Welcome back from the August real estate holiday…but don’t let the lull fool you- We saw some multiple offer activity on well price properties in August but it has become apparent over the past few years that activity drops-off enough in August that people wonder if the market is changing…yet, it then picks right back up in Mid-September for a solid six week run before the end of year holiday season. With interest rates at their lowest point for 2017 and a very strong LA economy, we fully anticipate a flurry of activity over the next few months.

Escrow cancellation rates are at all-time lows: In speaking with local escrow officers, cancellation rates are at all-time lows (give or take 10%) compared to rates that were triple that five years ago. A few other observations from the escrow side of things- *shorter escrows (15-21 days) with little to no contingency periods are becoming more frequent. In fact, some are able to still get loans closed within 21 days. We have buyers from San Francisco/Silicon Valley to thank for this trend. In the hyper competitive Bay Area market, all contingencies are being removed upfront on some deals, even on homes that don’t need much renovation.

Packing up and moving to the Northwest and Texas?– We are noticing a trend of more people willing to sell and relocate out of So Cal and take advantage of the equity they built in their home. Companies relocating to more reasonably cost real estate is obviously playing a significant role. The popular destinations seem to be the Pacific Northwest and areas around Dallas, Texas.

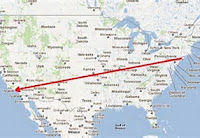

Moving in…New Yorkers fleeing to Los Angeles: A recent Linkedin report shows New Yorkers are on the move to Los Angeles. We are definitely seeing this trend on the Westside and are currently working with multiple parties from the New York area…Article- New Yorkers fleeing to Los Angeles

Homeless concerns impacting buyers in Venice and Santa Monica?– The homeless issue on the Westside seems to be more noticeable to out of town buyers. We don’t know if the metro has provided easier access to Santa Monica from skid row, but in showing properties in affluent areas (especially Venice and area near the metro in Santa Monica) we are definitely hearing comments on property tours.

Mar Vista/Westchester and Playa Del Rey solidly embraced by Silicon Beach– Mar Vista continues to be very popular with those in the tech world. They love the proximity to Silicon Beach while being central too much of what LA has to offer. It is not as crowded as Venice and with Venice Blvd. and Washington Blvd starting to go through a revitalization with shops and restaurants, we don’t see this trend changing for a long time. The same can be said for Playa Del Rey and Westchester. Both of these areas are also very popular with young families in the tech sector and even though some can afford what would be considered higher-end areas, they are specifically looking to be in these areas.

Caruso development in the Palisades will have an even bigger impact on home values than originally thought– The Palisades has always been at the top of the list of Westside locales of the rich and famous and even moreso with the current re-development of the Palisades village by renowned developer Rick Caruso. However, based on conversations we have had with area developers and real estate professionals, many believe the added value of this development will not truly be felt until it is fully in-use. They expect another step-up in value and demand for the beautiful seas-side area that will now provide amenities and cohesiveness the area did not provide in the past.

27 offers on a condo in Santa Monica with no laundry and heat- Condo with no laundry and heat in Santa Monica garners 27 offers and goes for almost 200K over asking!- When a sharp looking 2+2, 1070 sq. ft. unit located at 609 Washington hit the market for $896K, it definitely garnered a lot of attention but most thought it wouldn’t go crazy due to the unit not having inside laundry and no heating system. Typically, community laundry is a major handicap when it comes to resale value. However, that wasn’t the case this time. The listing agent was overwhelmed with 27 offers. They responded to the top 10 and supposedly sold to for around $1.070M…