Los Angeles emerges as the top city for US international investment

A recent survey has divulged that the greater Los Angeles area is the #1 locale in North America for world citizens seeking new property in 2017. The Los Angeles Times accentuates this real estate phenomenon in an article highlighting the allure of the City of Angels. Additionally, Knight Frank’s “Wealth Report” of 2017, which offers a global perspective on wealth and investment opportunities and strategies, has ranked Los Angeles as #5 out of 40 cities with the most formidable urban power in the world. It is widely acknowledged among Los Angeles real estate insiders that the market has not yet reached its paramount potential.

A recent survey has divulged that the greater Los Angeles area is the #1 locale in North America for world citizens seeking new property in 2017. The Los Angeles Times accentuates this real estate phenomenon in an article highlighting the allure of the City of Angels. Additionally, Knight Frank’s “Wealth Report” of 2017, which offers a global perspective on wealth and investment opportunities and strategies, has ranked Los Angeles as #5 out of 40 cities with the most formidable urban power in the world. It is widely acknowledged among Los Angeles real estate insiders that the market has not yet reached its paramount potential.

While San Francisco was ranked number one in the first CBRE Global Investor Intentions Survey, Los Angeles has increasingly become a safe bet. “Los Angeles is a safe haven for investment these days,” says Dario Svidler of Partners Trust Commercial. “Jobs, desirability, stability and lack of home affordability combine to make Los Angeles a steady growth market with little to no downside.”

The 2017 global investor assessment maintains that office spaces are the preferred type of real estate to purchase, while warehouses and multifamily residential buildings come in as second and third. Those who participated in this international survey were insurance companies, sovereign wealth funds, operators of pension and investment fund managers.

It is likely that the price of real estate in Los Angeles will increase as does demand. Several momentous deals have occurred in the last year, including Douglas Emmett Inc. and the Qatar Investment Authority’s $1.3 billion purchase of four Westwood office buildings and Boston Properties Inc.’s $511 million acquisition of the Colorado Center office complex in Santa Monica. These transactions were two of the largest deals made in the U.S. this last year.

While Los Angeles’ Westside is the epicenter for global investments, Downtown LA is quickly becoming another popular area among U.S., Chinese, and Canadian developers. The building boom in Downtown is the biggest we have seen since the 1920’s with some commercial brokers a little concerned it might be overkill but with the demand for housing in Los Angeles at an all-time high, the explosion of units that will come available should be absorbed.

Furthermore, the “Wealth Report” highlights Hancock Park as one of five areas throughout the world with the greatest real estate value. Thus, the Los Angeles real estate market is rapidly gaining traction and garnering attention from all corners of the globe.

“L.A. has been waiting for this moment for a long time,” says Lew Horne, president of SoCal and Hawaii’s CBRE Group Inc.

Source- Partners Trust Blog& LA Times

Why Ocean Park and Sunset Park are exploding in popularity

The north Santa Monica zip codes of 90401, 90402 and 90403 will always be the most coveted when it comes to Santa Monica real estate, but the gap is beginning to close when you compare them to the 90405 areas of Sunset and Ocean Park. A statement like that would have been blasphemous as little as ten years ago but with older homes in the area beginning to transform into homes you used to see only built north of Wilshire, combined with fantastic walkability and a more centralized location to all of what LA has to offer, this trend will inevitably continue. We have seen a hand-ful of new construction sell for over $3.5M and poised to break the $4M mark.

More reasons to be bullish—*The Santa Monica Airport is due to shorten the runway later this year which will eliminate some of the nosier jets in the short-term and in the long-term the airport is set to fully shut down in 12 years if not sooner. *The city has already claimed 12 acres of the airport to expand the Airport Park (drawing of park expansion below). *The phenomenal restaurants on Ocean Park Blvd. are as popular as ever and the Sunset Park area of Pico Blvd. continues to improve with popular restaurants and bars.

|

| SM Airport Park Expansion |

Playa Del Rey- A sleeping giant that’s received its wake-up call

We have been very bullish on Playa Del Rey for the past few years as it offers a bargain for beach living when compared to locales like Venice and Santa Monica. The LA Times is now feeling the love as well. Check out this recent article- Playa Del Rey is a sleeping GIANT.

Though you do have to deal with LAX noise, the sleepy beach community offers a centralized location to some of the best the Westside and South Bay has to offer while also being in an ideal position to benefit from the resurgence of the areas restaurant/shopping scene which still has plenty of room for improvement.

Though you do have to deal with LAX noise, the sleepy beach community offers a centralized location to some of the best the Westside and South Bay has to offer while also being in an ideal position to benefit from the resurgence of the areas restaurant/shopping scene which still has plenty of room for improvement.

Articles for your edification- what $2600 rents you on the Westside; Cali not in a housing bubble and more

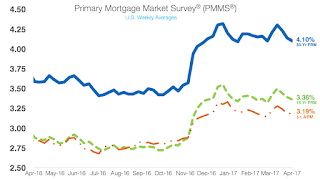

Mortgage rates just above 2017 lows

Mortgage rates dropped for the third consecutive week to just above 2017’s low. The 30-year fixed-rate mortgage dropped to 4.10% for the week ending April 6, 2017.

This is down from last week’s 4.14% but still up from last year’s 3.59%. Similarly, the 15-year FRM also dropped to 3.36%, down from last week’s 3.39% but still up from last year’s 2.88%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly to 3.19%. This is up from last week’s 3.18% and from last year’s 2.82%.

Source: Housing Wire

Seven takeaways from networking meetings with top realtors on the Westside

* January and early February were very slow from a transaction standpoint. However, things have taken off since with the Westside market taking another step up in appreciation since the Super Bowl. Well-priced new listings are going into strong multiples and properties that sat on the market longer than anticipated were absorbed by buyers, once pricing fell in-line with market expectations. We are expecting opportunities for buyers to pick-up in April, but thus far quality new listings are few and far between.

*Most agents feel that we will see further price appreciation in 2017 but the growth will be tempered by interest rate increases and affordability ceilings in certain segments and areas of the market.

*Rumblings of possible increased investment from Japan, and though we see continued interest from Chinese buyers, it is not at the rate we saw a few years ago. We are seeing a ton of Chinese money flowing into development projects downtown and the residential markets on the east side of Los Angeles where the Chinese influence is already very strong.

*We are seeing a strong crop of young buyers with parents who are helping them with major down-payment assistance and/or all-cash offers that are financed during escrow. Besides the parents thinking that real estate is ultimately the best long-term leveraged investments, the other motivation is the parents remember when interest rates were around 10%, and want their children to attain a home at the low rates that many feel will not be available in the future.

*New construction and tear-down type properties are the hottest type of inventory throughout the Westside/South Bay. New construction under $5M is mostly selling at a premium with the exception of poorly built product with flawed floor plans. Buyers are willing to pay a premium for a new home but builders that build a cheap home in pricy neighborhoods will see their product sit and face price reductions.

*About 15% of new construction is selling before they hit the market and teardowns are selling off-market at a clip of about 20%. Many realtors and agents feel that residents who are selling a teardown home are being taken advantage of the builders and are potentially losing hundreds of thousands of dollars by not having a representative for their own interest. Builders are commanding a premium for the right to purchase pre-completed projects in which sellers can choose finishes, etc.

*Millennial homebuyers are tough negotiators. They learn the markets they are in very well and are willing to take their time to find the right property at the right price.

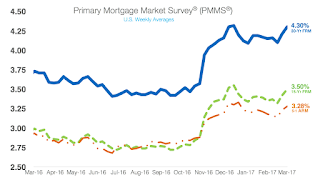

Freddie Mac: Mortgage rates increase again – don’t expect them to stop

Interest rates increased once again in anticipation that the Federal Reserve would increase interest rates Wednesday. “As expected, the FOMC announced its first rate hike of 2017 and hinted at additional increases throughout the remainder of the year,” Freddie Mac Chief Economist Sean Becketti said.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 15-year FRM increased to 3.5%, up eight basis points from 3.42% last week and from 2.99% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.28%, up from last week’s 3.23% and last year’s 2.93%.

“Increasing inflation, continued gains in the labor market and the Fed’s intentions for further rate increases—all three will keep pushing mortgage rates up this year,” Becketti said.

Source: Housing Wire

Creating urgency and perceived value is the key to listing a property

In the current market we are in, it cannot be emphasized enough that for the majority of homes and condos (excludes ultra high-end –above $10M), you must price a new listing at or slightly below market value to achieve the highest selling price. Why? The premium exposure period is within the first seven days of listing a property. The initial reaction from prospective buyers is hugely important in this fast moving, social media world. These perceptions are aided by automated pricing valuations that will state whether it is a “hot buy” or not.

In the current market we are in, it cannot be emphasized enough that for the majority of homes and condos (excludes ultra high-end –above $10M), you must price a new listing at or slightly below market value to achieve the highest selling price. Why? The premium exposure period is within the first seven days of listing a property. The initial reaction from prospective buyers is hugely important in this fast moving, social media world. These perceptions are aided by automated pricing valuations that will state whether it is a “hot buy” or not.

Combining this pricing strategy with dressing the property up in the best possible way to make a strong first impression is the key. 85% of buyers do not have the ability to see through clutter or a poorly staged space.

A few recent examples:

1625 Idaho Avenue in Santa Monica, is a 1478 sq. ft. townhouse with 2 bed, 2.5 bath + loft that we were about to bring to market a few weeks ago sold significantly over-asking within an hour of the sign going up on the property and NO MLS exposure. The seller staged and painted while also pricing the property attractively to create urgency and thus far the strategy paid off with the first buyer that walked through wanting to present an offer the seller would not turn down and the second showing leading to a back-up offer that was stronger than the accepted offer. (property picture)

1625 Idaho Avenue in Santa Monica, is a 1478 sq. ft. townhouse with 2 bed, 2.5 bath + loft that we were about to bring to market a few weeks ago sold significantly over-asking within an hour of the sign going up on the property and NO MLS exposure. The seller staged and painted while also pricing the property attractively to create urgency and thus far the strategy paid off with the first buyer that walked through wanting to present an offer the seller would not turn down and the second showing leading to a back-up offer that was stronger than the accepted offer. (property picture)

451 Olancha Drive in Glassell Park (near Dodger Stadium), a 3 bed/2 bath, 1,300 sq. ft. home came on the market with a $799K list price. The feeling among brokers was that it was worth closer to $900K but it had issues with a non-permitted area that made up part of the master bedroom and it was a hillside property with part of the house showing settlement issues. The homeowner is a successful designer and staged brilliantly to emphasize its unique Spanish feel. The strategy was hugely successful. The home received 28 offers and the frenzy of interest led to an inflated accepted sale price of $985,000 with no appraisal contingency. Had this home come on the market with a listing price above $925,000, it would have most likely sold for below $900,000. Creating urgency and value is hugely important.

13100 Rose Avenue (Mar Vista)- This 3+2, 1,211 sq. ft. house on a 6,750 sq. ft. lot with views was listed at $1.399M. The views and lot size definitely helped the situation as they received in excess of 40 offers! The final sale price was $1.610M. This is a big number for a busy street in Mar Vista…

13100 Rose Avenue (Mar Vista)- This 3+2, 1,211 sq. ft. house on a 6,750 sq. ft. lot with views was listed at $1.399M. The views and lot size definitely helped the situation as they received in excess of 40 offers! The final sale price was $1.610M. This is a big number for a busy street in Mar Vista…

Real Estate Market Outlook for 2017 & Beyond per Eastdil Secured

The data presented in a ninety minute presentation by analysts of a pioneer in the real estate investment banking industry, Eastdil Secured, makes a sound argument that we can expect continued growth in 2017 and beyond. This growth is fueled by the strength of the US economy in relation to the world, and demand for U.S. assets.

Key Take-Aways:*Los Angeles only trails Manhattan as the leading foreign capital market in the US since 2013. China is the largest investor and we should also keep an eye on South Korea’s appetite for investment in the Southland.

*The nation’s Gross Domestic Product is now at 2.4%, the highest since 2011 and that trend is expected to continue.

*Even though Eastdil expects to see as many as seven increases to the interest rate in the next two years to thwart inflationary pressures, the Fed Funds rate probably will not go higher than 3%. The reason for this interest rate ceiling is that anything above 3% will cause economic hardship on corporations’ ability to service their ballooning debt which is larger than it has ever been before.

*We can expect home loan interest rates to rise 1-2% higher than today’s interest rates, which will definitely impact affordability and price appreciation.

As long as the LA economy stays strong, they expect continued market appreciation but not at the double-digit year over year growth we have seen the past six years.

Considering all the data points presented, if you look at this from a cyclical perspective, we are in a similar place to where we were in 2004. In 2007, we started facing issues that led to the downturn between 2008-2010. This infers we have about 24 months of growth left in this cycle.

Source: Meeting notes from Partners Trust Founder Nick Segal

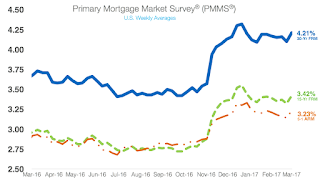

Mortgage rates follow Treasury yield for first time in 2017 – Show substantial increase from last week

The 10-year Treasury yield rose about 10 basis points this week. For the first time in weeks, the 30-year mortgage rate moved with treasury yields and jumped 11 basis points to 4.21%. The 30-year fixed-rate mortgage increased to 4.21% for the week ending March 9, 2017. This is up from last week’s 4.1% and from last year’s 3.68%.

The 10-year Treasury yield rose about 10 basis points this week. For the first time in weeks, the 30-year mortgage rate moved with treasury yields and jumped 11 basis points to 4.21%. The 30-year fixed-rate mortgage increased to 4.21% for the week ending March 9, 2017. This is up from last week’s 4.1% and from last year’s 3.68%.

Likewise, the 15-year FRM increased to 3.42%, up from 3.32% last week and 2.96% last year. The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.23%, up from 3.14% last week and 2.92% last year.

“The strength of Friday’s employment report and the outcome of next week’s FOMC meeting are likely to set the direction of next week’s survey rate,” said Freddie Mac Chief Economist Sean Becketti.

Source: Housing Wire