Westside Experiencing a Strong Seller’s Market

As I reported in the Skinny last year the real estate market was showing signs of strength thanks to low interest rates, tightening inventory and an influx of new wealth into the area thanks to the Silicon Beach phenomenon and the Westside always being an attractive second home destination for the international elite. In late 2011 many well respected financial analysts were touting this as a strong buying opportunity calculating that if you take the current interest rates combined with the drop in value of the past five years in actuality you have more like a 40-45% drop in Westside real estate value from the market heights.

Even knowing all of this, it would have been difficult to predict what the Westside market has experienced this year despite all of the worldwide economic turmoil. With inventory getting even tighter and interest rates continuing to drop to new lows the market flipped in almost overnight fashion and we are seeing double digit appreciation in many areas and price points over last year with multiple offers being presented on the majority of properties priced at market value. Make sure you read the Multiple Offer Mayhem posts below providing you with the inside scoop of what is going on.

Why so few properties?

Despite this strong value increase, many Westside owners are still underwater thanks to buying at the peak and then refinancing themselves to an even greater debt before the nation’s economic collapse. Many seller’s who are not in economic trouble are unwilling to take a significant loss to the property they currently occupy and even if they wanted to sell the tight inventory has left those looking for a home at a higher price point with very few options.

Standing out in a crowded pack of buyers

Agents are back to advising clients looking to purchase to do anything they can to create attention to their offers in a positive way. Ideas that were employed at the height of the market (personal notes written with flowers or baked goods, removing financing and physical inspection contingencies, picking up seller’s costs) are back in vogue as desperate buyers do whatever they can to get their hands on a property. Furthermore, agents must also present a clean and professional offer package with all the documentation along with having a solid reputation for the offer to be taken seriously.

Numbers tell the Story

In the highly coveted North of Montana market (90402) in Santa Monica, the number of days on market has dramatically shortened from 85 to 38 days and median sales has climbed to $2.694M compared to $2.441M in 2011. Further supporting the Seller’s market is the high listing to sales price ratio for the area – currently 97% and climbing higher. In a Seller’s market, this ratio hovers close to 100% and in a declining or Buyer’s market, the ratio can drop below 90%.

Patience is Key

Frustrated buyers need to stay patient and be ready to move on a property right away. The non-existent inventory should improve in the coming months with seller’s seeing this as a potential opportunity to get a price they didn’t think possible a year ago along with a presidential election looming. Though the Westside does not have nearly the amount of bank owned properties as other areas that are still struggling mightily, the banks still have properties they need to unload and that should provide a little relief as well.

Sources: *North of Montana Real Estate Voice

30 Year Mortgage Hits New Record Low at 3.79%

The LA Times reports that “30-year mortgage rates have fallen below 3.8% for the first time to average 3.79%, down from a then-record 3.83% a week ago.

The 15-year fixed loan also hit another new low, falling from 3.05% last week to 3.04% this week.

The start rates on adjustable mortgages rose slightly in the survey. Quotes are for solid borrowers with 20% down payments or equivalent equity in their homes if they are refinancing.

The borrowers would have paid 0.7% of the loan amount on average in upfront fees and discount points to obtain the fixed-rate loans, and slightly less for adjustable-rate loans.”

(*source LA Times)

Proud Partner at Partners Trust

A few weeks ago I officially became an associate partner at The Partners Trust real estate brokerage & acquisitions group based out of Brentwood which also has offices in Beverly Hills and Santa Monica. I am extremely excited to be with Partners Trust and believe the collaborative environment and level of service is unmatched in the industry. As I get situated and familiar with the technological and statistical advancements, clients will see positive advancements with the Skinny on Real Estate blog and continued advancement with customer service.

At Partners Trust, the objective is to present clients with the most professional, successful and ethical real estate associates in the business and represent clients with care, confidentiality and the utmost attention to service.

Since the company’s inception three years ago they have experienced exponential growth and are on pace to do over $1 billion dollars in sales in 2012 with just 80 agents. In the past year, almost 40% of the sales at Partners Trust were “off the market” (meaning not on the MLS) which is another testament to the tremendous collaborative environment. According to the MLS numbers, our company’s sales volume is up 144% since this time last year, making us the fastest growing independent real estate company on the Westside. Needless to say I am very excited about being part of this success!

If you are not familar with the Partners Trust web-site, I invite you to visit www.thepartnerstrust.com and please feel free to e-mail me at john.skinner@thepartnerstrust.com

Mortgage rates again at record lows

Mortgage rates are again at record lows, with lenders offering 30-year loans at an average of 3.84%, Freddie Mac’s weekly survey shows.

That’s down from 3.88% last week and a previous record low of 3.87% in February. All of the rates would have seemed unimaginable as recently as 2008, when the 30-year rate averaged more than 6%, or 2009, when the typical rate exceeded 5%.

That’s down from 3.88% last week and a previous record low of 3.87% in February. All of the rates would have seemed unimaginable as recently as 2008, when the 30-year rate averaged more than 6%, or 2009, when the typical rate exceeded 5%.

The 15-year fixed mortgage also dropped to a new record, showing the typical lender offering rate was 3.07% this week, down from 3.12% last week and its previous low point of 3.11%, set April 12.

Interest rates are at rock bottom because of the state of the economy and the inflation outlook.

The widely watched Freddie Mac survey, which has tracked 30-year rates for more than 40 years, presumes the borrowers have solid credit and 20% down payments or equity in their homes. It asks lenders what rates they are offering on loans of up to $417,000 to these borrowers assuming they pay less than 1% of the loan amount upfront in lender fees and points.

Borrowers with good credit who shop around frequently obtain slightly better rates than those in the survey. They also can obtain lower rates by paying additional discount points to their lender upfront.

Source: LA Times

Trampolines: a possible home insurance issue

Even though trampolines can be a great source of exercise and fun for children and adults a like, if you Google the words “trampoline” and “liability,” you’ll see that not only are trampoline injuries a very common cause of severe injuries, they are also the source of a full-blown body of law around homeowners being responsible to cover the costs and other damages related to those injuries.

In fact, just last month, New York Yankees pitcher Joba Chamberlain suffered a career-pausing ankle dislocation while jumping on a trampoline.

Many homeowners insurance and hazard insurance policies are actually voided by the installation of a trampoline on the home.

I strongly suggest that if your are thinking of getting a trampoline that you reach out to your insurance representative to fully understand the impact of having one and whether they will cover it and what the increase in your insurance will be.

Info source: www.inman.com

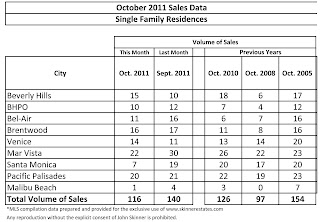

Westside October sales volume lagging

*click to enlarge image

The recent run of slow sales volume on the Westside for Single Family Homes continued into October with Santa Monica leading the way with only 7 sales which is almost three times less than last month’s number of 19 and last year’s number of 20. Most of the areas stayed fairly consistent compared to last year with Beverly Hills Post Office and Bel-Air the only areas seeing a solid increase over last year’s numbers.

Overall, sales volume for the areas calculated dropped 17 % compared to last month and 8% compared to last year. Sales are still firmly ahead of the dreadful 2008 numbers by 20%. Overall, it has been a frustrating market for serious buyers with very little inventory on top of having to deal with a tough lending market. The influx of tech companies to the Westside along with garnering a strong interest from international investors bodes well for property owners on the Westside at this time.

A look at some individual sales:

932 Chautauq ua sells in 3 days– This Pacific Palisades 5 bed/6 bath, 6,500 sq. ft. home on a 9,452 sq. ft. lot hit the market for $4.695M in early August. After about three days the seller’s accepted a $4.5M sale price and closed in early October. This resort style home was build in 2009 and featured great indoor/outdoor flow, chef’s kitchen, pool, wine room and workshop. An entertainer’s home with a family twist.

ua sells in 3 days– This Pacific Palisades 5 bed/6 bath, 6,500 sq. ft. home on a 9,452 sq. ft. lot hit the market for $4.695M in early August. After about three days the seller’s accepted a $4.5M sale price and closed in early October. This resort style home was build in 2009 and featured great indoor/outdoor flow, chef’s kitchen, pool, wine room and workshop. An entertainer’s home with a family twist.

1513 Sorrento sells for over asking- LOCATION, LOCATION, LOCATION! This view property situated in the Palisades Riviera on over a 22,651 sq. ft. lot with phenomenal views sold for $5.0M in multiple offers with a $4.395M asking price. Lots this size with views are a rare commodity on the Westside and always garner a ton of interest from the elite in Los Angeles. Unless a seller is asking for an outrageous sum properties like these go pretty fast.

820 Princeton sells for 100K over asking– This quaint and charming Santa Monica Tudor just south of Montana boasts 3 bed/1.75 baths, 1,584 sq. ft. on a 8,800 sq. ft. lot. It sold for $1.408M and closed October 21st. It was listed at $1.295M and the low asking price fetched a multitude of offers.

12495 Promontory sells for $1.7M- About 10 years ago the 24 hour guard gated Moutaingate estates was considered a hot place to buy on the Westside. Nestled above the 405 freeway near the Getty Center the location provides equal access to the Valley and the Westside along with resort like amenities. However, since its heyday this area that used to attract a decent amount of celebrities has fallen on some difficult times and you can pretty much pick up a home that is a bit dated but with good bones for under $400 a sq. ft. 12495 Promontory just sold for $1.7M after debuting on the market for $2.250M. We sold a home in the area that was completely updated for $2.0M in late 2010 so this sales price makes sense. The area is saddle with high HOA dues ($700+) per month but not a bad alternative for a large family looking for a Brentwood address.

These two took a huge hit-

130 Delfern Drive in Bel-Air sells for $8.4M…nearly ½ off the original $16.5M list price- This 1.2 acre estate in Holmby Hills that boast 4 separate structures but in need of updating originally made its debut on the market at the ridiculous price of $16.5M in May of 2010. After finally being dropped to a $9.995M list price in July of this year it sold on October 25th. A good buy for over 1 acre of land in prime Holmby Hills

130 Delfern Drive in Bel-Air sells for $8.4M…nearly ½ off the original $16.5M list price- This 1.2 acre estate in Holmby Hills that boast 4 separate structures but in need of updating originally made its debut on the market at the ridiculous price of $16.5M in May of 2010. After finally being dropped to a $9.995M list price in July of this year it sold on October 25th. A good buy for over 1 acre of land in prime Holmby Hills

9550 Heather Road in BHPO sells for $8.194M…just slightly off the original $15.5M ask price…LOL- Situated on over 1.7 acres this 6 bed/9 bath home (sq. ft. not reported) finally sold on October 24th after being on the market for 254 days. I have never understood why seller’s, especially in sophisticated neighborhoods think someone will just magically appear and pay them way over market. Most buyers who can afford multi-million dollar homes tend to make good financial decisions or have people working for them who do…

sold on October 24th after being on the market for 254 days. I have never understood why seller’s, especially in sophisticated neighborhoods think someone will just magically appear and pay them way over market. Most buyers who can afford multi-million dollar homes tend to make good financial decisions or have people working for them who do…

Interest Rates back below 4%

Investor worries over the European debt crisis helped drive the average rate for a 30-year fixed home loan down to 4% this week, according to Freddie Mac.

The figure, down from 4.1% last week, was the second lowest in the 40 years Freddie has been conducting a weekly survey of the terms being offered by home lenders. The lowest average rate recorded was 3.94% four weeks ago.

Freddie Mac said lenders were offering 15-year loans, a popular choice for homeowners who are refinancing, at an average rate of 3.31%, down from 3.38% a week earlier. That rate was below 3.3% for three weeks in late September and early October.

To obtain the loans at the rates being offered this week, a borrower would have to pay upfront fees averaging 0.7% of the amount borrowed.

*Source: LA Times

Real Estate articles you should review

Here are some recent articles from the LA Times that are worth taking a look at:

Victims of improper foreclosure practices can submit claims

Fourteen mortgage servicers have begun mailing out 4.3 million letters to potential victims of robo-signing. The letters will invite borrowers to submit their cases for a free review by independent consultants.

Mortgage refinancing to get easier under revised U.S. program

The plan could help 1 million to 2 million people get significantly lower monthly payments in hopes of stabilizing the real estate market.

Factoring energy efficiency into a home’s value

Under the SAVE (Sensible Accounting to Value Energy) Act, estimated energy-consumption expenses for a house would be included as a mandatory new underwriting factor.

Dot-coms want the beach in their address

The commercial real estate rental market is booming in Santa Monica, where the office vacancy rate is a fraction of the L.A. County average. Tech and entertainment firms like the lifestyle.

**We wrote about this impact on the residential market 6 months ago. No doubt the “Silicon Beach” effect is impacting the residential market on the Westside in a very positive way.

Tight inventory and record low rates making it tough for Westside buyers

You can characterize the Westside real estate inventory as pretty tight these days. There’s plenty to choose from in some categories and at some price points, but much of what is available has some kind of issue – from location to price – that causes buyers to put on the breaks and if we were playing Monopoly it is like the seller is being sent to jail.

On the flip side, quality offerings priced appropriately usually see multiple offers and pretty easy escrows thanks to record low interest rates and buyers from all over the world seeking property in this particular market.

We are seeing quite a bit of purchasing activity in price points that can be considered “entry level” depending on the micro market. Entry level for the 90402 zip code in Santa Monica for a non-tear down home is usually around 2-million (give or take based on sq. ft.) while in the 90066 zip code of Mar Vista north of Venice and West of Centinela it is around 750K. –Quick insert: With the current conforming loan limit dropping from $729,500 to $625,500 on October 1st look for markets like Mar Vista, Culver City and South Santa Monica to lose some buyers who will no longer be able to afford the higher payment.

Due to many potential sellers being financially handcuffed and unable to sell their homes the inventory that is available to buyers throughout the Westside is minimal leading to some segments of the market seeing a 5-10% uptick over the past 12 months, despite the economy. High-end buyers are taking advantage of a 15-20% drop in price from the height of the market along with record low interest rates around 4%. They feel it is a tremendous buying opportunity with some real estate analysts calculating that if you take the current interest rates combined with the drop in value of the past five years in actuality you have more like a 40-45% drop in Westside real estate value from the heights of 2005.

The best way to track value: A look at recent re-sales in SM and the Palisades

Though we have seen an uptick in the market as of late due to the factors mentioned in a previous post we still have seen quite a bit of price erosion. One of the best ways to look at value in certain market segments is to look at homes that have sold twice in the past 7 years that are in similar condition. Here are some great examples from the Pacific Palisades and North Santa Monica markets:

215 24th Street, Santa Monica- 9.8% drop in value since 2009 purchase- This beautiful 3K sq. ft. Spanish style home on a 8,700 sq. ft. lot recently sold f or $2.3905M after debuting on the market for $2.745M in February of this year with a different broker. Unfortunately for the seller the home seemed to fall out of escrow on two different times before finally settling on a buyer. This leads us to believe that the home may have had some type of inspection issue pop up. The home is updated and light/bright. It features a pool/spa and was a good buy at this price. The home was sold in 2009 for $2.650M.

or $2.3905M after debuting on the market for $2.745M in February of this year with a different broker. Unfortunately for the seller the home seemed to fall out of escrow on two different times before finally settling on a buyer. This leads us to believe that the home may have had some type of inspection issue pop up. The home is updated and light/bright. It features a pool/spa and was a good buy at this price. The home was sold in 2009 for $2.650M.

Ouch- 1436 Floresta, Pacific Palisades, sells for 25% less than 2007 purchase price and well below 2005 purchase price- This 4 bed/4 bath, 5,130 sq. ft. home on a 16K sq. ft. lot recently sold for $2.580M after being originally listed for $2.795M. It was on the market for 48 days. The same house was purchased for $3.450M in July of 2007. It was sold in 2005 for $3.130M so the home has dropped to around its 2003/2004 value.

On the upswing- 458 Toyopa, Pacific Palisades– sells for more than 2010 purchase price- This 6 bed/9 bath, 9K sq. ft. house on a 24,742 sq. ft. lot (home sq. ft. not reported) built in 2008 featuring many high end amenities including huge master with his/her’s baths, pool, spa and putting green recently sold for $9.8 Million after being on the market for 161 days. The house was sold in 2010 for $8,750,000 resulting in over a 10% increase in sales price. Even after brokerage fees not a bad return for a 1 year investment in a bad economy. Further proof that inventory is not great on the Westside and we have seen prices increase for properties of this nature.

710 23rd Street, Santa Monica- 9% drop since 2008 with only one agent involved- The seller got a fair price at $2.650M for this home but did it get exp osed to the whole market? It was pretty difficult to set up a showing and a little surprised they would take a $250K reduction and go into escrow after only being on the market for 11 days. However the list price was high and the reduction in purchase price may have taken the place of repairs that are needed.

osed to the whole market? It was pretty difficult to set up a showing and a little surprised they would take a $250K reduction and go into escrow after only being on the market for 11 days. However the list price was high and the reduction in purchase price may have taken the place of repairs that are needed.

This is a 4 bed/4 bath, remodeled architectural style home that is 2,848 sq. ft. on a 8,851 sq. ft. lot with a pool and Gourmet kitchen. It was purchased in April of 2008 for $2.9M.

942 Galloway, Pacific Palisades- Still worth more than 2004 purchase price- The Palisades definitely functions as a micro market. On one hand you have a house in the Marquez Knolls dropping below its 2004 price point but this house in the alphabet street is still holding its value about its late 2004 purchase price. This 4 bed/3 bath home on a 5,200 sq. ft. lot (sq. ft. of house not reported) was on the market for just 13 days and sold in late August for $2.120M above its $1.965M purchase in price in November of 2004.

functions as a micro market. On one hand you have a house in the Marquez Knolls dropping below its 2004 price point but this house in the alphabet street is still holding its value about its late 2004 purchase price. This 4 bed/3 bath home on a 5,200 sq. ft. lot (sq. ft. of house not reported) was on the market for just 13 days and sold in late August for $2.120M above its $1.965M purchase in price in November of 2004.