Skinny On Real Estate

SELLER AND BUYER BEWARE: buyer non-representation can lead to a myriad of issues.

After closely examining closed transactions on the Westside over the past few months the occurrence of the same sales agent(s) representing both sides of the deal stood out. This trend is a little alarming to some seasoned real estate agents and hope buyers an d sellers understand the substantial risks involved with dual agency to try and save a few bucks.

d sellers understand the substantial risks involved with dual agency to try and save a few bucks.

The seller and buyer will argue they can potentially drop the commission amount and it can be beneficial for both sides of the transaction. Furthermore, the agent will state it is easier for them to manage the deal as it eliminates another agent and they can “control” things more easily. Everybody will save money and the agent will pocket more money meaning everyone is happy is right? Not so fast.

Oftentimes these deals can get quite messy for a myriad of reasons. First and foremost the agent has a fiduciary responsibility to both sides of the transaction and a duty to disclose all facts and be honest and deal in good faith with loyalty. How can an agent who was initially employed by the seller (and will be paid by the seller) fulfill its fiduciary responsibility to the buyer? How can they be loyal to both sides when they have conflicting interests?

When an agent representing both sides of a transaction discusses a purchase price with the buyer and what they are willing to pay, wouldn’t that provide the agent intimate knowledge of where they can get a deal with the seller even though the buyer/seller might be willing to pay more? How does an agent properly juggle that? Throw in the fact the agent will make at least 1% to 2% more by getting the deal done as opposed to having another agent involved or even worse not properly disclosing known facts.

Where does the agent’s priority lay? On a typical $1.5 million dollar purchase on the Westside the difference to the agent could be an extra $15-20k.

The agent will literally have to walk the line perfectly to pull this off and many of the agents who are partaking in this are not the types to do this and frankly most have a reputation for being greedy. Many will justify their actions and say they referred the buyer to a buyer’s agent in their office. In this case the agent is getting a major cut of the “buyer’s agent” commission which still leads you to wonder where the fiduciary responsibility lies.

The language of the Real Estate Agency Relationships Disclosure is somewhat fuzzy when it comes to this. After being in this business for over 8 years I find it fascinating that one sales agent can represent both sides. In legal cases does the same lawyer represent both sides? In the case of referring the buyer to a buyer’s agent it is the same thing. Would the other side of a case go to an associate working under the partner who has the other side?

In the end it is the agent that ends up with the best deal and the buyer and seller in a potential lawsuit as lawsuit occurrences where one agent is involved is much higher than in a normal transaction.

A good buyer’s agent will earn their commission and also give the seller piece of mind that they have been properly represented.

Anybody who is looking to list a home with a sales agent should always ask the sales agent how they feel about representing both sides and how frequent they do it. Be wary of agents who tout the ability to represent both sides. A few successful Westside agents have a reputation for not making properties readily available for other agents to show to clients and have also gone to the lengths of not even presenting offers to the seller that were made by other agents. This is especially prevalent with short sales and lender owned properties where the listing agent is dealing with a negotiator on the other end that is working on 100 other transactions.

As a seller you have to completely trust that your agent is presenting every offer and most importantly that other agents want to show your property since they might be prejudicial toward your agent due to the “shelving” of contracts in the past.

Unfortunately greed is king in real estate and as much as I hate to say it this industry is full of people who will stop at nothing to take advantage of a situation where they can control everything and make more money doing it without much concern for either side.

Many reputable agents do not represent both sides in a transaction unless explicitly told to do so by the seller. We applaud those agents who understand the fiduciary responsibility they have to their clients and do not let greed interfere.

**Please note this only pertains to sales agent’s and not brokerage houses. Many brokerage houses like Prudential employ thousands of agents as Independent Contractors so having a company like Prudential represent both sides is not the issue. The issue is having the same sales associate represent both sides.

Typical 30 year Mortgage back above 4%

Blink and you may have missed it — the average rate on a 30-year fixed mortgage rate has crept higher since plunging to a record low of less than 4% late last week.

On Thursday Freddie Mac stated the 30-year loan was being offered at 4.01% on average for solid borrowers who paid 0.7% of the loan balance upfront in lender fees and points.

In the Western U.S., including California, the typical rate was lower at 3.95% early this week. Both figures are record lows.

*Source: LA Times

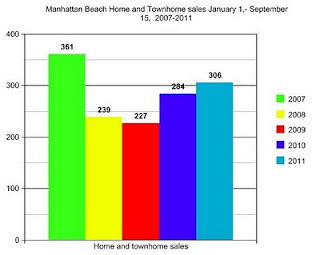

Sales volume increases in Manhattan Beach but median price down 6%

Sales volume is the highest it has been in Manhattan Beach since 2007 despite the tight inventory of appropriately priced listings. The rise in sales volume doesn’t mean prices have gone up as the median price was down 6% for the city compared to last year. Check out the sales volume graph below comparing the past four years:

Source: Manhattan Beach Confidential

Source: Manhattan Beach Confidential

Governator’s old compound in Pacific Palisades back on the market

14209 West Evans Road-Pacific Palisades- The Pacific Palisades home once owned by Former Governor Arnold Schwarzenegger and soon to be ex-wife Maria Shriver is back on the market with another broker but interestingly at a much higher price. This 9 bed/9 bath 10k sq. ft. house on approximately 2.5 acres has been on a pricing roller coaster since it was listed in 2006 for $26 Million. For the past five years the house has traded brokers and zig zagged on price. The house dropped to a list price of $23M and then again to 21.9M in late 2007 to 18.9M in 2009 and then dropped to $15.9M later that year and then up to $23.5M early this year and now dropped once again to $19.5M…umm, if it didn’t sell at $15.9M doesn’t common sense say that listing it at this price is a waste of time??

14209 West Evans Road-Pacific Palisades- The Pacific Palisades home once owned by Former Governor Arnold Schwarzenegger and soon to be ex-wife Maria Shriver is back on the market with another broker but interestingly at a much higher price. This 9 bed/9 bath 10k sq. ft. house on approximately 2.5 acres has been on a pricing roller coaster since it was listed in 2006 for $26 Million. For the past five years the house has traded brokers and zig zagged on price. The house dropped to a list price of $23M and then again to 21.9M in late 2007 to 18.9M in 2009 and then dropped to $15.9M later that year and then up to $23.5M early this year and now dropped once again to $19.5M…umm, if it didn’t sell at $15.9M doesn’t common sense say that listing it at this price is a waste of time??

A titanic drop in Malibu

31634 Sea Level Dr- Malibu- This ocean front Architectural modern on a gated street off Broad Beach is a 4 bed/4 bath home built in 2008. Designed by David Grey this home originally appeared on the market at the crazy high price of $15M in early 2009 when the Malibu Beach market was absolutely dead. Over the next year and a half the list price was reduced all the way down to $6.495M before going into foreclosure and falling into the banks hands. The property was listed by the bank in May for $5.750M and finally sold in late August for $5.350M.

31634 Sea Level Dr- Malibu- This ocean front Architectural modern on a gated street off Broad Beach is a 4 bed/4 bath home built in 2008. Designed by David Grey this home originally appeared on the market at the crazy high price of $15M in early 2009 when the Malibu Beach market was absolutely dead. Over the next year and a half the list price was reduced all the way down to $6.495M before going into foreclosure and falling into the banks hands. The property was listed by the bank in May for $5.750M and finally sold in late August for $5.350M.

Dropping almost 300% from its original list price this is a prime example of the greed and non-rational thinking that touched every segment of the real estate market.

Important real estate articles you should be aware of

Conforming Loan Limit Officially Drops to $625,500 October 1st: The loan limit officially drops October 1st.

Troubled Homeowners, Beware of “Mass Joinder” Lawsuit Invitations: All trouble homeowners should read.

Federal Agencies 20% down plan faces political hurdles: Legislation requiring all purchases to have 20% down will face a ton of opposition.

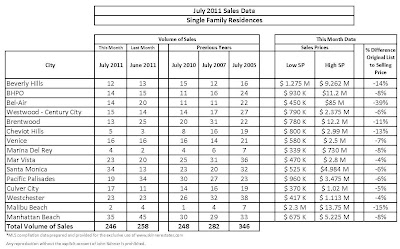

In-Depth Look at Single Family Home Sales Data for July

The summer keeps humming along on the Westside and in Manhattan Beach. Sales were down slightly compared to last month but thanks to record low interest rates and tight inventory, multiple offers are still the buzz. The overall average difference between original list price and selling price was -8.33%, which is lower than last months’ -10.07%.

The summer keeps humming along on the Westside and in Manhattan Beach. Sales were down slightly compared to last month but thanks to record low interest rates and tight inventory, multiple offers are still the buzz. The overall average difference between original list price and selling price was -8.33%, which is lower than last months’ -10.07%.

Both of those numbers are inflated by sales on the ultra high end that were way overpriced. For instance, you will notice that in Bel-Air the % difference between the original list price to the selling price is an alarming -39%. This is due to one sale that occurred @ 594 S. Mapleton Drive between heiress Petra Eccelstone and Caro Spelling. This huge 14 bedroom, 27 bath, 56,500 sq ft. house was listed on 9/1/10 for $150M and sold on 7/14/11 for $85M. If you dismiss some of these larger sales that should have never been listed at the current list price, the difference between original list price and sale price shrinks to around -6.5% which is close to the -5% in a healthy market.

Both of those numbers are inflated by sales on the ultra high end that were way overpriced. For instance, you will notice that in Bel-Air the % difference between the original list price to the selling price is an alarming -39%. This is due to one sale that occurred @ 594 S. Mapleton Drive between heiress Petra Eccelstone and Caro Spelling. This huge 14 bedroom, 27 bath, 56,500 sq ft. house was listed on 9/1/10 for $150M and sold on 7/14/11 for $85M. If you dismiss some of these larger sales that should have never been listed at the current list price, the difference between original list price and sale price shrinks to around -6.5% which is close to the -5% in a healthy market.

Sales dropped slightly from the previous month, however, most areas stayed consistent with last months’ numbers with the following exceptions:

Santa Monica had a great month with 21 more sales then last month. Half of the homes sold within 60 days of the list price, and the average% difference between the original list price and the selling price was only 6%. Almost all the homes in Santa Monica that sold for more than $2.5M sold within two weeks of coming on the market.

Culver City sales were also up from last month with the average% difference between the original list price and the selling price only 5%.

On the other side of the spectrum, Pacific Palisades sales were lower than last month with the majority of properties selling within 90 days of the listing date. Brentwood sales were considerably lower as well and the average % difference between the original list price and the selling price was much higher at 11% with properties on the market for a longer period of time.

Though Manhattan Beach and Mar Vista dipped against last month’s numbers they are still holding strong in terms of volume. In fact this is the second straight month that Manhattan Beach outpaced sales for the month compared to 2007 and 2005.

Mortgage Rates Down in the Basement Again

The typical rate on a 30-year fixed mortgage fell this week to 4.39%, the lowest level since November, according to home finance giant Freddie Mac, while other popular loans were at all-time lows in Freddie’s weekly survey of lenders.

That trend drove the yield on the 10-year Treasury note to 2.58% Thursday morning — it had been above 3.7% in February — and home lending rates followed suit.

The record lows were for 15-year fixed mortgages, a popular option for people refinancing their homes, and for loans with a fixed rate for five years that then become variable. The previous records for these mortgages also were set in November.

Lenders were offering the 15-year loan at an average of 3.54%, down from last week’s 3.66% and eclipsing the previous low of 3.57% in the Freddie Mac survey.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.18% this week, down from 3.25% a week earlier, which had tied the previous low.

The average offering rate for 30-year fixed-rate mortgages had briefly dropped below 4.2% in the survey last fall. The 4.39% rate that Freddie reported Thursday was sharply below last week’s 4.55%.

Borrowers would have paid less than 1% of the loan amount in upfront lender fees to obtain the rates, Freddie Mac said. Solid borrowers often can find slightly better rates by shopping around, and it’s also possible to lower mortgage rates by paying more upfront.

The Freddie Mac survey asks lenders what terms they are offering to borrowers with good credit ratings who have 20% down payments or 20% equity in their homes.

Source: USA Today

Articles You Should Read

More home buyers are walking away from signed contracts – According to the National Assn. of Realtors, 1 in 6 realty agents polled in June reported having signed contracts canceled before closing, up from just 1 in 25 the month before. The surging numbers of pending short sales clogging local markets are another cause of contract cancellations…

Debunking popular real estate myths – Read about popular misconceptions and myths

Home prices rise again, but experts are unimpressed – The Standard & Poor’s/Case-Shiller index of home prices in 20 metropolitan areas rose 1% from April to May. Some economists dismiss the uptick as seasonal.

Homeowners who want to trade up are stuck waiting – Before the bust, rising prices fueled the housing market, enabling buyers to start small and climb the ladder. Now that promise of upward mobility is on shaky ground and many potential sellers are underwater and can’t afford to sell