Skinny’s notes on the market

Welcome back from the August real estate holiday…but don’t let the lull fool you- We saw some multiple offer activity on well price properties in August but it has become apparent over the past few years that activity drops-off enough in August that people wonder if the market is changing…yet, it then picks right back up in Mid-September for a solid six week run before the end of year holiday season. With interest rates at their lowest point for 2017 and a very strong LA economy, we fully anticipate a flurry of activity over the next few months.

Escrow cancellation rates are at all-time lows: In speaking with local escrow officers, cancellation rates are at all-time lows (give or take 10%) compared to rates that were triple that five years ago. A few other observations from the escrow side of things- *shorter escrows (15-21 days) with little to no contingency periods are becoming more frequent. In fact, some are able to still get loans closed within 21 days. We have buyers from San Francisco/Silicon Valley to thank for this trend. In the hyper competitive Bay Area market, all contingencies are being removed upfront on some deals, even on homes that don’t need much renovation.

Packing up and moving to the Northwest and Texas?– We are noticing a trend of more people willing to sell and relocate out of So Cal and take advantage of the equity they built in their home. Companies relocating to more reasonably cost real estate is obviously playing a significant role. The popular destinations seem to be the Pacific Northwest and areas around Dallas, Texas.

Moving in…New Yorkers fleeing to Los Angeles: A recent Linkedin report shows New Yorkers are on the move to Los Angeles. We are definitely seeing this trend on the Westside and are currently working with multiple parties from the New York area…Article- New Yorkers fleeing to Los Angeles

Homeless concerns impacting buyers in Venice and Santa Monica?– The homeless issue on the Westside seems to be more noticeable to out of town buyers. We don’t know if the metro has provided easier access to Santa Monica from skid row, but in showing properties in affluent areas (especially Venice and area near the metro in Santa Monica) we are definitely hearing comments on property tours.

Mar Vista/Westchester and Playa Del Rey solidly embraced by Silicon Beach– Mar Vista continues to be very popular with those in the tech world. They love the proximity to Silicon Beach while being central too much of what LA has to offer. It is not as crowded as Venice and with Venice Blvd. and Washington Blvd starting to go through a revitalization with shops and restaurants, we don’t see this trend changing for a long time. The same can be said for Playa Del Rey and Westchester. Both of these areas are also very popular with young families in the tech sector and even though some can afford what would be considered higher-end areas, they are specifically looking to be in these areas.

Caruso development in the Palisades will have an even bigger impact on home values than originally thought– The Palisades has always been at the top of the list of Westside locales of the rich and famous and even moreso with the current re-development of the Palisades village by renowned developer Rick Caruso. However, based on conversations we have had with area developers and real estate professionals, many believe the added value of this development will not truly be felt until it is fully in-use. They expect another step-up in value and demand for the beautiful seas-side area that will now provide amenities and cohesiveness the area did not provide in the past.

27 offers on a condo in Santa Monica with no laundry and heat- Condo with no laundry and heat in Santa Monica garners 27 offers and goes for almost 200K over asking!- When a sharp looking 2+2, 1070 sq. ft. unit located at 609 Washington hit the market for $896K, it definitely garnered a lot of attention but most thought it wouldn’t go crazy due to the unit not having inside laundry and no heating system. Typically, community laundry is a major handicap when it comes to resale value. However, that wasn’t the case this time. The listing agent was overwhelmed with 27 offers. They responded to the top 10 and supposedly sold to for around $1.070M…

871 Granville #202 (Brentwood) Open this Sunday and Coming Soon- 954 20th street #A (Santa Monica)

Our new listing at 871 Granville Avenue #202 will be open on Sunday from 2-5. 3 bed/ 3 bath, 1870 sq. ft. remodeled unit in the heart of Brentwood listed at $1.299M. Check out the Property Web-Site

954 20th Street #A, a charming north Santa Monica 2 bed/3 bath + den, 1,700 sq. ft. townhouse will be hitting the market in the coming weeks. Feel free to contact us for more information.

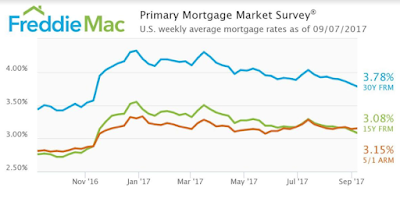

Morgage rates hit another new low for 2017

Mortgage rates continue to hit new lows this year as the Treasury yield reached a new 2017 low for the second consecutive week, according to Freddie Mac’s latest Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage “FRM” dropped to 3.78% for the week ending September 7, 2017. This is down from last week’s 3.82% but up from 3.44% last year.

The 15-year FRM also decreased, dropping to 3.08%, down from 3.12% last week. This is still up from last year’s 2.76%.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly from last week’s 3.14% to 3.15% this week. This is up from 2.81% last year.

Freddie Mac stated the 30-year fixed-rate mortgage followed in the steps of the 10-year Treasury yield, hitting yet another new low for 2017.

|

| click to enlarge |

Source: Housing Wire& Freddie Mac

COMMUNITY POLICING IS A MUST IN LOS ANGELES

If you live in the city of Los Angeles, community policing and keeping a watchful eye out on your neighborhood is as important as ever. According to a Sergeant in the Los Angeles Police Department, the LAPD has a less officers patrolling the street then they did in 1982. The Los Angeles population has exploded since that time yet the police force is smaller. You would be shocked to know how few squad cars are available to patrol Venice, West LA and Mar Vista. If you speak to any LAPD representative, they talk of how important it is for neighbors to know each other and keep a vigilant eye on the neighborhood. A neighborhood watch is a great start to making the neighborhood less desirable to thieves.

If you live in the city of Los Angeles, community policing and keeping a watchful eye out on your neighborhood is as important as ever. According to a Sergeant in the Los Angeles Police Department, the LAPD has a less officers patrolling the street then they did in 1982. The Los Angeles population has exploded since that time yet the police force is smaller. You would be shocked to know how few squad cars are available to patrol Venice, West LA and Mar Vista. If you speak to any LAPD representative, they talk of how important it is for neighbors to know each other and keep a vigilant eye on the neighborhood. A neighborhood watch is a great start to making the neighborhood less desirable to thieves.

A few other tips the sergeant wanted to pass along-

*Top burglary/theft deterrent- Dogs: Homes with dogs that are visible and/or easily heard is typically something a thief does not want to deal with.

*Visible cameras/ring system- Not as effective as a dog but still a deterrent and coupled with a dog, it creates a great makeshift security system.

*Be prepared for an emergency– City services are not equipped to serve all of Los Angeles should a major earthquake hit or an event happens in which we lose utilities for an extended period of time. Every home should have reserves they can tap into when it comes to water/food and some type of power source.

*Be prepared for an emergency– City services are not equipped to serve all of Los Angeles should a major earthquake hit or an event happens in which we lose utilities for an extended period of time. Every home should have reserves they can tap into when it comes to water/food and some type of power source.

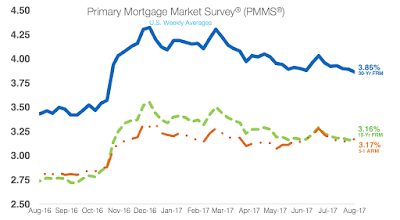

30-year mortgage rates hit a new low for 2017

Mortgage rates decreased for the fourth consecutive week and the 30-year mortgage hit a new low for 2017, according to Freddie Mac’s Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage dropped to 3.86% for the week ending August 24, 2017. This is down from last week’s 3.89% but up from 3.43% last year.

The 15-year FRM held steady at 3.16%, an increase from last year’s 2.74%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly, hitting 3.17%. This is up from 3.16% last week but down from 2.75% last year.

Sources: Freddie Mac and Housing Wire

Partners Trust comprehensive Los Angeles Mid-Year Report + a few key highlights

**Please note this report doesn’t just cover the Westside…it also covers Malibu, Downtown LA, Pasadena, South Bay and the San Fernando Valley.

Overall sales volume is up around 12% compared to last year in most Westside locations despite tight inventory. Cheviot Hills/Rancho park was up over 40% and the Hills of the Westside (Beverly Hills Post Office, Holmby Hills, Bel-Air, was up over 25%. All Westside communities saw increases in the average sold price except for Westwood. However, all this means is that less higher-end homes traded hands in Westwood as the area is still appreciating in value. Days on market continue to decrease in most areas but that is not necessarily the case in the market above $5M.

The outlook for the rest of the year is strong. In terms of the buzz regarding off-market activity…only about 5-15% of the sales in most areas are happening off-market and the buyer better be willing to pay a premium in most cases.

Check out the latest Partners Trust Los Angeles Mid-Year report.

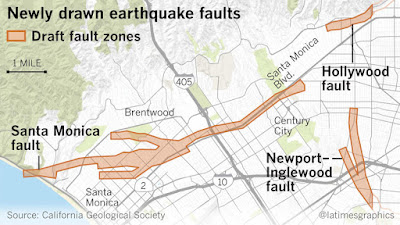

Updated Westside Earthquake Map – Could bring development restrictions

Check out the recently updated Earthquake fault map for the Westside via this LA Times article. This could bring development restrictions to Beverly Hills, Santa Monica and other Westside areas.

Articles on local development news around the Westside, Westchester and DTLA

34 story tower planned for Brentwood –The project, located at 11770 Wilshire Boulevard, would replace an existing commercial building with 376 units of housing.

Santa Monica will force developers to build the most affordable housing in the state –

The Santa Monica City Council voted Tuesday to require developers to make 20 to 30 percent of all new condos and apartments built in Downtown affordable for low-income earners.

|

| Howard Hughes Rendering |

Update on the Promenade at Howard Hughes Center- $30M makeover set to wrap in 2018

|

| Art’s District rendering |

Source: LA CURBED

Brokerage Industry Consolidation in Los Angeles- Partners Trust acquired by Pacific Union

Just as we were getting comfortable with boutique real estate companies leading the charge on the Westside, some major players have recently come in to snap us up. New York based Douglas- Elliman just purchased Teles Properties and Pacific Union out of San Francisco is now the majority owner of our company Partners Trust. Along with recently purchasing John Aaroe and having a large stake in Gibson International, Pacific Union who will now have a significant imprint in Los Angeles as it looks to become the biggest national boutique firm. Pacific Union is currently one of the biggest players in Northern California.

Pacific Union International to acquire Partners Trust (via Real Deal)

Douglas Elliman to acquire Teles Properties (via Real Deal)