Articles You Should Read

1- So Cal rents are likely to remain flat according to USC study: The steep declines in rent that were seen the past few years are beginning to ebb and places to rent on the Westside are becoming difficult to find. We believe renters on the Westside and in areas like Manhattan Beach should expect a 1-3% increase over the next 12 months. Here is an article about the broad So Cal rental market from the LA Times: Southern California rents are likely to remain flat, study says

2- Changes in mortgage finance rules will hurt housing recovery: Some of the requirements that federal agencies and the Obama administration are proposing will prove troublesome for consumers as you would need to spend no more than 28% of your gross monthly income on housing-related expenses, and you couldn’t have total monthly household debt that exceeds 36% of your income. There would be not flexibility beyond these ceilings. This is just one of the myriad of changes proposed that you can read about in this article from the LA Times.

3- Experienced appraisers getting priced out by banks: Accurate appraisals are extremely important in the current market and can be deal breakers when inexperienced appraisers get assigned to areas they do not know how to valuate. Lenders are not paying experienced appraisers enough ($200-$250) to cover their overhead costs yet they are charging the consumer $450. Less-experienced appraisers who sometimes have to travel long distances from their home markets tend to be more willing to work for the lower amounts and can create nightmare scenarios for transactions on the Westside and Manhattan Beach where the sale price can change 150-300K one street over. LA Times article: Are you getting your money’s worth with appraisal?

New Legislation Would Make Short Sale Process Quicker

Legislation proposed last week in the House of Representatives would make short sales faster.

The bill, with bipartisan backing would require banks and mortgage servicers to respond to requests for a short sale within 45 days of the request. This would be great news as getting negotiators on short sales to call back in this time frame is a nightmare even with daily phone calls to them.

A short sale is when a bank allows a borrower with negative equity to sell their home for less than is owed on the mortgage. The difference between the sale price and what is owed on the mortgage is usually then forgiven by the lender. They are most common in markets such as California where home prices have declined dramatically since the market peaked.

The problem is that in the era of mortgage securitization, multiple parties (investors, servicers, insurers, etc.) need to acquiesce to a short sale in order to complete the deal.

It can take an extremely long time for all involved parties to get back to the buyer and seller with an answer. It was recently found that in California, 4 out of 10 short sales that go under contract end up falling through. This is a direct result of the lengthy short sale process.

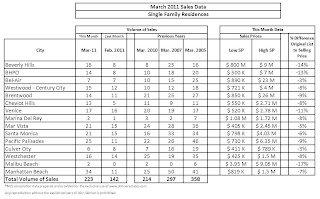

In-Depth Look at Single Family Sales in March for the Westside/Manhattan Beach

Sales volume increased 57% in March compared to February but only increased 4.2% over last March and down 33% and 60% when compared with the Wild West days of 2007 and 2005.

Sales volume increased 57% in March compared to February but only increased 4.2% over last March and down 33% and 60% when compared with the Wild West days of 2007 and 2005.

The difference between the average original list price and sales price also improved dramatically compared to February. With the exception of February, the recent trend shows Seller’s are being more realistic with their initial sales price and due to a lack of inventory we are seeing quite few multiple offer situations. Like the condo market, the buyer still has the leverage but it is not nearly as lopsided as previous years.

Every area saw an increase in sales except Culver City and Bel-Air.

Manhattan Beach increased in sales 4x’s with 34 in March compared to 11 in February. Most of these sales were on the lower end for Manhattan Beach. This past March was also 36% better than March 2010. They still fall short of the robust 50 sales in March of 2007 but definitely showing signs of life especially with first time homebuyers itching to enjoy that unparalleled Manhattan Beach lifestyle.

Beverly Hills Post Office popped with 14 sales, almost doubling last month’s output and beating March 2010 by about 40%. Sales ranged from $500k to 7M.

A look at a few individual sales that stood out:

12218 Octagon St- Brentwood: This North of Sunset home in need of major remodeling sold 10% above the original list price at $1.302M. It sold in 7 days and is a 3+2, 1,688 sq. ft. on a 9,583 sq. ft. lot. The low list price created an auction like atmosphere with multiple all cash buyers vying for the property.

12218 Octagon St- Brentwood: This North of Sunset home in need of major remodeling sold 10% above the original list price at $1.302M. It sold in 7 days and is a 3+2, 1,688 sq. ft. on a 9,583 sq. ft. lot. The low list price created an auction like atmosphere with multiple all cash buyers vying for the property.

11930 Currituck Dr- Brentwood: In between Montana and Sunset, this woodsy 2+1.75, 1,218 sq. ft. home on a 5,488 sq. ft. lot sold for $1.01M, 26% below its original list price! However, most would make you believe it sold for over asking with a last list price of $999K. This could may have been a short sale as it was bought in 2005 for $1,275,000.

2425 Frey Ave- Venice: Bank owned sale ends up going for 31% below ($895K) the original list price of $1.3M. This contemporary and recently updated 3+2, 2,640 sq. ft. home ended up being a terrific buy.

2425 Frey Ave- Venice: Bank owned sale ends up going for 31% below ($895K) the original list price of $1.3M. This contemporary and recently updated 3+2, 2,640 sq. ft. home ended up being a terrific buy.

746 26th street- Santa Monica– This frantic auction brought out the builders looking for a deal. Despite being on a busy street, the 8,700 sq. ft. lot is coveted and the “auction” list price of $799K brought buyers in by the droves. It ended up selling for $1.1M, 38% above asking. . .

616 25th Street- Santa Monica– Lot values North of Montana still trending lower. In our estimation, this tear down approximately sold for $1.684M even though they only reported a $1 sale price (shame on them). The most important info…8,700 sq. lot near Franklin Schol…

616 25th Street- Santa Monica– Lot values North of Montana still trending lower. In our estimation, this tear down approximately sold for $1.684M even though they only reported a $1 sale price (shame on them). The most important info…8,700 sq. lot near Franklin Schol…

7049 Birdview- Malibu– After being on the market for close to three years, 7049 Birdview finally sold for $9.045M, less than half its original asking price in 2008 of $19,950,000. How the mighty have fallen. This 6,397 sq. ft. home sits on an acre of land and boasts endless coastline and ocean views…

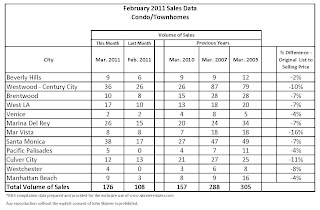

In-Depth Look at Condo/Townhouse Sales in March for the Westside and Manhattan Beach

Overall, we saw a solid increase in sales volume over February, which was expected. However, the increase in sales of 62% over last month was unexpected and the 12% growth in sales over March 2010 continues to show the market is growing steadily out of the Great Recession. Though the numbers look good, we are still off nearly 63% from sales volume 2007 and 73% from the Wild West days of 2005.

In looking at particular areas, Santa Monica had a great month of sales with 38 compared to a dismal February of 17. Santa Monica is up 40% in sales volume compared to March 2010. Most of the seller’s did a good job of pricing the property with the difference in Original List Price to Sale Price at -7% and the difference in List Price to Sale price being around -5%.

Marina Del Rey had a phenomenal month with increasing sales over February by 73% and having a better month than March 2007 which is very rare. Some of this can be attributed to quite a few short sales going through in some of the mid 2005 constructed towers that were flooded with liar loans.

Both Santa Monica and Marina Del Rey are being aided by an influx of buyers thanks to the multitude of tech companies opening offices in the area. It is still considered a buyer’s market but the leverage buyer’s have enjoyed over the past few years is receding somewhat. The good news for sellers is that if they price the unit at or around market value they should be able to sell quickly with good terms.

A look at a few individual sales in Santa Monica:

914 14th Street #101- Built in 2008 along with 4 other units, this 2+2.5, 1,580 sq. ft. unit sold for above asking at $1.150M and was on the market for just 11 days. The asking price was $1.125M. This is the fourth unit to sell in the building with two others selling in 2010 for $687 and $677 per sq. ft. This was the front unit and it sold for $727.85 a square foot. This unit debut on the market for $1.299M in 2008 before being rented out.

914 14th Street #101- Built in 2008 along with 4 other units, this 2+2.5, 1,580 sq. ft. unit sold for above asking at $1.150M and was on the market for just 11 days. The asking price was $1.125M. This is the fourth unit to sell in the building with two others selling in 2010 for $687 and $677 per sq. ft. This was the front unit and it sold for $727.85 a square foot. This unit debut on the market for $1.299M in 2008 before being rented out.

1033 Ocean Ave.#401- After being on the market for 304 days, this luxurious 2+2, 1,396 sq. ft. unit with amazing ocean views finally sold for $1.550M. It was originally listed at $1.850M and went for $1,110 per sq. ft.

Little Change in Mortgage Rates

The average mortgage rates available to borrowers with good credit and 20% down payments or home equity rose a notch.

Freddie Mac said the typical rate for a 30-year fixed loan was 4.87% this week, up from 4.86% last week. The average offering rate for 15-year fixed mortgages was 4.10% compared to 4.09% a week ago.

The lenders were requiring well-qualified borrowers to pay an average of 0.7% of the loan amount in “points” to obtain those rates. Additional third-party charges such as appraisal and title insurance fees are also often added to borrowers’ upfront costs.

Jumbo loans have been running about six-tenths of a percentage point higher than Freddie and Fannie loans in private surveys of the market.

The limit for Freddie and Fannie loans in high-cost areas such as Los Angeles and Orange counties is scheduled to drop on Oct. 1 to $625,500 from the current level of $729,750.

Variable loans with a fixed rate for the first five years were starting at an average 3.72% and 0.6 points, compared to 3.70% a week earlier.

*Source: LA Times

Another tech giant moves to the Westside

With Google creating an office campus in Venice, Facebook has now signed a lease to occupy anywhere between 8,000 and 15,000 square feet in Playa Vista. Over the past year, Venice, Santa Monica and Playa Vista have become quite popular destinations for these Silicon Valley companies and it is great news for our local real estate market and helps partially explain the influx of buyers we have seen.

Here is an article from the Los Angeles Business Journal: Another Tech Giant Moves to the Westside

Proposal would force banks to allow short sales for delinquent homeowners

Major banks may be forced to let severely delinquent homeowners sell their houses for less than the loan amounts owed as part of a broad settlement of federal and state investigations into botched foreclosure paperwork, according to government officials involved in the negotiations.

The requirement to allow so-called short sales would be in addition to forcing mortgage servicers to reduce the amount some homeowners owe on their loans, said two officials, who spoke on the condition of anonymity because negotiations are ongoing.

In Southern California, short sales made up an estimated 19.8% of the market for previously owned homes last month.

Though struggling homeowners escape weighty mortgage debts quickly under a short sale, they don’t get away unscathed.

Their credit scores are damaged enough to limit their borrowing capability for years, though the damage is perhaps less severe than in foreclosure. Money for down payments and renovations would be lost, and there may be tax consequences.

The California Assn. of Realtors has been pushing for short sales to be made simpler. Earlier this month, in an open letter in the Los Angeles Times and six other California newspapers, the group called on banks to approve more short sales and for regulators to streamline the process.

For the complete LA Times article: Proposal would force banks to allow short sales

443 14th sells for $3.1M…230K less than 2005 purchase price…Hockey Star takes 400K+ hit in Manhattan Beach

In Santa Monica, 443 14th Street a 4+5.5 bath, 4,071 sq. ft. house on a 7,550 lot constructed in 2002 sold for $3.1M, an 18% drop from the original list price. The home was featured in the LA Times Home Section and Domino Magazine.

This seller finally realized they wouldn’t get close to the original listing price of $3.795M in September 2010 and within a month reduced to $3.475 and again to $3.295M. It seems like a quick drop of the price but more research shows they have been trying to market the property off and on since 2008 with the astronomical list price of $4,250,000…

In Manhattan Beach, The Calgary Flames Craig Conroy sold his Manhattan Beach home located at 1221 6th street for $1,965,000($464 per sq. ft.) on March 23rd. He bought the home in 2005 for $2,495,000, representing about a 23% drop in value. The Craftsman-style house, built in 2005, is a 5+5 with 4,230 sq. ft. of living space. Conroy and family were smart sellers that understood the market. They listed the home at $1,999,000 and were in escrow with a strong buyer immediately. According to Lauren Beale of the LA Times, Conroy retired earlier this year to become a special assistant to the Flames’ general manager. The center had played since 1994 including a stint with the Los Angeles Kings.

In Manhattan Beach, The Calgary Flames Craig Conroy sold his Manhattan Beach home located at 1221 6th street for $1,965,000($464 per sq. ft.) on March 23rd. He bought the home in 2005 for $2,495,000, representing about a 23% drop in value. The Craftsman-style house, built in 2005, is a 5+5 with 4,230 sq. ft. of living space. Conroy and family were smart sellers that understood the market. They listed the home at $1,999,000 and were in escrow with a strong buyer immediately. According to Lauren Beale of the LA Times, Conroy retired earlier this year to become a special assistant to the Flames’ general manager. The center had played since 1994 including a stint with the Los Angeles Kings. Earthquake insurance worth the cost?

Japan’s massive earthquake has created a surge of interest in quake insurance in a place more than 5,000 miles away — California.

Only about 12% of Californians with home insurance have quake coverage. And the percentage of people who buy quake insurance in other states — including those with active faults — is far lower.

Should you buy quake coverage?

There’s no clear answer. The problem is that quake coverage is costly and limited. Experts say that it takes careful analysis to decide whether the expense is worth the potential benefits.

Here is a good article from the LA Times exploring the cost and feasibility: Is quake insurace worth the cost?

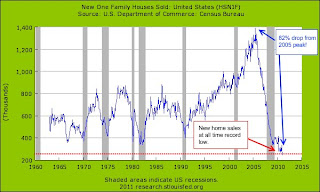

National Note:New Home Sales drop 82% since 2005…Worse than Great Depression

New home sales fell Eighty percent from 1929 to 1932, an infamous time in US history where the economy imploded in spectacular fashion thanks to Wall Street speculation and massive debt leverage.

In comparison, during the recent Great Recession, new home sales have fallen an astonishing Eighty Two percent from there 2005 peak. See the graph below regarding new home sales since 1960 and the free-fall ride since 2006.

*source: doctor housing bubble

*source: doctor housing bubble