3rd Quarter Market Report

Check out the latest Partners Trust Quarterly statistics report for the third quarter of 2015. The market report is extensive and covers the Westside, Los Angeles proper, Manhattan Beach, San Gabriel Valley and Malibu. Please feel free to contact our office with any specific questions about your neighborhood.

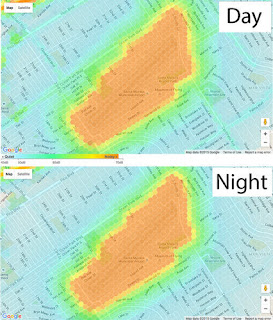

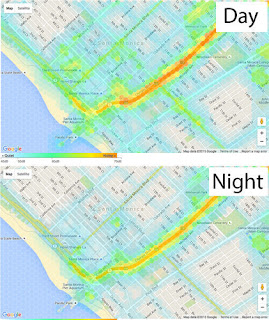

Check it out: Interactive Map for noise levels in Los Angeles

An app called HowLoud has created sound profiles of every Los Angeles address and RentLingo has released a searchable map that displays the decibel levels at any given point in Los Angeles, allowing you to see what it is like during the day and at night. This can definitely come in handy when searching for a home and are sensitive to noise. It is interesting to note that some of the trendier and pricey real estate is located in areas where the noise levels are fairly high thanks to restaurants and bars. Check out a few examples of Santa Monica below and why so many neighbors want the Santa Monica Airport to go away (at least the big jets).

|

| Santa Monica Airport |

|

| Santa Monica |

Source: LA Curbed Blog

Mortgage rates continue to drop

Mortgage rates continued to trend lower, following declining Treasury yields. The 30-year fixed-rate mortgage “FRM” averaged 3.79% for the week ending October 22, down from last week when it averaged 3.82%. In 2014, the 30-year FRM averaged 3.92%. The 15 year FRM averaged 2.98% while averaging 3.03% last week. A year ago at this time, the 15-year FRM averaged 3.08%.

(Source: Housing Wire)

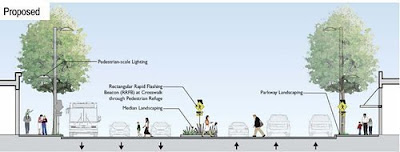

Santa Monica: Lincoln Boulevard to get a makeover

The section of Lincoln Blvd. between the 10 fwy and Ozone Ave (city border with Venice) is in for a make-over to beautify the area making it more inviting to pedestrian foot traffic and cut-down on conflicts between cars and people on bikes. The plan, called Lincoln Neighborhood Corridor, aims to add dedicated peak-hour bus lanes, more crosswalks, nicer landscaping, street furniture and better sidewalk lighting. The plans also calls for adaptive reuse of buildings for more consumer friendly tenants like eateries and coffee shops that will be more community friendly.

|

| click on images to enlarge |

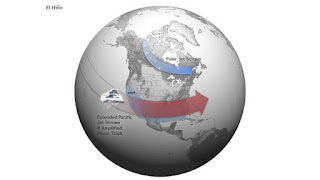

Be Prepared for El Nino!

We talked about the importance of preparing for El Nino a few months back and we are just reiterating it as this could potentially be one of the wettest winters in Southern California history. The largest hurricane in history is about to hit Mexico and is just another reminder of how warm the Pacific Ocean is.

Here is a link to a recent LA Times article outlining 28 things to do to prepare for El Nino. (Hint: check and fix leaks; clean out gutters and downspouts; inspect windows; Store emergency materials)

(Source: LA Times)

Deal of the Week: 4365 Alla Road #7, Marina Del Rey $829K

IN ESCROW

We rarely advertise properties for sale on this blog unless we strongly feel it is a great opportunity and this fits into that category. We just listed a luxurious 2 bed/2.5 bath, 1,866 sq. ft. Marina Del Rey townhouse that is priced well and a short walk to the Marina Marketplace (Ruth’s Chris Steakhouse, Tender Greens, Ra Sushi, AMC Dine-in theater, Yardhouse, Gelson’s, etc).

The spacious floor-plan is excellent for entertaining with high ceilings, oak floors, gas fireplace and a large and open kitchen. This end unit features two large bedroom suites, remodeled master bathroom, great closet space, two car attached garage, laundry area, direct access and a well-run HOA with access to multiple pools and spas.

The spacious floor-plan is excellent for entertaining with high ceilings, oak floors, gas fireplace and a large and open kitchen. This end unit features two large bedroom suites, remodeled master bathroom, great closet space, two car attached garage, laundry area, direct access and a well-run HOA with access to multiple pools and spas.

Please check out www.4365alla.com for photos and more information. Please don’t hesitate to contact John directly at 310-486-5962 if you have any interest. We will be open Sunday from 2-5pm.

Notes on a Realtors Scorecard- Lots of rookie house flippers; Venice Blvd in Mar Vista about to permanently change; a look at some recent sales

– The Westside market is continuing its three year roll of trading at premium prices with multiple offer and above asking sales prices being the norm for over 50% of the properties on the market. We have seen a little slow-down in the upper high-end market ($5M ++) but much of that has to do with unrealistic list prices. The properties that are priced at or near the true market value are moving fairly quickly.

– We are noticing quite a few newcomers getting into the flipping business. The main companies we typically see purchasing re-model/tear down candidates are getting outbid on quite a few properties lately…and in some cases it isn’t even close. An example of this is 3154 Barry Avenue in Mar Vista. A great location with a great walk score on a 7K sq. ft. lot hit the market for $1.098M and sold in multiple offers for $1.350M. A few builders went up to about $1.2M but felt the profit margin would get too tight if you purchase it above that number. Hopefully history won’t repeat itself and the market dynamics are different, but the last time we saw this behavior was around 2006…

|

| click to enlarge |

-Venice Boulevard in Mar Vista about to permanently lose car lanes: Venice Blvd. between Inglewood and Beethoven was named as one of the first Los Angeles roads that will be part of LA’s Great Streets program that takes away a lane of car traffic in each direction to create a protected bike lane and four mid-block crossings with their own signaling buttons. Locals wanted a more user friendly Venice Blvd. but the program doesn’t include much of a beautification plan which is needed if you want to attract more foot traffic from the higher-end areas of Mar Vista that are close-by. A more attractive Venice Blvd. would be great for the area, however, geographically speaking, LA seems like a pretty spread out place without nearly enough mass transit to start taking away lanes of traffic in already heavily congested areas. It will be interesting to see how this works out…Please check out an article about this along with graphics via CurbedLA: Part of Venice Blvd. will be getting more hospitable to non-drivers

|

| 923 20th Street #2 |

– A quick look at some recent condo sales in Santa Monica: 923 20th Street #2 has not officially sold but it immediately went into escrow one day after the first public open house. It was listed at $1.529M ($1,149 sq. ft.) but rumor is it sold above that number…it seems like yesterday people thought it was crazy to pay $1,000 a sq. ft. for a home north of Montana. The 1,330 sq. ft. 2 bed/3 bath Spanish Colonial built in 2006 has tons of charm and character but a very small 2nd bedroom.

|

|||

| 817 10th Street #307 |

817 10th street #307 is a top floor 1,394 sq. ft. 2+2 single level unit that was bought at the end of last year for $1.150M and after some upgrades were made to the kitchen and bathrooms, it just sold for $1.4M after being listed for $1.3M. We approximate the seller did about $70K in upgrades.

122 Ocean Park Blvd.#411, a 1,502 sq. ft. 2+2 was bought in 2012 for $1.185M, just under the $1.199M asking price. In pretty much the same condition, this coveted Sea Colony III unit with $800 a month HOA dues just sold for $1.601M, $206K over the asking price! The Sea Colony and the surrounding area is very popular right now with the emergence of Silicon Beach. The seller had phenomenal market timing!

122 Ocean Park Blvd.#411, a 1,502 sq. ft. 2+2 was bought in 2012 for $1.185M, just under the $1.199M asking price. In pretty much the same condition, this coveted Sea Colony III unit with $800 a month HOA dues just sold for $1.601M, $206K over the asking price! The Sea Colony and the surrounding area is very popular right now with the emergence of Silicon Beach. The seller had phenomenal market timing!

– The foreclosure saga of Sea Ridge’s 1948 Palisades Drive (Pacific Palisades) comes to an end: This rare foreclosure (bought in2006 for $1.4M) was hit with massive sewer and drainage issues that destroyed most of the integrity of the home and annoyed realtors as clients would call thinking they could get a great deal on the condo not knowing that has to be completely remodeled as previous listings of the property were vague when it came to explaining the horrible condition. After a saga lasting over four years, it finally sold through bankruptcy court in an all-cash deal for $1.180M, $280K over the $900K list price. Despite going for $200K over the list price it is not a bad deal for a 3,000 sq. ft townhouse in one of the most coveted complexes in the Palisades.

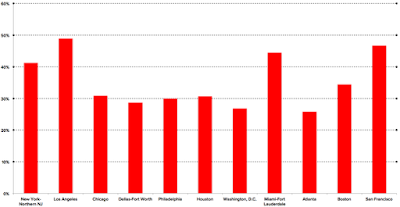

Los Angeles is the least affordable place to rent in the United States

According to an article from CurbedLA that cites a report from Zumper, Los Angeles residents on average spend nearly 50% of their income on rents! Rents are higher in San Francisco and New York but the household income in those cities is higher. San Francisco checks in around 45% followed by Miami with 43%. New York is 41%.

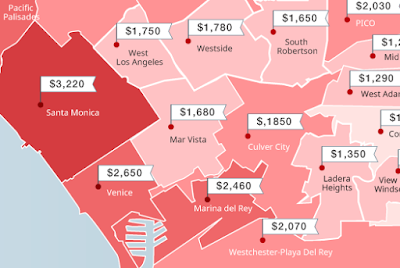

The median rent for one-bedrooms in Los Angeles in August was $1,830, a 7.6 percent increase from the last three month period. Two-bedroom apartments were up 5.6% from the last quarter, to $2,640. Downtown Santa Monica is the most expensive place to rent in LA with a median one-bedroom renting for $3,220 in August. Downtown LA was the runner up with a one-bedroom median of $2,640.

Check out the map below to see what the median rents are in specific areas of Los Angeles.

(Source: Curbed LA)

|

| click on image to enlarge |

|

| % of income toward rent in major cities- Click to enlarge |

Average rate on 30-year mortgage falls to 3.85%

Long-term U.S. mortgage rates declined this week following the Federal Reserve’s decision to keep interest rates at record lows for now.

Freddie Mac said Thursday the average rate on a 30-year fixed-rate mortgage fell to 3.85% from 3.91% a week earlier. The rate on 15-year fixed-rate mortgages eased to 3.08% from 3.11%.

Rates have stayed below 4% for nine straight weeks. The average fee for a 30-year mortgage rose to 0.7 point from 0.6 point last week. The fee for a 15-year loan was unchanged at 0.6 point.

(Source: LA Times)

New rules will impact residential real estate purchasers who obtain a loan after October 3rd!

The CFBP (Consumer Financial Protection Bureau) instituted new rules to protect consumers and it known as the Know Before You Owe initiative.

The CFBP (Consumer Financial Protection Bureau) instituted new rules to protect consumers and it known as the Know Before You Owe initiative.

The TRID (Truth in Lending Act- Real Estate Settlement and Procedures Act Integrated Disclosure Rule), disclosure rule replaces four disclosure forms with two new ones, The Loan Estimate and the Closing Disclosure. The borrower has up to ten days to review the Loan Estimate before the appraisal can be ordered which means appraisal period will take longer than normal.

The rule also requires that the borrower has three business days to review the Closing Disclosure and ask questions before closing. This is MANDATORY and NON-WAIVABLE period. Any changes in the loan (i.e. increased buyer credits or reduction in purchase price) will trigger an update to the disclosure and add another three-day review period.

How this impacts a transaction: The average length of escrow may increase anywhere from several days to several weeks! Agents and escrow officers must be diligent early in the process to work quickly with the lender and the buyer to try and avoid the mandatory three business day review period on multiple occasions. Unfortunately this extra step makes it even more difficult when those obtaining a loan are going up against all-cash buyers. Lenders and escrow companies will also have to be CFBP certified and follow stricter rules. Inevitably, we are preparing for escrows with a 30 day escrow period to possibly end up being more like 40 to 45 days. Patience and diligence from all involved will be essential while everyone adjusts to the new system.

How this impacts a transaction: The average length of escrow may increase anywhere from several days to several weeks! Agents and escrow officers must be diligent early in the process to work quickly with the lender and the buyer to try and avoid the mandatory three business day review period on multiple occasions. Unfortunately this extra step makes it even more difficult when those obtaining a loan are going up against all-cash buyers. Lenders and escrow companies will also have to be CFBP certified and follow stricter rules. Inevitably, we are preparing for escrows with a 30 day escrow period to possibly end up being more like 40 to 45 days. Patience and diligence from all involved will be essential while everyone adjusts to the new system.