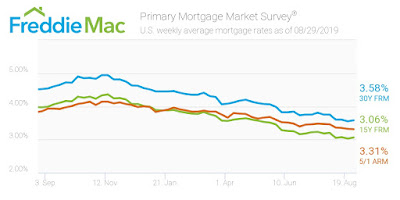

Mortgage rates tick up slightly to 3.58% but still nearly one percentage point lower than a year ago

Although the average U.S. rate for a 30-year fixed mortgage rose this week, the rate still managed to hover near last week’s 3-year low.

The 30-year fixed-rate mortgage averaged 3.58% for the week ending August 29, 2019, up from last week’s rate of 3.55%. A year earlier, the rate was 4.52%

The 15-year FRM averaged 3.06% this week, slightly rising from last week’s 3.03%. This time last year, the 15-year FRM came in at 3.97%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.31%, sliding from last week’s rate of 3.33%. Once again, this rate sits much lower than the same week in 2018 when it averaged 3.85%.

Source- Marketwatch

NEW PRICE- PRIME DTLA OPPORTUNITY – THE METROPOLIS- 38TH FLOOR – $1.799M

Live above it all in Downtown LA and acquire one of the most desirable units with the largest 2BR floorplans available (1,720 sq. ft.) in Tower 1 of the Metropolis. This luxurious residence is situated in the Southwest corner of the top floor and provides a fantastic floor-plan ideal for entertaining or enjoying a quiet evening watching the sunset. The 11-foot ceilings along with the floor-to-ceiling windows provide an expansive feel and the best views you can find in LA. Other features include custom cabinets in the kitchen along with Bosch appliances, automatic shades in the living room and plenty of storage. Tower 1 provides world-class amenities such as fitness center equipped with steam rooms in both ladies and men’s bathrooms, 24-hour lobby attendant, media room, business center and a wide open outdoor space located on the 6th floor that includes a BBQ area, resort-style pool, and dog park. A true gem providing the perfect blend of luxury and A+ location. **The Seller bought the unit for over $2.050M and is ready to move on…E-mail us for more information and to set up a showing.

Los Angeles real estate- lower interest rates have strengthened LA’s housing market after a slow start to the year

Compass Chief economist Dr. Selma Hepp has published an in-depth article examining the Los Angeles real estate landscape.

Here are the key takeaways-

* After a large dip in housing market activity starting in the last quarter of 2018 and first quarter of 2019, housing markets in recent months have mostly bounced back to where they were last summer.

* In July, total sales in Los Angeles County trended at the same level as July of last year, with an increase in sales of homes priced between $1 million and $2 million, up 5 percent year-over-year, being offset by slower sales in other price segments.

*Strong activity among homes priced between $1 million and $2 million bring the levels of homes in that price range to the highest level in the last five years.

*Some West Side communities, which experienced slower market conditions since last year, have finally seen more activity. Most notably, sales in Malibu and Beach Communities North have posted the first annual increase since last summer, up 11 percent year-over-year. The impact of wildfires has had a considerably negative impact on the area with overall year-to-date decline in sales of 26 percent. The most recent uptick was driven by strong sales of homes priced below $2 million while higher priced sales continue to lag.

*For-sale inventory is once again trending below last year’s levels with July’s year-over-year decline for the overall inventory down one percent, and inventory priced below $1 million down 5 percent. Declines follow almost a year of year-over-year increases. And the lower priced inventory is now 24 percent below the 2015 levels.

Also, here is the Compass July 2019 Market Real Estate Market Update which provides a quick summary of the overall market and more detailed statistics on specific areas.

Wire-Fraud continues to be an issue in real estate transactions- Here is how you avoid the scam!

Recently, the Consumer Finance Protection Bureau published a fraud alert for wire transfers of earnest money, down payments, closing costs and loan payoffs.

Here’s how you can avoid a wire-transfer scam:

1. Never follow wire-transfer instructions sent via email. Verify the closing instructions, including the account name and number, with your trusted representatives either in person or by using a predetermined phone number. Similarly, never email financial information.

2. Pay attention to email addresses related to the transaction. A legitimate address like john-doe@abc.com could be confused with a spoofed email like john_doe@abc.com or john-doe@bcd.com.

3. Keep computer security patches and antivirus software up to date. Change your password every 90 days and enable two-step authentication on your email account.

4. Suspect a scam? Contact the bank immediately and request a wire recall. To recover large, international wire transfers, ask the bank to contact the local FBI office and request a Financial Fraud Kill Chain.

Real estate articles worth checking out

The bank of Mom and Dad would rank as the seventh largest mortgage lender – Parents and grandparents supported the nationwide purchase of $317 billion worth of property—1.2 million homes—last year

Millenials are finally buying homes – According to the latest data from the Census Bureau, the national homeownership rate rose in the fourth quarter to 64.8%, which is a four-year high.

Growth in home prices continues to slow in January Nationally prices grew 4.4% year over year and .1% month over month

As sales volume plunges, LA home prices are inching up at the slowest rate in years – Year-over-year home sale prices are up 2% in LA County.

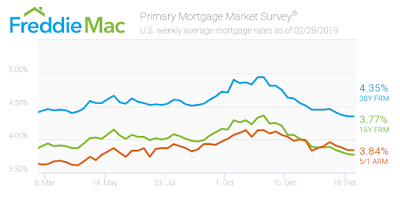

Mortgage rates remain subdued

Rates for home loans were little changed near long-time lows, providing a little breathing room for would-be buyers even as policy makers are increasingly taking an interest in housing matters.

The 30-year fixed-rate mortgage averaged 4.35% in the February 28 week, mortgage guarantor Freddie Mac said Thursday. That was unchanged from the prior week and the lowest in a year.

The 15-year adjustable-rate mortgage averaged 3.77%, down one basis point. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84%, also unchanged.

Source- Marketwatch

% of multiple bids for properties is dropping

Home shoppers in California will likely face less competition in their offers. January showed multiple offer bidding wars saw a significant drop from a year ago, according to a report from Redfin. Only 13 percent of offers written by agents on behalf of their customers faced war—down significantly from 53 percent a year ago.

As we noted last week, due to tight inventory and interest rates dropping again, we are still seeing a fair amount of multiple offer activity on the Westside for properties listed around the true market value. However, the amount of offers is more like two to three compared to the five or seven we were seeing last spring.

New Listings- Brentwood, Marina Del Rey and Palos Verdes

11921 Dorothy Street Unit 204, Brentwood Village– $1.250M -Open Sunday 2/10 1-4 and Tuesday 2/12 11-2 (*Under Contract within two weeks)

Spacious 3 bed+2.5 bath condo in one of the premier buildings in Brentwood. The open floor plan encompassing 1,780 sq. ft, features a wonderful kitchen that opens to a large entertainer’s living room with a fireplace and private balcony. The master suite has a large walk-in closet and en-suite bathroom with dual sinks. Other features include A/C, in-unit laundry, bonus storage, secured access to the building and guest parking. Steps to Brentwood restaurants, shops and easy access to all the Westside has to offer.

4200 Via Dolce Unit 129-Marina Del Rey– $930K -Open Sunday 2/10 1-4 and Tuesday 2/12 11-2 (*Under contract within two weeks)

Situated a few short blocks from the beach and the world-class dining and shops of the Marina, no expense was spared for this recently designer renovated 2 bed+ 2 Bath unit that features hardwood floors, upgraded LED recessed lighting and custom finishes throughout. The living room with a custom finished fireplace and wet bar flows into a large private patio creating fantastic indoor/outdoor flow. The Kitchen with stainless steel appliances, apron sink and water filtration system has enough space for a home office and is adjacent to the dining room. Master suite includes ‘his’ and ‘hers’ closets, en suite with dual vanity, soaking tub and separate rain shower. Side by side parking, storage unit, controlled access building with security, 2 pools, and plenty of guest parking.

30010 Via Borica- Rancho Palos Verdes- $1.599M -Open Sunday 2/10 1-4pm (*Under contract within 3 days of hitting the market)

Located on a picturesque cul-de-sac, this 4 bed + 3 bath home features spacious rooms, plenty of natural light and both ocean and hillside views. Generous living room complete with modern fireplace. Sunlit dining room adjacent to the beautifully-appointed remodeled kitchen. Upstairs you’ll find four airy bedrooms with wonderful light, charming built-ins and walk-in closets. The master suite features a luxurious remodeled en-suite bath and tranquil fireplace as well as a private balcony. Begin and end the day by taking in the exquisite views from Catalina to Malibu! The sprawling patio is an entertainer’s dream and provides both a welcoming seating area with covered pergola as well as an open area perfect for hosting guests. **Co-listed with Caskey&Caskey – Kurt Allen and Judy D’Angelo

Notes on the market and optimizing the sale price of your home

Recently, I have been asked a few questions regarding the market and thought it would be a good idea to gather them up and address them.

Q: How healthy is the housing market? What do you expect the mortgage rates to do in the next year and how will that affect sellers/buyers?

A: The Westside/South Bay markets definitely softened and depreciated some in the 4th quarter, especially when 30 year mortgage rates were around 5% (20% increase year over year) and the stock market was in a correction mode. However, things have picked up quite a bit over the past few weeks with mortgage rates retreating to ten-month lows and wiping out much of the interest rate increase that stalled out the market. Some properties that did not sell in the 4th quarter and were then taken off the market during the holidays and re-introduced after the New Year at the same price point immediately sold with some receiving multiple offers. Overall, we have shifted from the strong seller’s market over the past six years to a more normalized market with a slight lean toward the seller in price points below $5M. This will continue to be the case as long as 30-year mortgage rates stay south of 4.8%. Despite the drop in rates, the ultra-luxury market is typically favoring the buyer with current tax laws (no longer able to write off property taxes) not helping the seller’s cause.

Q: How do the proposed affordable housing guidelines proposed by the new governor look to impact investment in real estate?

A: Housing supply is limited in Southern California. The new affordable housing regulations may take some builders out of new housing development because of the lack of profitability but new homes/condo will still be in demand. New housing starts still significantly lag behind what was being built before the great recession. The supply will not match the overall needs for the job growth on the Westside of Los Angeles. The change in density zoning around the LA Metro route will provide for more housing units, but on the whole, the demand for existing homes will remain high. The one area to keep an eye on in terms of “over-building” is Downtown Los Angeles where developers do not have to battle restrictive building height requirements and this has led to quite a few luxury high-rise projects that will be hitting the market over the next few years.

Q: Where would you spend your dollars when getting ready to sell your house?

A: It is amazing what a fresh coat of paint will do. Consulting with a designer/stager to make the house appeal to a broader audience is also money well spent. Depending on the situation, you may only need to paint, accessorize and de-clutter but a full staging is optimal. With a bigger budget, updating flooring, the kitchen and master bath-room provide the most bang for the buck. Q: How important are open houses to sales? Is it more important to have a well-connected and experienced realtor/agent or great open house, which will get my property sold at the best price in a timely fashion? A: Since over 85% of sales involve a cooperating broker, it is really important to work with an agent that has a great reputation and known within the real estate industry for being positive to work with. The good agents like to avoid those with less than stellar reputations. A great agent will assist in every aspect of creating maximum visibility. Open houses are important to have, especially early on in the process when the property has maximum visibility. The most serious buyers will ask for a private showing if an open house is not available, but most home shoppers usually plan on seeing inventory on Sunday afternoons and over 40% of buyers’ state they first saw the property they purchased at an open house.