Notes on a Realtors Scorecard: Thoughts from a Cali economist…Inglewood is HOT and more

Thoughts from a respected California economist: Ken Rosen, chairman of the Fisher School of Real Estate and Urban Economics at UC Berkeley recently stated that Southern California is just starting to enter the 7th inning of a 9 inning game when it comes to real estate appreciation. He anticipates appreciation to continue through 2015 and 2016 but feels we will see some type of pull-back beginning in 2017. How big will depend on the jump in interest rates, the election of the next president and whether the Feds manipulation of the rates to get out of the great recession was truly economic genius or a quick fix to a bigger problem.

Inglewood attracting investors and young families: Last year we wrote a few blog articles on the surging popularity of Westchester and that has now spilled over into neighboring Inglewood. With the announcement that St. Louis Rams owner Stan Kroenke plans to build a state of the art NFL stadium

surrounded by retail and residential development where Hollywood Park currently resides, many investors have followed his lead. Most home sales are seeing multiple offers and the nicer areas have jumped up over 20% in value in the past 18 months. The mayor of Inglewood James Butts has done a phenomenal job of marketing the future of Inglewood as a place with tremendous potential thanks to new development and the cities proximity to LAX and both the Westside and South Bay. Inglewood still has a reputation as a tough city with poor schools and its fair share of gang violence. However, continued economic development with a focus on cleaning up the area will lead to increasing price appreciation and a reputation as a city of opportunity.

Fun Fact: Madison Square Garden bought the Forum in Inglewood in 2012 and promptly spent $50 million in renovations. In just a few short years, the Forum is on track to be the #1 major concert venue in Los Angeles this year.

Inventory slightly increasing: We are starting to see inventory slowly increase on the Westside which is what the market desperately needs. It is still nowhere close to historical levels but buyers are getting a little more breathing room. That said, we are still seeing some frustrated buyers pay a big premium in multiple offer situations to make sure they don’t get outbid. In some cases buyers are paying 7-10% more than the next highest offer. We expect this trend to start dying down by mid-summer but unless we see a bigger surge in inventory or a hiccup in the financial markets, multiple offers with favorable seller terms will still be the reality most buyers will face the rest of 2015.

9 offers in Mar Vista…on Walgrove!- Despite being situated on a busy street and a few doors down

from a busy intersection (Walgrove and Rose), 1409 Walgrove sold for $1.2M (all-cash), 150K over the asking price! The 3+2 home is only 1,244 sq. ft. with a non-permitted detached guest house which was formally the garage. The house is in good condition and ready to move into but the big selling point was the huge backyard as the lot is just over 8,500 sq. ft. Larger lots definitely go for a premium and this was no exception. Hedges shield the property from Walgrove so once inside you don’t notice the street…despite the large lot, we are surprised to see this sell for over $930 a sq. ft.

Two condos go way over asking in Santa Monica- 1915 Washington Avenue, an updated 3+3, measuring 2,500 sq. ft. hit the market for $1.995M and sold for $2.117M with multiple offers. The townhouse featured great natural light, a private elevator, rooftop deck with great views and a great master bed/bath.

1018 4th Street #303- A top floor 2+3 with 1,951 sq. ft. of living space sold to an all-cash buyer for

$1.818M, $200K over the $1.595K asking price. The buyer is rumored to be a foreign investor. The unit has a gourmet kitchen, rooftop deck, luxurious master bed/bath, captures great natural light and has vaulted ceilings.

Mortgate rates remain largely unchanged from last week

Average fixed mortgage rates moved just slightly lower following three consecutive weeks of increases. The 30-year fixed-rate mortgage averaged 3.84% with an average 0.7 point for the week ending May 21, 2015, down from last week when it averaged 3.85%. A year ago at this time, the 30-year averaged 4.14%.

“Housing starts surged 20.2% to a seasonally adjusted pace of 1.14 million units in April, the highest level since 2007,” said Len Kiefer, deputy chief economist, Freddie Mac. “As homebuying season moves into full swing, homebuilders remain positive about home sales in the near future. Although the NAHB housing market index slipped 2 points to 54 in May it is still above 50, indicating that on balance builders remain optimistic about housing markets.”

The 15-year FRM this week averaged 3.05% with an average 0.6 point, down from last week when it averaged 3.07%. A year ago at this time, the 15-year FRM averaged 3.25%.

Source- Housing Wire

Articles to check out

1- Sales of existing homes cool off in April amid tight supply (National)

Tight supply in many parts of the country is the reason behind the decline. Homes are selling in an average of 39 days, their fastest clip since June 2013, and that’s driving prices up.

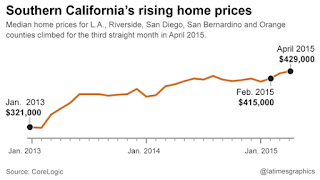

2- So Cal home sale prices show gains

Southern California home prices and sales climbed in April for the second straight month after a period of stagnation. The gains, however, may signal a tough summer ahead for buyers, who face a dwindling supply of homes in most areas. Prices up a moderate 6.2% from April 2014, to a median of $429,000 across the six-county Los Angeles metropolitan area. Sales volume climbed 8.5%.

3-New home construction rebounds strongly, reaches best pace since 2007 (National)

The figures were higher than forecasted and indicated broader economic growth. Many economists attributed the drop in 1st quarter numbers to severe weather across the nation.

$1 Million over asking! Three April examples- Brentwood and Santa Monica

Brentwood: 1626 Old Oak Road- Listed at $4.8M and sold for $6.535M!: This tear-down/major

remodel candidate was in high demand thanks to being located in highly desired Sullivan Canyon and boasting a 28K flat lot. The property had over 10 suitors and sold in an all cash deal.

12251 Castlegate- Listed at $3.650M and sold for $4.826M- $1.2M over list price: This 18K flat lot was in high demand thanks to being on a cul-de-sac street with views of the Getty, Mt. St. Mary’s and the ocean. The mid-century home that occupies the property will be torn down.

was in high demand thanks to being on a cul-de-sac street with views of the Getty, Mt. St. Mary’s and the ocean. The mid-century home that occupies the property will be torn down.

Santa Monica- 428 19th Street sells for $4.8M…$800K over the asking price: This elegant

Mediterranean North of Montana home is a 5+4, 4,460 sq. ft. home situated on a 8,932 sq. ft. lot. The house features soaring ceilings, great natural light, gourmet kitchen, huge master suite overlooking a Jay Griffith designed backyard and pool.

New water heater regulations now in effect leading them to be bigger and more costly

Changes in hot water heater regulations may cause a routine replacement to become an unexpectedly expensive endeavor. New federal regulations aimed at increasing Energy Factor (EF) ratings, require hot water heaters that are larger, more costly and more environmentally conscious than what is required under current regulations.

With these changes, homeowners will face increases in cost between 15 and 35 percent. The new regulations require a more complicated installation and an increased amount of system parts. The larger size of the new units could create an additional unforeseen expense. Electric hot water heaters larger than 55 gallons (the minimum size for most residential units) will require a minimum of 128 cu. ft. with a duct to a larger space in order to comply with these standards. For many homeowners, that could lead to a major renovation involving construction and a greater cost.

With these changes, homeowners will face increases in cost between 15 and 35 percent. The new regulations require a more complicated installation and an increased amount of system parts. The larger size of the new units could create an additional unforeseen expense. Electric hot water heaters larger than 55 gallons (the minimum size for most residential units) will require a minimum of 128 cu. ft. with a duct to a larger space in order to comply with these standards. For many homeowners, that could lead to a major renovation involving construction and a greater cost.

On a positive note, the savings on your utility bill will be around 25% and most tankless water heaters already meet efficiency standards.

A look at the numbers: 1st quarter 2015 statistics

The Westside real estate market continues to hum along with the market appreciating at a strong pace in 2015 and overall sales volume up compared to the 1st quarter of 2014. Click the graphic below for access to the Partners Trust statistics page which will provide you with a link to the 1st quarter 2015 report along with the ability to check out reports from the past three years.

Average rate on mortgages drops to 3.63%…lowest since May 2013…Will this continue?

Average long-term U.S. mortgage rates fell for the fourth straight week, with the 30-year rate again marking its lowest level since May 2013.

The nationwide average for a 30-year mortgage slid to 3.63% this week from 3.66% last week. The average for a 15year mortgage, a popular choice for people who are refinancing, dipped below 3% to 2.98%.

The ongoing decline in rates lured a crop of prospective buyers, as applications for mortgages marked their biggest weekly gain last week in over six years.

Applications jumped 49.1%, the biggest weekly increase since November 2008, according to the Mortgage Bankers Association.

Worries about economic troubles in Europe and Asia have sent mortgage rates plunging despite positive indicators regarding the domestic economy with rising consumer confidence and increases in wages. That strength contrasts with a European economy so fragile that the European Central Bank is expected later to launch a bond-buying program similar to the stimulus the Federal Reserve employed here as an extraordinary reaction to the Great Recession.

With once booming emerging economies from Brazil to China now slowing as well, spooked investors around the world are seeking the haven of ultra-safe government bonds. The effective annual interest rate on 10-year securities issued by Germany and Japan has fallen well below 1%, and the yield on 10-year U.S. Treasury notes dropped below 2% for the first time in three months. With bond investors accepting lower yields on these securities and on the Ginnie Mae bonds backed by Federal Housing Administration and Veterans Administration home loans, mortgage bankers can lower the rates charged to consumers.

Global uncertainty continues to be the friend of the American home-buyer and it should stay that way through most of 2015. Once the Europeon economy starts to stabilize expect rates to begin the climb that has been expected since early last year.

Sources: LA Times, Housing Wire, Fortune

Notes on a Realtors Scorecard- a look back at 2014 and what 2015 may hold…

– There is a new addition to the Skinner family! Dax Kenyon Skinner was born December 30th and both he and Jill are healthy and doing well. Here’s a picture from the proud dad.

– There is a new addition to the Skinner family! Dax Kenyon Skinner was born December 30th and both he and Jill are healthy and doing well. Here’s a picture from the proud dad.

– Thanks to wonderful clients who continue to provide amazing referrals, we had our best year ever. Despite the lack of inventory plaguing the market, we were able to increase our number of transactions compared to 2013 and we also were involved in six off-market transactions even though off-market activity has also slowed down.

– Price appreciation continued in upward trend on the Westside in 2014 thanks to low inventory, low interest rates, the presence of Silicon Beach expanding its economic footprint and international investors feeling good about the Los Angeles luxury market. Though price appreciation slowed down in the second half of the year compared to the torrid pace of the previous 36 months, demand still outpaced inventory which led to multiple offers on any homes that were listed at an appropriate price. Even though Buyers were desperate for properties, the premiums they were paying above market in the second half of the year decreased with an eye more on value instead of hysteria. Greedy sellers who listed properties over market value were quickly forgotten about.

– Areas that were scorching hot in 2014: 1- Westchester 2- Venice 3- Mar Vista 4- Santa Monica 5- Culver City

-The same areas that were hot in 2014 will continue that trend in 2015 with Playa Vista also garnering a lot of attention with its newest build-out becoming available. Playa Vista is very popular with the tech-savvy Silicon Beach crowd.

– Unless the national economy goes into a tailspin over dropping oil prices, we expect continued price appreciation in 2015 though not at the prolific clip of prior years. Inventory will still be low in comparison to historical data, but we expect it to increase, providing more options to buyers compared to the past two years. The strong price appreciation of the past three years will entice some sellers to cash out and take advantage of low interest rates on an up-leg property.

– Unless the national economy goes into a tailspin over dropping oil prices, we expect continued price appreciation in 2015 though not at the prolific clip of prior years. Inventory will still be low in comparison to historical data, but we expect it to increase, providing more options to buyers compared to the past two years. The strong price appreciation of the past three years will entice some sellers to cash out and take advantage of low interest rates on an up-leg property.

– One issue that will continue to contribute to low inventory is seller’s not wanting to lose the property tax basis they currently have on their property. If you purchased a home for $1M, you are paying property taxes on the purchased amount and not today’s value even if today’s value is now $2M. An up-leg purchase for that Seller could be around $3M so the increase in property tax triples. -Partners Trust consistently networks with the most productive agents across the country in upper end markets and those agents are experience many of the same things we are and expect modest appreciation and consistent buyer demand in 2015.

– One of the most desired zip codes on the Westside, 90402 (north of Montana in Santa Monica) is a great example of the shrinking inventory we have experienced the past few years. In 2012, the # of closed sales in the 90402 zip was 122. In 2013, it dropped to 101 and in 2014 it was just 94.

– Housing prices in Los Angeles have grown four times faster than incomes since 2000. Not only is Los Angeles the lease affordable in the nation, but according to a Harvard study, half of all households in the region are considered “cost burdened” and one and four households spend at least half its income on housing.

– LA County has 7 of the 10 ZIP codes with the worst overcrowding in the nation.

Marriage is no longer a pre-requisite for buying a home…it is so expensive friends are going in on a mortgage together

Over the past few years we have experienced a new phenomenon in representing buyers. Individuals who are good friends, or couples who are not married, have reached out to express the desire to purchase a home. The Westside real estate market is so expensive that it is pricing out the single home buyer and people are doing what they can to invest in the market as opposed to paying rent.

Though the idea initially sounds good, it is extremely important to have a written agreement (often referred to as a tenant-in-common agreement) documenting all the terms of the parties’ agreement, including a way to terminate the agreement, before purchasing a property.

The LA times recently wrote an informative article about this trend among couples purchasing before they get married.

Article: Marriage is no longer a pre-requisite for buying a home

We said Westchester was HOT and the LA Times has noticed

A few weeks ago the LA times wrote a nice article on Westchester enjoying a housing surge which we noted throughout 2014. Our clients who have bought in the Kentwood and Loyola Village areas of Westchester are quite happy with the family friendly atmosphere and ability to be just minutes away from the South Bay and Santa Monica.

We continue to expect these neighborhoods in Westchester (Westport Heights is also on the upswing) to appreciate in value. With better education options popping up due to charter schools, and the next phase of the Playa Vista development eventually providing great entertainment and shopping options, Westchester shows no signs of slowing down.

Article: Buoyed by Silicon Beach, Westchester enjoys a housing surge