Deal of the Week: 4365 Alla Road #7, Marina Del Rey $829K

IN ESCROW

We rarely advertise properties for sale on this blog unless we strongly feel it is a great opportunity and this fits into that category. We just listed a luxurious 2 bed/2.5 bath, 1,866 sq. ft. Marina Del Rey townhouse that is priced well and a short walk to the Marina Marketplace (Ruth’s Chris Steakhouse, Tender Greens, Ra Sushi, AMC Dine-in theater, Yardhouse, Gelson’s, etc).

The spacious floor-plan is excellent for entertaining with high ceilings, oak floors, gas fireplace and a large and open kitchen. This end unit features two large bedroom suites, remodeled master bathroom, great closet space, two car attached garage, laundry area, direct access and a well-run HOA with access to multiple pools and spas.

The spacious floor-plan is excellent for entertaining with high ceilings, oak floors, gas fireplace and a large and open kitchen. This end unit features two large bedroom suites, remodeled master bathroom, great closet space, two car attached garage, laundry area, direct access and a well-run HOA with access to multiple pools and spas.

Please check out www.4365alla.com for photos and more information. Please don’t hesitate to contact John directly at 310-486-5962 if you have any interest. We will be open Sunday from 2-5pm.

Notes on a Realtors Scorecard- Lots of rookie house flippers; Venice Blvd in Mar Vista about to permanently change; a look at some recent sales

– The Westside market is continuing its three year roll of trading at premium prices with multiple offer and above asking sales prices being the norm for over 50% of the properties on the market. We have seen a little slow-down in the upper high-end market ($5M ++) but much of that has to do with unrealistic list prices. The properties that are priced at or near the true market value are moving fairly quickly.

– We are noticing quite a few newcomers getting into the flipping business. The main companies we typically see purchasing re-model/tear down candidates are getting outbid on quite a few properties lately…and in some cases it isn’t even close. An example of this is 3154 Barry Avenue in Mar Vista. A great location with a great walk score on a 7K sq. ft. lot hit the market for $1.098M and sold in multiple offers for $1.350M. A few builders went up to about $1.2M but felt the profit margin would get too tight if you purchase it above that number. Hopefully history won’t repeat itself and the market dynamics are different, but the last time we saw this behavior was around 2006…

|

| click to enlarge |

-Venice Boulevard in Mar Vista about to permanently lose car lanes: Venice Blvd. between Inglewood and Beethoven was named as one of the first Los Angeles roads that will be part of LA’s Great Streets program that takes away a lane of car traffic in each direction to create a protected bike lane and four mid-block crossings with their own signaling buttons. Locals wanted a more user friendly Venice Blvd. but the program doesn’t include much of a beautification plan which is needed if you want to attract more foot traffic from the higher-end areas of Mar Vista that are close-by. A more attractive Venice Blvd. would be great for the area, however, geographically speaking, LA seems like a pretty spread out place without nearly enough mass transit to start taking away lanes of traffic in already heavily congested areas. It will be interesting to see how this works out…Please check out an article about this along with graphics via CurbedLA: Part of Venice Blvd. will be getting more hospitable to non-drivers

|

| 923 20th Street #2 |

– A quick look at some recent condo sales in Santa Monica: 923 20th Street #2 has not officially sold but it immediately went into escrow one day after the first public open house. It was listed at $1.529M ($1,149 sq. ft.) but rumor is it sold above that number…it seems like yesterday people thought it was crazy to pay $1,000 a sq. ft. for a home north of Montana. The 1,330 sq. ft. 2 bed/3 bath Spanish Colonial built in 2006 has tons of charm and character but a very small 2nd bedroom.

|

|||

| 817 10th Street #307 |

817 10th street #307 is a top floor 1,394 sq. ft. 2+2 single level unit that was bought at the end of last year for $1.150M and after some upgrades were made to the kitchen and bathrooms, it just sold for $1.4M after being listed for $1.3M. We approximate the seller did about $70K in upgrades.

122 Ocean Park Blvd.#411, a 1,502 sq. ft. 2+2 was bought in 2012 for $1.185M, just under the $1.199M asking price. In pretty much the same condition, this coveted Sea Colony III unit with $800 a month HOA dues just sold for $1.601M, $206K over the asking price! The Sea Colony and the surrounding area is very popular right now with the emergence of Silicon Beach. The seller had phenomenal market timing!

122 Ocean Park Blvd.#411, a 1,502 sq. ft. 2+2 was bought in 2012 for $1.185M, just under the $1.199M asking price. In pretty much the same condition, this coveted Sea Colony III unit with $800 a month HOA dues just sold for $1.601M, $206K over the asking price! The Sea Colony and the surrounding area is very popular right now with the emergence of Silicon Beach. The seller had phenomenal market timing!

– The foreclosure saga of Sea Ridge’s 1948 Palisades Drive (Pacific Palisades) comes to an end: This rare foreclosure (bought in2006 for $1.4M) was hit with massive sewer and drainage issues that destroyed most of the integrity of the home and annoyed realtors as clients would call thinking they could get a great deal on the condo not knowing that has to be completely remodeled as previous listings of the property were vague when it came to explaining the horrible condition. After a saga lasting over four years, it finally sold through bankruptcy court in an all-cash deal for $1.180M, $280K over the $900K list price. Despite going for $200K over the list price it is not a bad deal for a 3,000 sq. ft townhouse in one of the most coveted complexes in the Palisades.

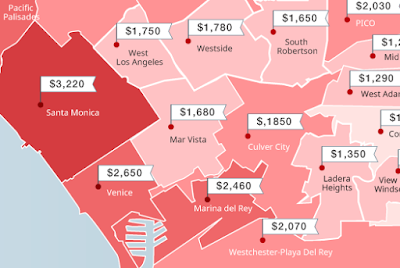

Los Angeles is the least affordable place to rent in the United States

According to an article from CurbedLA that cites a report from Zumper, Los Angeles residents on average spend nearly 50% of their income on rents! Rents are higher in San Francisco and New York but the household income in those cities is higher. San Francisco checks in around 45% followed by Miami with 43%. New York is 41%.

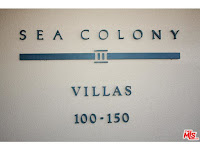

The median rent for one-bedrooms in Los Angeles in August was $1,830, a 7.6 percent increase from the last three month period. Two-bedroom apartments were up 5.6% from the last quarter, to $2,640. Downtown Santa Monica is the most expensive place to rent in LA with a median one-bedroom renting for $3,220 in August. Downtown LA was the runner up with a one-bedroom median of $2,640.

Check out the map below to see what the median rents are in specific areas of Los Angeles.

(Source: Curbed LA)

|

| click on image to enlarge |

|

| % of income toward rent in major cities- Click to enlarge |

Average rate on 30-year mortgage falls to 3.85%

Long-term U.S. mortgage rates declined this week following the Federal Reserve’s decision to keep interest rates at record lows for now.

Freddie Mac said Thursday the average rate on a 30-year fixed-rate mortgage fell to 3.85% from 3.91% a week earlier. The rate on 15-year fixed-rate mortgages eased to 3.08% from 3.11%.

Rates have stayed below 4% for nine straight weeks. The average fee for a 30-year mortgage rose to 0.7 point from 0.6 point last week. The fee for a 15-year loan was unchanged at 0.6 point.

(Source: LA Times)

New rules will impact residential real estate purchasers who obtain a loan after October 3rd!

The CFBP (Consumer Financial Protection Bureau) instituted new rules to protect consumers and it known as the Know Before You Owe initiative.

The CFBP (Consumer Financial Protection Bureau) instituted new rules to protect consumers and it known as the Know Before You Owe initiative.

The TRID (Truth in Lending Act- Real Estate Settlement and Procedures Act Integrated Disclosure Rule), disclosure rule replaces four disclosure forms with two new ones, The Loan Estimate and the Closing Disclosure. The borrower has up to ten days to review the Loan Estimate before the appraisal can be ordered which means appraisal period will take longer than normal.

The rule also requires that the borrower has three business days to review the Closing Disclosure and ask questions before closing. This is MANDATORY and NON-WAIVABLE period. Any changes in the loan (i.e. increased buyer credits or reduction in purchase price) will trigger an update to the disclosure and add another three-day review period.

How this impacts a transaction: The average length of escrow may increase anywhere from several days to several weeks! Agents and escrow officers must be diligent early in the process to work quickly with the lender and the buyer to try and avoid the mandatory three business day review period on multiple occasions. Unfortunately this extra step makes it even more difficult when those obtaining a loan are going up against all-cash buyers. Lenders and escrow companies will also have to be CFBP certified and follow stricter rules. Inevitably, we are preparing for escrows with a 30 day escrow period to possibly end up being more like 40 to 45 days. Patience and diligence from all involved will be essential while everyone adjusts to the new system.

How this impacts a transaction: The average length of escrow may increase anywhere from several days to several weeks! Agents and escrow officers must be diligent early in the process to work quickly with the lender and the buyer to try and avoid the mandatory three business day review period on multiple occasions. Unfortunately this extra step makes it even more difficult when those obtaining a loan are going up against all-cash buyers. Lenders and escrow companies will also have to be CFBP certified and follow stricter rules. Inevitably, we are preparing for escrows with a 30 day escrow period to possibly end up being more like 40 to 45 days. Patience and diligence from all involved will be essential while everyone adjusts to the new system.

Notes on a Realtors Scorecard- A look at high-end sales; will the recent stock market dip impact the housing market; short-term rentals; Developers going crazy in Venice and Mar Vista and more!

High-End sales (above $5M) still tracking to have a strong year: We have heard some concerns

|

| 384 Delfern Drive |

from people who own high-end homes that it feels like the market is slowing down in their neck of the woods. After looking at Multiple Listing Service “MLS” data regarding sales in high-end Westside neighborhoods, we found the market for homes above $5 Million is still doing well. We looked at overall sales from March/April compared to July/August and found the total # of sales was similar with 54 in March/April and55 in June/July. The average days on market dropped to 87 from 100 with properties selling for 96.5% of the list price in July/August compared to 94.65% in March/April. The average sale price dropped to $8.2M from $9.53M but that is partially skewed due to two sales above $45M in March/April headlined by 384 Delfern Drive in Holmby Hills selling for $59.355M (asking price was $75M). The highest sale in July/August was 609 East Channel Road in Santa Monica Canyon selling for $23M (asking price was 27.5M). With the recent stock market turmoil and the strength of the dollar potentially discouraging international bargain shoppers, it will be interesting to see if these numbers continue to hold steady.

Will the recent stock market dip actually help the real estate market?: The dip in the stock market will hurt potential buyers in terms of overall net worth and possibly detour the number of international buyers we have seen, however, many local economists remain bullish when it comes to the short-term future of Southern California real estate. Another factor that will help those looking to purchase a home is the interest rates have been dropping as the stock market drops allowing for the consumer to have more purchasing power. The FED to delay raising the benchmark rate, since some fear a hike in interest rates could push the American economy back into a recession. Here is an article from the LA Times to check out: Real Estate and recent Stock Market turmoil

Short Term rentals take 11 units off the LA rental market everyday: A report released earlier this year from the Los Angeles Alliance for a New Economy showed that short-term rentals are taking good apartments and homes off the regular market they can be rented out at huge mark-ups on sites like Airbnb. Rentals prices have spiked over 20% in the 2.5 years with the average person paying half of their income toward rent (typically you want your rent to be no more than 35% of your income). Curbed LA writer Adrian Kudler wrote an extensive article on the situation.

Developers going crazy in Venice: When you combine Abbott Kinney being considered one of the

sexiest streets in America, Silicon Beach becoming a major player in the LA economy attracting highly paid tech executives, you get developers salivating for properties in the area. 1519 Louella, a 850 sq. ft. home on a 5,900 sq. ft. lot sold for $1.4M on August 1st to a developer in an all-cash transaction. The house was in decent shape and had a pool but word is it will be torn down. To give you an idea on how much property values have jumped, we sold 1509 Louella, similar in sq. ft, lot size and interior, for $942K in May of 2013.

Small house in Mar Vista bordering SM Airport is in escrow for over $1.150M: 12701 Dewey

Street, a 3+1, 1,092 sq. ft. home on a 5,591 sq. ft. lot was listed a few weeks ago for $1,050M and promptly received 8 offers and is currently in escrow for $100K+ over the asking price. Over $1,000 a square foot! Dewey is a nice street but it does border the Santa Monica Airport. On two separate occasions, this house was listed in 2011 and 2012 for $715K and then for $750K and they couldn’t sell it. This is a rare occasion where they are extremely happy it didn’t sell three years ago.

The Eastside is hot as well…20 offers for a 2 bedroom home in Silver Lake/Echo Park: I had a well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.

well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.

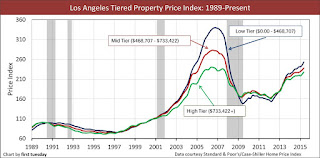

Thoughts on the future of the Los Angeles housing market

Until this year, the acceleration in housing prices in Los Angeles the past few years was largely driven by investors. We expect the housing market to continue to appreciate over the next 12 months as employment and incomes continue to improve. The Westside and South Bay will continue to see a multiple offer environment with the continued growth of Silicon Beach bringing high paying tech jobs to the area to supplement the already strong demand in a low inventory environment. A potential hiccup would be if the current stock market correction continues a strong downward spiral that would hit the tech sector hard enough that the growth of Silicon Beach is stalled.

|

| click to enlarge |

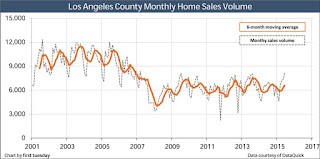

Despite home sales volume rising over last year, we still predict volume to stay low compared to historical standards with people reluctant to give up low interest rate loans and lower property tax base for a more expensive property that is also difficult to find in this market.

Though the outlook looks good in the near future, sine real estate economists feel the impending Fed rate hike will lead to a decrease in home values from late 2016 into 2018. History has shown us that prices naturally fall 9-12 months following a sustainable increase in mortgage rates as the rise in rates will decrease the amount of principal homeowners are able to borrow with the same mortgage payment. This will hit the market at all levels with more of the impact felt on the lower and mid-tier markets. Obviously rates will need to increase for this outlook to take shape and rates have been expected to rise for the past 12-18 months and it has not happened.

|

| click to enlarge |

The most sustainable prerequisite to a long-term rise in prices occurs when access to full-time jobs is optimal and according to economists, we will start to see that again in 2018. Once the international markets stabilize, we will see another strong international push to acquire Los Angeles real estate which is also predicted to begin around 2018-2019.

The start of another price appreciation run should be upon us at the end of the decade. In the long run, Westside real estate has proven to be a phenomenal leveraged investment and it will continue to be that way as it is one of most desired places to live in the world. However, prices will depreciate, as we saw from 2007-2009, and as long as you have a long-term outlook and are not constantly borrowing against the equity in your house, it will be one of the best investments you can make.

The cost of homeownership adds up in California

A recent report on the hidden costs of homeownership by Zillow and Thumbtack analyzes costs often overlooked by homebuyers, such as property taxes, homeowners insurance and utilities and the most common homeowner maintenance expenses, which are house cleaning, gardening/lawn mower, landscaping, carpet cleaning; and specific regional costs like air conditioner maintenance, gutter cleaning and pest removal.

These “hidden” homeownership costs add up to a national average of $9,477 per year. Los Angeles has a higher average at $11,333 and San Francisco checks in at a robust $13,287 (second highest in the nation behind Boston, MA). The reason Los Angeles is above the national average is mainly due to California’s high cost of living. Things are just more expensive in California, including the cost of domestic labor, which is included under common homeowner maintenance expenses cited in the report. Ultimately, California’s pleasant climate and bountiful opportunities come with a price.

Homebuyers shouldn’t necessarily be scared away by the higher level of homeownership costs in California — not all homeowners hire a cleaner or gardener, as this analysis assumes. But there are definitely some extra costs new homeowners need to keep on their radar. Also, it is important to remember the occasional maintenance expenses that can come out of nowhere and end up costing more than a homeowner imagined. Therefore, homeowners should always set aside savings for big expenses that come along every few years. A few examples are roof repair and replacement; termite damage; water damage; mildew removal; paint/sealing (especially exposed wood) and appliance repair and replacement.

Articles you should read

The Hamilton Project recently released a report stating that retirees are becoming more and more dependent on home equity: Housing Increasingly a source of net worth in retirement

Cash buyers paying premium prices are making it a difficult market for those obtaining a loan, especially at the middle-class level: Cash buyers and premium prices leave middle-class home seekers locked out

Thanks to job growth, low mortgage rates and continued investment from both domestic and international sources, Southland sales hit a nine-year high: Southland home sales hit a nine-year high; prices up 5.5%

According to a recent article on CurbedLA, Los Angeles has the biggest difference between normal travel times and rush hour travel times in the nation- it is 43 percent slower during rush hour than non-peak hours: The worst day and time to drive on every LA Freeway