Partners Trust Year-End report and 12 real estate trends to watch for in 2017

The Partners Trust Year- End Report highlights Los Angeles from Malibu to the South Bay and from the Westside to Pasadena.

Check out the pertinent sales data for your neighborhood and let us know if we can help provide any further information you need.

Here are 12 real estate trends to look out for in 2017. –Hint: Rising interest rates, Millenial Buyers emerging, LA home prices will continue to increase…

REMINDER: CALIFORNIA PROPERTY TAX PAYMENT DEADLINE DECEMBER 12th!

The 1st installment of your California property taxes are technically due November 1st but it is not delinquent until December 12th. It is usually December 10th but since the 10th is a Saturday, it is extended until Monday. If you have not paid your property taxes, DO IT NOW otherwise it is a 10% penalty if not received or postmarked by the 12th!!

China’s Looming Debt Crisis Could Mean Big Opportunities for U.S. Real Estate

The founding partner of Partners Trust China, Sean Mei, just penned an informative article on China’s growing debt problem and how it could mean more investment in the United State, specifically in real estate in the first part of 2017…I am a little more skeptical of Sean about how much money will come from China as foreign investment has fallen off the past six months but will see.

Article: China’s Looming Debt Crisis Could Mean Big Opportunities for US Real Estate

Baldwin Hills Crenshaw Plaza Slated for 2020 Completion…Real Estate Surging In Surrounding Areas

Baldwin Hills and its surrounding areas have been on fire from a real estate perspective for some time and we are expecting that to continue with Expo’s Crenshaw line slated to open in the next five years and information surfacing that the new Baldwin Hills Crenshaw Plaza transformation will be completed in 2020.

|

| Artist rendering of Baldwin Hills Crenshaw Plaza |

The Plaza is a much-anticipated project for the neighborhood with plans to turn it into an urban village much like Pasadena’s Americana, including a completely rehabbed retail space, hotel, offices and more.

With housing becoming difficult to afford on the Westside and beautification projects and mass transit redefining the outlook for areas like Baldwin Vista, Leimert Park and Crenhsaw Manor, it is no longer a secret that these areas are a hot spot with investors and young families and we still believe some great opportunities will be had in these up and coming areas for years to come.

Source: Partners Trust Company Blog

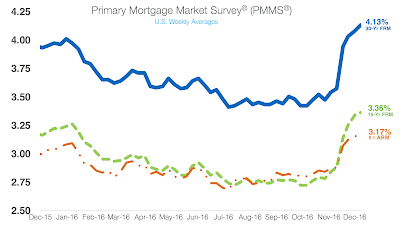

Mortgage Rates increase for the fifth consecutive week…hitting a new high in 2016

The 30 year fixed-rate mortgage (FRM) increased to 4.13% for the week ending December 8th. This is up from last week’s 4.08% and 18 basis points higher than this time last year.

The 15-year FRM increased to 3.36%, slightly up from last week’s 3.34% and 3.19% last year. Freddie Mac Chief Economist Sean Becketti stated that the markets are 94% certain of a quarter-point-rate hike.

|

| Interest Rate Chart since Dec. 2015 |

Source- Housingwire

Alexis Antin Joins the Team!

Thanks to a wonderful network of clients who have passionately referred us, business has grown over 70% this year and we are excited to announce that Alexis Antin joined the team as an associate partner. Alexis has been a fantastic addition since coming on board providing a ton of positive energy and tremendous customer service. A native of Los Angeles with strong local knowledge of the micro markets of So Cal real estate, Alexis is an ideal teammate in representing the needs of our clients with enthusiasm, integrity and attention to detail. She has a very bright future in this business and looking forward to an even more successful year in 2017 with her on board.

Alexis and her husband Brandon currently reside on the Westside and are active supporters of many local charitable organizations and she is on the advisory board of the Wendy Walk, an annual fundraiser for cancer research.

Articles You Should Read- Real Estate trends for 2017, Realtor.com Housing Forecast and more!

Check out the following articles:

1- Six things to know about LA’s plans to fix its awful sidewalks –

2- Los Angeles County Home Prices Are up 7 percent

3- 5 Big Real Estate Trends To Watch For in 2017

4- Realtor.Com 2017 Housing Forecast- The 2017 housing market will be a year of slowing, yet moderate growth, set against the backdrop of a changing composition of home buyers and a post-election interest rate jump that could potentially price some first-timers out of the market, according to the realtor.com® 2017 housing forecast.

THE SKINNY ON THE WESTSIDE MARKET: Still in the seller’s favor however higher-end listings in most micro markets are sitting despite low inventory and strong LA economy

Over the past few weeks I have participated in a few realtor networking groups and spoken with fellow top producing agents to get a gauge on the market. The general consensus, with very few exceptions, is the entry to mid-level range in each micro area (ex: North of Montana in Santa Monica, North of Venice in Mar Vista, Huntington Palisades, etc) is soliciting multiple offers and continuing to push home values higher in that range. On the flip side, the higher-end properties in these same areas are experiencing a slow-down and sitting on the market longer, with the volume of interested buyers much less than what it was six months ago.

Quite a few factors seem to be contributing to this. The strong run-up in market appreciation has created some unrealistic seller’s with overzealous listing prices coupled with buyers who are well educated and willing to wait for appropriate price reductions. We have also begun to see affordability ceilings develop in terms of what most buyers can/will pay on the higher end of a neighborhood.

It is also important to note that we typically hit a bit of a sales lull as we head into the holidays. We experienced it last year but it started picking up again in December…so will see if that pattern repeats itself for the higher end properties. The entry and mid-level properties aren’t showing signs of a slow-down.

Additionally, I attended a presentation by Myers Research, who primarily focus on the Southern California economy, specifically housing trends. They were extremely upbeat about the health of the LA economy and investing in real estate, especially on the Westside. They believe inventory levels are going to continue to stay at record lows while the region continues to add well-paying jobs. The Westside is still affordable compared to most luxury markets internationally and with cities like Santa Monica trending toward discouraging new development, it will only make land in the area more valuable.

Additionally, I attended a presentation by Myers Research, who primarily focus on the Southern California economy, specifically housing trends. They were extremely upbeat about the health of the LA economy and investing in real estate, especially on the Westside. They believe inventory levels are going to continue to stay at record lows while the region continues to add well-paying jobs. The Westside is still affordable compared to most luxury markets internationally and with cities like Santa Monica trending toward discouraging new development, it will only make land in the area more valuable.

Myers Research felt the impact of any national or international economic hiccups would be minimal on Westside real estate. The major concern when it comes to future appreciation would ultimately be affordability ceilings, which they are seeing becoming a problem in San Francisco, a market they feel is “over-heated.”

They failed to address what the impact would be on the Westside if the technology sector had major issues in 2017.

MORTGAGE INTEREST RATES HIGHEST SINCE JUNE

The average interest rate for 30-year fixed-rate mortgages rose to 3.57%, up seven basis points since last week and the highest they have been since June.

The average interest rate for 30-year fixed-rate mortgages rose to 3.57%, up seven basis points since last week and the highest they have been since June. The average 15-year fixed mortgage rate is 2.87 percent, up 13 basis points since the same time last week.

The average rate on a 5/1 ARM is 3.03 percent, falling 23 basis points over the last week.

Michael Fratantoni, the Mortgage Bankers Association chief economist stated: “Globally, rates have begun to creep upwards as investors anticipate less aggressive monetary policies from central banks, and U.S. rates are being pushed upwards in response. Additionally, new data show continued positive signals regarding the job market and rising inflation, indicating that the Fed is likely to hike in December and will continue increasing rates next year.”

Sources: CNBC and Bankrate