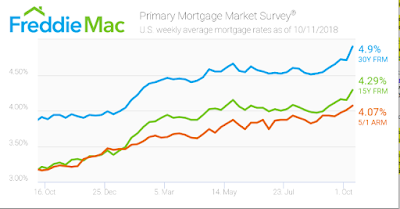

Mortgage Rates reach seven year highs – 20% increase over last year

After weeks of climbing, mortgage rates have now risen to their highest level in seven years According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.9% for the week ending Oct. 11, 2018, increasing from 4.71% last week, and significantly higher than last year’s rate of 3.91%.

An initial mortgage payment on a $1M loan at last year’s rate of 3.91% was 4,721.41. The same initial payment at 4.9% is 5,307.21, an increase of over 20% at $600.00 per month or $7,200.00 over the course of a year.

The 15-year FRM averaged 4.29% this week, moving forward from last week’s 4.15%. This time last year, the 15-year FRM was 3.21%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.07% this week, moderately increasing from 4.01% last week. This is substantially higher than this time last year when it averaged 3.16%.

Sources- Housing Wire

Mid-October Update: Mortgage Rates Increase Slightly

Freddie Mac said in its latest survey that fixed rates on home loans increased this week after declining for the past 3 consecutive weeks. For well-qualified borrowers who paid 0.8% of the loan amount in upfront lender fees and discount points, 30-year fixed rate mortgages were offered at an average of 4.21%, up from 4.19% the previous week.

Full Article from the LA Times Money and Company Blog: Mortgage rates edge higher after 3 weeks of declines

1st Time in 12 Weeks: Mortgage Rates Creep Up

After 11 consecutive weeks of record lows, the 30-year fixed-rate mortgage increased 3 basis points for the week ending Sept. 9 to 4.35% with an average 0.7 point, according to the Freddie Mac Market survey.

Last week’s 4.32% was the lowest rate the survey recorded since its inception in 1971. While the rate this week did increase for the first time in nearly three months, it remains below the 5.07% level seen last year.

The survey of large banks and thrifts reported the average rate for a 30-year FRM at 4.58%, a 5 bps increase from last year.

*Source: Housingwire

Have We Seen The Last Of Sub 5% Mortgages?

As the government continues to print money inflation fears are flaring up and we have seen interest rates climb over 75 basis point in the past two weeks.

Rates for conforming 30-year fixed loans — the plain vanilla mortgages that make up most of the market — jumped from an average of under 5% two weeks ago to over 5.7% this week.

The bond market, which ultimately determines what happens to interest rates, tends to drive rates down when the economic outlook is bad. Signs that the economy may no longer be getting worse contributed to the shift away from the rates under 5% seen in recent months.

However, some financial analyst are cautioning against the idea that we are going to see a major jump in rates. The economy will have to improve to support higher price points and realistically that will probably not happen until 2010.

Bankrate.com senior analyst Greg McBride said federal government borrowing to fund its huge deficit spending is driving up borrowing costs for everyone, “and for consumers that means higher mortgage rates.”

“If you wanted a sub-5% rate, that opportunity has passed you by,” McBride aid.

Mortgage Rates Increase Almost .5% The Past 7 Days

If you have waited to refinance your loan, you may have waited too long. . .

Rates for conforming 30-year fixed loans jumped from an average 5.03% last Tuesday to 5.44% on Thursday before slipping to 5.30% Friday, according to HSH Associates of Pompton Plains, N.J.

The bond market, which ultimately determines what happens to interest rates, tends to drive them down when the economic outlook is bad. Signs that the economy may no longer be getting worse contributed to the shift away from the rates under 5% seen in recent months, Gumbinger said.

Other reasons for the move include bond investors’ demands for higher rates because of worries that inflation may return sooner than anticipated and a flood of new sovereign debt being issued.

Bankrate.com senior analyst Greg McBride said federal government borrowing to fund its huge deficit spending is driving up borrowing costs for everyone,

But heavy Federal Reserve purchases of Treasury bonds and mortgage-backed securities should in the short term keep the cost of home loans at what historically are extraordinarily low levels, he said.

“They may not necessarily be able to bring rates to sub-5%,” McBride said, “but they can keep a lid on mortgage rates.”

The upward tick is expected to slow refinancings more than home purchases, because, as Gumbinger put it, “The interest rate is just one of a number of planets which must align” for a home to get sold.

Still, the higher rates, if sustained, could put some additional downward pressure on home prices, since interest rates do affect affordability.

(*Sources: LA Times, Wall Street Journal)