market? In the mid to late 1980’s, the Japanese bought quite a bit of west coast real estate and were quite aggressive much like the Chinese have been. When the Japanese stock market crashed in the early 1990’s, a massive sell-off of Japanese owned property shortly followed and contributed to a fairly significant drop in Southern California real estate values. The dynamics are different but it is something to keep an eye on.

Fun Fact: Only 11% of California homes (including both renter- and owner-occupied homes) have an earthquake insurance policy, according to the California Earthquake Authority.

Mortgage note– If you pay $150-200 more a month toward your mortgage you will be surprised how much you will end up saving in the long-run even at the historically low interest rates we are currently experiencing.

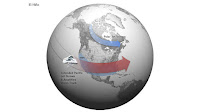

Why should the homeowner lose the right to have grass? Is it fair for the government to dictate how much grass you can have in your yard? New construction and extensive remodels will require that only 25% of the landscaping be grass. We are in a significant drought but will that always be the case? Shouldn’t a land owner have the right to pay a higher rate for water if they choose? Instead of bothering homeowners who only account for a very small percentage of the state’s water use (state agriculture is the major water user) the state and local municipalities need to focus on capturing storm run-off and figure out more efficient ways for farmers to water crops. With a strong El Nino expected, it would be nice if Southern California could take better advantage of what is expected to be a significant rainy season.

|

| click to enlarge |

Speaking of El Nino…Prepare your property!– We strongly encourage all of our readers to deal with any potential drainage issues (ex- water not draining away from your home/foundation, clogged gutters, drains) sooner rather than later.

Home of the week- Quick $3.2M sale in Santa Monica near Pico– 2432 32nd street is a brand new 3,363 sq. ft. traditional 5+4 home on a large 9,007 sq. ft. lot that came on the market for $3.2M and immediately sold right after the broker caravan. The builder did a very nice job with the details of the home and when you combine its emotional appeal and large lot, one can start to look past the ½ block proximity to a stretch of Pico that is not the most aesthetically pleasing. The house features a large gourmet kitchen that opens to the living room, huge windows providing tons of natural light, vaulted ceilings, luxurious master and drought resistant landscaping with the majority of it featuring turf.

Home of the week- Quick $3.2M sale in Santa Monica near Pico– 2432 32nd street is a brand new 3,363 sq. ft. traditional 5+4 home on a large 9,007 sq. ft. lot that came on the market for $3.2M and immediately sold right after the broker caravan. The builder did a very nice job with the details of the home and when you combine its emotional appeal and large lot, one can start to look past the ½ block proximity to a stretch of Pico that is not the most aesthetically pleasing. The house features a large gourmet kitchen that opens to the living room, huge windows providing tons of natural light, vaulted ceilings, luxurious master and drought resistant landscaping with the majority of it featuring turf. Second quarter market report reflects robust housing market in Los Angeles

|

| click on image to enlarge |

The Los Angeles housing market continues to be robust with no signs of abating in the near future. Average sale prices hit record highs in many areas (both single family and condos) and the number of sales rose to the highest second-quarter total in a decade. . The Westside luxury market (ex. Santa Monica, Pacific Palisades, Beverly Hills) saw strong growth, proving the enduring value of these communities commands a premium.

Manhattan Beach reflects the vibrant and strong South Bay market where prices are up by double digit percentage points and the decreasing days on market shows a tight inventory crunch.

Property in areas where prices are a little lower such as Mar Vista and Westchester saw some of the largest appreciation.

Overall, Los Angeles County is on the rise as the value of all assessed taxable property in the county has risen 6.13% in 2015, the largest jump since 2010.

Please click on the image below to download the full report and if you need more detail on your neighborhood please contact us and will be happy to help.

Average rate on 30-year mortgage falls

The average rate on a 30-year fixed-rate mortgage declined to 4.04 percent from 4.09 percent a week earlier. The rate on 15-year fixed-rate mortgages slipped to 3.21 percent from 3.25 percent. As in recent weeks, mortgage rates followed the yield on the key 10-year Treasury note, which declined.

Bond yields for Treasury’s were pushed lower by a rise in bond prices.

The average fee for a 30-year mortgage was unchanged from last week at 0.6 point. The fee for a 15-year loan also held steady at 0.6 point.

With mortgage rates at low levels and the economic recovery in its sixth year, home-buying has recently surged as more buyers have flooded into the real estate market. Data issued Wednesday by the National Association of Realtors showed that Americans bought homes in June at the fastest rate in more than eight years, pushing prices to record highs as buyer demand has eclipsed the availability of houses on the market.

Mortgage rates still remain relatively low due primarily to near-zero short-term borrowing rates set by the Federal Reserve, as well as the present lack of investment opportunities for the excess sums in bonds and on deposit with the Fed. This allows homebuyers to borrow more mortgage funds with relatively unchanged incomes. However, mortgage rates will likely begin to increase steadily in late 2015 as the bond market anticipates the Fed’s inevitable short-term rate hike.

The median home price has climbed 6.5 percent nationally over the past 12 months to $236,400, the highest level — unadjusted for inflation — reported by the Realtors.

Sources: LA Times and Housing Wire

Westchester residents excited about 30 million dollar facelift set for Howard Hughes Center

Westchester and Playa Del Rey residents received some welcome news when the new owner of the Howard Hughes Center announced they would be spending $30 million dollars to upgrade the facility. With Playa Vista continuing to grow with a new Cineplex, restaurants and a Whole foods, the close access to these amenities will continue to fuel the surge in popularity with young families that Westchester has been experiencing over the past four years.

The large-scale overhaul will be designed by Jerde Partnership (which designed Universal CityWalk and the open-air renovation of Santa Monica Place) and aimed at creating smoother entries into the compound for walkers, like a new crossing planned for Center Drive. Meanwhile, the courtyard across from the Cinemark Theaters will become the “center” of the complex and get a new outdoor film screening area and a fire pit. By Laurus’s estimates, Howard Hughes Center “will soon hold nearly 3,200 new multifamily units,” including the luxury Altitude apartments, “and more than 1.3 million square feet of office space.” That’s a lot of potential shoppers. Renovations are supposed to begin immediately.

The large-scale overhaul will be designed by Jerde Partnership (which designed Universal CityWalk and the open-air renovation of Santa Monica Place) and aimed at creating smoother entries into the compound for walkers, like a new crossing planned for Center Drive. Meanwhile, the courtyard across from the Cinemark Theaters will become the “center” of the complex and get a new outdoor film screening area and a fire pit. By Laurus’s estimates, Howard Hughes Center “will soon hold nearly 3,200 new multifamily units,” including the luxury Altitude apartments, “and more than 1.3 million square feet of office space.” That’s a lot of potential shoppers. Renovations are supposed to begin immediately.

Sources: LA Times and Cubed LA

Two mixed use projects proposed for Downtown Santa Monica

The Santa Monica planning commission is recommending two development agreements with NMS properties that will create much larger mixed use sites than what currently occupy the land. The locations are 1560 Lincoln Blvd. (currently Denny’s) and 1415 5th street.

Both projects are right near the light rail line connecting Downtown Los Angeles with Santa Monica. The increase in residential units will continue to add to the congestion that already plagues the area.

Check out the full article here: Mixed use projects recommended for Downtown Santa Monica

(Source: Santa Monica Daily Press)