A look at 1Q single-family sales North of Wilshire (90403) and South Santa Monica (90405)

90403 update–

Sales volume doubled compared to the 1Q of 2016 (12 vs. 6). However, the amount of homes that sold over asking dipped to 3 while 5 of the 6 sales in 2016 sold over the asking price. We did not find any evidence of off-market sales in the 1Q of 2016 or 2017.

Quick Analysis- The north of Wilshire market is in high demand especially with the improved walk-ability of Wilshire Blvd. The educated SM buyer knows they can get most of the 90402 perks for a discount. The majority of sales were for tear-down properties but most listing prices tended to be above market, curtailing over asking price sales.

Here is a look at the sales price data. Per earlier posts, we strongly recommend you don’t depend on quarterly sales price data to draw strong conclusions regarding market health. In fact, activity in the 90403 zip provides a great example of this. Due to the amount of tear-down sales, the average sale price has dropped considerably compared to last year yet the highest selling property (see below) sold way over the asking price and significantly above what it sold for in 2015.

Average sale amount/Average price per sq. ft.

2017: $2.362M — $1,141

2016: $3.666M — $2,331

906 Princeton Ave– 3+3, 2,400 sq. ft. main house, 1,200 sq. ft. guest house on an 8K lot was listed for $2.995M in late October of 2016. They immediately received multiple offers and the property sold for $3.325M, closing in January. The house had a Spanish charm mixed with a modern feel creating quite a bit of interest. The home in similar condition sold in 2015 for $2.675M after being listed for $2.475M…

90405 update-

The 1Q of 2017 pretty much mirrored that of 2016 from a sales volume perspective (22 vs. 21) and off-market activity (2 vs. 2). However, the amount of homes that sold over asking practically doubled (11 vs. 6).

Quick analysis- As we mentioned in a previous blog post last month, Ocean Park and Sunset Park are extremely popular with buyers and builders which leads to a very competitive environment with tight inventory. We expect this to continue for at least 12-18 months. Quite a few tear-downs/small homes traded hands this quarter which brought the average sale price down.

Average sale amount/Average price per sq. ft.

2017: $1.604M — $1,258

2016: $2.215M — $1,591

Crazy sales of the quarter-

1101 Cedar Street- This 3+2, 1,833 sq. ft. home on a 6K lot was nicely updated but has a bit of a weird floorplan and minimal yard area. Despite being located on one of the busier streets in the area (11th), they received over 10 offers at the $1.595M list price and ended up selling to an all-cash buyer at $1.907M! The deal closed on March 28th.

1101 Cedar Street- This 3+2, 1,833 sq. ft. home on a 6K lot was nicely updated but has a bit of a weird floorplan and minimal yard area. Despite being located on one of the busier streets in the area (11th), they received over 10 offers at the $1.595M list price and ended up selling to an all-cash buyer at $1.907M! The deal closed on March 28th.

1713 Pier Avenue– This 3+2, 1,720 sq. ft. home Spanish home on a 7K lot was listed for $1.549M and received over a dozen offers. The property was a major remodel candidate but the second floor did feature views and the backyard has a pool. The selling price was $400K over asking at $2.0M and it closed March 15th.

1713 Pier Avenue– This 3+2, 1,720 sq. ft. home Spanish home on a 7K lot was listed for $1.549M and received over a dozen offers. The property was a major remodel candidate but the second floor did feature views and the backyard has a pool. The selling price was $400K over asking at $2.0M and it closed March 15th.

Please feel free to contact us directly if you require further information or would like a market analysis of your property.

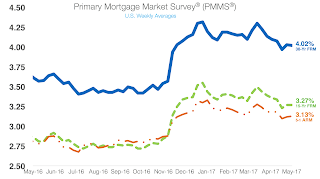

Rates hover near 4% mark

|

| click to enlarge |

Mortgage rates ticked up slightly, but hovered near the 4% mark after the weak gross domestic product increase and the Federal Open Market Committee’s decision not to raise rates.

The 30-year fixed rate mortgage edged down slightly to 4.02% for the week ending May 4, 2017. This is down from last week’s4.03% but still up from last year’s 3.61%.

The 15-year FRM held steady at 3.27%, an increase from last year’s 2.86%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly, hitting 3.13%. This is up from last week’s 3.12%, but down from 2.8% last year.

Source: Housing Wire

Los Angeles now has the nation’s fifth-highest rental prices

Los Angeles renters face the fifth-highest prices in the nation, according to a new report from rental website Zumper. LA has overtaken Oakland, and now trails only San Francisco, New York, San Jose, and Boston.

The report shows that the median rental price for a one-bedroom apartment in Los Angeles jumped up to $2,090 in April. That’s a 1.5 percent increase over the month before, when the median price was $2,060.

Meanwhile, two-bedroom prices in Los Angeles are still higher than anywhere but San Francisco and New York. The median price for units with a second bedroom was $2,980 per month in April, up a percent since March.

Rental prices nationwide have increased in recent months. Zumper CEO Anthemos Georgiades suggests that’s the result of a seasonal uptick in the number of people moving, constraining supply and causing prices to rise.

It may be a while before prices begin to level off in LA. A report from real estate firm Marcus & Millichap earlier this year projected that the city’s rents would rise more than 5 percent by the end of 2017.

Source: Curbed LA

A look at 1Q sales North of Montana – Santa Monica zip 90402

When looking at quarterly sales, many people make the mistake of looking at the sales price compared to previous quarters when examining the health of a market. The sample size is small enough that a few non-median sales on the high-end or low-end can artificially skew the numbers.

What we like to do is look at sales volume compared to the same quarter of the previous year along with how many single-family properties sold off-market and how many of the properties that were in the MLS sold at over the asking price. This information was collected via the MLS and title report records.

Overall, the numbers show a sizable drop in the amount of sales (30-2016 vs. 22-2017) in the 90402 zip thanks to disappearing inventory. Only two homes sold outside of the MLS compared to 11 in 2016. Of the 20 properties in the MLS, 7 sold at or over the asking price this year while 11 of the 19 listed in the MLS in 2016 sold at or over.

Quick Analysis- The most prestigious zip code in Santa Monica is still highly desired but the sellers are being a little more aggressive with listing prices and the market above $4.5M isn’t as hot as the lower price ranges. However, sales under $4M are hopping. Check out these two examples with a little inside dirt…

454 14th street– This 3+2, 1,972 sq. ft. home on a 7,518 sq. ft. lot sold was basically marketed as a tear down at an auction price of $2.949M. A few realtors and neighbors thought it would go out for around $3.250M but of the double digit offers, only about 7 were taken seriously and countered. In particular, one very interested party really wanted the home…the neighbor…who snagged it for $3.6M! The deal closed on March 3rd. Though this was a hefty price tag, it was a smart investment. Land is king on the Westside and large lots are few and far between in the 90402 zip and they typically trade at super premium pricing.

335 16th street– Another tear down opportunity, this 3+1, 1,358 sq. ft. home on a 7,512 lot was also listed at $2.995M and fed off the frenzy of the 14th street sale. Multiple bidders weren’t even allowed in the property. Listed a month later then 454 14th, this property sold to an all-cash buyer in two weeks for $3.450M. The closing date was March 20th. It will be interesting to see if the market truly holds around $3.5M for teardowns on 7,500 sq. ft. lots or if these were anomalies…if not, the Gillette Regent tear down lots which are 8,900 sq. ft. would be around a $4M value…

Here is a quick look at the Average sale amount and the average price per square foot of the properties sold.

Average sale amount/Average price per sq. ft.

2017: $4.452M — $2,168

2016: $4.533M– $1,371

Please feel free to contact us directly if you require further information or would like a market analysis of your property.

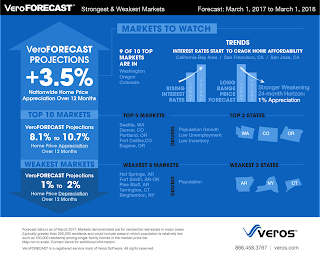

Mortgage experts agree: There is no housing bubble…slow-steady growth await

|

| click to enlarge |

According to an article by Brena Swanson of HousingWire, three experts in the mortgage industry (Darius Bozorgi, Veros CEO, Mike Fratantoni, Mortgage Bankers Association chief economist and Douglas Duncan, Fannie Mae chief economist), all agree they don’t see a housing bubble on the horizon. They all took part in a HousingWire webinar this past week.

Check out the article: Mortgage experts agree- There is no housing bubble

Writing love letters and bidding $100K over asking – the reality of buying in Southern California

The LA Times just posted an article outlining the craziness we have seen over the past two months across Southern California. With some of the best employment numbers Los Angeles has seen in decades, tight inventory and the fear of eventual rising mortgage rates, the pressure is on especially when it comes to homes worth under $1M.

Check it out: Writing love letters and bidding $100K over asking- Buying in Southern California is Insane!

Partners Trust 2017 Q1 Los Angeles market report

From the Westside to the San Fernando Valley and Malibu to the South Bay, this report provides an extensive look at sales data for the 1st quarter of 2017. We will be providing an in-depth look at the numbers and specific sales for certain Westside zip codes in the coming weeks.

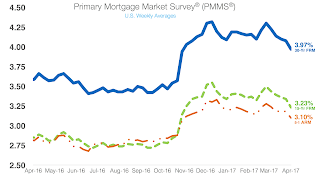

Mortgage rates drop below 4%

|

| click to enlarge |

Mortgage rates dropped below the psychologically important 4% mark, hitting the lowest point since November of last year.

The 30-year fixed-rate mortgage dropped to 3.97% for the week ending April 20, 2017. This is down from last week’s 4.08% but still up from last year’s 3.59%.

The 15-year FRM dropped to 3.23%, down from last week’s 3.34% but up from last year when it averaged 2.85%.

Weak economic data and growing international tensions are driving investors out of riskier sectors and into Treasury securities thus causing a shift in investment sentiment which has propelled rates lower.

The drop in rates in an environment where rates are expected to rise has increased pressure on serious buyers to find a home which gives more leverage to sellers.

Source- Housing Wire & Freddie Mac Chief Economist Sean Becketti

Los Angeles is making it harder for landlords to take rent controlled units off the market

The Los Angeles City Council unanimously approved a new set of regulations on Wednesday to deter owners of rent-controlled building from taking their units off the market.

The Los Angeles City Council unanimously approved a new set of regulations on Wednesday to deter owners of rent-controlled building from taking their units off the market.

The new rules will require landlords who want to build at a site, make an equal number, or 20 percent of the new units affordable-whichever is larger.

Landlords will also have to pay for the relocation of tenants evicted under the Ellis Act and file annual reports with the city on the status of the units.

Last year, close to 1,400 units were taken off the rental market citywide due to Ellis Act evictions which was an increase of over 25% since 2015.

Here is a more in-depth article via LA Curbed: LA is making it harder for landlords to take rent controlled units off the market

Homes are selling in 30 days or less

According to the California Association of Realtors, the median amount of time homes spent on the market before finding a buyer dropped below 30 days- from 38.8 in February and 43.2 last March. That’s the shortest amount of time on the market in over a year for the Los Angeles area.