Mortgage Rates Fall to Lowest Level of 2011

Fixed-rate mortgages are at their lowest point of the year, declining for the fifth consecutive week amid mixed economic and housing data.

The 30-year fixed-rate loans averaged 4.61% and the 15-year, 3.80%. Borrowers would have paid 0.7% of the loan amount in upfront lender fees to obtain the rate, Freddie Mac said.

Last year at this time, the 30-year fixed-rate mortgage averaged 4.84%, according to Freddie Mac, which surveys rates lenders are offering to well-qualified borrowers who make down payments of at least 20% or have that much equity in their homes if they are refinancing.

As rates fall, applications for home loans have risen. The Mortgage Bankers Assn. said Wednesday that applications for new loans last week were 7.8% higher than in the previous week.

Source: LA Times

PLAN AHEAD: 405 Closed July 16th thru early morning of the 18th!!

Starting just after midnight July 15, the San Diego (405) Freeway will be shut down in both directions from Getty Center Drive to the 101 Freeway for 53 hours, so that the south side of the Mulholland Bridge can be demolished.

The freeway section is expected to reopen at 5 a.m. July 18, according to Metro officials.

An estimated half-million cars, trucks and buses use this freeway on a typical summer weekend. The closure is part of the ongoing freeway-widening project, which will create a 10-mile northbound carpool lane on the 405 between the Westside and the San Fernando Valley.

Supervisor Zev Yaroslavsky’s refers to this planned shutdown as a “midsummer night’s nightmare for motorists heading to LAX, the beach, or other destinations.”

Two Articles Worth Checking Out

Here are two articles that we felt were particularly good reads from the LA Times:

April home sales prove lackluster in Southern California: This article discusses the current “macro” market situation as increasingly dire with sales falling 5.5% from March to April. This is obviously not the case in higher end areas where activity has picked up.

Foreclosure rate slows as repossession timeline lengthens: This article discusses the length of time it is taking for borrowers to be pushed into foreclosures, resulting in fewer bank-owned properties being released into the market

Pacific Palisades Full of Multiple Offer Activity

This past week has felt like a trip back to 2004-2007 for many realtors that work the Pacific Palisades market. Four homes hit the market and all have multiple offers with rumors having at least three of the four going for over asking. Here is a look.

555 Muskingum- Major Fixer/Tear Down on a 8,799 sq. ft. lot hit the market for $1.295M and immediately received multiple offers and is currently in escrow at over asking.

527 Muskingum- 3+2, approx. 2K sq. ft. on a 7,870 sq. ft. lot with ocean views. $1.849M list price. Cute beach cottage home in very good condition with strong emotional appeal. Word on the street is this property received four offers and they accepted an offer yesterday. We do not know the price range.

527 Muskingum- 3+2, approx. 2K sq. ft. on a 7,870 sq. ft. lot with ocean views. $1.849M list price. Cute beach cottage home in very good condition with strong emotional appeal. Word on the street is this property received four offers and they accepted an offer yesterday. We do not know the price range.

737 Almar- 4+4, 2,954 sq. ft. on a 5,837 sq. ft. lot located in the El Medio bluffs. $1.949M list price. Cute Mediterranean style home that has a nice lay-out and needs a little bit of updating but something someone can easily move into. Limited yard space but good appeal. They received two offers right after the broker caravan on Tuesday and are rumored to be in escrow at asking or above.

878 Galloway- 4+3.5, 2,958 sq. ft. on a 5,867 sq. ft. lot located in the Alphabet streets in a prime walking location. Beautiful East Coast traditional with a ton of emotional appeal. It was bought in 2007 for $2.725 and was listed at $2.295M. Apparently they received 5 offers and are in counters above the asking price…

878 Galloway- 4+3.5, 2,958 sq. ft. on a 5,867 sq. ft. lot located in the Alphabet streets in a prime walking location. Beautiful East Coast traditional with a ton of emotional appeal. It was bought in 2007 for $2.725 and was listed at $2.295M. Apparently they received 5 offers and are in counters above the asking price…

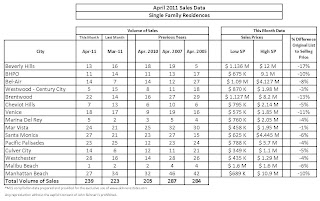

SFR Sales Data for April

*click graph to enlarge

*click graph to enlarge

Unlike the Condo market, sales volume increased in April compared to last month and was stronger than April 2010 in the areas we track. With inventory decreasing and demand continuing to pick up, the market is definitely the hottest it has been in the last 4 years. Homes in good condition that are priced anywhere from 17-20% off the market heights of 2006-2007 are usually garnering multiple offers. The difference between original list price and sale price continues to decrease though Beverly Hills and Marina Del Rey increased in the discrepancy. Sales volume has increased % over April of last year while still % behind sales volume in 2007.

In looking at the broad picture the graph presents, Pacific Palisades, Westchester and Venice doubled its sales volume compared to last April while Cuvler City, Marina Del Rey and Bel-Air doubled sales volume compared to last month.

A quick look at a few individual sales:

Brentwood-510 North Kenter, a 4+3, 2,150 sq. ft. house on a 20,298 size lot sold for $1.775M – 7% above the asking price and went out in multiple offers after being on the market in twelve days. This was a very stylish contemporary home with a pool and open kitchen.

Brentwood-510 North Kenter, a 4+3, 2,150 sq. ft. house on a 20,298 size lot sold for $1.775M – 7% above the asking price and went out in multiple offers after being on the market in twelve days. This was a very stylish contemporary home with a pool and open kitchen.

Pacific Palisades- 15976 Alcima Ave- 5 +3.5, 2,982 sq. ft. house on a 18,300 size lot. This was a tear down and sold for $1.90M, 21% below the original list price .

Down the street, 15920 Alcima, a 4+4, 5,241 sq. ft. house on a 20,470 lot sold for $3.185M, just below the $3.195 M list price and was only on the market for 5 days. This was a well-maintained home with great ocean views and only needed a little cosmetic work.

The bottom line is that people are paying a premium to move into homes that don’t require much work while the better deals are falling into the hands of those willing to remodel.

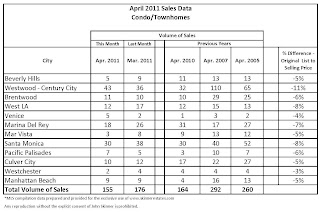

Condo Sales Data for April

*click graph to enlarge

*click graph to enlarge

According to the MLS, overall sales volume for condos in the areas we cover decreased in April and was lower than sales in April of last year by 5.5%. However, this is not surprising since we have been writing about decreasing inventory. In fact, the market has heated up with the spring and summer selling season and that is evident with the average days on market and % difference between original list price “OLP” and sales price is decreasing significantly. For example, the % difference between OLP and sales price in March had 3 areas in the double digit range and many hovering around 7-9%. April only had one area in double digit % (Westwood/Century City 11%) and most were around 4-6%. Earlier in the year, the majority of the areas we cover had a double digit discrepancy.

As many of you know from reading this blog, the recent surge in buyer demand has been fueled by low interest rates, an influx of buyer’s from tech companies relocating office space to the Westside and a general feeling that the economy seems to be on solid ground. The frustrating thing for buyer’s is that inventory is artificially low because so many people have a loan that is higher than what the property is worth and the bank’s continue to unload properties at a snail’s pace.

A quick look at the overall volume of sales shows that Beverly Hills and Mar Vista saw a drastic reduction in sales compared to last month and only Westwood and Brentwood showed an increase in sales volume over last month. In comparison to April 2007, sales are off 88%.

Mortgage Rates Drift Lower

Freddie Mac reported on Thursday the lenders it surveys were offering 30-year fixed-rate mortgages at an average rate of 4.71% early this week, compared with 4.78% the week before.

Rates for 15-year fixed loans, a popular option for homeowners looking to refinance mortgages, averaged 3.89%, down from 3.97%.

Buyers would have paid 0.7% of the loan amount upfront to the lenders to obtain the rates, according to Freddie Mac.

The initial rates for floating-rate mortgages fell as well, Freddie Mac said.

WSJ: Buyer’s Market? Stressed Sellers Say Not So Fast

This article that appeared in Monday’s Wall Street Journal is in line with articles that we have been writing lately in regards to the difficulty buyer’s are currently having. Though this article paints a broader stroke and touches on some issues that are not impacting the Westside market, it is a good read – Article

Lack of Inventory Causing Headache for Buyers in Westside/South Bay Markets

Usually when one picks up the LA Times and reads about a fledgling housing market or tunes to the business networks on TV and sees signs of national distress, they naturally believe a buyer in this market would have all of the leverage. Unfortunately for buyers searching for phenomenal deals on the Westside and Manhattan Beach deals are extremely hard to come by thanks to a severe lack of inventory.

Westside prices which in our estimation are higher than they should in the grand scheme of things have stabilized and even gone up in some areas this year. Our recent Townhouse listing at 2922 Montana Ave. Unit B recently sold in three weeks for $1.1M, 70K higher than a similar unit in the building sold four months prior. Though we would love to take all of the credit for the uptick as the agent (will take some along with the stellar job of staging by our client), the reality is we were helped by the fact that we did not have much competition for a stylish unit in a great location.

Westside prices which in our estimation are higher than they should in the grand scheme of things have stabilized and even gone up in some areas this year. Our recent Townhouse listing at 2922 Montana Ave. Unit B recently sold in three weeks for $1.1M, 70K higher than a similar unit in the building sold four months prior. Though we would love to take all of the credit for the uptick as the agent (will take some along with the stellar job of staging by our client), the reality is we were helped by the fact that we did not have much competition for a stylish unit in a great location.

In the 90402 zip there are only 15 new listings since March 1st. Of those, 3 are already in escrow. Areas like Mar Vista have seen 30% of new listings sell within 20 days of coming on the market and we can give you individual examples of clients recently losing out in multiple offer situations to bids that appeared to be above market. Multiple offer situations have been feverishly popping up in all price ranges as long as the property is priced at market.

This has been frustrating many buyers who have recently moved to the area or have been waiting for an opportunity to buy prime real estate. It doesn’t make logical sense in comparison to the economy as a whole and here are the reasons as to why this is happening.

Massive amount of purchases during the bubble peak: Most high priced areas like the Westside and Manhattan Beach saw historical sales volume between 2004 and 2007, at or near the top of the peak. Many of these purchases were done with less than 20% down (many at 5-10% even in the jumbo markets) and buyers were turning around and refinancing if prices trended upward after they bought. These purchasers now owe quite a bit more than the home is worth and are simply not in position where they can afford to sell. They also refinanced at historically low rates and if they are in a similar position from a job standpoint they are simply stuck and “hanging on” until a significant jump in the market happens. Short sales and foreclosures are happening but only with people in dire financial straits and many on the Westside tend to have jobs or family money to help them. Speaking of foreclosures and short sales…

Shadow inventory has not appeared: Bank owned homes and short sales have been slow to hit prominent markets like the Westside. Banks are incentivized to slowly release high priced assets. Until they lose a loan valued at $2.5M, the banks can report it as an asset at that value even though it may only be worth $1.8M. Once that asset sells for $1.8M, the bank not only loses a $2.5M asset but also reports a loss of $700K. Legislation slowing down foreclosures in California has also hurt this pipeline. I am currently working on one short sale where the seller has been in default for over 15 months and we have yet to reach an auction date. The short sale process has also contributed to this mess with some taking over a year to close from beginning to end. Expect the shadow inventory to continue to hit the market at a snail’s pace.

Buyers are anxious: Due to the lack of opportunity for purchasers cited above the leverage they enjoyed in 2009 and the first part of 2010 is dissipating for now. Many purchasers have been waiting for the right opportunity to buy on the Westside and feel now is the time with interest rates at or near record lows with the looming threat of rates going higher as the economy seems to recover.

When you couple this mentality with a strong pool of international buyers (most notably all cash buyers China and Europe taking advantage of the weak dollar) and tech companies like Google and Facebook strategically opening offices on the Westside, you end up with a strong pool of purchasers competing for a limited product causing quite a bit of frustration.

Another factor pushing buyers valued in the $800K-$1M range is the conforming loan rate of $729,500 is expiring October 1st and being replaced by a rate limit of only $625,000. Loans above $625K will be a a higher rate and that $100K+ difference will definitely impact the market and what one can afford to buy.

For now, purchasers have to understand what they are dealing with due to the circumstances above. The days of trying to “steal” a property have been suspended for the time being and replaced with patience and knowing they are not the only ones out there. It is a good time for a seller to list a home and get good terms from a buyer if they are willing to acknowledge about a 20% cut from bubble prices.

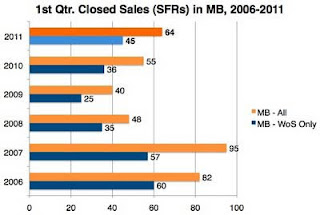

1st Quarter Sales trends compare favorably to 2010 in Manhattan Beach

*Note on graph: WoS only stands for West of Sepulveda

*Note on graph: WoS only stands for West of Sepulveda

There were more closed sales in the first quarter of 2011 than in any year since 2007,when the bubble was starting to super inflate and get ready to pop, which is extremely apparent when examining the above graphic.

The boost in sales was +9 for Manhattan Beach as a whole and when you look at the micro market West of Sepulveda. Though sales increased, the median price of sales West of Sepulveda dropped 7% from $1.607M in the first quarter of last year to $1.50M this year.

Overall, the whole city of Manhattan Beach saw an increase in sale price from $1.430M in the 1st quarter of 2010 to $1.5M this year. Though prices declined West of Sepulveda, the increase in overall price is directly related in the increase in sales in the higher priced area.

Please note that tracking sales on a quarterly basis can skew the numbers especially when sales volume is relatively low. For example, the 4th quarter of 2010 median price was $1.362M west of Sepulveda, and $1.252M for all of MB. If you were to compare the most recent quarters to quarters, you would think Manhattan Beach prices went up 20% at the snap of a finger. Obviously that is not the case.

Another interesting and important thing to look at is how the % of Single Family Residences selling above $1M has changed dramatically since 2008 when the bubble started to officially burst.

In the first quarter of 2006, just 6% of all homes sold in Manhattan Beach sold for less than $1M. This year 27% of homes sold for less than $1M, statistically, that is a 450% increase in homes selling below $1M.

In terms of sales above $2M, during the late-boom year of 2006, almost half the homes sold in Q1 went for $2M oe more (44%). The median price that quarter was $1,972,500.

This year 83% of the homes sold in Manhattan Beach in Q1 sold for less than $2M.

Manhattan Beach West of Sepulveda fared about the same over this 6-year period. Sales above $2M were 22% of the sales in the first part of 2011, down from 48% in 2006. Sales above $2M are at a six year low.

(*Source: Manhattan Beach Confidential – article and graph)