Skinny On Real Estate

Mortgage Rates Hold Steady at 4.5%

Mortgage rates changed little in the past week, snapping a streak of weekly declines that had taken fixed rates to the lowest points of 2011.

While the 30-year fixed-rate mortgage rate ticked up to 4.50% from 4.49% last week, still well below last year’s 4.75% average. Rates on 15-year fixed-rate mortgages ticked down to 3.67% from 3.68% the previous week and 4.20% a year earlier. .

Meantime, the Mortgage Bankers Association on Wednesday said the volume of mortgage applications jumped a seasonally adjusted 13% last week from the previous week. Refinancing activity jumped nearly 17%, according to the weekly survey.

In the latest week, five-year Treasury-indexed hybrid adjustable-rate mortgages fell to 3.27% from 3.28% last week and 3.89% rate a year earlier.

To obtain the rates, fixed-rate borrowers required an average payment of 0.7 point. The five-year hybrid adjustable rate mortgages required a 0.6-point payment. A point is 1% of the mortgage amount, charged as prepaid interest.

Beware Loan-Modification, Foreclosure Scams

One in nine homeowners nationwide are more than 90 days behind on their mortgage payments and fear of foreclosure has desperate homeowners turning to loan modifications or foreclosure rescue companies for help. But that may be a recipe to falling prey to a foreclosure scam.

Foreclosure scammers will promise you everything while using a wide variety of tactics and targets like asking for an upfront fee and then disappearing with your money. Since foreclosure laws can be complex and confusing, almost anyone can become a victim.

Here are some red flags to help you spot a scam:

(*Source: KABC-7.com)

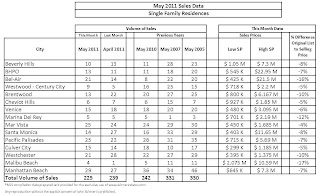

In-Depth Look at May Single Family May Sales Data Westside/Manhattan Beach

Though on a national level inventory is at an all-time high, the Westside has clearly bucked that trend. Inventory continues to decrease and homes that are priced appropriately are attracting a frenzy of buyers and leading to price stabilization. Due to the lack of inventory, sales volume has decreased month over month for the third straight month in the areas we track. Bel-Air, Pacific Palisades and Malibu Beach were the only areas to truly buck the trend of declining sales volume. Santa Monica (down almost 50%), Westchester and Brentwood fell off in sales volume significantly compared to last month.

Though on a national level inventory is at an all-time high, the Westside has clearly bucked that trend. Inventory continues to decrease and homes that are priced appropriately are attracting a frenzy of buyers and leading to price stabilization. Due to the lack of inventory, sales volume has decreased month over month for the third straight month in the areas we track. Bel-Air, Pacific Palisades and Malibu Beach were the only areas to truly buck the trend of declining sales volume. Santa Monica (down almost 50%), Westchester and Brentwood fell off in sales volume significantly compared to last month.

Overall, sale volume is slightly off last year’s number’s (225 vs. 242) and 47% off the hey-day of 2005 and 2007.

The average difference between original list price and sale price continues to shrink back to normal levels (4-6%) in most areas. The pricey locales of Bel-Air and Malibu Beach had a large discrepancy but those can be attributed to a few high priced listings that were severely overpriced and finally sold for market value. If you take those out of the equation the average would drop in the 7-9% range.

A quick look at a few individual sales:

627 Grand View (Mar Vista)- This 6+6, 3,792 sq. ft. 3-story recently updated craftsman home on a 11,786 sq. ft. lot sold for $1.685M. At first glance one would think it sold for well over the asking price of $1.495M. However, it was originally listed under a different agent for $1.8M late last year and they did not find a buyer. The new list price created a buzz and helped the seller get market price with strong terms.

627 Grand View (Mar Vista)- This 6+6, 3,792 sq. ft. 3-story recently updated craftsman home on a 11,786 sq. ft. lot sold for $1.685M. At first glance one would think it sold for well over the asking price of $1.495M. However, it was originally listed under a different agent for $1.8M late last year and they did not find a buyer. The new list price created a buzz and helped the seller get market price with strong terms.1105 Centinela Ave. (Santa Monica)- This 4+ 2, 2,111 sq. ft. house on a 9K sq. ft. lot sold for 8% higher than its list price at $1.623M. This ranch style home is a fixer and was priced around land value.

11434 Ayrshire Road (Brentwood)– This 4+4.5, 4,258 sq. ft. house on a sizable lot of 18,817 sq. ft. sold for $2.225M. The home is in need of cosmetic remodeling but does boast very good bones with sizable living areas and bedrooms. It was originally listed in September of last year for $3.195M which denotes a 30% loss in an 8 month period.

11434 Ayrshire Road (Brentwood)– This 4+4.5, 4,258 sq. ft. house on a sizable lot of 18,817 sq. ft. sold for $2.225M. The home is in need of cosmetic remodeling but does boast very good bones with sizable living areas and bedrooms. It was originally listed in September of last year for $3.195M which denotes a 30% loss in an 8 month period.  1056 Iliff Street (Pacific Palisades)- This 2+2, 1,641 sq. ft. house was a short sale that was listed at $1.2M in January, increased to $1.3928M in February and sold in probate court for $1.326M. This is a classic case of what can happen in probate and short sale situation. The listing agent prices the house below market value and gets an accepted offer. Since the offer has to be fully approved by the court or bank, it is still listed as active in the MLS but at the price of the accepted offer. 60% of the time the original offer falls out as was the case in this instance.

1056 Iliff Street (Pacific Palisades)- This 2+2, 1,641 sq. ft. house was a short sale that was listed at $1.2M in January, increased to $1.3928M in February and sold in probate court for $1.326M. This is a classic case of what can happen in probate and short sale situation. The listing agent prices the house below market value and gets an accepted offer. Since the offer has to be fully approved by the court or bank, it is still listed as active in the MLS but at the price of the accepted offer. 60% of the time the original offer falls out as was the case in this instance.*Source: MLS

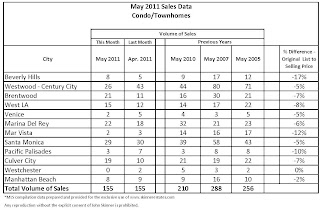

In-Depth look at May Condo sales data for Westside/Manhattan Beach

Sales volume matched last month’s at 155. Compared to last year, sales volume is down 35% and good inventory is hard to find with many willing seller’s unable sell their place since they would be short to the bank.

Sales volume matched last month’s at 155. Compared to last year, sales volume is down 35% and good inventory is hard to find with many willing seller’s unable sell their place since they would be short to the bank.

To give you some perspective, sales volume for May is off 85% since 2007 when we saw record volume. With the market declining at least 20% since then and many people refinancing many people can’t afford to sell. The good news is a seller that is priced appropriately will attract a lot of attention and command a strong buyer.

Since inventory is declining, so is the gap between list price and sale price. The average difference is around 6% when you take into account areas with more than ten sales. This difference was over 12% a year ago.

Mortgage Rates Slide for a 7th Straight Week

![]() Home loan rates continue to fall as does mortgage demand

Home loan rates continue to fall as does mortgage demand

Responding to sluggish economic and housing data, mortgage rates have fallen for the seventh straight week, following the yield on Treasury bonds to new lows for the year.

But many people remain on the sidelines of the housing market, expecting further price declines or unable to refinance their existing home because they have little or no remaining home equity.

The yield on the 10-year Treasury note, a benchmark for home lending rates, dropped below 3% on Wednesday for the first time since early December and mortgage rates also fell to levels not seen since then, according to the widely watched Freddie Mac Survey of lender offering rates.

Freddie Mac said Thursday that the typical rate for a 30-year fixed-rate home loan declined to 4.55% this week from 4.60% a week earlier. Not since the week of Dec. 2, when the survey showed the 30-year mortgage at 4.46%, have rates in the survey been lower.

The 15-year fixed loan averaged 3.74% in the latest survey, down from 3.78% a week ago and the lowest since Nov. 11, when it was at 3.57%.

Borrowers in the survey would have needed good credit and 20% down payments or 20% home equity in the case of refinancing to obtain the rates. They would have paid 0.6% of the loan amount on average in upfront lender fees to obtain the 30-year loan and 0.7% for the 15-year loan, Freddie Mac said.

A weekly survey by the Mortgage Bankers Assn., released Wednesday, found that applications for new mortgages decreased by 4% during the week that ended May 27, compared with the previous week. Refinance applications were down by 5.7%.

“The last time mortgage rates were this low, refinance volume was more than 20% higher,” said Mike Fratantoni, the mortgage trade group’s vice president of research and economics. “It is likely that many borrowers still cannot qualify to refinance given the lack of equity in their homes.”

Source: LA TIMES, CNN

Wall Street Journal: Why It’s Time to Buy?

A great article appeared in the Wall Street Journal this past Saturday that everyone with any interest in purchasing or selling real estate should read. It provides a balanced look and some great tips on how market dynamics lead to a great time to buy.

Here is a quick intro and the link is at the bottom: There are growing indications that it is a good time to buy. Mortgage rates, which fell to 4.55% for the week ending June 2, according to Freddie Mac, are near 50-year lows. Homes have become more affordable than they have been in years: According to Moody’s Analytics, the ratio of home prices to income is now 20.9% lower than the 15-year average through 2010, and 12.5% lower than the 1989-2004 average.

A historic glut of homes, meanwhile, has created a buyer’s market: There were about 15 million vacant homes in the U.S. last year, according to John Burns Real Estate ConsultingInc.—some 3.1 million more than normal.

Article: Why It’s time To Buy

Why Buyer’s Need Reputable Representation

It seems like it would be a simple thing to do – look at a house on the internet, go and see it and enlist that agent to make a deal and represent both sides. Let’s look at this more closely.

In an analysis of homes that were bought between 2003 and 2006 in Manhattan Beach and then sold again in the past year, we generally see that prices are back to 2004 levels or are very close to those numbers. The good news for seller’s is the market has firmed up quite a bit around mid to late 2004 prices after trending toward 2003 numbers. Now, you will always have exceptions to the rule in either direction but one particular sale caught the attention of the Manhattan Beach Confidential blog.

Look at 319 S. Poinsettia in the Hill Section, a big (6br/6ba, 4825 sq. ft.) Craftsman that is positioned as far south as you can get – it borders Boundary Place, the alley/street that divides Manhattan Beach from Hermosa. The home has no views, is positioned on an odd slanted lot and hasn’t been improved from its 2004 condition.

Look at 319 S. Poinsettia in the Hill Section, a big (6br/6ba, 4825 sq. ft.) Craftsman that is positioned as far south as you can get – it borders Boundary Place, the alley/street that divides Manhattan Beach from Hermosa. The home has no views, is positioned on an odd slanted lot and hasn’t been improved from its 2004 condition.

In 0ctober 2004 it sold for $2.137M and in the past week it sold for $2.495M, a 17% mark-up from late 2004 levels. This mark-up is a bit alarming and one thing that can be noted right away is the buyer used the listing agent on the deal. Some buyers will go through a listing agent to try and make sure they get the deal and possibly save a little money.

***However, buyers that go through the listing agent need to clearly understand the listing agent’s fiduciary responsibility is to the seller! Had the buyers on this particular property used a reputable local agent, they possibly could have saved themselves $130-200K on this transaction. Plus, a buyer’s agent acting in the best interest of their client is invaluable when it comes to the request for repairs process and having a strong pulse on the trend of that particular market. Local areas such as Manhattan Beach and Santa Monica operate on a micro level and could be trending far differently than what people read about nationally or regionally in the newspaper.

Another area where it is important to work with a reputable agent is internet errors and wading through the misinformation that can be found online regarding comparable properties. Around 21% of the data realtors individually submit for posting on real estate web sites is not updated or erroneous when changes are made to the price or when the property is sold, according to a report released last month by Trulia. Though the data available online is undoubtedly helpful, misinformation and properties that are listed on the web but aren’t actually for sale can add up to a handicap for buyers. “You’re probably going to get exposed to inaccurate information,” says H. Pike Oliver, executive director for industry outreach at Cornell University’s Program in Real Estate. “There’s no real assurance.”

Always make sure you consult with a reputable agent before making any major decisions.

Source: Manhattan Beach Confidential, Smart Money

Hillside Ordinance Will Have Major Impact on Hillside Areas of the Westside

The landmark Baseline Hillside Ordinance, approved by the City Council, was signed by Mayor Villaraigosa on March 25 and went into effect May 9. This ordinance will have a major impact on future single family building projects in hillside locations much like the approval of the Baseline Mansionization Ordinance that was past a few years ago limiting the size of a home that can be built based on a calculation involving the size and width of the lot. Hillside properties were previously exempt from the Baseline Mansionization Ordinance.

This is the third step in the City’s attempt to prevent out-of-scale single-family development in the city of Los Angeles. The ordinance will apply to approximately 133,000 lots.

The Baseline Hillside Ordinance will reduce the allowable area for a site, change the way in which area is calculated, change the height limits and how they are calculated, and create limits on the amount of grading that can be done to a site. Like the Baseline Mansionization Ordinance, this ordinance will allow individual neighborhoods to adjust the baseline limits to better fit their community’s character and scale through an overlay option.

The Baseline Hillside Ordinance will reduce the allowable area for a site, change the way in which area is calculated, change the height limits and how they are calculated, and create limits on the amount of grading that can be done to a site. Like the Baseline Mansionization Ordinance, this ordinance will allow individual neighborhoods to adjust the baseline limits to better fit their community’s character and scale through an overlay option.

The ordinance’s proposed FAR (building size to lot size ratio) is based on lot size, zone, and steepness of slopes on the property.

A survey is currently required for a hillside lot. The new ordinance requires that the surveyor prepare a Slope Analysis Map that delineates the portions of the property which fall under each Slope Band (interval) and include a tabulation of the total area of the lot (in square feet) within each interval.

A survey is currently required for a hillside lot. The new ordinance requires that the surveyor prepare a Slope Analysis Map that delineates the portions of the property which fall under each Slope Band (interval) and include a tabulation of the total area of the lot (in square feet) within each interval.

To determine the Maximum Residential Floor Area, one must multiply the area of each Slope Band times the percentage allowed for that slope. Then, add up all the amounts to get the total area allowed for the site. Residential Floor Area bonuses are also provided for (as in the Baseline Mansionization Ordinance), with additional options related to hillside massing and grading.

Important exemptions and criteria have been established but they are difficult to explain. You are strongly encouraged to an architect who specializes in the Los Angeles area and you can also visit the City of Los Angles City Planning Web-site.

(Source: Palisades Post, LA Times)

Friendly Reminder: Get your Air Conditioner Maintenance and Sewer Line Snaked and while you are at it…

While June gloom hangs around LA, it is a great time to get maintenance done on some key systems in your house.

If you have any questions or need a referral for any work that needs to be done around the house, please feel free to contact us and will be happy to line you up with someone who has been highly recommended.