A look at the numbers- Venice

Thanks to tight inventory and some sellers listing their property too high, the sales volume for Venice is down 41% when comparing May 2015 vs. May 2014. According to the MLS, 16 single family residences “SFR” sold this year, with eight selling for over asking, while May of last year had a whopping 27 sales with 14 going for over asking. Despite a few properties sitting on the market, the average days on market has dropped 19%, from 38 in May 2014 to 31 in May of this year. The average days on market was as high as 63 in March and has been on major downward trajectory over the pasty two months.

The median sales price is up 46% from $1.450M in May 2014 to $2.120M. This dramatic jump shows more high-end and newer construction homes sold this May compared to last year. The median sales price in the 1st quarter of 2015 is up 55% since the 1st quarter of 2012.

The skinny on a few of the sales-2004 Louella Avenue- This 3+2 on a 5,462 sq. ft. lot was sold for land value and made the neighbors pretty happy considering it sold for $200K over the asking price! The property was listed at $1.199M and they immediately received multiple offers. It was sold to an all-cash investor with a very short contingency period for $1.405M!

The skinny on a few of the sales-2004 Louella Avenue- This 3+2 on a 5,462 sq. ft. lot was sold for land value and made the neighbors pretty happy considering it sold for $200K over the asking price! The property was listed at $1.199M and they immediately received multiple offers. It was sold to an all-cash investor with a very short contingency period for $1.405M!

214 South Venice– Despite being located in an extremely busy area, this one of a kind 3+3, 3,284 sq. ft. architectural on a 4,337 sq. ft. lot sold for $3.425M, $326K over the $3,099M asking price. The made for an entertainer property was recently renovated with high-end finishes and features an expansive split-level roof-top deck with a fire-pit and full outdoor kitchen. The 1 bed/1 bath guest unit is a great income producing opportunity and the property offers a four car garage with three extra parking spots which is extremely valuable for the location.

A look at the the numbers- Culver City

According to the MLS, the number of single family residential “SFR” sales in May was 15, with 9 over the asking price. In May of 2014, 17 SFR’s sold with 13 selling for over asking. The sales volume is down slightly with sellers being a little more aggressive with the list price compared to May 2014, in which over 75% of the homes sold for over the asking price.

The median sales price is up 25% from $810,000 to $1.010M. The median sales price is up 79% over a three-year period when comparing the 1st quarter median sales price of 2012 vs. 2015. Despite having so many homes sell for over asking in May of last year, the average days on market dropped to 21 this year compared to 36 last year. This is the lowest monthly average days on market in the last 12 months. Inventory is picking up this month so we expect the average days on market to increase.

Crazy sale of the month- 3330 Cattaragus– This 3+2, 1,590 sq. ft. Spanish home on a 4,797 sq. ft. lot was listed at only $999,000 to create a ton of initial interest. The listing agent also asked for highest and best right off the bat with no counters. They received quite a few offers with the winning bid coming in all-cash at $1.3M, with no appraisal contingency. The house has an open floor plan with a chef’s kitchen, hardwood floors and a garage converted into a living space.

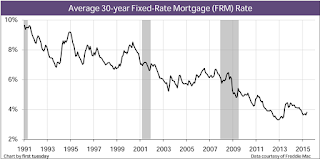

Mortgage rates tick down slightly to 4%

Average fixed mortgage rates moved lower from the previous week’s new highs for 2015 while housing data was generally positive, according to the latest from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.00% with an average 0.7 point for the week ending June 18, 2015, down from last week when it averaged 4.04%. A year ago at this time, the 30-year FRM averaged 4.17%. The 15-year FRM this week averaged 3.23% with an average 0.5 point, down from last week when it averaged 3.25%.

A year ago at this time, the 15-year FRM averaged 3.30%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.00% this week with an average 0.4 point, down from last week when it averaged 3.01%. A year ago, the 5-year ARM averaged 3.00%.

(Source: Housingwire)

A look inside the numbers- Pacific Palisades sales volume drops slightly compared to last month but up compared to last year… the median sales price continues to climb.

The number of single family sales per the Multiple Listing Service (MLS) in the Palisades for May of this year decreased slightly compared to last month (36 to 33). However, it was an increase from the 29 that were sold in May of 2014.

The median sales price is up over 8% compared to last May, and the 1st quarter median sales price is 73% higher than the median in the first quarter of 2012.

The average days on market (DOM) for properties sold was 47 compared to 54 last May. The drop in DOM has been substantial since February of this year when it was 79! Tightening inventory while entrenched in the spring/summer selling season with buyers trying to get a mortgage before rates continue to increase is the double whammy creating this market dynamic.

Let’s take a look at a few examples- 735 Alma Real Drive– This 5+5, 3,534 sq. ft. traditional on a 7,151 sq. ft. lot in the sought after Huntington Palisades was listed for $3,595M ($1,017 per sq. ft.) and promptly received 7 offers. It is currently in escrow with two strong back-up offers. The accepted offer was well over the asking price.

750 Chapala Drive is a recently built (2008) 6+6, 5,948 sq. ft. Traditional on a large 11K lot. It is located on one of the most sought after streets in the Huntington and it had no shortage of buyers. They received over 6 offers at the $6.995M list price and it sold to an all-cash buyer for $7.915M…$1,330.00 a sq. ft!

A contrast in sales on Sunset Blvd– The harm of pricing your home incorrectly- 14300 W. Sunset Blvd. is almost an acre of prime land with a 4+3, 2,346 sq. ft. home (remodel or tear down candidate). It sold for $3.7M…However, it was on the market for 116 days and was originally listed for $4.7M before having to finally be reduced to $3.9M before receiving an offer. If this property was originally listed at $3.9M it may very well have sold for that if not a little bit more…lots of this size are not easy to find in the Palisades.

13946 W. Sunset Blvd. is a beautiful 4+6 5,100 sq. ft. Spanish revival on a 15K sq. ft. lot. The property was listed for $5.329M and received multiple offers and sold with short contingency periods at $5.8M! It is an ultimate family home that would also appeal to an entertainer.

Mortgage Rates remain near 2015 high- insightful charts included

Average fixed mortgage rates remained near their highest level of the year with the 30-year fixed-rate mortgage (FRM) averaging 3.87% with an average 0.6 point for the week ending June 4, 2015, unchanged from last week.

A year ago at this time, the 30-year FRM averaged 4.14%. The 15-year FRM this week averaged 3.08% with an average 0.5 point, down from last week when it averaged 3.11%. A year ago at this time, the 15-year FRM averaged 3.23%.

Sources- Housing Wire and First Tuesday

Focus on the home- Money-saving do-it yourself projects; ways to get rid of weeds and six things you should do when moving into a house

Houselogic.com has released some timely articles with good ideas and tips in time for summer projects around the house:

If you do a minor bathroom facelift (5 ft x 7 ft) on your own it will cost you around $6,900…however, if you hire someone it can be around $16,500. Read about this and four other do it yourself projects.

Best money-saving do-it-yourself projects

Did you know that vinegar can be used to kill the weeds in your yard? Here are seven natural remedies to get rid of weeds.

Seven killer ways to get rid of weeds

Moving into a new house? Here are six things you should do once you get the keys.

Articles you should read- do you overestimate your home’s value? Rising trend in Cali construction

A new statistical study, published in the journal of Housing Economics, found that homeowners on average overestimate the value of their properties by about 8%.

Why homeowners often overestimate their home market’s value

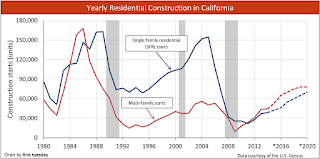

Single family residential (SFR) starts for the six-month phase ending April 2015 rose 11% over one year earlier, compared to the 17% rise in Multi-family construction. This reflects a higher demand for multi-family rentals compared to new SFRs. A very insightful article with predictions on the future of California home and multi-family construction.

Notes on a Realtors Scorecard: Thoughts from a Cali economist…Inglewood is HOT and more

Thoughts from a respected California economist: Ken Rosen, chairman of the Fisher School of Real Estate and Urban Economics at UC Berkeley recently stated that Southern California is just starting to enter the 7th inning of a 9 inning game when it comes to real estate appreciation. He anticipates appreciation to continue through 2015 and 2016 but feels we will see some type of pull-back beginning in 2017. How big will depend on the jump in interest rates, the election of the next president and whether the Feds manipulation of the rates to get out of the great recession was truly economic genius or a quick fix to a bigger problem.

Inglewood attracting investors and young families: Last year we wrote a few blog articles on the surging popularity of Westchester and that has now spilled over into neighboring Inglewood. With the announcement that St. Louis Rams owner Stan Kroenke plans to build a state of the art NFL stadium

surrounded by retail and residential development where Hollywood Park currently resides, many investors have followed his lead. Most home sales are seeing multiple offers and the nicer areas have jumped up over 20% in value in the past 18 months. The mayor of Inglewood James Butts has done a phenomenal job of marketing the future of Inglewood as a place with tremendous potential thanks to new development and the cities proximity to LAX and both the Westside and South Bay. Inglewood still has a reputation as a tough city with poor schools and its fair share of gang violence. However, continued economic development with a focus on cleaning up the area will lead to increasing price appreciation and a reputation as a city of opportunity.

Fun Fact: Madison Square Garden bought the Forum in Inglewood in 2012 and promptly spent $50 million in renovations. In just a few short years, the Forum is on track to be the #1 major concert venue in Los Angeles this year.

Inventory slightly increasing: We are starting to see inventory slowly increase on the Westside which is what the market desperately needs. It is still nowhere close to historical levels but buyers are getting a little more breathing room. That said, we are still seeing some frustrated buyers pay a big premium in multiple offer situations to make sure they don’t get outbid. In some cases buyers are paying 7-10% more than the next highest offer. We expect this trend to start dying down by mid-summer but unless we see a bigger surge in inventory or a hiccup in the financial markets, multiple offers with favorable seller terms will still be the reality most buyers will face the rest of 2015.

9 offers in Mar Vista…on Walgrove!- Despite being situated on a busy street and a few doors down

from a busy intersection (Walgrove and Rose), 1409 Walgrove sold for $1.2M (all-cash), 150K over the asking price! The 3+2 home is only 1,244 sq. ft. with a non-permitted detached guest house which was formally the garage. The house is in good condition and ready to move into but the big selling point was the huge backyard as the lot is just over 8,500 sq. ft. Larger lots definitely go for a premium and this was no exception. Hedges shield the property from Walgrove so once inside you don’t notice the street…despite the large lot, we are surprised to see this sell for over $930 a sq. ft.

Two condos go way over asking in Santa Monica- 1915 Washington Avenue, an updated 3+3, measuring 2,500 sq. ft. hit the market for $1.995M and sold for $2.117M with multiple offers. The townhouse featured great natural light, a private elevator, rooftop deck with great views and a great master bed/bath.

1018 4th Street #303- A top floor 2+3 with 1,951 sq. ft. of living space sold to an all-cash buyer for

$1.818M, $200K over the $1.595K asking price. The buyer is rumored to be a foreign investor. The unit has a gourmet kitchen, rooftop deck, luxurious master bed/bath, captures great natural light and has vaulted ceilings.

Mortgate rates remain largely unchanged from last week

Average fixed mortgage rates moved just slightly lower following three consecutive weeks of increases. The 30-year fixed-rate mortgage averaged 3.84% with an average 0.7 point for the week ending May 21, 2015, down from last week when it averaged 3.85%. A year ago at this time, the 30-year averaged 4.14%.

“Housing starts surged 20.2% to a seasonally adjusted pace of 1.14 million units in April, the highest level since 2007,” said Len Kiefer, deputy chief economist, Freddie Mac. “As homebuying season moves into full swing, homebuilders remain positive about home sales in the near future. Although the NAHB housing market index slipped 2 points to 54 in May it is still above 50, indicating that on balance builders remain optimistic about housing markets.”

The 15-year FRM this week averaged 3.05% with an average 0.6 point, down from last week when it averaged 3.07%. A year ago at this time, the 15-year FRM averaged 3.25%.

Source- Housing Wire

Articles to check out

1- Sales of existing homes cool off in April amid tight supply (National)

Tight supply in many parts of the country is the reason behind the decline. Homes are selling in an average of 39 days, their fastest clip since June 2013, and that’s driving prices up.

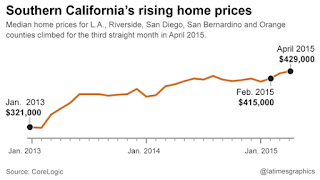

2- So Cal home sale prices show gains

Southern California home prices and sales climbed in April for the second straight month after a period of stagnation. The gains, however, may signal a tough summer ahead for buyers, who face a dwindling supply of homes in most areas. Prices up a moderate 6.2% from April 2014, to a median of $429,000 across the six-county Los Angeles metropolitan area. Sales volume climbed 8.5%.

3-New home construction rebounds strongly, reaches best pace since 2007 (National)

The figures were higher than forecasted and indicated broader economic growth. Many economists attributed the drop in 1st quarter numbers to severe weather across the nation.