Notes on a Realtors Scorecard- The buzz from the street and networking meetings…

*New Construction continues to be in high-demand all over the Westside/South Bay and with that, tear-down lots are selling at strong premiums provided sellers have solid representation and don’t sell directly to a builder.

*In the past seven years, the value of land has exploded on the Westside. Lot values have grown 75-120% (depending on the area) while the average sales price has only gone up 45%-65%. A gap between new construction and tear-downs has opened up to the point that homes that were once considered livable while making a few upgrades, is now being scraped.

*Marina Del Rey might be the hottest market over the past 90 days, as entry level townhouses seem to be up about 10% in just three months. At one point the Marina was flying under the radar while areas like Playa Vista were on fire. Properties that were selling for around $800K three months ago are going for closer to $900K now…

*Entry-level price points across Los Angeles continue to rise at a very strong pace, especially under the $2M mark. They type of multiple offer activity we are seeing from inner-city areas like Leimert Park, Jefferson Park, West Adams to the entry level condo in Culver City and Santa Monica is crazy. We were just involved in a multiple-offer situation for a condo on Girard Avenue in Culver City. The 1,200 sq. ft. 2+2 townhouse with a generous outdoor space had over 200 people at the first open house and attracted 15 offers at the $779K list price. Despite being across from a school and about a mile from the popular downtown Culver City area, the unit is in escrow for around $860K! Three years ago it sold just under the asking price for $615K. At the higher-end entry level points, we are seeing the same thing. It is almost impossible to get a house North of Montana in Santa Monica that is not a tear-down for less than $4M and small South Santa Monica homes in decent shape are trading for $1.750M+.

*Wealthy families and individuals are getting very aggressive when it comes monopolizing properties on the Westside/South Bay. They are buying properties, especially single family homes, at a quicker pace then we have ever seen before. Whether they are buying for their children or just investment purposes, these buyers are aggressive and feel the best long-term leveraged investment is real estate. A few principles have clearly stated to their agents that in the long run, the best financial investment they have ever made is Westside/South Bay real estate.

*Wealthy families and individuals are getting very aggressive when it comes monopolizing properties on the Westside/South Bay. They are buying properties, especially single family homes, at a quicker pace then we have ever seen before. Whether they are buying for their children or just investment purposes, these buyers are aggressive and feel the best long-term leveraged investment is real estate. A few principles have clearly stated to their agents that in the long run, the best financial investment they have ever made is Westside/South Bay real estate.

*Despite rates being about 15% higher than at this time last year, we are still seeing solid price appreciation.

*The higher-end price point in each micro market is the only area that is somewhat struggling yet even then the choice properties are still moving quickly.

*The historic rains we received earlier in the year has led to a back-log of construction and some developers are hiring any subs they can to finish jobs which means the quality on some projects will be sub-standard.

*Speaking of historic rains, those of that live in the hills/fire hazard zones, should take note that officials are expecting this to be one of the worst fire seasons in years. The extra plant and grass growth will die during the summer months creating extra fuel for wildfires and the Los Angeles Fire Department wants to make sure everyone living in hillside areas is properly clearing brush near their homes. California also has a massive amount of dead trees from the recent drought so this combination is extremely combustible…

*Pricing your property for sale correctly at the outset is the key. We can’t over-emphasize this enough. Proper marketing and pricing within the first 10-14 days can be the difference in $100K’s of thousands of dollars to the seller depending on price point. If a property doesn’t sell in the first few weeks in this fast moving world, the first question a buyer asks is “what is wrong with the property?”…not the thinking you want from a perspective buyer.

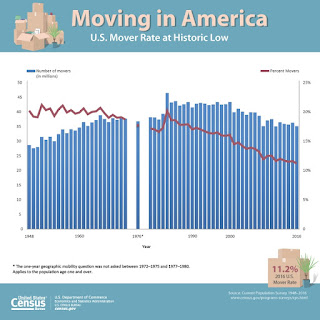

Americans are moving less than ever before and this declining mobility is a problem for Millenials…Here are the major contributing factors…

According to the latest data from the U.S. Census Bureau, the percentage of Americans moving over a one-year period fell to an all-time low of 11.2 percent last year. The drop is particularly prevalent among millennials. New survey data from the Pew Research Center found that 25- to 35-year-olds are relocating at much lower rates than the previous generation. Last year, 20 percent of millennials moved sometime in the last year. When older generations were the same age as millennials now, they moved at higher rates: Gen X was at 26 percent, as was the generation between 1925 and 1942.

This drop has many worried about the housing market and economic vitality as this change has been tough on young adults. The job market has improved since the recession and unemployment is down yet we aren’t seeing more Americans, especially Milennials, take the next step and purchase property.

This drop has many worried about the housing market and economic vitality as this change has been tough on young adults. The job market has improved since the recession and unemployment is down yet we aren’t seeing more Americans, especially Milennials, take the next step and purchase property.

Instead, they are stuck renting with upwards to 45% a renters income in Los Angeles going to rent for people between the ages of 22-34. They are unlikely to be able to save up enough to purchase a home and with more people renting, and more rental demand, property values rise. There is more incentive for property owners to be landlords with rental payments as percentage of U.S. GDP growth hitting an all-time high last month.

According to data from Moody’s Analytics, the average time someone stays in their home is up over 8.5 years, the longest amount of time since they began collecting this data. As little as 15 years ago, the median homeownership tenure was between 5-6.5 years. In another ten years, we could easily see homeownership average up over 11 years, especially with the “lock-in” effect with current homeowners being addicted to low monthly payments thanks to the record low interest rates we have enjoyed over the past five years. If rates rise a few percentage points, current owners have even less of an incentive to move when you figure in higher monthly payments and taxes. This “lock-in”, especially in areas like Los Angeles, is creating a vicious cycle of stagnation, less inventory, and higher prices.

The other issue that negatively impacts millennials ability to buy where the best jobs are is in the major cities and they are already dealing with population overflow, and the current residents don’t want new development and support laws that can’t accommodate new demand. Without new development, the supply is artificially constrained in hot housing markets, prices are bid up and only the rich elite can own property (see recent notes on a realtors scorecard blurb about the Westside rich playing a real monopoly game with homes). It is an increasingly winner-take all economy and the land-use restrictions help lock people out of opportunity. Between 2010 and 2014, 5% of metro areas accounted for half of the U.S. job growth.

These market realities make it extremely difficult for millennials, especially those without help from parents, to purchase a home. A homeowner’s net worth is approximately 45 times greater than that of renters and we need more people sharing in that expansion of wealth

Sources- LA Curbed, Census Bureau, Zillow, Housing Wire

Articles for your edification

Here are the five most unaffordable cities in the world- LA checks in at #4…Mexico City #1

LA’s is the most unaffordable housing market and it is not going to change anytime soon

Neighborhood Spotlight- Westchester evolves into a techie utopia

Los Angeles County sets record with median home sale price surpassing last decade’s housing boom

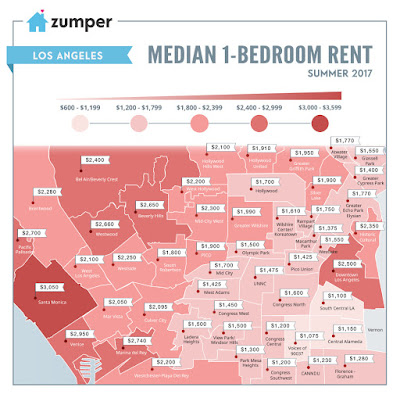

Los Angeles Rental Map- Where rents are highest and lowes for 1 bedroom apartments

Check out this interactive map provided by Zumper.

*Santa Monica checks in at $3,050…

|

| Click to Enlarge |

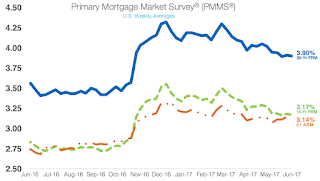

Mortgage rates hold steady at year to date lows

The 30-year fixed-rate mortgage dropped slightly to 3.9% for the week ending June 22, 2017. This is down from last week’s 3.91% but up from last year’s 3.56%.

The 30-year fixed-rate mortgage dropped slightly to 3.9% for the week ending June 22, 2017. This is down from last week’s 3.91% but up from last year’s 3.56%.

The 15-year FRM also decreased, dropping from last week’s 3.18% to 3.17% this week. This is up from last year’s 2.83%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage dropped slightly to 3.14%. This is down from last week’s 3.15% but up from last year’s 2.74%.

Source: Housing Wire

A look at 1Q sales in Pacific Palisades (90272)

The Palisades market enjoyed a robust 1Q of 2017 compared to last year’s 1Q with overall sales increasing, and the most off-market activity of any area on the Westside.

The number of sales this year was 72 with a whopping 15 happening off-market while the 1Q of 2016 saw 58 sales with 7 happening off-market. Per MLS data, 10 homes sold for over the asking price while 11 sold over last year. You have to figure a fair amount of the off-market sales sold for a premium since the buyer had the privilege of purchasing the property without competition.

When reviewing the MLS sales individually, it was evident that quite a few sellers had an inflated view of their property value leading to some properties having to drastically reduce their price and selling for under market value despite this being a strong seller’s market.

Overall, it was a good quarter for the Palisades and one of the most sought after areas on the Westside will continue to command premium pricing throughout 2017.

Average sale amount/Average price per sq. ft.

2017: $4.213M–$1,312

2016: $3.466M–$1,429

Favorite sale of the quarter- 1102 Galloway Street- This newly constructed Cape Cod 6+8, 7,400 sq. ft. home on a 7,500 lot is a stunning union of modern craftsmanship and traditional architecture. They built the home with the finest tastes in mind including a huge basement with a lavish theatre and enormous wine cellar, elevator, roof-top deck and more all while being within walking distance to the new Caruso development. The property hit the market in November of last year for $5.985M and sold for $6M with an early January close.

Sneaky good buy- 333 N. Mount Holyoke- This spectacular 16K lot with amazing bluff views provided the buyer a rare opportunity to build an estate or build two homes since the lot has two parcel numbers. Unfortunately for the seller, they originally priced the home for $6.2M, and after being on and off the market for over a year while constantly reducing the price, the property finally sold for what we believe was a below market price of $4.3M in late January.

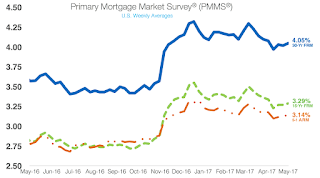

Mortgage rates increase slightly but hold steady around the 4% mark

|

| click to enlarge |

Mixed economic reports over the last few weeks have anchored the 30-year mortgage rate around the 4% mark.

The 30-year fixed rate mortgage (FRM) is at 4.05% which is up slightly from the 4.02% last week. Last year at this time, the rate was only 3.57%.

The 15-year FRM is 3.29%,

up from 3.27% last week and 2.81% last year.

The five-year Treasury-indexed hybrid adjustable rate mortgage is at 3.14%, up from 3.13% last week and 2.78% last year.

Source: Housing Wire

A look at 1Q sales in Mar Vista and Rancho Park/Cheviot (90066 and 90064)

90066 update-

Sales volume was higher in the 1Q of 2017 (73) compared to 62 in the 1Q of 2016. Off-market activity increased with 10 sales compared to last year’s 1Q when 6 sales sold off-market. The majority of the off-market sale activity involved tear-down/land value sales where the seller typically sold the property to a developer which unfortunately for the seller without proper market knowledge or representation, sell it to them for under market. The amount of sales over the asking price remained steady with over 50% of the MLS market sales going for over the asking price (2017=33 vs. 2016=32).

The competition between those vying for a home in Mar Vista is fierce with the area extremely popular with the Silicon Beach crowd and young families priced out of Santa Monica and the Palisades.

Average sale amount/Average price per sq. ft.

2017: $1.463M–$1,083 sq. ft.

2016: $1.347M–$1,026 sq. ft.

Top sale of the quarter- 11927 Tabor Street- The newly constructed 5+6. 4,045 sq. ft. home on a 8,800 lot was listed for $3.395M and they accepted an offer of $3.4M before the first open house. The sale closed on February 14th. It was a beautifully done modern home that is great for entertaining that flows into a spacious backyard featuring a pool. City light views from the master bedroom helped create a strong emotional bond with the buyers. The developer hit a financial home-run with this sale.

90064 update–

It was a strong 1Q with 62 sales recorded compared to just 42 in the 1Q of 2016. The number of homes that sold over asking per the MLS wasn’t as robust as last year (2017= 12 2016= 24) while the off-market activity jumped up to 12 sales compared to just 3 in the 1Q of 2016. It appears that most of the off-market activity involved tear-down lots.

Similar to the sister 90066 zip code, the areas that encompass this zip code are very popular and the demand continues to push sale prices higher, which should be the trend throughout the rest of the year.

Average sale amount/Average price per sq. ft.

2017: $1.896M–$1,104 sq. ft.

2016: $1.214M–$917 sq. ft.

The sale of the quarter- 10974 Ayres Ave- Situated right near the Westside Pavillion and all that Pico Blvd. has to offer, this newly constructed Cape Cod, 5+6, 4,050 sq. ft. on a 6,597 lot created quite the buzz when it hit the market in early January. The $2.495M list price was quickly bid up in a multiple offer situation featuring 5+ buyers and the ultimate sale price was $2.1718M. The sale closed on March 10th. It was a very well-designed home with high-end finishes a great indoor/outdoor flow to take advantage of the So Cal lifestyle.

Builder buys 18 acres near Rams Stadium, announces plans for 228 homes

Harridge Development group says it will build 228 detached condos in a gated community on the site at 333 North Prairie Avenue, just south of Florence Avenue. The new tract of homes which will be called Grace Park, supposedly will be move-in ready by the time the stadium is scheduled to open in 2019. Harridge is betting the new homes would appeal to, “Los Angeles County’s highly educated tech workers”.

Source- LA Curbed