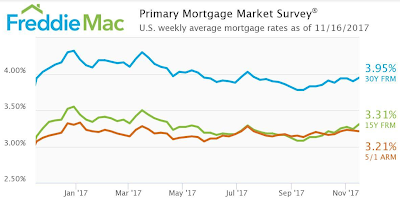

Mortgage rates increase to 4-month high hovering just below 4%

Mortgage interest rates increased to their highest point in four months, and now hover just below the psychologically important 4% mark, according to Freddie Mac’s latest Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage increased to 3.95% for the week ending Nov. 16, 2017. This is up from last week’s 3.9% and up slightly from last year’s 3.94%.

The 15-year FRM increased to 3.31%, up from 3.24% last week and up even more from last year’s 3.14%.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage decreased slightly to 3.21%. This is down from 3.22% last week, but up from 3.07% last year.

Source: Housing Wire

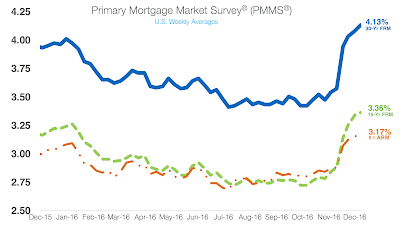

Mortgage Rates increase for the fifth consecutive week…hitting a new high in 2016

The 30 year fixed-rate mortgage (FRM) increased to 4.13% for the week ending December 8th. This is up from last week’s 4.08% and 18 basis points higher than this time last year.

The 15-year FRM increased to 3.36%, slightly up from last week’s 3.34% and 3.19% last year. Freddie Mac Chief Economist Sean Becketti stated that the markets are 94% certain of a quarter-point-rate hike.

|

| Interest Rate Chart since Dec. 2015 |

Source- Housingwire

Mortgage rates increase this week but still low compared to last May

Mortgage rates rose this week to the highest level since the week of March 12. The 30-year, fixed-rate mortgage averaged 3.80% with an average 0.6 point for the week ending May 7, 2015, up from last week when it averaged 3.68%. A year ago at this time, the 30-year fixed rate mortgate averaged 4.21%.

Source: Housing Wire