Skinny On Real Estate

Sunday’s Open House and the Best Value in Brentwood

Our listing in the Palisades at 1341 Duende Lane is now offered at $1,299,000 and is Open this Sunday 10/24 from 2-5pm. Come by and check out this great value, 3bed/2.5bath home with great views, a landscaped backyard that’s perfect for entertaining and huge patios on both levels.

Our listing in the Palisades at 1341 Duende Lane is now offered at $1,299,000 and is Open this Sunday 10/24 from 2-5pm. Come by and check out this great value, 3bed/2.5bath home with great views, a landscaped backyard that’s perfect for entertaining and huge patios on both levels.

For another great value listing, check out  12679 Promontory. Up in the exclusive Mountaingate community, at only $2,289,000 this home has too many great features to list. Including superior built-ins, picture windows, high ceilings, a chefs kitchen, great views, 4 bedrooms and 4.5 bathrooms, this home is truly exceptional. Easy to show and so worth checking out. Please contact my office to set up and appointment.

12679 Promontory. Up in the exclusive Mountaingate community, at only $2,289,000 this home has too many great features to list. Including superior built-ins, picture windows, high ceilings, a chefs kitchen, great views, 4 bedrooms and 4.5 bathrooms, this home is truly exceptional. Easy to show and so worth checking out. Please contact my office to set up and appointment.

$13M Bank Owned Property in Brentwood

12759 Chalon Rd. Los Angeles, CA 90049.

12759 Chalon Rd. Los Angeles, CA 90049.

This listing proves that bank owned properties come in all shapes and sizes and at all sorts of prices. In the past week, a Brentwood Estates, bank owned home hit the market with the tiny price tag of $13.4M… no sweat right?

Whats kinda ironic and owing to the state of the property market is that the current price tag is rather cheap for this property… yes, cheap. How is that? Well… about a year and a half ago, it was listed at around $20M. So from $19.9 to $13.4 is a $6.5M or a 33% decline in list price.

What do you get for $13.4M? Well for one thing 8 Bedrooms, 9.5  Bathrooms, a Cigar room, a wine room and wine tasting area (that’s wine tasting, not wine drinking), and celebrity neighbors like Tom Brady and Giselle, and the Governator. Not too shabby.

Bathrooms, a Cigar room, a wine room and wine tasting area (that’s wine tasting, not wine drinking), and celebrity neighbors like Tom Brady and Giselle, and the Governator. Not too shabby.

The Importance of Setting a Realistic List Price

According to studies performed by Realestate.co.nz, a New Zealand housing web-site and popular American online property web-site Redfin.com, properties receive four times as many views in the first week of being on the market than it does a week later.

“The most important people in the market are serious buyers who are searching online every day and they’re fully aware when a home that might meet their needs becomes available.” Said Alistair Helm, chief executive of Realestate.co.nz whose study looked at 1,100 New Zealand properties during a six-week period in July and August.

The bottom line: If you’re considering listing your house and you’re serious about selling, you’re better off being realistic right from the get-go. Otherwise, you are blowing it, especially in a market facing continuing downward pressure.

Source: LA Times: Set a realistic price from the start when you list your home online

The Mess Regarding Foreclosures

Foreclosures in all 50 states are now being called on for complete reviews. Banks could have been fraudulently throwing people out of their homes, without the legal authority to do so thanks to a break in the chain of title since the mortgages were bundled into securitized products, nobody really knows, who is actually able to foreclose.

With foreclosures making up 1/3 of the home purchases in California, this could cause some serious issues regarding title insurance in the future since banks were signing off on foreclosure paperwork without the legal authority to do so. I am sure this will all get figured out appropriately but it just another way for the banks to extend things further out and pushing a recovery even further into the future. I still find it absolutely amazing that banks, which we bailed out, are able to tell Wall Street the value of a loan is its original value as opposed to what it would be on the secondary market. A bank can tell Wall Street a loan that originated in 2004 at a value of $1.5 million is still worth 1.5 million even though we all know it is probably worth more like $900K in today’s environment. Wouldn’t it be great to be able to tell people that your stock portfolio is worth the same amount it was before the stock market crash?

If you have a few minutes, watch this funny video regarding the foreclosure crisis from Jon Stewart.

Mid-October Update: Mortgage Rates Increase Slightly

Freddie Mac said in its latest survey that fixed rates on home loans increased this week after declining for the past 3 consecutive weeks. For well-qualified borrowers who paid 0.8% of the loan amount in upfront lender fees and discount points, 30-year fixed rate mortgages were offered at an average of 4.21%, up from 4.19% the previous week.

Full Article from the LA Times Money and Company Blog: Mortgage rates edge higher after 3 weeks of declines

Mortgage Rates Drop to 1951 Levels

The LA Times: Money & Company Blog is reporting that mortgage rates have continued their decline to record lows according to Freddie Mac’s survey of lender offering rates.

The 30-year fixed-rate loan dropped to an average of 4.19% this week from 4.27% in the previous week.

Link to the full article: Freddie Mac: Mortgage rates drop again, now at 1951 levels

Foreclosures – Record High Numbers and CA Investigation of Practices

This September saw a record number of homes being foreclosed upon as lenders carry on working through the distressed properties in their inventory. September foreclosures increased 3% from August and reached a high of 347,420 properties.

This September saw a record number of homes being foreclosed upon as lenders carry on working through the distressed properties in their inventory. September foreclosures increased 3% from August and reached a high of 347,420 properties.

Arguably in response to the increasing number of homes in foreclosure and the spike in foreclosure fraud that has occurred during this real estate bust, California has joined 48 other states who are investigating foreclosure practices. California’s non-judicial foreclosure process may be to blame for lenders not complying with the law to contact homeowners to discuss other options before foreclosing. California Atty. Gen. Jerry Brown announced the investigation and explained that he wants it to be determined if lenders are in compliance.

Links to full articles from HousingWire and the LA Times: Money & Company Blog are below:

Housing Wire: Foreclosures reach record high in 3Q

Money & Company: California among 49 states to jointly investigate foreclosure practices

Palisades Home – New Reduction! Under $1.3M and Open this Sunday!

Our featured listing at 1341 Duende in the Palisades has just been reduced and is newly staged!

Our featured listing at 1341 Duende in the Palisades has just been reduced and is newly staged!

Now $1,299,000!

This home, only minutes from Sunset, the village, and the beach, makes you feel like you’re living above it all. With city views and all the Palisades has to offer, this home is not to be missed.

Check out the Virtual Tour Here. Open Sunday from 2-5pm.

Other Featured Listings:

12679 Promontory  Only $2,289,000.

Only $2,289,000.

This superbly designed and elegantly remodeled 4 bed/4.5 bath view home is a great opportunity and the best price per square foot in Brentwood for a home recently remodeled.

Take a look at the Virtual Tour Here and as usual, please contact our office for any more information or to schedule a viewing.

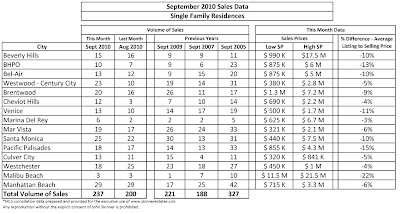

September 2010 Sales Data

In comparison the last three years, September sales activity was strong on the Westside and in Manhattan Beach. Though it trails the scorching 2005 sales numbers (it will be a very long time before we see those numbers again), these numbers are starting to show the market balancing out and finding a bit of a normal pattern. In terms of activity, Westwood/Century City saw a solid jump in sales in comparison to last month and Manhattan Beach and Santa Monica led the way with the total # of sales this month. In fact, Manhattan Beach almost doubled the amount of sales it had in September of 09.

In comparison the last three years, September sales activity was strong on the Westside and in Manhattan Beach. Though it trails the scorching 2005 sales numbers (it will be a very long time before we see those numbers again), these numbers are starting to show the market balancing out and finding a bit of a normal pattern. In terms of activity, Westwood/Century City saw a solid jump in sales in comparison to last month and Manhattan Beach and Santa Monica led the way with the total # of sales this month. In fact, Manhattan Beach almost doubled the amount of sales it had in September of 09.

High-end sellers are still having a difficult time coming to grips with the reality of the market. The % difference between the average list to sale price is between 10%-22% in most high-end markets while it is usually between 3-6% in mid-level markets. The struggle between buyer’s and seller’s on the high end will continue but some seller’s are starting to wise up with quite a few properties priced above 1.5 million going into escrow in a fairly quick manner. The smart seller is turning back the clock and pricing in the 2003-2004 range.