Skinny On Real Estate

Notes on a Realtors Scorecard- A look at high-end sales; will the recent stock market dip impact the housing market; short-term rentals; Developers going crazy in Venice and Mar Vista and more!

High-End sales (above $5M) still tracking to have a strong year: We have heard some concerns

|

| 384 Delfern Drive |

from people who own high-end homes that it feels like the market is slowing down in their neck of the woods. After looking at Multiple Listing Service “MLS” data regarding sales in high-end Westside neighborhoods, we found the market for homes above $5 Million is still doing well. We looked at overall sales from March/April compared to July/August and found the total # of sales was similar with 54 in March/April and55 in June/July. The average days on market dropped to 87 from 100 with properties selling for 96.5% of the list price in July/August compared to 94.65% in March/April. The average sale price dropped to $8.2M from $9.53M but that is partially skewed due to two sales above $45M in March/April headlined by 384 Delfern Drive in Holmby Hills selling for $59.355M (asking price was $75M). The highest sale in July/August was 609 East Channel Road in Santa Monica Canyon selling for $23M (asking price was 27.5M). With the recent stock market turmoil and the strength of the dollar potentially discouraging international bargain shoppers, it will be interesting to see if these numbers continue to hold steady.

Will the recent stock market dip actually help the real estate market?: The dip in the stock market will hurt potential buyers in terms of overall net worth and possibly detour the number of international buyers we have seen, however, many local economists remain bullish when it comes to the short-term future of Southern California real estate. Another factor that will help those looking to purchase a home is the interest rates have been dropping as the stock market drops allowing for the consumer to have more purchasing power. The FED to delay raising the benchmark rate, since some fear a hike in interest rates could push the American economy back into a recession. Here is an article from the LA Times to check out: Real Estate and recent Stock Market turmoil

Short Term rentals take 11 units off the LA rental market everyday: A report released earlier this year from the Los Angeles Alliance for a New Economy showed that short-term rentals are taking good apartments and homes off the regular market they can be rented out at huge mark-ups on sites like Airbnb. Rentals prices have spiked over 20% in the 2.5 years with the average person paying half of their income toward rent (typically you want your rent to be no more than 35% of your income). Curbed LA writer Adrian Kudler wrote an extensive article on the situation.

Developers going crazy in Venice: When you combine Abbott Kinney being considered one of the

sexiest streets in America, Silicon Beach becoming a major player in the LA economy attracting highly paid tech executives, you get developers salivating for properties in the area. 1519 Louella, a 850 sq. ft. home on a 5,900 sq. ft. lot sold for $1.4M on August 1st to a developer in an all-cash transaction. The house was in decent shape and had a pool but word is it will be torn down. To give you an idea on how much property values have jumped, we sold 1509 Louella, similar in sq. ft, lot size and interior, for $942K in May of 2013.

Small house in Mar Vista bordering SM Airport is in escrow for over $1.150M: 12701 Dewey

Street, a 3+1, 1,092 sq. ft. home on a 5,591 sq. ft. lot was listed a few weeks ago for $1,050M and promptly received 8 offers and is currently in escrow for $100K+ over the asking price. Over $1,000 a square foot! Dewey is a nice street but it does border the Santa Monica Airport. On two separate occasions, this house was listed in 2011 and 2012 for $715K and then for $750K and they couldn’t sell it. This is a rare occasion where they are extremely happy it didn’t sell three years ago.

The Eastside is hot as well…20 offers for a 2 bedroom home in Silver Lake/Echo Park: I had a well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.

well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.

Thoughts on the future of the Los Angeles housing market

Until this year, the acceleration in housing prices in Los Angeles the past few years was largely driven by investors. We expect the housing market to continue to appreciate over the next 12 months as employment and incomes continue to improve. The Westside and South Bay will continue to see a multiple offer environment with the continued growth of Silicon Beach bringing high paying tech jobs to the area to supplement the already strong demand in a low inventory environment. A potential hiccup would be if the current stock market correction continues a strong downward spiral that would hit the tech sector hard enough that the growth of Silicon Beach is stalled.

|

| click to enlarge |

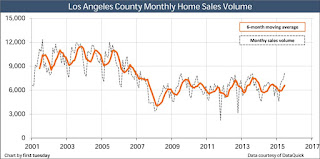

Despite home sales volume rising over last year, we still predict volume to stay low compared to historical standards with people reluctant to give up low interest rate loans and lower property tax base for a more expensive property that is also difficult to find in this market.

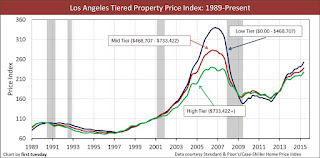

Though the outlook looks good in the near future, sine real estate economists feel the impending Fed rate hike will lead to a decrease in home values from late 2016 into 2018. History has shown us that prices naturally fall 9-12 months following a sustainable increase in mortgage rates as the rise in rates will decrease the amount of principal homeowners are able to borrow with the same mortgage payment. This will hit the market at all levels with more of the impact felt on the lower and mid-tier markets. Obviously rates will need to increase for this outlook to take shape and rates have been expected to rise for the past 12-18 months and it has not happened.

|

| click to enlarge |

The most sustainable prerequisite to a long-term rise in prices occurs when access to full-time jobs is optimal and according to economists, we will start to see that again in 2018. Once the international markets stabilize, we will see another strong international push to acquire Los Angeles real estate which is also predicted to begin around 2018-2019.

The start of another price appreciation run should be upon us at the end of the decade. In the long run, Westside real estate has proven to be a phenomenal leveraged investment and it will continue to be that way as it is one of most desired places to live in the world. However, prices will depreciate, as we saw from 2007-2009, and as long as you have a long-term outlook and are not constantly borrowing against the equity in your house, it will be one of the best investments you can make.

The cost of homeownership adds up in California

A recent report on the hidden costs of homeownership by Zillow and Thumbtack analyzes costs often overlooked by homebuyers, such as property taxes, homeowners insurance and utilities and the most common homeowner maintenance expenses, which are house cleaning, gardening/lawn mower, landscaping, carpet cleaning; and specific regional costs like air conditioner maintenance, gutter cleaning and pest removal.

These “hidden” homeownership costs add up to a national average of $9,477 per year. Los Angeles has a higher average at $11,333 and San Francisco checks in at a robust $13,287 (second highest in the nation behind Boston, MA). The reason Los Angeles is above the national average is mainly due to California’s high cost of living. Things are just more expensive in California, including the cost of domestic labor, which is included under common homeowner maintenance expenses cited in the report. Ultimately, California’s pleasant climate and bountiful opportunities come with a price.

Homebuyers shouldn’t necessarily be scared away by the higher level of homeownership costs in California — not all homeowners hire a cleaner or gardener, as this analysis assumes. But there are definitely some extra costs new homeowners need to keep on their radar. Also, it is important to remember the occasional maintenance expenses that can come out of nowhere and end up costing more than a homeowner imagined. Therefore, homeowners should always set aside savings for big expenses that come along every few years. A few examples are roof repair and replacement; termite damage; water damage; mildew removal; paint/sealing (especially exposed wood) and appliance repair and replacement.

Articles you should read

The Hamilton Project recently released a report stating that retirees are becoming more and more dependent on home equity: Housing Increasingly a source of net worth in retirement

Cash buyers paying premium prices are making it a difficult market for those obtaining a loan, especially at the middle-class level: Cash buyers and premium prices leave middle-class home seekers locked out

Thanks to job growth, low mortgage rates and continued investment from both domestic and international sources, Southland sales hit a nine-year high: Southland home sales hit a nine-year high; prices up 5.5%

According to a recent article on CurbedLA, Los Angeles has the biggest difference between normal travel times and rush hour travel times in the nation- it is 43 percent slower during rush hour than non-peak hours: The worst day and time to drive on every LA Freeway

Notes on a Realtors Scorecard – Buyers staying longer, the Chinese aren’t just buying, prepare for El Nino and more!

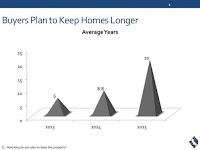

Buyers plan to stay put longer and the process of finding a home is taking more time– A recent survey of buyers by the California Association of Realtors “CAR” stated that buyers are planning to stay longer in their homes…for an average of 20 years! This is far above the six years that home buyers were forecasting in 2013. The survey also noted the process of buying a home is the longest it has been since CAR has been tracking the statistic. Even before contacting agents, buyers spent an average of 14 weeks exploring properties and neighborhoods. Once they engaged an agent, the process took an average of 12 weeks to get a home in escrow. The process is typically taking even longer in the nicer areas of Los Angeles due to low inventory.

Mar Vista closing the gap on South Santa Monica but not on the high-end:The popularity of Mar Vista with the young families and the Silicon Beach crowd has resulted in 17 homes in Mar Vista selling for over $2M in the first half of 2015. Only 10 sold for over $2M in the first half of 2014. No sales were made above $3M. In comparison, South Santa Monica (90405) had only 16 home sell for over $2M the first half of this year but five sold for over $3M. The average sale price was $2.658M while it was only $2.358M in Mar Vista. The appeal of Santa Monica’s school system, city services and better walk score will always create a value difference despite Mar Vista’s surge in popularity.

Chinese investors have been very busy purchasing property in LA, but some are selling…is this a sign?- For the past three years the international buyer, especially the Chinese, have made a big impact on Los Angeles real estate. In 2014, $22 billion in Southern California real estate was purchased by the Chinese. We are still seeing strong purchase activity from China but not at the rate we were seeing a year ago. With the Chinese stock market on shaky ground, we have seen an uptick of luxury homes being sold by Chinese property owners. With the financial markets in China predicted to continue to struggle, will this begin to negatively impact the So Cal housing market? In the mid to late 1980’s, the Japanese bought quite a bit of west coast real estate and were quite aggressive much like the Chinese have been. When the Japanese stock market crashed in the early 1990’s, a massive sell-off of Japanese owned property shortly followed and contributed to a fairly significant drop in Southern California real estate values. The dynamics are different but it is something to keep an eye on.

Fun Fact: Only 11% of California homes (including both renter- and owner-occupied homes) have an earthquake insurance policy, according to the California Earthquake Authority.

Mortgage note– If you pay $150-200 more a month toward your mortgage you will be surprised how much you will end up saving in the long-run even at the historically low interest rates we are currently experiencing.

Why should the homeowner lose the right to have grass? Is it fair for the government to dictate how much grass you can have in your yard? New construction and extensive remodels will require that only 25% of the landscaping be grass. We are in a significant drought but will that always be the case? Shouldn’t a land owner have the right to pay a higher rate for water if they choose? Instead of bothering homeowners who only account for a very small percentage of the state’s water use (state agriculture is the major water user) the state and local municipalities need to focus on capturing storm run-off and figure out more efficient ways for farmers to water crops. With a strong El Nino expected, it would be nice if Southern California could take better advantage of what is expected to be a significant rainy season.

|

| click to enlarge |

Speaking of El Nino…Prepare your property!– We strongly encourage all of our readers to deal with any potential drainage issues (ex- water not draining away from your home/foundation, clogged gutters, drains) sooner rather than later.

Home of the week- Quick $3.2M sale in Santa Monica near Pico– 2432 32nd street is a brand new 3,363 sq. ft. traditional 5+4 home on a large 9,007 sq. ft. lot that came on the market for $3.2M and immediately sold right after the broker caravan. The builder did a very nice job with the details of the home and when you combine its emotional appeal and large lot, one can start to look past the ½ block proximity to a stretch of Pico that is not the most aesthetically pleasing. The house features a large gourmet kitchen that opens to the living room, huge windows providing tons of natural light, vaulted ceilings, luxurious master and drought resistant landscaping with the majority of it featuring turf.

Home of the week- Quick $3.2M sale in Santa Monica near Pico– 2432 32nd street is a brand new 3,363 sq. ft. traditional 5+4 home on a large 9,007 sq. ft. lot that came on the market for $3.2M and immediately sold right after the broker caravan. The builder did a very nice job with the details of the home and when you combine its emotional appeal and large lot, one can start to look past the ½ block proximity to a stretch of Pico that is not the most aesthetically pleasing. The house features a large gourmet kitchen that opens to the living room, huge windows providing tons of natural light, vaulted ceilings, luxurious master and drought resistant landscaping with the majority of it featuring turf. Second quarter market report reflects robust housing market in Los Angeles

|

| click on image to enlarge |

The Los Angeles housing market continues to be robust with no signs of abating in the near future. Average sale prices hit record highs in many areas (both single family and condos) and the number of sales rose to the highest second-quarter total in a decade. . The Westside luxury market (ex. Santa Monica, Pacific Palisades, Beverly Hills) saw strong growth, proving the enduring value of these communities commands a premium.

Manhattan Beach reflects the vibrant and strong South Bay market where prices are up by double digit percentage points and the decreasing days on market shows a tight inventory crunch.

Property in areas where prices are a little lower such as Mar Vista and Westchester saw some of the largest appreciation.

Overall, Los Angeles County is on the rise as the value of all assessed taxable property in the county has risen 6.13% in 2015, the largest jump since 2010.

Please click on the image below to download the full report and if you need more detail on your neighborhood please contact us and will be happy to help.

Average rate on 30-year mortgage falls

The average rate on a 30-year fixed-rate mortgage declined to 4.04 percent from 4.09 percent a week earlier. The rate on 15-year fixed-rate mortgages slipped to 3.21 percent from 3.25 percent. As in recent weeks, mortgage rates followed the yield on the key 10-year Treasury note, which declined.

Bond yields for Treasury’s were pushed lower by a rise in bond prices.

The average fee for a 30-year mortgage was unchanged from last week at 0.6 point. The fee for a 15-year loan also held steady at 0.6 point.

With mortgage rates at low levels and the economic recovery in its sixth year, home-buying has recently surged as more buyers have flooded into the real estate market. Data issued Wednesday by the National Association of Realtors showed that Americans bought homes in June at the fastest rate in more than eight years, pushing prices to record highs as buyer demand has eclipsed the availability of houses on the market.

Mortgage rates still remain relatively low due primarily to near-zero short-term borrowing rates set by the Federal Reserve, as well as the present lack of investment opportunities for the excess sums in bonds and on deposit with the Fed. This allows homebuyers to borrow more mortgage funds with relatively unchanged incomes. However, mortgage rates will likely begin to increase steadily in late 2015 as the bond market anticipates the Fed’s inevitable short-term rate hike.

The median home price has climbed 6.5 percent nationally over the past 12 months to $236,400, the highest level — unadjusted for inflation — reported by the Realtors.

Sources: LA Times and Housing Wire

Westchester residents excited about 30 million dollar facelift set for Howard Hughes Center

Westchester and Playa Del Rey residents received some welcome news when the new owner of the Howard Hughes Center announced they would be spending $30 million dollars to upgrade the facility. With Playa Vista continuing to grow with a new Cineplex, restaurants and a Whole foods, the close access to these amenities will continue to fuel the surge in popularity with young families that Westchester has been experiencing over the past four years.

The large-scale overhaul will be designed by Jerde Partnership (which designed Universal CityWalk and the open-air renovation of Santa Monica Place) and aimed at creating smoother entries into the compound for walkers, like a new crossing planned for Center Drive. Meanwhile, the courtyard across from the Cinemark Theaters will become the “center” of the complex and get a new outdoor film screening area and a fire pit. By Laurus’s estimates, Howard Hughes Center “will soon hold nearly 3,200 new multifamily units,” including the luxury Altitude apartments, “and more than 1.3 million square feet of office space.” That’s a lot of potential shoppers. Renovations are supposed to begin immediately.

The large-scale overhaul will be designed by Jerde Partnership (which designed Universal CityWalk and the open-air renovation of Santa Monica Place) and aimed at creating smoother entries into the compound for walkers, like a new crossing planned for Center Drive. Meanwhile, the courtyard across from the Cinemark Theaters will become the “center” of the complex and get a new outdoor film screening area and a fire pit. By Laurus’s estimates, Howard Hughes Center “will soon hold nearly 3,200 new multifamily units,” including the luxury Altitude apartments, “and more than 1.3 million square feet of office space.” That’s a lot of potential shoppers. Renovations are supposed to begin immediately.

Sources: LA Times and Cubed LA

Two mixed use projects proposed for Downtown Santa Monica

The Santa Monica planning commission is recommending two development agreements with NMS properties that will create much larger mixed use sites than what currently occupy the land. The locations are 1560 Lincoln Blvd. (currently Denny’s) and 1415 5th street.

Both projects are right near the light rail line connecting Downtown Los Angeles with Santa Monica. The increase in residential units will continue to add to the congestion that already plagues the area.

Check out the full article here: Mixed use projects recommended for Downtown Santa Monica

(Source: Santa Monica Daily Press)

Notes on a Realtors Scorecard- Hot market persists despite some realtors slowing down…is your title insurance up to date…Future housing realities in SM…3 quick sales in Mar Vista

Hot market but cooling off for some realtors: While talking to colleagues that represent many of the different brokerages that service the Westside, the majority noted they have slowed down compared to 2014. Last year was great for many of us so a slow-down is understandable yet the market is still appreciating and sales volume overall is higher, making it puzzling that many of these reputable/high producing agents have slowed down. The reasons given for the slow-down are the lack of inventory, frustrated buyers deciding to step away from the market and more competition from out of area agents. It will be interesting to see if this trend sticks as we expect the market to continue to appreciate and see multiple offers on market price homes through the rest of this year.

Future housing realities in Santa Monica?: Check out this opinion piece, “Housing Realities in the Bel-Air by the Sea“, which appeared in the Santa Monica Daily Press about the amount of housing being built and what Santa Monica can actually handle. Very interesting…sounds like traffic could get even worse in #gridlockcity.

Is your title insurance up to date? A common mistake we see is when owners voluntarily transfer title to other family members or entities like Trusts, LLC’s, Partnerships and Corporations. If the title company insuring the owner/property is not notified and asked to insure the transfer into the entity through a policy endorsement 107.9, then the title insurance is nullified. This is something that can be easily fixed through a policy endorsement which generally ranges from $50-100 depending on the insurer. If you come across this scenario, please contact your title representative, or, if you don’t have one, please contact our office and we will get you connected with the right person.

The skinny on three homes that just went into escrow in Mar Vista:

3330 Keeshen Drive- Located on Mar Vista hill, this 4,220 sq. ft. 2007 built Traditional on a 5,786 sq. ft. lot, hit the market on June 11th for $2.689M and promptly went into escrow after the broker caravan. The rumor is they had a solid offer come in right off the bat and the seller accepted it. The home features high-end finished throughout, cook’s kitchen, huge master bed/bath with city views and a backyard with a fire pit and built-in barbecue. We were a little surprised this sold as fast as it did with a small yard but it is tough to find homes in Mar Vista that are over 4,000 sq. ft.

3568 Veteran– This brand new Cap Code Westside Village home hit the market on June 10th with a list price of $1.795M. They immediately received a very strong offer the day after the first open house and accepted it on June 15th, despite telling agents that offers were due on the 17th. The house is a 5 bed/6 bath consisting of 3,611 sq. ft. on a 6,174 sq. ft. lot. It is a great family home with high-ceilings, large living room, cook’s kitchen and each bedroom has its own bathroom.

3540 Ashwood Avenue– This simple 3+3, 1,508 sq. ft. home sitting on only a 4,900 sq. ft. lot was listed on June 4th and received nine offers at the $1.295M list price. The listing agent countered the top five initial bidders with a price of $1.4M and no appraisal contingency period. A response to this counter offer was accepted a few days later. If the $1.4M counter was accepted, this charming south of Palms home with an open floor plan, sold for over $925 a sq. ft.! Wow!