Skinny On Real Estate

Notes on a Realtors Scorecard: The craziness continues…

The real estate market has picked up steam and is outperforming all expectations with listings and sales once again setting new records: The strong seller’s market has not shown any signs of subsiding this year. Through the first quarter of 2015, we are experiencing multiple offer madness with a lack of inventory for eligible buyers. We seem to have about five buyers for every reasonably priced home or condo that comes on the market. The environment for buyers was tough the past 18 months but now it seems to have hit another level. Buyers with conventional loans are having to compete with more all-cash buyers thanks to continued foreign investment, an influx of even more builders and flippers and Silicon Beach making the tech industry a huge player in Los Angeles.

In my estimation we have passed the hysteria experienced in the last housing peak but as long as interest rates stay low and the Westside and South Bay is a destination in the tech world, housing prices will continue to increase over the next 18 months.

Follow-up: I am starting to hear the same thing I heard in 2006 when the market was at its height. Real estate on the Westside never goes down. We know this is not true. We must always remember real estate, even on the Westside, does experience downturns and anybody who tells you likewise is fooling themselves. In the long-run it is a great investment but it can be a high risk/high reward situation if you have a short-term horizon.

Sales volume up: According to Progressive and Chicago title companies, new title orders (indicating a home sale or refinance) are up 10% from last year and if you take into account refinancing, title orders are up 15-20% with people taking advantage of higher equity in their homes and low interest rates.

90402 has a robust 1st quarter: The first quarter of 2015 is up over 20% in terms of the average price per square foot of homes sold compared to 2014. The number of listings sold is up from 13 in the 1st quarter of last year to 15 this year and sellers are receiving over 100% of their asking price. Properties listed for sale in the first quarter of this year average being on the market for just 38 days while last year the average was 133 days. Most of the properties are being bought with cash or a large downpayment with appraisal and financing contingencies being waived.

California not the most expensive when it comes to property taxes: While real estate property taxes in California have gone up in recent years, the good news is that California is not one of the most expensive states. The average American household spends $2,089 on real estate property taxes each year. The average for the entire state of California is $1,431.

Quick look at a few headline sales in April: Brentwood- 230 North Carmelina sells slightly over asking for $10.4M- This John Byers designed 5+4.5 home situated on a 35,000 sq. ft. lot in prime

Quick look at a few headline sales in April: Brentwood- 230 North Carmelina sells slightly over asking for $10.4M- This John Byers designed 5+4.5 home situated on a 35,000 sq. ft. lot in prime

Brentwood sold for over the $10.250M asking price despite being on the market for about a month before going into escrow. They received multiple offers a few weeks into marketing the property which has a great layout for entertaining and a large master suite. The property needs some cosmetic upgrades and is another example of the premium buyers will pay for large lots on the Westside.

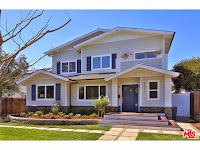

Westchester- 7911 Denrock Ave sells for $1.825M: This 5+5 Cap Cod style new construction boasting 3,250 sq. ft. on a 5,788 sq. ft. lot in prime North Kentwood is another example of the luxury properties that are being built in Westchester. The property received multiple offers and sold over the $1.799M asking price and closed on April 24th.

Culver City- 4269 Vinton Ave sells for $1.338M: This 4+3, 2,209 sq. ft. traditional style home on a 5,774 sq. ft. lot had six offers and sold over the $1.299M asking price. It has some nice features including Brazilian hardwood floors and a spacious Master suite. The house has a bit of a funky floorplan but not enough of one to trip up potential buyers.

Partners Trust in the rankings: The Los Angeles Business Journal ranked Partners Trust in the top ten of all real estate agencies in Los Angeles and listed among the leading independent franchises in the city. Real Trends named us as the 86th highest brokerage by volume nationwide and 20th in California

$1 Million over asking! Three April examples- Brentwood and Santa Monica

Brentwood: 1626 Old Oak Road- Listed at $4.8M and sold for $6.535M!: This tear-down/major

remodel candidate was in high demand thanks to being located in highly desired Sullivan Canyon and boasting a 28K flat lot. The property had over 10 suitors and sold in an all cash deal.

12251 Castlegate- Listed at $3.650M and sold for $4.826M- $1.2M over list price: This 18K flat lot was in high demand thanks to being on a cul-de-sac street with views of the Getty, Mt. St. Mary’s and the ocean. The mid-century home that occupies the property will be torn down.

was in high demand thanks to being on a cul-de-sac street with views of the Getty, Mt. St. Mary’s and the ocean. The mid-century home that occupies the property will be torn down.

Santa Monica- 428 19th Street sells for $4.8M…$800K over the asking price: This elegant

Mediterranean North of Montana home is a 5+4, 4,460 sq. ft. home situated on a 8,932 sq. ft. lot. The house features soaring ceilings, great natural light, gourmet kitchen, huge master suite overlooking a Jay Griffith designed backyard and pool.

Articles you should read

1- The Incredible Shrinking Mega-City: How Los Angeles has engineered a housing crisis

2- Santa Monica City Council takes first steps to reign in short-term rentals

3- For millennial home buyers, only Honolulu is pricier than Southern California

4- Cash out refinancing is making a comeback as home equity rises

5- Silicon Beach expansion- Snapchat signs leases to expand in Venice

New water heater regulations now in effect leading them to be bigger and more costly

Changes in hot water heater regulations may cause a routine replacement to become an unexpectedly expensive endeavor. New federal regulations aimed at increasing Energy Factor (EF) ratings, require hot water heaters that are larger, more costly and more environmentally conscious than what is required under current regulations.

With these changes, homeowners will face increases in cost between 15 and 35 percent. The new regulations require a more complicated installation and an increased amount of system parts. The larger size of the new units could create an additional unforeseen expense. Electric hot water heaters larger than 55 gallons (the minimum size for most residential units) will require a minimum of 128 cu. ft. with a duct to a larger space in order to comply with these standards. For many homeowners, that could lead to a major renovation involving construction and a greater cost.

With these changes, homeowners will face increases in cost between 15 and 35 percent. The new regulations require a more complicated installation and an increased amount of system parts. The larger size of the new units could create an additional unforeseen expense. Electric hot water heaters larger than 55 gallons (the minimum size for most residential units) will require a minimum of 128 cu. ft. with a duct to a larger space in order to comply with these standards. For many homeowners, that could lead to a major renovation involving construction and a greater cost.

On a positive note, the savings on your utility bill will be around 25% and most tankless water heaters already meet efficiency standards.

Population Growth in LA is outpacing new housing…and it isn’t even close

Waves of new residents are outpacing new housing stock in the country’s least affordable rental markets, according to a Zillow analysis of U.S. rental and mortgage affordability.

In Los Angeles, where renters spend an average of 48.2 percent of their monthly income on rent, only 187 new housing units were added for every 1,000 new arrivals between 2012 and 2013. In New York, it was 383 per 1,000 newcomers, and in San Francisco, it was just 193.

The middle class increasingly feels the pinch, according to Christopher Herbert, managing director of Harvard University’s Joint Center for Housing Studies. “Low-income people have always had trouble finding affordable housing, but now as rents have gone up, that’s true of middle-income people as well,” said Herbert, who cites income declines as a major culprit.

Source: Housing Wire

Los Angeles mansionization laws could negatively impact the value of your property

Bowing to the demands of the anti-mansionization crowd, The Los Angeles City Council’s Planning and Use Management committee has approved temporary measures that could be in effect up to two years while the city fully updates the old ordinance.

The Baseline Mansionization Ordinance, which has been in place for years has some loopholes and the city council is looking at enacting stricter rules. It is very important that residents understand the repercussion for having strict building codes that cut down on the square footage of a home being built. Grotesque over-sized mansions on small lots are ugly and should be curtailed. However, strict rules such as stating basements have to count toward the square footage even though they are not visible at street level is a bit extreme.

In specific zip codes, the allowable home size is 50% of the lot size for residential lots less than 7500 square feet. With the size of new homes reduced, the resulting property value may decrease as well. The value of an older home that is purchased with the intention of either building new or enlarging its size is most often a home that is priced at the lower end of the market in a neighborhood, and those homes will likely suffer a reduction in value since the home size that can be built on that site will be reduced.

If you would like more information, here is a good article that appeared in the times last month.

Temporary LA Mansionization rules could be in effect for two years

A look at the numbers: 1st quarter 2015 statistics

The Westside real estate market continues to hum along with the market appreciating at a strong pace in 2015 and overall sales volume up compared to the 1st quarter of 2014. Click the graphic below for access to the Partners Trust statistics page which will provide you with a link to the 1st quarter 2015 report along with the ability to check out reports from the past three years.

Mortgage rates increase this week but still low compared to last May

Mortgage rates rose this week to the highest level since the week of March 12. The 30-year, fixed-rate mortgage averaged 3.80% with an average 0.6 point for the week ending May 7, 2015, up from last week when it averaged 3.68%. A year ago at this time, the 30-year fixed rate mortgate averaged 4.21%.

Source: Housing Wire

Average rate on mortgages drops to 3.63%…lowest since May 2013…Will this continue?

Average long-term U.S. mortgage rates fell for the fourth straight week, with the 30-year rate again marking its lowest level since May 2013.

The nationwide average for a 30-year mortgage slid to 3.63% this week from 3.66% last week. The average for a 15year mortgage, a popular choice for people who are refinancing, dipped below 3% to 2.98%.

The ongoing decline in rates lured a crop of prospective buyers, as applications for mortgages marked their biggest weekly gain last week in over six years.

Applications jumped 49.1%, the biggest weekly increase since November 2008, according to the Mortgage Bankers Association.

Worries about economic troubles in Europe and Asia have sent mortgage rates plunging despite positive indicators regarding the domestic economy with rising consumer confidence and increases in wages. That strength contrasts with a European economy so fragile that the European Central Bank is expected later to launch a bond-buying program similar to the stimulus the Federal Reserve employed here as an extraordinary reaction to the Great Recession.

With once booming emerging economies from Brazil to China now slowing as well, spooked investors around the world are seeking the haven of ultra-safe government bonds. The effective annual interest rate on 10-year securities issued by Germany and Japan has fallen well below 1%, and the yield on 10-year U.S. Treasury notes dropped below 2% for the first time in three months. With bond investors accepting lower yields on these securities and on the Ginnie Mae bonds backed by Federal Housing Administration and Veterans Administration home loans, mortgage bankers can lower the rates charged to consumers.

Global uncertainty continues to be the friend of the American home-buyer and it should stay that way through most of 2015. Once the Europeon economy starts to stabilize expect rates to begin the climb that has been expected since early last year.

Sources: LA Times, Housing Wire, Fortune

Notes on a Realtors Scorecard- a look back at 2014 and what 2015 may hold…

– There is a new addition to the Skinner family! Dax Kenyon Skinner was born December 30th and both he and Jill are healthy and doing well. Here’s a picture from the proud dad.

– There is a new addition to the Skinner family! Dax Kenyon Skinner was born December 30th and both he and Jill are healthy and doing well. Here’s a picture from the proud dad.

– Thanks to wonderful clients who continue to provide amazing referrals, we had our best year ever. Despite the lack of inventory plaguing the market, we were able to increase our number of transactions compared to 2013 and we also were involved in six off-market transactions even though off-market activity has also slowed down.

– Price appreciation continued in upward trend on the Westside in 2014 thanks to low inventory, low interest rates, the presence of Silicon Beach expanding its economic footprint and international investors feeling good about the Los Angeles luxury market. Though price appreciation slowed down in the second half of the year compared to the torrid pace of the previous 36 months, demand still outpaced inventory which led to multiple offers on any homes that were listed at an appropriate price. Even though Buyers were desperate for properties, the premiums they were paying above market in the second half of the year decreased with an eye more on value instead of hysteria. Greedy sellers who listed properties over market value were quickly forgotten about.

– Areas that were scorching hot in 2014: 1- Westchester 2- Venice 3- Mar Vista 4- Santa Monica 5- Culver City

-The same areas that were hot in 2014 will continue that trend in 2015 with Playa Vista also garnering a lot of attention with its newest build-out becoming available. Playa Vista is very popular with the tech-savvy Silicon Beach crowd.

– Unless the national economy goes into a tailspin over dropping oil prices, we expect continued price appreciation in 2015 though not at the prolific clip of prior years. Inventory will still be low in comparison to historical data, but we expect it to increase, providing more options to buyers compared to the past two years. The strong price appreciation of the past three years will entice some sellers to cash out and take advantage of low interest rates on an up-leg property.

– Unless the national economy goes into a tailspin over dropping oil prices, we expect continued price appreciation in 2015 though not at the prolific clip of prior years. Inventory will still be low in comparison to historical data, but we expect it to increase, providing more options to buyers compared to the past two years. The strong price appreciation of the past three years will entice some sellers to cash out and take advantage of low interest rates on an up-leg property.

– One issue that will continue to contribute to low inventory is seller’s not wanting to lose the property tax basis they currently have on their property. If you purchased a home for $1M, you are paying property taxes on the purchased amount and not today’s value even if today’s value is now $2M. An up-leg purchase for that Seller could be around $3M so the increase in property tax triples. -Partners Trust consistently networks with the most productive agents across the country in upper end markets and those agents are experience many of the same things we are and expect modest appreciation and consistent buyer demand in 2015.

– One of the most desired zip codes on the Westside, 90402 (north of Montana in Santa Monica) is a great example of the shrinking inventory we have experienced the past few years. In 2012, the # of closed sales in the 90402 zip was 122. In 2013, it dropped to 101 and in 2014 it was just 94.

– Housing prices in Los Angeles have grown four times faster than incomes since 2000. Not only is Los Angeles the lease affordable in the nation, but according to a Harvard study, half of all households in the region are considered “cost burdened” and one and four households spend at least half its income on housing.

– LA County has 7 of the 10 ZIP codes with the worst overcrowding in the nation.