A look at 1Q sales in Pacific Palisades (90272)

The Palisades market enjoyed a robust 1Q of 2017 compared to last year’s 1Q with overall sales increasing, and the most off-market activity of any area on the Westside.

The number of sales this year was 72 with a whopping 15 happening off-market while the 1Q of 2016 saw 58 sales with 7 happening off-market. Per MLS data, 10 homes sold for over the asking price while 11 sold over last year. You have to figure a fair amount of the off-market sales sold for a premium since the buyer had the privilege of purchasing the property without competition.

When reviewing the MLS sales individually, it was evident that quite a few sellers had an inflated view of their property value leading to some properties having to drastically reduce their price and selling for under market value despite this being a strong seller’s market.

Overall, it was a good quarter for the Palisades and one of the most sought after areas on the Westside will continue to command premium pricing throughout 2017.

Average sale amount/Average price per sq. ft.

2017: $4.213M–$1,312

2016: $3.466M–$1,429

Favorite sale of the quarter- 1102 Galloway Street- This newly constructed Cape Cod 6+8, 7,400 sq. ft. home on a 7,500 lot is a stunning union of modern craftsmanship and traditional architecture. They built the home with the finest tastes in mind including a huge basement with a lavish theatre and enormous wine cellar, elevator, roof-top deck and more all while being within walking distance to the new Caruso development. The property hit the market in November of last year for $5.985M and sold for $6M with an early January close.

Sneaky good buy- 333 N. Mount Holyoke- This spectacular 16K lot with amazing bluff views provided the buyer a rare opportunity to build an estate or build two homes since the lot has two parcel numbers. Unfortunately for the seller, they originally priced the home for $6.2M, and after being on and off the market for over a year while constantly reducing the price, the property finally sold for what we believe was a below market price of $4.3M in late January.

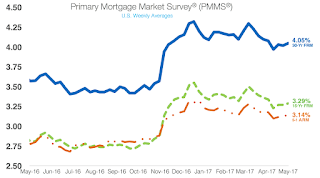

Mortgage rates increase slightly but hold steady around the 4% mark

|

| click to enlarge |

Mixed economic reports over the last few weeks have anchored the 30-year mortgage rate around the 4% mark.

The 30-year fixed rate mortgage (FRM) is at 4.05% which is up slightly from the 4.02% last week. Last year at this time, the rate was only 3.57%.

The 15-year FRM is 3.29%,

up from 3.27% last week and 2.81% last year.

The five-year Treasury-indexed hybrid adjustable rate mortgage is at 3.14%, up from 3.13% last week and 2.78% last year.

Source: Housing Wire

A look at 1Q sales in Mar Vista and Rancho Park/Cheviot (90066 and 90064)

90066 update-

Sales volume was higher in the 1Q of 2017 (73) compared to 62 in the 1Q of 2016. Off-market activity increased with 10 sales compared to last year’s 1Q when 6 sales sold off-market. The majority of the off-market sale activity involved tear-down/land value sales where the seller typically sold the property to a developer which unfortunately for the seller without proper market knowledge or representation, sell it to them for under market. The amount of sales over the asking price remained steady with over 50% of the MLS market sales going for over the asking price (2017=33 vs. 2016=32).

The competition between those vying for a home in Mar Vista is fierce with the area extremely popular with the Silicon Beach crowd and young families priced out of Santa Monica and the Palisades.

Average sale amount/Average price per sq. ft.

2017: $1.463M–$1,083 sq. ft.

2016: $1.347M–$1,026 sq. ft.

Top sale of the quarter- 11927 Tabor Street- The newly constructed 5+6. 4,045 sq. ft. home on a 8,800 lot was listed for $3.395M and they accepted an offer of $3.4M before the first open house. The sale closed on February 14th. It was a beautifully done modern home that is great for entertaining that flows into a spacious backyard featuring a pool. City light views from the master bedroom helped create a strong emotional bond with the buyers. The developer hit a financial home-run with this sale.

90064 update–

It was a strong 1Q with 62 sales recorded compared to just 42 in the 1Q of 2016. The number of homes that sold over asking per the MLS wasn’t as robust as last year (2017= 12 2016= 24) while the off-market activity jumped up to 12 sales compared to just 3 in the 1Q of 2016. It appears that most of the off-market activity involved tear-down lots.

Similar to the sister 90066 zip code, the areas that encompass this zip code are very popular and the demand continues to push sale prices higher, which should be the trend throughout the rest of the year.

Average sale amount/Average price per sq. ft.

2017: $1.896M–$1,104 sq. ft.

2016: $1.214M–$917 sq. ft.

The sale of the quarter- 10974 Ayres Ave- Situated right near the Westside Pavillion and all that Pico Blvd. has to offer, this newly constructed Cape Cod, 5+6, 4,050 sq. ft. on a 6,597 lot created quite the buzz when it hit the market in early January. The $2.495M list price was quickly bid up in a multiple offer situation featuring 5+ buyers and the ultimate sale price was $2.1718M. The sale closed on March 10th. It was a very well-designed home with high-end finishes a great indoor/outdoor flow to take advantage of the So Cal lifestyle.

Builder buys 18 acres near Rams Stadium, announces plans for 228 homes

Harridge Development group says it will build 228 detached condos in a gated community on the site at 333 North Prairie Avenue, just south of Florence Avenue. The new tract of homes which will be called Grace Park, supposedly will be move-in ready by the time the stadium is scheduled to open in 2019. Harridge is betting the new homes would appeal to, “Los Angeles County’s highly educated tech workers”.

Source- LA Curbed

A look at 1Q single-family sales North of Wilshire (90403) and South Santa Monica (90405)

90403 update–

Sales volume doubled compared to the 1Q of 2016 (12 vs. 6). However, the amount of homes that sold over asking dipped to 3 while 5 of the 6 sales in 2016 sold over the asking price. We did not find any evidence of off-market sales in the 1Q of 2016 or 2017.

Quick Analysis- The north of Wilshire market is in high demand especially with the improved walk-ability of Wilshire Blvd. The educated SM buyer knows they can get most of the 90402 perks for a discount. The majority of sales were for tear-down properties but most listing prices tended to be above market, curtailing over asking price sales.

Here is a look at the sales price data. Per earlier posts, we strongly recommend you don’t depend on quarterly sales price data to draw strong conclusions regarding market health. In fact, activity in the 90403 zip provides a great example of this. Due to the amount of tear-down sales, the average sale price has dropped considerably compared to last year yet the highest selling property (see below) sold way over the asking price and significantly above what it sold for in 2015.

Average sale amount/Average price per sq. ft.

2017: $2.362M — $1,141

2016: $3.666M — $2,331

906 Princeton Ave– 3+3, 2,400 sq. ft. main house, 1,200 sq. ft. guest house on an 8K lot was listed for $2.995M in late October of 2016. They immediately received multiple offers and the property sold for $3.325M, closing in January. The house had a Spanish charm mixed with a modern feel creating quite a bit of interest. The home in similar condition sold in 2015 for $2.675M after being listed for $2.475M…

90405 update-

The 1Q of 2017 pretty much mirrored that of 2016 from a sales volume perspective (22 vs. 21) and off-market activity (2 vs. 2). However, the amount of homes that sold over asking practically doubled (11 vs. 6).

Quick analysis- As we mentioned in a previous blog post last month, Ocean Park and Sunset Park are extremely popular with buyers and builders which leads to a very competitive environment with tight inventory. We expect this to continue for at least 12-18 months. Quite a few tear-downs/small homes traded hands this quarter which brought the average sale price down.

Average sale amount/Average price per sq. ft.

2017: $1.604M — $1,258

2016: $2.215M — $1,591

Crazy sales of the quarter-

1101 Cedar Street- This 3+2, 1,833 sq. ft. home on a 6K lot was nicely updated but has a bit of a weird floorplan and minimal yard area. Despite being located on one of the busier streets in the area (11th), they received over 10 offers at the $1.595M list price and ended up selling to an all-cash buyer at $1.907M! The deal closed on March 28th.

1101 Cedar Street- This 3+2, 1,833 sq. ft. home on a 6K lot was nicely updated but has a bit of a weird floorplan and minimal yard area. Despite being located on one of the busier streets in the area (11th), they received over 10 offers at the $1.595M list price and ended up selling to an all-cash buyer at $1.907M! The deal closed on March 28th.

1713 Pier Avenue– This 3+2, 1,720 sq. ft. home Spanish home on a 7K lot was listed for $1.549M and received over a dozen offers. The property was a major remodel candidate but the second floor did feature views and the backyard has a pool. The selling price was $400K over asking at $2.0M and it closed March 15th.

1713 Pier Avenue– This 3+2, 1,720 sq. ft. home Spanish home on a 7K lot was listed for $1.549M and received over a dozen offers. The property was a major remodel candidate but the second floor did feature views and the backyard has a pool. The selling price was $400K over asking at $2.0M and it closed March 15th.

Please feel free to contact us directly if you require further information or would like a market analysis of your property.

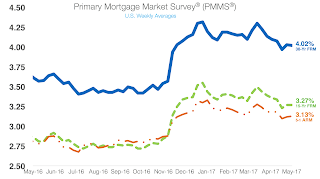

Rates hover near 4% mark

|

| click to enlarge |

Mortgage rates ticked up slightly, but hovered near the 4% mark after the weak gross domestic product increase and the Federal Open Market Committee’s decision not to raise rates.

The 30-year fixed rate mortgage edged down slightly to 4.02% for the week ending May 4, 2017. This is down from last week’s4.03% but still up from last year’s 3.61%.

The 15-year FRM held steady at 3.27%, an increase from last year’s 2.86%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly, hitting 3.13%. This is up from last week’s 3.12%, but down from 2.8% last year.

Source: Housing Wire

Los Angeles now has the nation’s fifth-highest rental prices

Los Angeles renters face the fifth-highest prices in the nation, according to a new report from rental website Zumper. LA has overtaken Oakland, and now trails only San Francisco, New York, San Jose, and Boston.

The report shows that the median rental price for a one-bedroom apartment in Los Angeles jumped up to $2,090 in April. That’s a 1.5 percent increase over the month before, when the median price was $2,060.

Meanwhile, two-bedroom prices in Los Angeles are still higher than anywhere but San Francisco and New York. The median price for units with a second bedroom was $2,980 per month in April, up a percent since March.

Rental prices nationwide have increased in recent months. Zumper CEO Anthemos Georgiades suggests that’s the result of a seasonal uptick in the number of people moving, constraining supply and causing prices to rise.

It may be a while before prices begin to level off in LA. A report from real estate firm Marcus & Millichap earlier this year projected that the city’s rents would rise more than 5 percent by the end of 2017.

Source: Curbed LA