Skinny On Real Estate

SANTA MONICA BALLOT MEASURE LV REGARDING COMMUNITY GROWTH HANGS OVER THE CITY

Ballot Measure LV, which some feel is poorly written, could be setting a precedence for allowing voters to have a say on community growth and development if it passes.

The highly restrictive growth limitations presented in the ballot measure would allow residents to weigh in and vote to approve any “major development” exceeding 32-36 feet, with exception to single unit dwellings and affordable housing projects. Please check out the articles below:

LA TIMES: MEASURE LV SANTA MONICA

KCRW: MEASURE LV BEING WATCHED AROUNG THE SOUTHLAND

SANTA MONICA BALLOT MEASURE DETAIL INFORMATION

COOKIE CUTTER FEEL FOR NEW CONSTRUCTION

|

| 12613 Appleton Way (Mar Vista |

We have seen a new construction blitz over the past 24 months and we are expecting it to continue for the next 3 to 5 years. The reality is that many Los Angeles neighborhoods are filled with homes that are close to 80+ years old, and with land values as high as they are we have a strong demand for new/remodeled homes. That said, it would be nice if we could get a little more variation in regards to the interiors and styles that are used by developers. When I am out on Broker Caravan I sometimes wonder if I have seen the same house twice.

|

| 12923 Warren Ave (Mar Vista) |

ARTICLES YOU SHOULD READ

According to the National Association of Realtors lack of inventory has once again caused home prices to accelerate in the third quarter. NAR chief economist stated that solid job creation and historically low mortgage rates were part of this winning formula for sustained home buying demand all summer long.

HOME PRICE INCREASES SPEED UP IN THIRD QUARTER HIT NEW PEAK

Due to demand and all the regulatory changes in the home appraisal process, appraisals are often holding up the loan approval and closing process

WHY IT TAKES SO LONG TO CLOSE A MORTGAGE

According to a recent LA Times article homebuyers who are unable to afford the traditional 20% down payment for traditional mortgages need not to worry as lenders have begun to fill this gap with new low down payment loan products. Apparently 3% is the new 20% and some lenders are requiring as little as 1% down.

SILICON BEACH OPPORTUNITY: 235 OCEAN PARK #C NOW $2.079M- SELLER MOTIVATED!

Now priced under what the market appreciation has been since the owner bought it, this stunning architectural 3 bed 3 bath (over 2,000 sq. ft.) + loft with rooftop deck in the heart of Silicon Beach is just one block from Main Street and 3 blocks from the beach. Take advantage of this great opportunity that was originally listed at $2.349M!

Check out the PROPERTY WEB-SITE and please contact us if you would like to set up a showing.

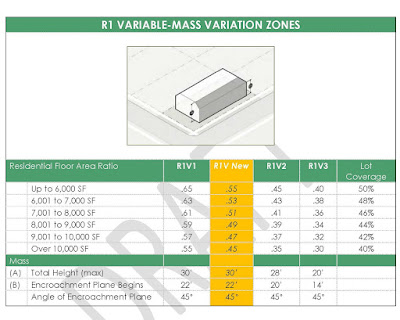

Mar Vista Community Council “MVCC” Recommends R1V New Zoning to the Department of City Planning and not the Extremely Restrictive R1V2 Proposal.

After hearing public comments Wednesday night where the majority of the public speakers were against the City Planning Commission’s proposal for a R1V2 zone change on single-family homes in Mar Vista neighborhoods, the MVCC voted 6 to 2 in favor of recommending R1V New to the City Planning Commission. The new zoning recommendations will replace the existing Interim Control Ordinance “ICO” regarding the Baseline Mansionization Ordinance “BMO” that are set to expire next year. This does not mean the City Council will elect to implement the R1V New zone for Mar Vista but it would be very surprising if they went against the wishes of the Community Council. The R1V2 proposal limits building height and floor area ratio “FAR” significantly compared to the current BMO and would hurt property values. It is an over-reaction to the developers who took advantage of the 20% green building bonus the past seven years and in many cases over-built homes to make more of a profit. The R1V New proposal seems to be a fair compromise which still allows people to remodel and build larger scale homes while curtailing some of the “over-building” by developers. The above chart outlines the options that communities in Los Angeles can choose from. The Department of City Planning will be providing its recommendations to the City Council and people are encouraged to voice their opinions via e-mail to neighborhoodconservation@lacity.org. Here is the link to the full R1 Variation Zone Code Amendment Update as of August 25, 2016

After hearing public comments Wednesday night where the majority of the public speakers were against the City Planning Commission’s proposal for a R1V2 zone change on single-family homes in Mar Vista neighborhoods, the MVCC voted 6 to 2 in favor of recommending R1V New to the City Planning Commission. The new zoning recommendations will replace the existing Interim Control Ordinance “ICO” regarding the Baseline Mansionization Ordinance “BMO” that are set to expire next year. This does not mean the City Council will elect to implement the R1V New zone for Mar Vista but it would be very surprising if they went against the wishes of the Community Council. The R1V2 proposal limits building height and floor area ratio “FAR” significantly compared to the current BMO and would hurt property values. It is an over-reaction to the developers who took advantage of the 20% green building bonus the past seven years and in many cases over-built homes to make more of a profit. The R1V New proposal seems to be a fair compromise which still allows people to remodel and build larger scale homes while curtailing some of the “over-building” by developers. The above chart outlines the options that communities in Los Angeles can choose from. The Department of City Planning will be providing its recommendations to the City Council and people are encouraged to voice their opinions via e-mail to neighborhoodconservation@lacity.org. Here is the link to the full R1 Variation Zone Code Amendment Update as of August 25, 2016

Must Read Articles!

We found some good articles regarding Los Angeles real estate on the CurbedLA web-site.

Have LA’s Home Prices Peaked for 2016?– So Cal’s median home price has held steady for months

LA’s Cheapest and Most Expensive Places to Rent Easy to Read Graph showcasing Rents down 3.5% compared to last month

Where Gentrification is Happening in Los Angeles Click to see the interactive map, UCLA researchers have created to reflect Los Angeles gentrification and the effects of the new light-rail

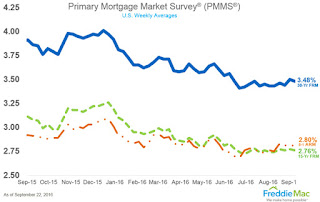

FED has Decided Against Increasing Rates, Mortgage Rates Decline!

The Federal Open Market Committee (FOMC) announced they decided against raising interest rates this month. The FOMC stated that although the case for a rate increase has strengthened they have decided to wait for further evidence on continued progress towards their objectives, and allow the markets to recover from the initial impact of the U.K. choosing to leave the European Union. Minutes from the FOMC meeting also suggest that they may not even raise rates until December or later. Chief Economist Curt Long, from the National Association of Federal Credit Unions stated that despite the temporary hold, the committee also sent a strong signal that a rate hike is imminent. While Capitol Economics Chief Economist, Paul Ashworth said that this seems to have been one of the most diverse FOMC meetings in recent memory, as 3 of the 10 board members dissented and proffered an immediate rate hike. On the Lender Side, Freddie Mac stated Thursday that the average 30-year fixed rate mortgage has declined to 3.48% from 3.50% last week, and 3.86% only a year ago. Only .17% away from it’s all time low of 3.31% from November 2012! The 15-year fixed mortgage rate eased to 2.76% from 2.77%, and the yield on the 10-year notes declined to 1.63% from 1.70%

The Federal Open Market Committee (FOMC) announced they decided against raising interest rates this month. The FOMC stated that although the case for a rate increase has strengthened they have decided to wait for further evidence on continued progress towards their objectives, and allow the markets to recover from the initial impact of the U.K. choosing to leave the European Union. Minutes from the FOMC meeting also suggest that they may not even raise rates until December or later. Chief Economist Curt Long, from the National Association of Federal Credit Unions stated that despite the temporary hold, the committee also sent a strong signal that a rate hike is imminent. While Capitol Economics Chief Economist, Paul Ashworth said that this seems to have been one of the most diverse FOMC meetings in recent memory, as 3 of the 10 board members dissented and proffered an immediate rate hike. On the Lender Side, Freddie Mac stated Thursday that the average 30-year fixed rate mortgage has declined to 3.48% from 3.50% last week, and 3.86% only a year ago. Only .17% away from it’s all time low of 3.31% from November 2012! The 15-year fixed mortgage rate eased to 2.76% from 2.77%, and the yield on the 10-year notes declined to 1.63% from 1.70%

Skinny’s market thoughts as we head into the 4th quarter

The market is jumping all over the place. Certain areas remain hot while others are beginning to see price ceilings develop. Buyers are definitely pickier right now and with more valuation technology, they are strongly in-tune with what a property is worth from a numbers perspective. In many cases they are willing to pay a premium for properties with very few objections, however, the objections are definitely ringing louder if the listing is priced higher than what the market will bear and often attract buyers who are in a mood to negotiate further and press for an even lower price even if the listing has been reduced.

Overall, the market has pumped its breaks a bit with a typical August lull as people were on vacation and getting kids back to school. Last year we experienced a similar August but the market charged forward for the rest of the year. It will be interesting to see how the rest of 2016 plays out. With interest rates still around record lows, we anticipate the market will continue to sway in the seller’s favor.

Hot Spots: Mar Vista up to about $2.4M: The area continues to be very popular with the silicon

beach crowd and young families. On the flip side, despite seeing 8 homes sell for over $3M this year (3 sold for over $3M last year), we are seeing buyers getting hesitant to spend more than $3M unless the property comes with great views or a larger lot. 4056 East Blvd, a 4,000 sq. ft. house on a 8,300 sq.ft. lot originally listed for $3.4M is now reduced to $2.995M despite the house next door, 4060 East Blvd. (4,292 sq. ft. with a nice guest house 4056 doesn’t have) by the same builder selling for $3.350M.

Westchester up to about $1.8M. Kentwood and Loyola Village continue to be wildly popular with young families and Westport Heights, which used to be the red-headed step-child of Kentwood and Loyola Village is seeing its fair share of sales above $1M. 7800 Westlawn in the Kentwood area was listed for $995K, a bit low for a 1,400 sq. ft. house on a 6K lot, received over 7 offers and is rumored to have sold at or close to $1,250,000. Inventory is steadily growing in all price ranges though and we are seeing new construction around $2M sitting for a bit longer…

Pacific Palisades (El Medio Bluffs, Alphabet Streets, Huntington): With the new Caruso development approved and starting construction, areas within a short distance of it are seeing buyers willing to pay a little more of a premium for easy access to this new and exciting development the Palisades has lacked.

Westwood: Westwood’s appealing centralized location along with the wildly popular Westwood Charter Elementary School has created quite the frenzy. 2035 Manning was listed by a colleague at $1.849M and she felt they priced it right around what it would sell for. This 2,100 sq. ft. house on a 6,700 Sq. ft. lot received 17 OFFERS and is in escrow for over $2.1M!!

EXTREMELY IMPORTANT: THE NEW BASELINE MANSIONIZATION PROPOSAL “BMO” AND PROPOSED NEW SING-FAMILY ZONE OPTIONS FEELS LIKE AN OVER-REACTION TO OVERZEALOUS DEVELOPERS AND UNFAIR TO HOME OWNERS…YOU MUST VOICE YOUR OPINION!!

The Planning Department is working on two separate, but related, programs to address concerns about the size of houses in the City’s single-family (R1) neighborhoods: (1) amending the Citywide ordinances (BMO and BHO) that regulate the development of single-family homes, and (2) adopting new single-family zone options that will be applied to neighborhoods currently subject to Interim Control Ordinances (ICOs).

As a resident of Mar Vista, I despise the big, unimaginative cookie-cutter boxes erected all over Los Angeles, especially those with roof-top decks that take away the privacy of neighbors in smaller homes. I hear and agree with these valid complaints and changes need to be made! At the same time, what is currently being proposed, especially for the new single-family zone option for Mar Vista/East Venice and Kentwood (Westchester) is extremely restrictive and irrational.

As a realtor I must disclose that I occasionally work with developers. However, I have NOT been happy with their aggressive push on maxing square footage and using un-imaginative structures to increase profit margins. Unfortunately, this has created the uproar against “McMansions” and the people who are ultimately going to pay the price with highly restrictive square footage rules is the regular homeowner while also de-valuing the land they currently own. Many growing families will not be able to remodel as they intended when they purchased their home under the previous BMO ordinance.

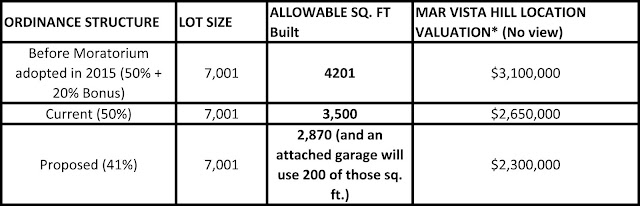

The latest proposal for the Mar Vista/East Venice/Kentwood neighborhoods is extremely restrictive. Until a recent moratorium (ICO), homeowners/developers were allowed to build up to 50% of a lot size with a 20% and sometimes 25% allowable green building bonus. The ICO got rid of the green

building bonus which was a reasonable response to the over-building. However, the loud voices of the anti-mansionization movement have frightened the City Council into making deeper cuts into the size of a house that can be built. The proposed new single-family zones for Mar Vista/East Venice and Kentwood would involve a zone change from R1-1 to R1V2 and would regulate floor area, depending on lot size, to between only 35% and 45%. Currently, if one owns a 7,001 sq. ft. lot in Mar Vista, they can build a 3,500 sq. ft. house. Under the new R1V2 proposal, they would only be able to build up to 41% of the lot size meaning the house can only be 2,870 sq. ft. This is almost a 20% reduction in size and that doesn’t take into account if you have an attached garage where 200 sq. ft. of that would eat into your overall square footage, further reducing your livable square footage to 2,670 sq. ft.!

To give you some perspective on the size of these cuts, see the table below which also takes into account the financial impact this would have on most families largest financial investment. Land value is paramount in Los Angeles and principles will pay less money for land in which less square footage can be built on.

*valuation is based on overall market knowledge and figuring the home is in very good condition. Current land value for a 7,001 sq. ft. lot is around $1.35M+ and will drop overnight if the proposal is passed.

I would also like to address what many homeowners in my neighborhood have expressed to me. They didn’t realize the severity of this proposal and frankly many of them are dual income families with children without the time or energy to show up to the public hearings about this topic.

Attached Garages: Since when would an area in which you park your car be counted against the

livable square footage? It is NOT fair to assume that everyone uses an attached garage as extra living space. Attached garages are essential for safety, especially when a spouse is a frequent business traveler. Attached garages allow for people to build a home that creates a larger backyard which is an essential component for maximizing California living and one’s own land value. I have yet to hear a rationale argument as to why an attached garage should be counted against the allowable floor area of a lot especially when non-attached garage square footage is considered exempt.

Caring for elderly parents/grandparents: People are living much longer. Even though society is having less kids then they did 20+ years ago, the size of families living together is INCREASING. Due to medical and health advancements, some households will have four living generations in them. “By 2025, as many as 25% of the U.S. population will be in multi-generational households and the demand for a different kind of residential property will accelerate over the next decade to meet this demand” (Strategic Advantage Real Estate newsletter). When you combine this with astronomically high rents forcing children to live at home longer than ever, does it really make sense to further restrict a homeowner in regards to what they can do with their property? Also, as a father and someone who grew up with five siblings, I have a serious problem with many of the proponents for the new proposal arbitrarily telling people they can make due in smaller houses. They don’t know the specific needs of a certain families that might require more space, etc. We all have different needs and that should be respected.

Why make the ugly boxes even more valuable?: By passing the proposed ordinance, it will have the unfortunate impact of making those unsightly/over-built shoe boxes even more valuable. They will never be torn down since the homeowner would have to build a significantly smaller house. Since these homes will not have any competition, their value will end up trading at premium prices…so the people with the homes that everyone loves to hate will be in an even better financial position.

Can we just meet in the middle? We need changes but they don’t need to be this dramatic. Why not a proposal that targets the problem areas, but is not an arbitrary reduction in allowable square feet, such as the following proposal:

*A 50% floor area ratio without any bonuses. The 45% proposed in the recent BMO is also too restrictive.

*Create a second floor ratio or an architectural requirement that takes away the boxy nature of larger homes. *Attached garages should NOT be counted against the floor area ratio.

*Roof-Top decks would not be allowed unless explicitly approved by neighbors that would be impacted.

FYI: Pacific Palisades residents have loudly voiced their opposition to this and those outside of the Coastal Zone will have an allowable floor area between 55% to 65%.

LET YOUR VOICE BE HEARD (written submissions are encouraged!):

Contact: Christine Saponara, Department of City Planning-

christine@saponara.lacity.org

Phyllis Nathanson, Department of City Planning- Phyllis.Nathanson@lacity.org/ phone: 213.978.1474

FILL OUT THE ZONING INPUT FORM: Provide your address and e-mail and answer three questions. Shouldn’t take more than two minutes unless you add extensive comments.

For more information check out the Neighborhood Conservation Update web-page.

PUBLIC HEARING INFORMATION

Mar Vista/ East Venice, Kentwood and Pacific Palisades

When: Tuesday, September 13, 2016

Time: Open House at 5:30 p.m., Presentation at 6:30 p.m., Public Hearing at 6:30 p.m.

Where: Henry Medina Building, 11214 Exposition Blvd. Los Angeles, CA 90064

Lower Council District 5, Inner Council District 5, Beverlywood and Fairfax

When: Tuesday, September 20, 2016

Time: Open House at 5:30 p.m., Presentation at 6:30 p.m., Public Hearing at 6:30 p.m.

Where: Henry Medina Building, 11214 Exposition Blvd. Los Angeles, CA 90064

Will the luxury home market take a hit with the new disclosure law?

The luxury market has cooled off a bit and it will be interesting to see how the new law requiring the identity of individuals behind shell companies making all-cash purchases “Geographic Targeting Orders” above $2M will impact the market as the new disclosure requirement was implemented this week in Los Angeles.

This law was enacted earlier this year in Manhattan and Miami and the number of cash deals in those markets has dropped significantly. High-end condo prices in New York are off 15% according to Corelogic who tracks national real estate sales.

This law was enacted earlier this year in Manhattan and Miami and the number of cash deals in those markets has dropped significantly. High-end condo prices in New York are off 15% according to Corelogic who tracks national real estate sales.

Through this program the federal government is already investigating 20+% all-cash purchases for “suspicious” activity related to money laundering. Up until this identity requirement was put in place, the US real estate market has been known across the globe as a great way to launder money with no questions asked. On another related note, according to Corelogic, Chinese investment is down 15% for the year.

Despite this new disclosure requirement, the Brexit vote should lead to added demand for American real estate. Investors look at U.S. real estate as a reasonable alternative to the London market, in addition to the fact that the U.S. government has made international investment easier. A non-U.S. citizen can now invest or own up to 10% of a REIT before incurring federal taxes…up from 5%…while some foreign pension funds are exempt from taxes on their U.S. property holdings.