Two articles you should read- So Cal market downshift; Tough time for renters

As we have noted on this blog lately, the rapid pace of the market has slowed on the micro markets of the Westside. Last week, the LA Times published an article talking about the subject on broader Southern California terms. Home prices hit their highest level in nearly seven years this summer, but the gains are slowing down and here is an article outlining some of the reasons why.

Article: Southern California Market Downshifts in August

——-

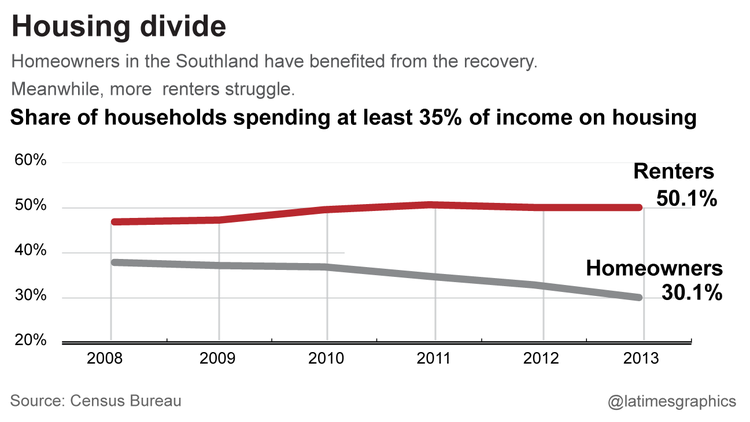

The sharp increase in home values over the past few years, without wages increasing is making the ability to afford a home in Los Angeles very difficult. Strong investor interest along with international money flooding into the market are a few of the other reasons why it is a struggle for first time homeowners. The frustration for renters is that rents continue to increase while owners are able to take advantage of low interest rates and tax write offs. Check out the informative article below.

Article: The divide between homeowners and renters is growing

Traffic nightmare to hit PCH- rebuilding of California Incline will begin early 2015

The repair and repaving project of the Moomat Ahiko bridge (connects Ocean Blvd. with PCH North near the Santa Monica pier) is underway as city official expect that it will serve as one of the primary detour routes during the construction of the California Incline Bridge project set to begin in early 2015. That’s right, the main artery providing north and southbound access to PCH from the heart of Santa Monica will be closed for 12-18 months while the incline is properly retrofitted.

The incline rests on unstable soil and a significant earthquake would likely decimate the incline. The project is expected to take 12-18 months. Construction hours will not be around the clock to maintain the sanity of those living on PCH and Ocean Avenue. However, the hours will be extended to 7AM thru 10PM Monday through Friday and 7AM to 9PM on Saturday. The extended hours will lead to the project being completed 25% faster than under standard construction hours. A closure of one southbound lane on PCH will be needed during construction.

The incline rests on unstable soil and a significant earthquake would likely decimate the incline. The project is expected to take 12-18 months. Construction hours will not be around the clock to maintain the sanity of those living on PCH and Ocean Avenue. However, the hours will be extended to 7AM thru 10PM Monday through Friday and 7AM to 9PM on Saturday. The extended hours will lead to the project being completed 25% faster than under standard construction hours. A closure of one southbound lane on PCH will be needed during construction.

Between 7am and 10am- they will provide two northbound lanes and three southbound lanes and left turns to coastal properties will be prohibited.

Between 10am-4pm, two northbound and southbound lanes will be available and left turn access will be available.

Between 4pm-7pm, they will provide three northbound lanes, two southbound lanes and left turns will be prohibited.

Between 9pm-5am, two southbound lanes will be closed.

An average of 20,000 cars use the incline daily. To avoid the construction, people will be asked to use Chautauqua in Santa Monica Canyon, and Sunset Blvd. in the Palisades with Moomat Ahiko and Lincoln Blvd. for south Santa Monica.

I can’t imagine what beach traffic will be like next summer when people escape the heat from the mid-city and visit beaches near the Santa Monica and Venice piers. From a real estate perspective, this will not be welcome in Malibu and to a lesser extent the Palisades.

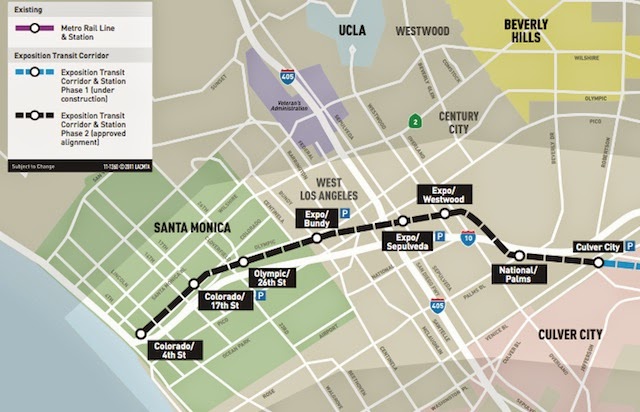

Expo Light Rail expansion into Santa Monica to be completed in late 2015

The Expo Light Rail Project, a 15-mile rail line connecting Downtown LA with Santa Monica is expected to be completed in late 2015. The line currently only connects Culver City with Downtown. The extension into Santa Monica will have 7 new stations and it will take 45 minutes to get to Downtown from Santa Monica.

The Expo Light Rail Project, a 15-mile rail line connecting Downtown LA with Santa Monica is expected to be completed in late 2015. The line currently only connects Culver City with Downtown. The extension into Santa Monica will have 7 new stations and it will take 45 minutes to get to Downtown from Santa Monica.

(Sources- City of Santa Monica and PT Voice Blog)

August Slowdown in Pacific Palisades and Santa Monica

The red hot real estate market that has engulfed the Westside over the past two years is beginning to slow down. We still have multiple offers on well-priced properties and the housing demand is still healthy. However, with some Westside zip codes up over 40% in just 24 months, buyers are proceeding with more caution unless it is a trophy property. Another factor impacting August sales is that many schools started earlier than ever, leaving many families with July as the only viable summer vacation month. This helped lead to less inventory and a smaller pool of buyers to put a home in escrow. Typical escrow periods this year have been between 28-40 days.

Let’s take a quick look at sale activity per the Multiple Listing Service “MLS” statistics.

Pacific Palisades– Only 23 single-family homes (“SFR”) sold in August and six of them were over asking. Compare that to July, in which 45 SFR’s sold (12 over asking) and August 2013 in which 40 SFR’s sold (also with 12 over asking).

Highlight Sales: In July, 1495 Capri Drive sold for $4.88M, after being listed for $3.995M. Almost $1 Million over asking! The 5+5 house measuring at just under 4K sq. ft., has an ideal family floor plan. The location north of Sunset in prime Palisades Riviera, situated on a 18,260 sq. ft., attracted over a dozen serious buyers despite limited showings due to a tenant. The house was built in 1964 and will require some updating. The house was obviously listed under market value to create a bidding process. The buyer paid a strong premium due to the idea location and lot size.

1379 Piedra Morada– This Palisades Highlands 5+6 traditional measuring 4,689 Sq. ft. on a mostly useable 22K lot, also attracted multiple offers from families looking for more space that is difficult to find in the flats (see above). The home has a great floor plan with vaulted ceilings and an exquisite master suite that has the feel of a Four Seasons Hotel. The grounds include a pool, spa, tennis court and grassy area. The property was listed for $2.995M and sold for $3.145M. They received multiple offers within a week of being on the market.

Santa Monica didn’t have quite the fluctuation in sales volume as the Palisades, but it still experienced a decent drop. August saw 22 SFR’s sell (5 over asking) compared to 28 last August. July of this year had 30 sales with a whopping 14 over asking! We are definitely seeing a cooling trend.

Highlight Sale: 492 East Channel Road, a 3+3, 1,927 Sq. ft. home on a 6,021 sq. ft. lot sold for $2.461M in July after being listed for $2.049M. The beach-chic bungalow in the exclusive Santa Monica Canyon has solar panels and remodeled to be a model of energy efficiency and eco-friendliness. The house was a hit with a young families who created a multiple offer frenzy thanks in part to the home being located in the highly coveted Canyon Elementary attendance area.

Articles you should read- Mortgage rates may be poised to rise and what you should know about appraisals!

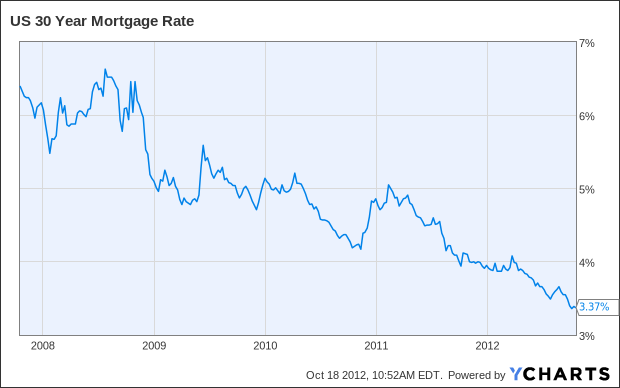

Interest rates have been bouncing around 4% for the past year, but at some point, and fairly soon some forecasters say, these cheap money days will end. At this time next year, the Mortgage Bankers Association projects, the average interest rate on a 30-year fixed-rate mortgage will be 5.2%, its highest level since early 2010. However, will that really happen? Check out the full article via the LA Times: Mortgage rates may be poised to rise

***********************************

When it comes to real estate, the appraisal is usually the linchpin around which all else revolves. Check out this informative article on what home buyers and sellers should know about real estate appraisals: What home buyers and sellers should know about appraisals

Equity credit lines are making a comeback…

With the strong appreciation in the housing market over the past couple of year, homeowners across the country have begun taking out home equity credit lines at a rapidly accelerating pace. Check out the article via the LA Times: Equity credit lines are making a comeback

Westside Market Trend Notes- Westchester HOT…market above $1.7M+ cooling a bit…lenders making it tough

Westside Market Trend Notes- Westchester hot…market $1.7M+ cooling a bit…Lenders making it tough…

– Tight inventory is still tilting the market in the seller’s favor but things slowed down a bit in July. Since most schools are starting the year early this could be a product of families traveling as we have seen buyer activity picking up this past week. In fact, traffic at open houses in Westchester, Culver City and Santa Monica was pretty strong on Sunday. One house in particular in Westchester had over 50 parties through in the first hour…

– The market above 1.7M in Mar Vista and above $2M in Brentwood has slowed down and we have seen more reductions in listing prices compared to last quarter. In fact, a nice home like 12035 Dewey could possibly be had for around 1.9M and it is tough to find that combination of architecture and views under $2M. They have reduced $150K. A really nice remodel with a captivating view to the ocean at 3360 Beethoven went into escrow last week after a $100K reduction. . .they originally had multiple offers and the original buyer who was in for over asking walked away and opened escrow on a different but similar property in the area.

– The market above 1.7M in Mar Vista and above $2M in Brentwood has slowed down and we have seen more reductions in listing prices compared to last quarter. In fact, a nice home like 12035 Dewey could possibly be had for around 1.9M and it is tough to find that combination of architecture and views under $2M. They have reduced $150K. A really nice remodel with a captivating view to the ocean at 3360 Beethoven went into escrow last week after a $100K reduction. . .they originally had multiple offers and the original buyer who was in for over asking walked away and opened escrow on a different but similar property in the area.

– With Mar Vista and South Santa Monica to the north and Manhattan Beach and El Segundo to the south seeing such strong price appreciation over the past 24 months, buyers around the $900-1.1M mark are focusing on Westchester and neighboring areas of Playa Del Rey. They are finding great family friendly pockets like Kentwood and Loyola Village. I feel Westchester is a strong long-term investment choice especially with the expansion of the Playa Vista project providing more amenities and the availability of charter schools popping up in the area. The large builder/flip companies like Thomas James Capital and Anchor Homes are both aggressively pursuing homes in the area.

– If you are going through a re-finance or purchase, you already know the amount of paperwork and detail the lenders are asking for is extremely detailed. The lenders cut back on staff during the great recession and have not re-hired making the process longer and frustrating for all involved. The good news is we have well-qualified buyers during this recent run up in pricing. However, it can be extremely frustrating and time consuming when going through the process. Be Prepared!

Feel free to contact me directly at 310-486-5962 if you need any assistance or have some real estate related questions. Make it a great day!

Today’s Luxury Homes Must Haves

What makes a home truly luxurious? Today’s builders are constantly adapting to the needs of future homeowners, staying ahead of design trends but also considering the larger questions of what types of homes will meet the demands of our ever-changing world.

In many ways, true luxury defies definition. There are certain determining factors such as the latest in smart home technology or the best high-end finishes, but what truly takes a home to the next level is both more simple and more complex. What do my friends feel like when they come into my home? Do I have art walls? A comfortable environment?”

The biggest key is the importance of “micro-environments” within the home — picture-perfect settings throughout today’s luxury homes, vignettes that draw the eye and bring a sigh of delight. Here in Los Angeles we prize indoor/outdoor spaces. Smart homes with command centers that can be accessed remotely are increasingly popular because they provide a combination of security and comfort that resonates with today’s buyer.

What makes the best view in Los Angeles? The Partners Trust View Criteria

Los Angeles is a city built on views. The abundant hillsides and valleys make for plenty of opportunities to view the surrounding landscape all the way to the Pacific Ocean. There are, however, views that stand out from the rest–views that are peerless in their expansiveness and beauty. These are the views that are talked about, whispered about, and shown off by proud property owners who proclaim that they have “the best view” around.

What really makes a view extraordinary? Intrigued by claims of hearing about the “Best view in Los Angeles” for years without a true measuring rod for comparison, Partners Trust decided to create a grading criteria to better define the ultimate bragging rights within the City of Angels.

Based on six core criteria with a grading scale from 1-10, the average of those six scores reveals where the property fits on the overall scale. With a grade of one being a modestly desirable view and ten representing the small handful of top-tier properties in Los Angeles that offer a truly extraordinary vantage point, we can now start to better articulate who may actually claim that their view represents the “Best of Los Angeles”.

The Partners Trust View Standard Criteria:

Explosiveness—Explosiveness is defined as the ‘wow’ factor, the type of jaw-dropping view that offers both height and breadth with an expansive vista showcasing the city. A panoramic expanse along the lines of a 270-degree view would warrant a 9 or 10 on our scale. However, unsightly obstructions like power lines or poles would cause a reduction in points. Massive ocean views can also be considered as explosive provided that they are dramatic and wide-ranging however in our opinion, they won’t receive as high a rating as the staggering city lights view because these views go “dark” at night. The best views dazzle by day and by night.

Explosiveness—Explosiveness is defined as the ‘wow’ factor, the type of jaw-dropping view that offers both height and breadth with an expansive vista showcasing the city. A panoramic expanse along the lines of a 270-degree view would warrant a 9 or 10 on our scale. However, unsightly obstructions like power lines or poles would cause a reduction in points. Massive ocean views can also be considered as explosive provided that they are dramatic and wide-ranging however in our opinion, they won’t receive as high a rating as the staggering city lights view because these views go “dark” at night. The best views dazzle by day and by night.

Texture—Texture can be described as a type of softness, a gradation of local hillsides, light and shadow, and differing vantage points that add character to a view. The view from a tall building or hillside property can be explosive but still lack the type of texture t

hat makes a view pleasing at all times of day or night. A view that is both explosive and textured creates tremendous view enhancement and must be awarded points on our scale.

Exclusivity—Does the property offer relief from the street? Is it accessed via a private drive or through a set of gates? Does it occupy a promontory or other spot that is not accessible to others? The longer the drive and the more unique and rare the view, the more points it receives in this category. The more exclusive the view, the higher the ranking and if no one else can claim the same vantage point then you can add 10 points to your score.

Proximity—An ideal view property also offers reasonable proximity to civilization. If there are many switchbacks up a twisting, narrow road, miles to travel, and a level of inaccessibility, points are to be deducted against the view’s ultimate dynamic composition. No one wants to drive a long distance for the proverbial quart of milk. If you can get easy access to your convenience store without burning through much gas, rank your property accordingly.

Iconography—Los Angeles is a town defined by both its natural beauty and its landmarks. The ideal view should include as many of these landmarks as possible: the Hollywood sign, the Griffith Observatory, Dodger Stadium, the downtown Los Angeles skyline, and the Capitol Records tower. The view should also extend all the way to the Pacific Ocean. If you can pick up 10 iconic “Hollywood” landmarks in your view, go ahead and give yourself a 10 in this category.

Privacy—Does the property offer the utmost in privacy? Are there houses nearby at the same height? Is it easy for someone to look in the windows or observe you on the deck, balcony or lawn? Is anyone looking down onto the property? The ideal view property is one that offers complete protection from prying eyes. If your view affords a “paparazzi-proof” vantage point, go ahead and tack on another “10” on our scale.

To illustrate the use of this scale, Nick Segal applies it to The Gary Johns House on Los Tilos Road (pictured) in the Hollywood Hills. This property defines what makes a stellar view on the Partners Trust scale. It has jaw-dropping views that sweep from the city to the ocean (10 points) and yet it also offers exposure to softer, more intimate hillside vistas (9 points). It is situated on a promontory accessed via a long private drive (10 points). It is located in an area that offers relatively easy access to the city (8 points). The city’s landmarks can be easily pointed out in the view (10 points) and the property is beautifully situated so that residents can enjoy the views with limited access to voyeurism (7 points). Tallying our score, The Gary Johns House delivers a score total of 54 for an average “9” on the Partners Trust View Standard.

To illustrate the use of this scale, Nick Segal applies it to The Gary Johns House on Los Tilos Road (pictured) in the Hollywood Hills. This property defines what makes a stellar view on the Partners Trust scale. It has jaw-dropping views that sweep from the city to the ocean (10 points) and yet it also offers exposure to softer, more intimate hillside vistas (9 points). It is situated on a promontory accessed via a long private drive (10 points). It is located in an area that offers relatively easy access to the city (8 points). The city’s landmarks can be easily pointed out in the view (10 points) and the property is beautifully situated so that residents can enjoy the views with limited access to voyeurism (7 points). Tallying our score, The Gary Johns House delivers a score total of 54 for an average “9” on the Partners Trust View Standard.

-Source- Partners Trust Voice Blog

Partners Trust Acquires Malibu Firm

Partners Trust Real Estate Brokerage & Acquisitions in Beverly Hills purchased Arete Estates, a Malibu firm specializing in high-end real estate. The purchase price was not disclosed.

Partners Trust was founded in 2009 by a five-person partnership. The company has some 200 associates and annual sales of greater than $1.7 billion. Arete Estates’ nine employees will join the bigger firm and Arete will take the Partners Trust name.

Partners Trust was founded in 2009 by a five-person partnership. The company has some 200 associates and annual sales of greater than $1.7 billion. Arete Estates’ nine employees will join the bigger firm and Arete will take the Partners Trust name.

(Source: Los Angeles Business Journal)