Skinny On Real Estate

Marriage is no longer a pre-requisite for buying a home…it is so expensive friends are going in on a mortgage together

Over the past few years we have experienced a new phenomenon in representing buyers. Individuals who are good friends, or couples who are not married, have reached out to express the desire to purchase a home. The Westside real estate market is so expensive that it is pricing out the single home buyer and people are doing what they can to invest in the market as opposed to paying rent.

Though the idea initially sounds good, it is extremely important to have a written agreement (often referred to as a tenant-in-common agreement) documenting all the terms of the parties’ agreement, including a way to terminate the agreement, before purchasing a property.

The LA times recently wrote an informative article about this trend among couples purchasing before they get married.

Article: Marriage is no longer a pre-requisite for buying a home

We said Westchester was HOT and the LA Times has noticed

A few weeks ago the LA times wrote a nice article on Westchester enjoying a housing surge which we noted throughout 2014. Our clients who have bought in the Kentwood and Loyola Village areas of Westchester are quite happy with the family friendly atmosphere and ability to be just minutes away from the South Bay and Santa Monica.

We continue to expect these neighborhoods in Westchester (Westport Heights is also on the upswing) to appreciate in value. With better education options popping up due to charter schools, and the next phase of the Playa Vista development eventually providing great entertainment and shopping options, Westchester shows no signs of slowing down.

Article: Buoyed by Silicon Beach, Westchester enjoys a housing surge

Homeowners over 65 can often get property tax exemptions

Homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled. These exemptions could reduce their tax bills by hundreds of dollars, or more than $1,000 in some wealthier districts.

To win voter approval for school parcel taxes, many K-12 districts offer exemptions to people 65 and older. But they don’t often publicize the exemptions or make them easy to get.

To qualify, homeowners generally must live in the home as their primary residence. They must request, fill out and send in application provided by the district, generally with proof of age, ownership and residency. Some districts require seniors to fill out a new application every year, others renew it automatically.

Most require seniors to apply by a certain date, often in May or June, to get an exemption for the tax year that starts July 1. Some will grant an exemption retroactively for applicants who miss the deadline, many will not. People do not have to be 65 when the tax was approved to get the exemption; they can apply when they turn 65.

Another thing homeowners can do is look up the ballot measure for the tax and see if any exemptions were offered.

Articles you should read- FHA to lower mortgage insurance fees; High End sales are surging and New Fannie Mae program could foul up appraisals

FHA to lower mortgage insurance fees

The Federal Housing Administration will lower its fees for mortgage insurance to encourage purchases by first-time and middle-income home buyers. The annual premiums will drop to .85% from 1.35% of the total loan amount. The average borrower will save about $7500 over a decade of payments under the new fee plan.

Article: FHA to lower mortgage insurance fees

New Fannie Mae program could negatively impact appraisals

Starting Jan. 26, Fannie Mae plans to offer mortgage lenders access to proprietary home valuation databases that they can use to assess the accuracy of and risks posed by the reports submitted by appraisers. The Fannie data will flag possible errors in the appraiser’s work before the lender commits to fund the loan, score the appraisal for overall risk of inaccuracy and may provide as many as 20 alternative comparables. This new layer to the process is predicted to delay closings and add higher costs to the appraisal besides causing potential valuation conflicts if Fannie’s data is not able to recognize differences between adjacent neighborhoods.

Article: New Fannie Mae program could bust deals, appraisers say

High End sales are surging

The high end is hopping in Southern California. The number of homes bought for $2 million or more in recent months is the highest on record. Sales worth $10 million or more doubled their number from the heights of the housing bubble.

Article: High end home sales are surging in Southern California

Mar Vista and Santa Monica- A look inside the September numbers

Mar Vista: The hysteria of multiple offer madness is definitely dying down compared to last year. In 2013, Mar Vista had 25 sales for September with 19 of them over asking and the average sale going for 4% of the list price. The average days on market “DOM”, was 40. The median sale price was $945,000. This year, Mar Vista had 29 sales with only 11 over asking. Of those, 8 were at asking and only three were 5% over the asking price. The DOM increased to 51 as did the median sale price to $972,500. The average sale went for about 2% under the list price, a 6% difference compared to September 2013. Price have exploded so much in Mar Vista that a premium is already priced into the market and seller cannot expect the crazy multiples of last year unless they price it under market.

An example of an undervalued list price is 3031 Midvale, which was listed for $1.095M. The 3+2, 1700 sq. ft. (approximate) home on a 6,098 lot, is in escrow for around $1.2M which is around what I thought it would sell for when offering a price opinion. It was an all cash buyer and they received eight offers.

Santa Monica: Santa Monica saw a nice increase in sales compared to September 2013 with most of the sales in the southern part of the city. Last September, Santa Monica had 18 sales with 6 over asking and a median sales price of $2.431M, a sign that most of the sales were in the more expensive northern part of the city. The DOM was 56. The average sale was 2% under the list price.

This year, Santa Monica had 27 sales, 11 over asking with 3 at least 5% over. DOM matched last year’s with 56 and the median sales price was $1.979M. The average sale was just under 1% of the list price.

The craziest sale of the month was 2223 Cloverfield. The authentic Spanish 3+3, 2,132 sq. ft home on a 6,263 sq. ft. lot received over 10 offers. The list price was $1.699M and sold for 2.001M, 300K over the list price, despite being fairly close to Pico Blvd. The house had a strong emotional pull combining old world Spain with today’s modern amenities.

The sale of 881 Berkeley to a developer for 225K over asking shows developers are not slowing down in acquiring properties. The 11K lot was in high demand as large lots with ocean views are hard to come by in Santa Monica. It was listed for 2.375M and sold for 2.6M.

*Source- Multiple Listing Service- does not include any off-market activity

Westwood and Westchester both have a strong September compared to last year

Westwood: September was a strong month. The lack of inventory only led to 19 sales (11 over asking- 5 that were 5% over list), but that was five more than last year. The DOM of 44 days was less than the 54 of 2013 and homes sold for 2% over list price compared with .5% above list last year.

This is unique since Westwood had quite a few high-end home sales with a median sales price of $2.05M compared with last year’s $1.567M. Typically you see a little more of a premium paid when the median for the month is lower as more affordable properties were sold.

The most noteworthy sale was 10737 Le Conte, which sold for $500K over the asking price. The classic traditional 4+4, 3,469 sq. ft. home on a spacious 8,235 lot, received33 offers. It is in good shape but the kitchen and some bathrooms could use updating. The property was listed for $2.095M and sold for $2.615M. It is located in a premier Westwood location within walking distance to UCLA and the village.

The most noteworthy sale was 10737 Le Conte, which sold for $500K over the asking price. The classic traditional 4+4, 3,469 sq. ft. home on a spacious 8,235 lot, received33 offers. It is in good shape but the kitchen and some bathrooms could use updating. The property was listed for $2.095M and sold for $2.615M. It is located in a premier Westwood location within walking distance to UCLA and the village.

Westchester: Viewed as an affordable alternative to the pricier neighboring communities of Mar Vista and El Segundo, Westchester is one of the most popular areas with buyers right now. Once people visit areas like Kentwood and Loyola village, they are hooked and ready to buy.

September only saw 29 sales compared to 32 in 2013, but average sale price was 1% over the asking price, increasing from .65% the year before. The median sale price was $880K with a DOM of 51. The median sale price in 2013 was $760K with a DOM of 48.

Two sales stood out this month. They both feature large lots and are very inviting to medium to large families. 6415 Riggs Place, which sits on a bluff overlooking the city, is a 3+3, 2,948 sq. ft. traditional on a 14,630 lot with a phenomenal back-yard. Riggs is one of the most desirable streets in Westchester. The house was listed in an auction type manner at $1.550M and perspective buyers were asked to submit best and final right away with no possibility for a counter. The winning buyer paid $200K over asking settling at $1.750M. The house was in solid shape but will most likely be remodeled and expanded. It was a steep price to pay but worth it when you can grab that combination of lot size and views.

Two sales stood out this month. They both feature large lots and are very inviting to medium to large families. 6415 Riggs Place, which sits on a bluff overlooking the city, is a 3+3, 2,948 sq. ft. traditional on a 14,630 lot with a phenomenal back-yard. Riggs is one of the most desirable streets in Westchester. The house was listed in an auction type manner at $1.550M and perspective buyers were asked to submit best and final right away with no possibility for a counter. The winning buyer paid $200K over asking settling at $1.750M. The house was in solid shape but will most likely be remodeled and expanded. It was a steep price to pay but worth it when you can grab that combination of lot size and views.

634 West 78th street, a 3+2, 1,913 sq. ft. traditional on a 9,597 lot also has a great back-yard which caught the attention of multiple buyers. The home is in need of some cosmetic upgrades but in good enough shape to move into without any work. It was listed for $1.195M and sold for $1.235M.

*Source- Multiple Listing Service- does not include any off-market activity

Interest rates hit low for the year

Earlier this week lenders offered a 30-year fixed-rate loan at an average interest rate of 3.81%, down from 3.96% last week. This week’s average was the lowest since the week of June 20, 2013, when they were offered at 3.93%. Just a few weeks ago rates were going in the opposite direction and rising to around 4.23%. These rates are on loans up to $417,000. Jumbo loan rates (above $417K) will be higher but in the same ball park.

The average rate for a 15-year fixed loan was 3.18%, down from 3.3% last week. The 5/1 adjustable rate mortgages also feel from 2.83% to 2.7%.

Sources: LA Times, Zillow and Housing Wire

Santa Monica Ballot Measure H proposes to triple transfer tax in Santa Monica

The City of Santa Monica wants to triple the transfer tax on homes sold for over $1 million dollars beginning January 1, 2015. The current transfer tax in the city is $3.00 per $1,000. On the sale of a million dollar property, the transfer tax is $3,000. The new proposal wants to raise it to $9.00 per $1,000 making it $9,000 on the same million dollar property.

The city states they need the extra funds to further enhance the quality of life in the community of Santa Monica and help redevelopment efforts. In 2012 all city redevelopment agencies in California were dissolved due to budget cuts. Currently, Santa Monica has a lower transfer tax compared to Los Angeles ($4.50 per $1,000), but the new proposal would double that of Los Angeles.

With property values increasing over 40% in the Santa Monica over the past three years, the city is already seeing increased revenues from the transfer tax. The average median home sale in Santa Monica is approaching $1.3M and the large majority of residences in Santa Monica will be impacted by this increase.

Further, how fair is this to the people who bought at the height of the 2005 market. The market has recovered above those numbers but this unexpectedly cuts into a seller’s bottom line and ability to purchase an up-leg property. Sellers in Southern California are expected to pay the transfer tax (though it is negotiable) and this would increase the total closing costs for Santa Monica residents about .7%. The county of Los Angeles also receives $1.10 per $1,00.00 as well. Assuming a 5% brokerage fee and the numerous fees that go with selling a home, Santa Monica residents are looking at 9% in sale expenses.

If you are going to increase the transfer tax, why not make it less daunting, maybe $5.50 per $1,000.00? This seems like a dramatic jump for a city that already levies increased taxes on the purchase of a car and charges a 9.5% sales tax compared to LA’s 9.0%. A good chance exists this measure will pass with a majority of renters in Santa Monica and the powerful group Santa Monican’s for Renters Rights pushing to get this passed. Feel free to read more about Measure H.

The days of trying to hide the sale price of a home officially ends January 1st, 2015

Years ago it was a common practice for celebrities and developers to try and hide what they bought a property for. This was done by having the tax stamps put on the back of the deed instead of the front.

Lately, the Multiple Listing Service “MLS” and the county of Los Angeles have been combating this tactic and checking the back of the documents and able to produce the sale price within six months.

Effective January 1st, 2015 AB 1888 requires the amount of tax due and the location of the property to show on the face of the document on ALL properties. You can no longer close escrow and try and

withhold the sales price from the public. The MLS and various realtor groups have been campaigning for this as it makes the valuation of properties more accurate and puts everyone on a level playing field.

Articles you should read- So Cal rents to jump; Sales pick-up in September; Downtown LA drawing New York investors

Informative articles from the LA Times you should be aware of:

Southern California Rents to climb over the next two years– The average cost of rent over the next two years in Southern California is expected to climb 8% over the next two years. Economists predict vacancy rates to stay low with an improving economy. Wages are not increasing at this rate which could impact whether rates will increase to the predicted level.

Home Sales pick up pace in So Cal for September– It’s the latest sign of a housing market that’s reaching equilibrium after years of big swings. Real estate agents and other market watchers this summer have reported growing inventory, price cuts and a shift in the market toward regular buyers, instead of the flood of investors and cash-only purchasers.

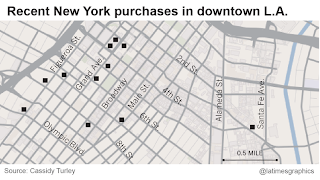

Downtown LA real estate is drawing New York Investor’s interest– New York investors love the growth potential and recent progress in the multiple dynamics that Downtown LA is offering