Highest 9K lot value sale in North Santa Monica and Palisades sale 300K over asking

After taking a hiaturs since the housing crash, builders are back in droves looking for potential projects especially in areas like Pacific Palisades and Santa Monica where profits of $800K-$1M can be had in a hot market. The builders are also competing with end users who are sick of trying to find the right house and willing to build. Without much inventory the price for desirable land is skyrocketing and the end user willing to pay a little bit more tends to be winning the majority of these battles.

702 21st Street- Word is an end user won a tenacious multiple offer battle featuring 12 bidders for this Gillette Regent lot. The fixer/tear down property was listed for $2.2M and ended up selling in a cash deal with no contingencies for $2.650M on October 29th. This is the highest recorded price for a 8,900 Gillete Regent lot that was priced to sell for land value. $450K over asking! On the heels of this sale…

702 21st Street- Word is an end user won a tenacious multiple offer battle featuring 12 bidders for this Gillette Regent lot. The fixer/tear down property was listed for $2.2M and ended up selling in a cash deal with no contingencies for $2.650M on October 29th. This is the highest recorded price for a 8,900 Gillete Regent lot that was priced to sell for land value. $450K over asking! On the heels of this sale…

221 18th Street- This charming vintage Spanish boasts 2,000 sq. ft. with 2 bed/2.50 bath on a 8,925 sq. ft. lot. Located on one of the premier streets North of Montana, it also garnered a lot of initial interest with 11 parties initially bidding on the home with a list price of $2.2M. They ended up countering six parties and rumor has it the winning bid was all-cash around $2.4M with a 21 day close.

The Palisades is not far behind…

1342 Charmel Place- Marquez Knolls is not the easiest location to find in the Palisades but it does boast incredible ocean views and a complete escape from the city. This property provides the perfect landscape for a designer/architect to take full advantage of breathtaking views. The 4 bed/3 bath, 2,808 sq. ft. home on a 12,455 sq. ft. lot (only about 7,500 useable) sold for $2.002M, just over $350K above the list price.

Two homes sell $100K over asking on Dewey in Mar Vista!

Check out these two recent sales on Dewey. The Westide is on fire and don’t be surprised if Mar Vista is up over 20% by the end of the year. We have seen a significant jump in the past three months as buyers desperate for properties are doing whatever they can to get a foot in the door…especially for a home in excellent condition.

12673 Dewey St– Being located right next to the Santa Monica Airport didn’t phase buyers looking for a modern architectural that was recently completed. The 1,900 sq. ft. home (2,400 if you include the finished garage that is used for living purposes) received over 6 offers and sold for $1.425M, which is $130K over the list price of $1.295M .According to public records the house sold for $580K in February before being reconstructed in its current condition.

The house had a strong emotional appeal for someone seeking an architectural style home but with only a 5,483 sq. ft. lot the back-yard is tiny and backs up to a public walk-way. The neigbors must be estatic with this sale at $736 a sq. ft and yet another example of how quickly the market has changed.

12114 Dewey St- This custom architectural created quite a buzz. Located in the Mar Vista Elementary school district, young families were clamoring over this 3 bed/3 bath, 2,187 sq. ft. home on a 5,850 sq. ft. lot. Rumor has it they received over 12 offers at the $1.397M list price. The property ended up selling for $1.501M with a 30 day escrow period. This home has a higher quality feel compared to 12673 Dewey and the kitchen and master bedroom areas are more spacious.

12114 Dewey St- This custom architectural created quite a buzz. Located in the Mar Vista Elementary school district, young families were clamoring over this 3 bed/3 bath, 2,187 sq. ft. home on a 5,850 sq. ft. lot. Rumor has it they received over 12 offers at the $1.397M list price. The property ended up selling for $1.501M with a 30 day escrow period. This home has a higher quality feel compared to 12673 Dewey and the kitchen and master bedroom areas are more spacious.

North Santa Monica Party House Causing Quite the Ruckus

The old Kathryn Grayson Estate on La Mesa Drive overlooking Riviera Country Club was sold in 2010 to a high end designer for $7.7 Million and it has become quite the rave lately…literally. After being extensively remodeled, the owners have tried to think outside the box and have large parties attracting the Los Angeles elite with the goal of trying to get someone drunk enough or high enough to overpay to the tune of $20-25 Million Dollars for the home. The parties have been happening on a frequent basis attracting in upwards of 400 people and driving neighbors on the normally quiet street nuts. Reports of naked people sleeping in cars and open drug use on the street have been circulating around town.

Tonight at the Santa Monica City Council meeting, an emergency ordinance that prohibits homeowners from hosting more than 150 people at one time for the purposes of selling a home. Please see the article below for more detailed information. The attorney representing the owners is threatening a lawsuit against the city if the ordinance is passed…I just have one question: Do the owners realize who the neighbors are that they are driving crazy? Growing up in the neighborhood my answer would be they are not the type of people you want to make enemies with…you may win a small battle but in the long run you will lose the war…in a big way.

UPDATE: The Santa Monica City Council had a split vote on the emergency ordinance and will be revisiting this situation at the next meeting.

Article: North Santa Monica Party House

3rd Quarter Market Stats…Upward Momentum Continues

For the past few weeks I have heard seasoned real estate professionals state they have never seen a market like this. The recovery in home values on the Westside this year has been dramatic and doesn’t show any signs of slowing down. This is a real life case of Econ 101 with lack of supply+high demand equaling upward price movement.

Most of the U.S. is seeing a strong rebound this year but high-end areas butting up against the coast like Santa Monica and Pacific Palisades are getting an even stronger kick thanks to Santa Monica, Venice and the Marina being commercially robust due to major technology companies flocking to the area thus giving it the nickname Silicon Beach.

Please click on the link below and have access to the Partners Trust single family and condo reports where we compare this year’s 3rd quarter to last year’s 3rd quarter. The comprehensive report stretches all the way out to the valley and some eastside locales. Besides strong increases in the average price sold the number you really want to pay attention to is how the average month of supply of inventory has decreased dramatically. The lack of inventory is bordering on historic levels.

North Santa Monica is seeing 2007 prices with moderately sized nice homes going for over $1,000/1,150 a square foot. Santa Monica in general is up 28.67% with the monthly inventory dropping 57.75%…Pacific Palisades is up 26.72% with monthly inventory dropping 30.14%. More moderately priced locales like Mar Vista are up around 10% and seeing montly inventory dropping alomost 60%. Please remember these numbers are only comparing specific quarters and can be skewed a bit.

Please check out:

| http://www.thepartnerstrust.com/market-stats |

Even the bubble bloggers acknowledge market strength

From the Santa Monica Distress Monitor: “I started this blog over 5 years ago. A lot has happened over the past 5 years but I am increasingly convinced that this blog and “bubble blogs” as a whole are largely irrelevant now. Yes there is still “uncertainty”, but there always is. The recovery may be choppy at times but I think it is pretty obvious that we are well into recovery territory. At this rate I won’t be surprised to see quality Westside properties at or very near all time highs over the next year or two. Real estate is boring now, and that’s a good thing. But it also means less blogging. I’m not ready to pull the plug just yet, but from now through the end of the year I anticipate less posting.

Source: SM Distress Monitor

Two significant articles from a national perspective

Article: U.S.families’ debt loads decline to pre-recession levels

Overall, households today are paying less than 16% of after-tax income to cover debt payments and lease obligations, the smallest share since 1984, Federal Reserve data show.

September existing-home sales fell slightly from the previous month, but remain well above year-ago levels as prices continue to escalate on new demand in key real estate markets.

September numbers are up 11% from the 4.28 million units sold a year ago.

**Articles both from LA Times

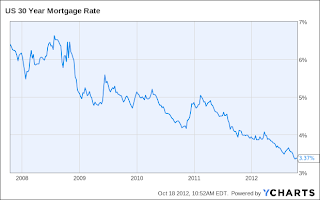

Mortgage rates hovering near all-time lows

Mortgage rates hovered near their all-time lows this week, with the average 30-year fixed loan at 3.37%, down from 3.39% last week, Freddie Mac said in its latest survey of what lenders are offering to solid borrowers.

The record low of 3.36% was set two weeks ago.

Freddie said the average offering rate for a 15-year home loan was 2.66%, a new record low. Borrowers would have paid an average 0.7% of the loan amount in upfront lender fees and points for the 30-year loan and 0.6% for the 15-year mortgage.

Source (article and chart): LA Times

Westside Market Stats

One of the many things I love about Partners Trust is the market research provided to agents and our clients. We have a market research team who know the micro markets that make-up the Westside better than anyone. Click the link below for our latest quarterly market stats for single family homes and condos. Across the board we have seen healthy price increases through 2012. If you would like specific information about a zip code or area, please feel to contact me and we can make it happen!

Mortgage rates rise for third straight week

Fixed mortgage rates rose for the third straight week after setting all-time lows, with the typical 30-year rate on a loan below $417K increasing from 3.59% to 3.62%.

The yield on the benchmark 10-year Treasury note closed at 1.8% Wednesday after bottoming out at 1.4% on July 24. The average 30-year fixed mortgage rate, hit an all-time low of 3.49% that same week. These rates are based on loans to solid borrowers who have 20% or higher downpayments or 20% equity in their homes if they are refinancing. Borrowers typically paid 0.6% of the loan amount in lender fees and discount points.

Source: LA Times