Live in style in the heart of Silicon Beach! $2.349M…

A superb location that is one block from the famous restaurants and shops of Main Street, three blocks from the beach and close to Abbot Kinney. This FAIA Award winning Michael Folonis creation is an entertainer’s dream! Filled with tons of natural light, it melds with a sleek contemporary style to provide an open and expansive feel. Chef’s kitchen with open living and dining areas. Fireplace in living room. Generous loft leads to the secluded rooftop deck with ocean and city views. Master suite has its own outdoor sitting area and fully remodeled and expansive master bath. Brazilian cherry oak floors and cabinets throughout. Huge storage/flex space (around 300 additional square feet) and side by side parking in gated garage with room to possibly park more cars. Unique end unit with each bedroom having access to an outdoor area. This rare opportunity is not to be missed!

A superb location that is one block from the famous restaurants and shops of Main Street, three blocks from the beach and close to Abbot Kinney. This FAIA Award winning Michael Folonis creation is an entertainer’s dream! Filled with tons of natural light, it melds with a sleek contemporary style to provide an open and expansive feel. Chef’s kitchen with open living and dining areas. Fireplace in living room. Generous loft leads to the secluded rooftop deck with ocean and city views. Master suite has its own outdoor sitting area and fully remodeled and expansive master bath. Brazilian cherry oak floors and cabinets throughout. Huge storage/flex space (around 300 additional square feet) and side by side parking in gated garage with room to possibly park more cars. Unique end unit with each bedroom having access to an outdoor area. This rare opportunity is not to be missed!

Check it out: Property Web-Site

Mar Vista Listing- 3242 Rosewood Avenue…accepted offer within 4 days of listing…$1.899M list price

Charming 2,600+ sq. ft. home on a large corner lot in one of Mar Vista’s best neighborhoods. This 3 bed/2.5 bath, light filled traditional with beautiful updates is great for entertaining with the chef’s dream kitchen situated next to the dining room and opening up to the family room and backyard. The remodeled kitchen has custom cabinetry, granite counter-tops, great storage and stainless steel appliances. Enjoy California living with a private backyard complete with patio, lawn and versatile hardscape area. The generously sized master suite has custom built-ins, a sitting area, dual-sink bathroom with soaking tub, large walk-in closet and peaceful balcony with tree top views. Features crown moldings and plantation shutters throughout, large formal living room, hardwood floors, A/C, wood-burning fireplace and custom built storage shed. Enjoy the benefits of this family friendly neighborhood while being minutes from the beach and all the Westside has to offer.

Charming 2,600+ sq. ft. home on a large corner lot in one of Mar Vista’s best neighborhoods. This 3 bed/2.5 bath, light filled traditional with beautiful updates is great for entertaining with the chef’s dream kitchen situated next to the dining room and opening up to the family room and backyard. The remodeled kitchen has custom cabinetry, granite counter-tops, great storage and stainless steel appliances. Enjoy California living with a private backyard complete with patio, lawn and versatile hardscape area. The generously sized master suite has custom built-ins, a sitting area, dual-sink bathroom with soaking tub, large walk-in closet and peaceful balcony with tree top views. Features crown moldings and plantation shutters throughout, large formal living room, hardwood floors, A/C, wood-burning fireplace and custom built storage shed. Enjoy the benefits of this family friendly neighborhood while being minutes from the beach and all the Westside has to offer.

Check it out: Property Web-Site

The areas that have benefitted the most from Silicon Beach…-Mar Vista, Culver City, Westchester to name a few…

The tech boom has benefited Los Angeles as a whole, but the residents that should be thanking their hi-tech friends the most are in Mar Vista, South Santa Monica, Playa Vista, Culver City and Westchester. These areas used to be considered the “affordable” adjacent areas to the uber expensive locales of Venice, North Santa Monica and Manhattan Beach.

Fun facts to know-

*The average 2015 sale price in Playa Vista was up 38% vs. 2014.

*In 2011, Mar Vista had 1 home sell for over $2M…in 2015, 31 sold for over $2M with three homes selling for over $3M.

*The average sale price in Westchester was $798K in 2013…in 2015, it was $1.040M.

*The average sale price in South Santa Monica was up 14.5% in 2015…Culver City was up 19.3%!

*A home in South Santa Monica on 32nd street between Pico and Ocean Park is in escrow for around the $3.8M asking price.

The Pocket Myth…the new buzz to get your business

With inventory tight, one of the go-to lines sales agents use in trying to pick-up business is that they or their company “know about all the pocket/off-market listings”. Though most brokerages (including Partners Trust) will state that off-market sales accounted for over 20% of the sales in some zip codes in 2015, a deeper look into the numbers shows these numbers are inflated.

With inventory tight, one of the go-to lines sales agents use in trying to pick-up business is that they or their company “know about all the pocket/off-market listings”. Though most brokerages (including Partners Trust) will state that off-market sales accounted for over 20% of the sales in some zip codes in 2015, a deeper look into the numbers shows these numbers are inflated.

Some of those sales were properties that didn’t originally sell at a higher price when they came on the market earlier in the year. Another portion may have not been on the MLS but were marketed to all of the agents which in essence is exposing the property to the market.

We are not saying off-market sales do not happen. In fact, we have been involved in a handful of them over the past few years. They just do not happen at the frequency that is being told to buyers.

Another factor to remember is that most of the time, the seller in an off-market transaction will want a premium price along with generous contract terms they would get in a multiple offer to be comfortable they didn’t undersell the home by not fully exposing it to the market. A buyer has to be comfortable paying a hefty premium. Also, most reputable agents have clients who are willing to sell if someone is willing to pay 15% above market…but is that really a legitimate pocket listing?

It is important to have an agent who has good relationships in the brokerage community and is aware of the handful of legitimate pocket listings that are competitively priced. However, based on what we see and hear from, it is not happening at the level that is being marketed to potential buyers.

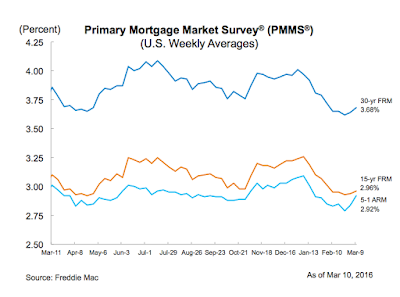

Mortgage rates well below end-of-2015 level for spring home-buying season

Despite increasing for the second week in a row, mortgage interest rates are still well below levels seen at the end of last year. The 30-year fixed-rate mortgage averaged 3.68%, up from last week’s 3.64%. A year ago, the 30-year FRM averaged 3.86%. Mortgage rate remains 33 basis points lower than its end-of-2015 level.

(Source: Housing Wire)

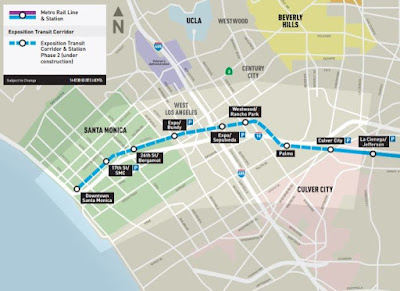

Expo line extension to Santa Monca will open May 20th!

The expo line extension to Downtown Santa Monica will open May 20th and it will be the first time in 53 years that an Angeleano will be able to hop on a train in Santa Monica. The extension will add seven stops to the line that currently terminates in Culver City. A full trip from Downtown LA to Santa Monica will take about 45 minutes.

This is great news for those that frequent downtown LA and live on the Westside. However, the delays to already snarled north/south traffic on major streets where the train crosses will be difficult for commuters to stomach. We have already heard quite a few complaints about the impact on traffic during the current testing phase.

2015 Year in Review- Partners Trust Detailed Annual Report

Check out how your neighborhood fared in 2015. The report covers the westside/South Bay/Pasadena/Malibu/Valley…both single family homes and condos…also includes insightful articles and predictions for 2016!

Check it out: PARTNERS TRUST ANNUAL REPORT

Amendments to the Los Angeles Mansionization regulations will most likely be approved in May…

According to the Los Angeles city planning office, it looks like the new Baseline (BMO) and hillside (BHO) mansionization ordinances will be recommended for approval by city council in May. Despite strong opposition from developers and property owners who are looking to enhance/expand their properties, the city planning office states that about 85% of the public input was for stricter building rules. Some changes may still be made to the proposal but the bulk of it looks like it will be approved. This is a positive thing for areas that have been impacted developers over-building but it is frustrating for normal property owners with nice homes that need to expand due to a growing family, etc. A one size fits all approach isn’t necessarily fair as the needs of one family differ from those of others.

According to the Los Angeles city planning office, it looks like the new Baseline (BMO) and hillside (BHO) mansionization ordinances will be recommended for approval by city council in May. Despite strong opposition from developers and property owners who are looking to enhance/expand their properties, the city planning office states that about 85% of the public input was for stricter building rules. Some changes may still be made to the proposal but the bulk of it looks like it will be approved. This is a positive thing for areas that have been impacted developers over-building but it is frustrating for normal property owners with nice homes that need to expand due to a growing family, etc. A one size fits all approach isn’t necessarily fair as the needs of one family differ from those of others.

Here are some highlights from the proposed update you should be aware of:

*Attached garages will be considered usable living square footage. Garage space has never been considered livable space until this proposal. The typical garage is around 400 square feet. If you want to build a 2,000 sq. ft. house with an attached garage, the house itself would only be 1,600 sq. ft. (quick note- Most homebuyers prefer an attached garage for safety and comfort. Attaching a garage to the house, especially in the front, maximizes backyard space allowing families to take full advantage of the wonderful Southern California weather.)

*Properties with a lot size of 9,000 sq. ft. or less can only be 45% of the lot size with an allowable green building bonus of 20% if your garage is NOT attached. Currently it is 50% with a 20% allowable green building bonus. This is a 10% decrease in sq. ft. and an attached garage would make the decrease more significant.

*Homes on lots above 9,000 sq. ft. can only be 40% of the lot size with an allowable green building bonus of 20% if you garage is NOT attached. Currently, it is 45%.

*Hillside homes will no longer have grading exemptions underneath the footprint of the structure.

*A second story can only be 60% of the first floor footprint. Right now, it is 75%. Under the new proposal, if you have a 1,200 sq. ft. first story, the second story addition can only 720 sq. ft. making it very difficult to have two bedrooms. Homeowners looking to expand will probably have to rebuild to have a correct/proper floorplan.

*The planning department did NOT perform an economic impact report.

*The original BMO/BHO took over 7 years to develop and it was a collaborative effort with real estate professionals. The proposed amendments took a little over a year without any collaboration.

*New amendments could go into effect as early as May 2016.

Personally speaking, I believe you can curtail overzealous builders without being this restrictive. Cut out some loopholes that allow for the 20% building bonus or require further set-backs but telling someone that where they park their car is considered living space and that 2,300 sq. ft (including attached garage) is enough on a 6,000 sq. ft. lot is unfair.

From an economic perspective, limiting the square footage that can be built from the original BMO/BHMO will negatively impact home values, especially for older homes that need to be remodeled. The cost of land is so expensive throughout most of Los Angeles that a regular homeowner or developer is going to add square footage or build a new house for the investment to make sense. The increase in square footage along with the overall rehabilitation of the property, done in a tasteful manner, increases the value of the neighborhood.

In terms of counting attached garage space as living space, it’s no secret some property owners are using their garage as living space whether it is attached or detached. This is a violation of the city code and it’s not fair for the city to punish homeowners who utilize an attached garage properly due to their inability to enforce the improper use of a garage. Furthermore, if people are using garages as living space, it is an example the typical needs for families are outgrowing the current residence, especially with an aging population in which caring for elderly parents in the home for many years is increasing. It doesn’t seem to make much sense to further restrict the size of a home when families could be forced to expand in non-traditional ways.

You can e-mail the neighborhoodconservation@lacity.org for a draft of the full proposal.

You can e-mail the neighborhoodconservation@lacity.org for a draft of the full proposal.

It is not too late to express your thoughts to the city planning office- hagu.solomon-cary@lacity.org and contact your local city councilman as well. In talking to local residents, it seems most typical homeowners are not being heard and it is a vocal minority that is creating much of the noise.

Close some of the loopholes currently being exploited and figure out ways to control overzealous developers but this current proposal seems a bit restrictive.

Price reductions are more prominent…close to 50% of active listings in some westside areas

Last month a colleague noted that around 40% of the active single-family residences (“SFR”) in Culver City experienced a price reduction. We decided to see if this was a trend in other Westside locations and ran the numbers for the Palisades, Santa Monica, Westchester and Mar Vista as of November 24th.

We found Culver City is not unique and the reductions over the last month even increased in Culver City to 14 of the 29 SFR active listings being reduced.

Area # of Active Listings # Reduced

Culver City 29 14 (2)

Santa Monica 49 24 (6)

Mar Vista 39 20 (2)

Westchester 32 11 (0)

Pacific Palisades 80 32 (7)

**The # in perenthises are homes the Multiple Listing Service “MLS” mis-categorized as not being reduced. Realtors can come up with tricks to eliminate the reduction label to the public but a check of the listing history of each property can expose this. This practice is more popular in luxury markets.

The percentage of reductions compared to active listings is inflated due to the holiday season with quite a few sellers holding off to list their homes. However, the trend of increasing reductions has been consistent since the middle of the summer. Typically we see about 25% of the active listings showing a reduction and over the past few years that number has dipped to 10-15% due to the strength of the market. The increase in the reductions is a sign the market is settling down a little bit with buyers unwilling to pay the heavy premiums we saw earlier this year.

Though we are seeing this trend, do not be mistaken into thinking the market is headed in a downward spiral. Well priced listings (around the true market value), especially those in premium locations, are still selling in multiple offers with favorable terms for the seller. The market is still strong but just not at the level it was four to six months ago.