Real estate articles worth checking out

The bank of Mom and Dad would rank as the seventh largest mortgage lender – Parents and grandparents supported the nationwide purchase of $317 billion worth of property—1.2 million homes—last year

Millenials are finally buying homes – According to the latest data from the Census Bureau, the national homeownership rate rose in the fourth quarter to 64.8%, which is a four-year high.

Growth in home prices continues to slow in January Nationally prices grew 4.4% year over year and .1% month over month

As sales volume plunges, LA home prices are inching up at the slowest rate in years – Year-over-year home sale prices are up 2% in LA County.

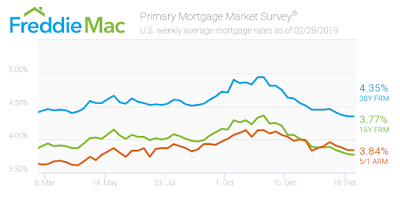

Mortgage rates remain subdued

Rates for home loans were little changed near long-time lows, providing a little breathing room for would-be buyers even as policy makers are increasingly taking an interest in housing matters.

The 30-year fixed-rate mortgage averaged 4.35% in the February 28 week, mortgage guarantor Freddie Mac said Thursday. That was unchanged from the prior week and the lowest in a year.

The 15-year adjustable-rate mortgage averaged 3.77%, down one basis point. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84%, also unchanged.

Source- Marketwatch

% of multiple bids for properties is dropping

Home shoppers in California will likely face less competition in their offers. January showed multiple offer bidding wars saw a significant drop from a year ago, according to a report from Redfin. Only 13 percent of offers written by agents on behalf of their customers faced war—down significantly from 53 percent a year ago.

As we noted last week, due to tight inventory and interest rates dropping again, we are still seeing a fair amount of multiple offer activity on the Westside for properties listed around the true market value. However, the amount of offers is more like two to three compared to the five or seven we were seeing last spring.