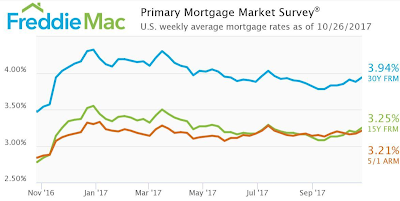

Mortgage rates surge to highest level in 3 months

The 30-year fixed-rate mortgage increased to its highest point in the past three months, nearly hitting the 4% mark, according to Freddie Mac’s latest Primary Mortgage Market Survey.

The 30-year fixed rate mortgage increased to 3.94% for the week ending October 26, 2017. This is up from 3.88% last week and 3.47% last year.

The 15-year FRM also increased, hitting 3.25%. This is up from 3.19% last week and 2.78% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage came in at 3.21%, up from 3.17% last week and 2.84% last year.

Source: Housing Wire

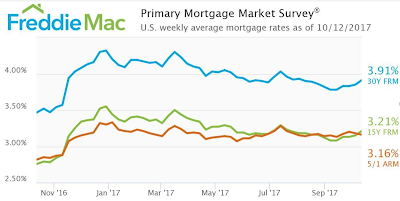

Mortgage rates increase for the second week in a row

Mortgage rates increased once again, edging closer to the psychologically important 4% mark, according to Freddie Mac’s latest Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage increased to an average 3.91% for the week ending October 12, 2017. This is up from last week’s 3.85%. Last year at this time, the 30-year mortgage interest rate was 3.47%.

The 15-year FRM increased to 3.21% this week, up from 3.15% last week and from 2.76% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage, however, decreased to 3.16%. This is down from 3.18% last week but up from 2.82% last year.

Source- Freddie Mac and Housingwire

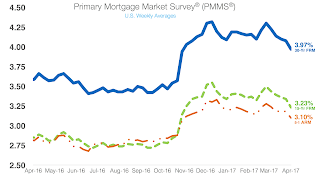

Mortgage rates drop below 4%

|

| click to enlarge |

Mortgage rates dropped below the psychologically important 4% mark, hitting the lowest point since November of last year.

The 30-year fixed-rate mortgage dropped to 3.97% for the week ending April 20, 2017. This is down from last week’s 4.08% but still up from last year’s 3.59%.

The 15-year FRM dropped to 3.23%, down from last week’s 3.34% but up from last year when it averaged 2.85%.

Weak economic data and growing international tensions are driving investors out of riskier sectors and into Treasury securities thus causing a shift in investment sentiment which has propelled rates lower.

The drop in rates in an environment where rates are expected to rise has increased pressure on serious buyers to find a home which gives more leverage to sellers.

Source- Housing Wire & Freddie Mac Chief Economist Sean Becketti

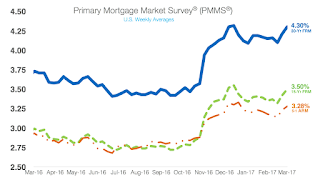

Freddie Mac: Mortgage rates increase again – don’t expect them to stop

Interest rates increased once again in anticipation that the Federal Reserve would increase interest rates Wednesday. “As expected, the FOMC announced its first rate hike of 2017 and hinted at additional increases throughout the remainder of the year,” Freddie Mac Chief Economist Sean Becketti said.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 15-year FRM increased to 3.5%, up eight basis points from 3.42% last week and from 2.99% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.28%, up from last week’s 3.23% and last year’s 2.93%.

“Increasing inflation, continued gains in the labor market and the Fed’s intentions for further rate increases—all three will keep pushing mortgage rates up this year,” Becketti said.

Source: Housing Wire

FED has Decided Against Increasing Rates, Mortgage Rates Decline!

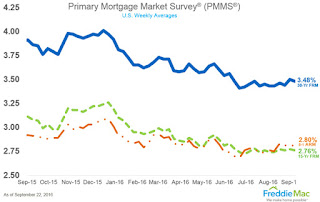

The Federal Open Market Committee (FOMC) announced they decided against raising interest rates this month. The FOMC stated that although the case for a rate increase has strengthened they have decided to wait for further evidence on continued progress towards their objectives, and allow the markets to recover from the initial impact of the U.K. choosing to leave the European Union. Minutes from the FOMC meeting also suggest that they may not even raise rates until December or later. Chief Economist Curt Long, from the National Association of Federal Credit Unions stated that despite the temporary hold, the committee also sent a strong signal that a rate hike is imminent. While Capitol Economics Chief Economist, Paul Ashworth said that this seems to have been one of the most diverse FOMC meetings in recent memory, as 3 of the 10 board members dissented and proffered an immediate rate hike. On the Lender Side, Freddie Mac stated Thursday that the average 30-year fixed rate mortgage has declined to 3.48% from 3.50% last week, and 3.86% only a year ago. Only .17% away from it’s all time low of 3.31% from November 2012! The 15-year fixed mortgage rate eased to 2.76% from 2.77%, and the yield on the 10-year notes declined to 1.63% from 1.70%

The Federal Open Market Committee (FOMC) announced they decided against raising interest rates this month. The FOMC stated that although the case for a rate increase has strengthened they have decided to wait for further evidence on continued progress towards their objectives, and allow the markets to recover from the initial impact of the U.K. choosing to leave the European Union. Minutes from the FOMC meeting also suggest that they may not even raise rates until December or later. Chief Economist Curt Long, from the National Association of Federal Credit Unions stated that despite the temporary hold, the committee also sent a strong signal that a rate hike is imminent. While Capitol Economics Chief Economist, Paul Ashworth said that this seems to have been one of the most diverse FOMC meetings in recent memory, as 3 of the 10 board members dissented and proffered an immediate rate hike. On the Lender Side, Freddie Mac stated Thursday that the average 30-year fixed rate mortgage has declined to 3.48% from 3.50% last week, and 3.86% only a year ago. Only .17% away from it’s all time low of 3.31% from November 2012! The 15-year fixed mortgage rate eased to 2.76% from 2.77%, and the yield on the 10-year notes declined to 1.63% from 1.70%

Mortgage rates tick down slightly to 4%

Average fixed mortgage rates moved lower from the previous week’s new highs for 2015 while housing data was generally positive, according to the latest from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.00% with an average 0.7 point for the week ending June 18, 2015, down from last week when it averaged 4.04%. A year ago at this time, the 30-year FRM averaged 4.17%. The 15-year FRM this week averaged 3.23% with an average 0.5 point, down from last week when it averaged 3.25%.

A year ago at this time, the 15-year FRM averaged 3.30%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.00% this week with an average 0.4 point, down from last week when it averaged 3.01%. A year ago, the 5-year ARM averaged 3.00%.

(Source: Housingwire)