Proud Partner at Partners Trust

A few weeks ago I officially became an associate partner at The Partners Trust real estate brokerage & acquisitions group based out of Brentwood which also has offices in Beverly Hills and Santa Monica. I am extremely excited to be with Partners Trust and believe the collaborative environment and level of service is unmatched in the industry. As I get situated and familiar with the technological and statistical advancements, clients will see positive advancements with the Skinny on Real Estate blog and continued advancement with customer service.

At Partners Trust, the objective is to present clients with the most professional, successful and ethical real estate associates in the business and represent clients with care, confidentiality and the utmost attention to service.

Since the company’s inception three years ago they have experienced exponential growth and are on pace to do over $1 billion dollars in sales in 2012 with just 80 agents. In the past year, almost 40% of the sales at Partners Trust were “off the market” (meaning not on the MLS) which is another testament to the tremendous collaborative environment. According to the MLS numbers, our company’s sales volume is up 144% since this time last year, making us the fastest growing independent real estate company on the Westside. Needless to say I am very excited about being part of this success!

If you are not familar with the Partners Trust web-site, I invite you to visit www.thepartnerstrust.com and please feel free to e-mail me at john.skinner@thepartnerstrust.com

Mortgage rates again at record lows

Mortgage rates are again at record lows, with lenders offering 30-year loans at an average of 3.84%, Freddie Mac’s weekly survey shows.

That’s down from 3.88% last week and a previous record low of 3.87% in February. All of the rates would have seemed unimaginable as recently as 2008, when the 30-year rate averaged more than 6%, or 2009, when the typical rate exceeded 5%.

That’s down from 3.88% last week and a previous record low of 3.87% in February. All of the rates would have seemed unimaginable as recently as 2008, when the 30-year rate averaged more than 6%, or 2009, when the typical rate exceeded 5%.

The 15-year fixed mortgage also dropped to a new record, showing the typical lender offering rate was 3.07% this week, down from 3.12% last week and its previous low point of 3.11%, set April 12.

Interest rates are at rock bottom because of the state of the economy and the inflation outlook.

The widely watched Freddie Mac survey, which has tracked 30-year rates for more than 40 years, presumes the borrowers have solid credit and 20% down payments or equity in their homes. It asks lenders what rates they are offering on loans of up to $417,000 to these borrowers assuming they pay less than 1% of the loan amount upfront in lender fees and points.

Borrowers with good credit who shop around frequently obtain slightly better rates than those in the survey. They also can obtain lower rates by paying additional discount points to their lender upfront.

Source: LA Times

Trampolines: a possible home insurance issue

Even though trampolines can be a great source of exercise and fun for children and adults a like, if you Google the words “trampoline” and “liability,” you’ll see that not only are trampoline injuries a very common cause of severe injuries, they are also the source of a full-blown body of law around homeowners being responsible to cover the costs and other damages related to those injuries.

In fact, just last month, New York Yankees pitcher Joba Chamberlain suffered a career-pausing ankle dislocation while jumping on a trampoline.

Many homeowners insurance and hazard insurance policies are actually voided by the installation of a trampoline on the home.

I strongly suggest that if your are thinking of getting a trampoline that you reach out to your insurance representative to fully understand the impact of having one and whether they will cover it and what the increase in your insurance will be.

Info source: www.inman.com

Homeowners are Optimistic Amid Mixed Signals

A recent survey conducted by the Home Buying Institute showed that homebuyers expected marked improvements in home prices over the next few years. Activity on the Westside is certainly showing optimism with open houses buzzing with people and multiple offers being the buzz phrase throughout the summer. At our first open house two weeks ago in Westwood on Fairburn Ave., we had over 60 parties attend and we were in escrow with multiple offers within a week of hitting the market.

The summer survey by HBI asked 25,000 consumers how they felt about the value of their homes, and an overwhelming 69 percent stated that they expected their home price to rise in the next 24 months. Some of this optimism could be due to a brighter Standard & Poor’s Case/Shiller Home Price Index, according to HBI.

The most current S&P Home Index stated that home prices had risen for the second consecutive month in several cities.

“This is a seasonal period of stronger demand for houses, so monthly price increases are to be expected and were seen in 16 of the 20 cities,” explained Index Committee chairman David Blitzer.

However, an abundance of foreclosure and shadow properties could curb rising home values. The vast number of bank-owned properties may continue to drag home prices down, as demand lags behind inventory in many regions.

Unsteady unemployment rates and increased difficulty qualifying for mortgages may also work against these positive housing market indicators, the source reports.

Source: Home Buying Institute

A quick look at some recent Westside sales

Brentwood

310 Avondale Ave. a 3+3, 2,927 sq. ft. fixer in Brentwood Park with a lot size of 2,927 square feet, listed on 5/25 at $2.99M and sold quickly for $3.15M. $155K above asking price

Santa Monica – only 7 homes have sold as of 6/23 – of those, 4 went for over asking!

560 16th St. a 4+4, 3,128 sq. ft. remodeled 1930’s Spanish style home on a large 11,670 lot, went on the market 4/8/11 for $3.798 and sold in 2 months above asking for $3.940M

560 16th St. a 4+4, 3,128 sq. ft. remodeled 1930’s Spanish style home on a large 11,670 lot, went on the market 4/8/11 for $3.798 and sold in 2 months above asking for $3.940M

740 21st Place– A rare foreclosure/bank owned property North of Montana. This 4+4, 2,913 sq. ft. Spanish house on a 8,940 sq. ft. lot with a pool in solid condition sold right away and over asking. The bank was smart to price this property attractively. It was listed for $2.299M and sold on 6/10 for $2.325M. The property was bought in 2004 by the foreclosed owner for $2.180M.

740 21st Place– A rare foreclosure/bank owned property North of Montana. This 4+4, 2,913 sq. ft. Spanish house on a 8,940 sq. ft. lot with a pool in solid condition sold right away and over asking. The bank was smart to price this property attractively. It was listed for $2.299M and sold on 6/10 for $2.325M. The property was bought in 2004 by the foreclosed owner for $2.180M.

Pacific Palisades – in comparison with Santa Monica, a much busier month thus far with 26 homes selling since 6/23. Most homes sold near or over asking price.

733 El Medio Ave. a 2+2.5, 1,495 sq. ft. house on a 6,920 sq. ft. lot was put on the market on 4/25/11 and sold on 6/1/11 for $1.1M which was 16% above the original list price of $950K. This house was a fixer/teardown and sold for lot value.

Culver City-

11343 Utopia– PHENOMENAL BUY: A 2+1, 905 sq. ft. house on a 8,088 sq. ft. lot was originally listed for $629K in November 2010 and finally sold as a short sale for $300K. It was bought in 2003 for $449K. A great Culver City market as a whole has not dropped nearly that far.

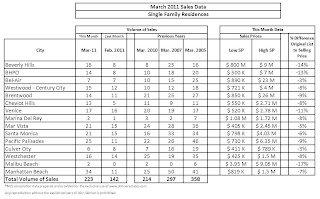

In-Depth Look at Single Family Sales in March for the Westside/Manhattan Beach

Sales volume increased 57% in March compared to February but only increased 4.2% over last March and down 33% and 60% when compared with the Wild West days of 2007 and 2005.

Sales volume increased 57% in March compared to February but only increased 4.2% over last March and down 33% and 60% when compared with the Wild West days of 2007 and 2005.

The difference between the average original list price and sales price also improved dramatically compared to February. With the exception of February, the recent trend shows Seller’s are being more realistic with their initial sales price and due to a lack of inventory we are seeing quite few multiple offer situations. Like the condo market, the buyer still has the leverage but it is not nearly as lopsided as previous years.

Every area saw an increase in sales except Culver City and Bel-Air.

Manhattan Beach increased in sales 4x’s with 34 in March compared to 11 in February. Most of these sales were on the lower end for Manhattan Beach. This past March was also 36% better than March 2010. They still fall short of the robust 50 sales in March of 2007 but definitely showing signs of life especially with first time homebuyers itching to enjoy that unparalleled Manhattan Beach lifestyle.

Beverly Hills Post Office popped with 14 sales, almost doubling last month’s output and beating March 2010 by about 40%. Sales ranged from $500k to 7M.

A look at a few individual sales that stood out:

12218 Octagon St- Brentwood: This North of Sunset home in need of major remodeling sold 10% above the original list price at $1.302M. It sold in 7 days and is a 3+2, 1,688 sq. ft. on a 9,583 sq. ft. lot. The low list price created an auction like atmosphere with multiple all cash buyers vying for the property.

12218 Octagon St- Brentwood: This North of Sunset home in need of major remodeling sold 10% above the original list price at $1.302M. It sold in 7 days and is a 3+2, 1,688 sq. ft. on a 9,583 sq. ft. lot. The low list price created an auction like atmosphere with multiple all cash buyers vying for the property.

11930 Currituck Dr- Brentwood: In between Montana and Sunset, this woodsy 2+1.75, 1,218 sq. ft. home on a 5,488 sq. ft. lot sold for $1.01M, 26% below its original list price! However, most would make you believe it sold for over asking with a last list price of $999K. This could may have been a short sale as it was bought in 2005 for $1,275,000.

2425 Frey Ave- Venice: Bank owned sale ends up going for 31% below ($895K) the original list price of $1.3M. This contemporary and recently updated 3+2, 2,640 sq. ft. home ended up being a terrific buy.

2425 Frey Ave- Venice: Bank owned sale ends up going for 31% below ($895K) the original list price of $1.3M. This contemporary and recently updated 3+2, 2,640 sq. ft. home ended up being a terrific buy.

746 26th street- Santa Monica– This frantic auction brought out the builders looking for a deal. Despite being on a busy street, the 8,700 sq. ft. lot is coveted and the “auction” list price of $799K brought buyers in by the droves. It ended up selling for $1.1M, 38% above asking. . .

616 25th Street- Santa Monica– Lot values North of Montana still trending lower. In our estimation, this tear down approximately sold for $1.684M even though they only reported a $1 sale price (shame on them). The most important info…8,700 sq. lot near Franklin Schol…

616 25th Street- Santa Monica– Lot values North of Montana still trending lower. In our estimation, this tear down approximately sold for $1.684M even though they only reported a $1 sale price (shame on them). The most important info…8,700 sq. lot near Franklin Schol…

7049 Birdview- Malibu– After being on the market for close to three years, 7049 Birdview finally sold for $9.045M, less than half its original asking price in 2008 of $19,950,000. How the mighty have fallen. This 6,397 sq. ft. home sits on an acre of land and boasts endless coastline and ocean views…

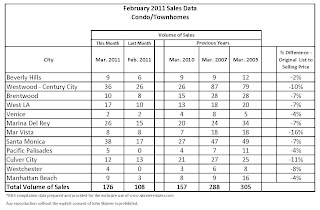

In-Depth Look at Condo/Townhouse Sales in March for the Westside and Manhattan Beach

Overall, we saw a solid increase in sales volume over February, which was expected. However, the increase in sales of 62% over last month was unexpected and the 12% growth in sales over March 2010 continues to show the market is growing steadily out of the Great Recession. Though the numbers look good, we are still off nearly 63% from sales volume 2007 and 73% from the Wild West days of 2005.

In looking at particular areas, Santa Monica had a great month of sales with 38 compared to a dismal February of 17. Santa Monica is up 40% in sales volume compared to March 2010. Most of the seller’s did a good job of pricing the property with the difference in Original List Price to Sale Price at -7% and the difference in List Price to Sale price being around -5%.

Marina Del Rey had a phenomenal month with increasing sales over February by 73% and having a better month than March 2007 which is very rare. Some of this can be attributed to quite a few short sales going through in some of the mid 2005 constructed towers that were flooded with liar loans.

Both Santa Monica and Marina Del Rey are being aided by an influx of buyers thanks to the multitude of tech companies opening offices in the area. It is still considered a buyer’s market but the leverage buyer’s have enjoyed over the past few years is receding somewhat. The good news for sellers is that if they price the unit at or around market value they should be able to sell quickly with good terms.

A look at a few individual sales in Santa Monica:

914 14th Street #101- Built in 2008 along with 4 other units, this 2+2.5, 1,580 sq. ft. unit sold for above asking at $1.150M and was on the market for just 11 days. The asking price was $1.125M. This is the fourth unit to sell in the building with two others selling in 2010 for $687 and $677 per sq. ft. This was the front unit and it sold for $727.85 a square foot. This unit debut on the market for $1.299M in 2008 before being rented out.

914 14th Street #101- Built in 2008 along with 4 other units, this 2+2.5, 1,580 sq. ft. unit sold for above asking at $1.150M and was on the market for just 11 days. The asking price was $1.125M. This is the fourth unit to sell in the building with two others selling in 2010 for $687 and $677 per sq. ft. This was the front unit and it sold for $727.85 a square foot. This unit debut on the market for $1.299M in 2008 before being rented out.

1033 Ocean Ave.#401- After being on the market for 304 days, this luxurious 2+2, 1,396 sq. ft. unit with amazing ocean views finally sold for $1.550M. It was originally listed at $1.850M and went for $1,110 per sq. ft.

Another tech giant moves to the Westside

With Google creating an office campus in Venice, Facebook has now signed a lease to occupy anywhere between 8,000 and 15,000 square feet in Playa Vista. Over the past year, Venice, Santa Monica and Playa Vista have become quite popular destinations for these Silicon Valley companies and it is great news for our local real estate market and helps partially explain the influx of buyers we have seen.

Here is an article from the Los Angeles Business Journal: Another Tech Giant Moves to the Westside

Notes on a Realtor’s Scorecard

Median LA County home price down 10% since September: In September of 2010 the median LA home was going for $340,000 so we are now down over 10 percent in a matter of four months.

Case and Shiller disagree about the future: The widely followed Standard & Poor’s/Case-Shiller Index, which tracks the real estate market in 20 major U.S. cities, has differing opinions. According to a recent New York Times piece, Case calls the current state of the market a “rocky bottom with a down trend,” but doesn’t seem to think the sky will fall. Shiller, on the other hand, sees “‘a substantial risk’ of declines of ’15 percent, 20 percent, 25 percent'” from here.

Standards for loans will continue to rise and create negative issues: A wind-down of government-controlled Fannie Mae and Freddie Mac, as proposed by the Obama administration in February will make home buying more difficult and add pressure to the real estate market. It won’t have as dramatic of an effect on the Westside as it will in less well-to-do areas like the Inland Empire but you can definitely expect a jump in interest rates and even tighter lending standards which will cut down on what Westside buyers can afford. This coinciding with the conforming high limit loan balance dropping from $729,500 to $625,000 at the end of October is not a good recipe for homes worth around a million dollars.

Market anxiety subsides: While 53 percent of Americans said they are “very concerned” or “somewhat concerned” about having the money to make their monthly mortgage or rent payment, according to a recent Washington Post poll, 61 percent believe it is a good time to buy a house…

Buyers Turn Fussy…Underwater Mortgages rise

Buyers are becoming fussier and fussier. A new report found that 87% of first time houme-buyers said “finding a move-in ready home is important.”

Check out this informative article about what the majority of buyer’s are looking for:

LA Times Article First-time buyers turn fussy about ‘move-in ready’ homes

Underwater mortgages rise: We still have quite a few issues to work out even though we have seen some signs of stability: LA Times Article Underwater mortgages rose at end of 2010 as home prices fell