Pre-Market opportunities you should know about

We will be bringing the following properties to market in the next month-

Renovated 3+3, 1800+ sq. ft. Brentwood Condo- LP- Not established (high 900K range?): Centrally located in the heart of Brentwood, this Montana Avenue (just east of Barrington) condo is currently being renovated and should be ready by the end of September/Early October.

*We have two West Los Angeles Condos (2 bed/2 bath, aprox. 1,800 sq. ft.) located just south of Santa Monica Blvd. between Bundy and Barrington that are tentatively scheduled to come to market by early October and the price range for both will be in the $1M-1.1M range. Please reach out to us directly for more detailed information on any of these properties!

Thoughts on the current Westside market and what to expect in 2019

As I stated above, according to various title services, volume is down about 13-15%. We have definitely experienced some market softening with condos at all levels and single family homes above $3M. We have seen a little price depreciation but the softening is more along the lines of a normalizing market. Multiple offers are still common but not as plentiful. The entry and mid-level price points per neighborhood are still appreciating but not at the clip we have seen the past five years.

We are definitely at the end of a summer lull. Some colleagues feel this is a sign for a depreciating 2019 market and when you combine that with lower sales volume throughout the year, they have a point. However, we had a very slow July/August period the past two years and saw things pick up nicely in September and October and frankly, inventory has been dreadful since the beginning of this summer. We have buyers who are ready to go but they have very few properties to choose from.

Silicon Beach is continuing to grow at a very strong pace (ex: Google is in the process of purchasing the Westside Pavilion) providing plenty of high paying jobs; the stock market is still on a bull run and a day does not go by that I do not receive e-mails from agents looking for pocket listings.

Overall, I am expecting things to pick-up again over the next few months (many people are waiting to put their properties on the market after Labor Day weekend). 2019 should be stronger from a volume perspective and most economic forecasts call for a 5% appreciation in home values next year. If interest rates continue to float around the 4.5% mark, I agree with this assessment. However, if rates get to around 5%, I believe we will see a potential decline in values across all price ranges. Mortgage rates will have increased almost 25% in just two years. When you combine that with losing the ability to write-off your property taxes above the standard $10,000 deduction provided, it creates an affordability issue for most buyers.

Compass acquires Pacific Union – could the MLS become antiquated?

As little as two years ago, top independent brokerages such as Partners Trust, The Agency, Teles Properties, John Aaroe and Gibson International were big-time players when it came to residential real estate on the Westside. In 2017, the sale of Teles properties to Douglas Elliman and Partners Trust, John Aaroe and Gibson International being acquired by Pacific Union, signaled an end to those days.

In less than one year, the Amazon effect is hitting the residential real estate world. It was officially announced this week that Compass has bought Pacific Union, the third largest brokerage in California. Compass seems to have every intention (thanks in part to a $450M investment from SoftBank) to become one of, if not, the largest national brokerages and take the lead in a war that is developing between full-service/traditional brokers and industry disruptors like Zillow, Purple Bricks and Redfin. In the next few years, it would not be surprising to see the major full-service brokerages creating their own platforms outside of the the Multiple Listing Service. One way or another, CHANGE is coming.

Acquisition part II– It is personally frustrating to have three different company names in a one-year period while sitting in the same office in Brentwood. I saw this same industry consolidation happen around 2008, right before the last real estate downturn. With sales volume currently down about 13-15% for the year on the Westside, the economics are definitely tougher for brokerages right now.

However, it is sad to see the strong independents go away. Most of them were made up of strong and ethical agents that do things the right way and are appreciated by clients. It was nice to walk down the hall and grab the president when you needed something. We held ourselves to a higher standard and I truly hope that Compass can continue that. I hear very good things about them and like many of the agents I already know at the company…we shall see.

Articles on Acquisition-

Compass Acquires Pacific Union

Compass and Pacific Union CEO’s weigh-in on their mega real-estate merger

Quick-hitting real estate info you should know

*Jet traffic is down almost 85% since the Santa Monica Airport shortened its runway earlier this year…property owners in South Santa Monica and Mar Vista are definitely enjoying that.

* Mid-City is now a million-dollar neighborhood, with a median price point of $1,065,000

* More price reductions compared with last July were recorded in areas with a larger share of homes priced between $2 million and $3 million: Malibu, Silicon Beach, the Hollywood Hills, and Brentwood.

*With an average of $4,883 per month, the 90024 zip code of Westwood, ranked as the third-most expensive place to rent in the country, according to a new analysis by RentCafe. Westwood ranked higher then San Francisco!

*Nationwide home sales volume has dropped for seven straight months. The Western U.S. saw the biggest year-over-year dip by dropping 5.8%. The national association of realtors points to an over-heated housing market in which perspective buyers are just unable to afford homes and a ceiling of pricing could be developing…

*The value of all residential real estate in New York City is equivalent to the gross domestic product of France!

*More than 1/3 of the country’s $28.4 trillion in resi real estate is concentrated in ten American cities…New York and Los Angeles top the list, though Los Angeles is a distant 2nd

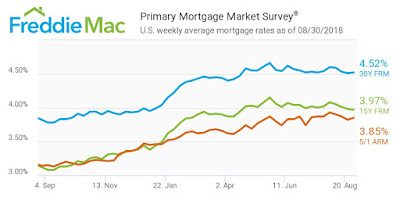

30-Year rates holding steady around 4.50%

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.52% for the week ending Aug. 30, 2018, increasing from 4.51% last week, and is still a substantial increase from last year’s rate of 3.82%.

The 15-year FRM averaged 3.97 this week, down from last week’s 3.98%. This time last year, the 15-year FRM was 3.12%.

Source: Housing Wire