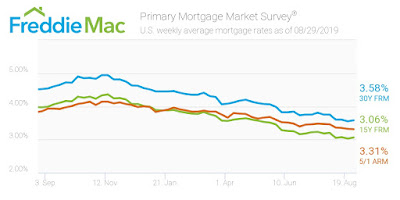

Mortgage rates tick up slightly to 3.58% but still nearly one percentage point lower than a year ago

Although the average U.S. rate for a 30-year fixed mortgage rose this week, the rate still managed to hover near last week’s 3-year low.

The 30-year fixed-rate mortgage averaged 3.58% for the week ending August 29, 2019, up from last week’s rate of 3.55%. A year earlier, the rate was 4.52%

The 15-year FRM averaged 3.06% this week, slightly rising from last week’s 3.03%. This time last year, the 15-year FRM came in at 3.97%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.31%, sliding from last week’s rate of 3.33%. Once again, this rate sits much lower than the same week in 2018 when it averaged 3.85%.

Source- Marketwatch

NEW PRICE- PRIME DTLA OPPORTUNITY – THE METROPOLIS- 38TH FLOOR – $1.799M

Live above it all in Downtown LA and acquire one of the most desirable units with the largest 2BR floorplans available (1,720 sq. ft.) in Tower 1 of the Metropolis. This luxurious residence is situated in the Southwest corner of the top floor and provides a fantastic floor-plan ideal for entertaining or enjoying a quiet evening watching the sunset. The 11-foot ceilings along with the floor-to-ceiling windows provide an expansive feel and the best views you can find in LA. Other features include custom cabinets in the kitchen along with Bosch appliances, automatic shades in the living room and plenty of storage. Tower 1 provides world-class amenities such as fitness center equipped with steam rooms in both ladies and men’s bathrooms, 24-hour lobby attendant, media room, business center and a wide open outdoor space located on the 6th floor that includes a BBQ area, resort-style pool, and dog park. A true gem providing the perfect blend of luxury and A+ location. **The Seller bought the unit for over $2.050M and is ready to move on…E-mail us for more information and to set up a showing.

Los Angeles real estate- lower interest rates have strengthened LA’s housing market after a slow start to the year

Compass Chief economist Dr. Selma Hepp has published an in-depth article examining the Los Angeles real estate landscape.

Here are the key takeaways-

* After a large dip in housing market activity starting in the last quarter of 2018 and first quarter of 2019, housing markets in recent months have mostly bounced back to where they were last summer.

* In July, total sales in Los Angeles County trended at the same level as July of last year, with an increase in sales of homes priced between $1 million and $2 million, up 5 percent year-over-year, being offset by slower sales in other price segments.

*Strong activity among homes priced between $1 million and $2 million bring the levels of homes in that price range to the highest level in the last five years.

*Some West Side communities, which experienced slower market conditions since last year, have finally seen more activity. Most notably, sales in Malibu and Beach Communities North have posted the first annual increase since last summer, up 11 percent year-over-year. The impact of wildfires has had a considerably negative impact on the area with overall year-to-date decline in sales of 26 percent. The most recent uptick was driven by strong sales of homes priced below $2 million while higher priced sales continue to lag.

*For-sale inventory is once again trending below last year’s levels with July’s year-over-year decline for the overall inventory down one percent, and inventory priced below $1 million down 5 percent. Declines follow almost a year of year-over-year increases. And the lower priced inventory is now 24 percent below the 2015 levels.

Also, here is the Compass July 2019 Market Real Estate Market Update which provides a quick summary of the overall market and more detailed statistics on specific areas.

Wire-Fraud continues to be an issue in real estate transactions- Here is how you avoid the scam!

Recently, the Consumer Finance Protection Bureau published a fraud alert for wire transfers of earnest money, down payments, closing costs and loan payoffs.

Here’s how you can avoid a wire-transfer scam:

1. Never follow wire-transfer instructions sent via email. Verify the closing instructions, including the account name and number, with your trusted representatives either in person or by using a predetermined phone number. Similarly, never email financial information.

2. Pay attention to email addresses related to the transaction. A legitimate address like john-doe@abc.com could be confused with a spoofed email like john_doe@abc.com or john-doe@bcd.com.

3. Keep computer security patches and antivirus software up to date. Change your password every 90 days and enable two-step authentication on your email account.

4. Suspect a scam? Contact the bank immediately and request a wire recall. To recover large, international wire transfers, ask the bank to contact the local FBI office and request a Financial Fraud Kill Chain.