Skinny On Real Estate

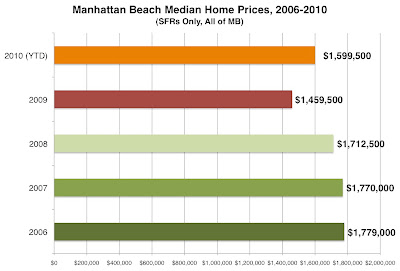

Manhattan Beach Bouncing Back… Median Price up 10% in 2010

As the chart here shows – looking at SFRs citywide– the median price locally took its biggest hit in 2009, dropping from nearly $1.8m in 2006-07 to a 5-year low of $1.459m. A drop of 18% from 2006. However, the median has bounced back solidly in 2010.

As the chart here shows – looking at SFRs citywide– the median price locally took its biggest hit in 2009, dropping from nearly $1.8m in 2006-07 to a 5-year low of $1.459m. A drop of 18% from 2006. However, the median has bounced back solidly in 2010.

With 230 sales year-to-date (thru Sept. 22), we’ve got nearly as many closed sales to look at in 2010 as there were in the full years of 2008 (242) and 2009 (265).

This year the citywide median price, at $1.599m, is up 10% from 2009, down just 10% from 2006.

The nice rally earlier this year, lots of one-time failed sellers came back in 2010 and made their deals, the high end returned – are the main reasons why you see in a 10% boost in the median this year.

*Source: Manhattan Beach Confidential. A great resource about Manhattan Beach Real Estate.

GLOW Event – A True All-Nighter in Santa Monica

This Saturday is the GLOW Event at Santa Monica Beach and Pier, Palisades Park and the 3rd Street Promenade and new Santa Monica Place Mall and Dining Terrace. It features original light installations, art displays and exhibits, as well as live music and DJs, Food and Drinks Specials, Promotions in stores and extended store hours.

It should be a lot of fun and a great way to experience Santa Monica nightlife! Check out the article below for some advice on getting to the event and links to the event’s webpage that features the specials and store hours.

Santa Monica Daily Press Article: Glow Survival Guide

Mortgage Rates Still Near Record Lows

Freddie Mac said mortgage rates were unchanged this week, while another rate survey set new record lows.

The Freddie Mac weekly survey put the average for a 30-year fixed-rate mortgage at 4.37% with an average 0.7 point for the week ending Sept. 23, stable from last week’s slight increase. A year ago, the average rate was 5.04%.

Freddie said the 15-year FRM average also remain unchanged this week at 3.82% with an average 0.7 point — below last year’s average rate of 4.46%.

The weekly Bankrate survey of large banks and thrifts shows the average 30-year FRM at 4.5% with a 0.35 point, setting a new low in the 25-year-old survey and below 5.36% a year ago. The 15-year FRM was 3.96% with a 0.35 point, down from 4% last week and also at a record low. The 30-year, jumbo FRM averaged 5.17% last week with a 0.35 point, down from 5.19% last week.

*Source: Housing Wire: Mortgage surveys vary slightly, but weekly rates still at or near record lows

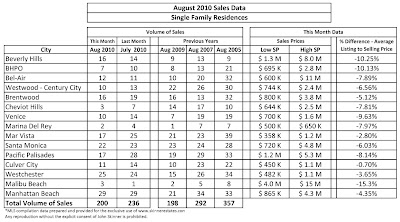

Analysis of August Sales Data

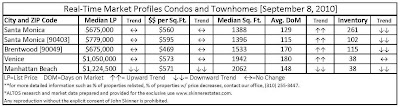

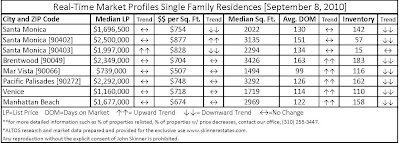

The excitement of the spring selling season has officially passed us by with sales volume continuing to shrink with only Westchester showing higher sales in August over July. Santa Monica pretty much stayed status quo with Pacific Palisades and Mar Vista dropping off over 30%.

If you take a look at the above chart, you will notice a fairly big difference from the Original List Price and the eventual sale price, especially on the high end. We have started to use the original list price in our research as opposed to the list price reported in the MLS to give you a more accurate idea of what is going on in the market. Listing agents have tricky ways to manipulate the original list price to be higher on sales report data and unless the listing history is properly explored, the numbers can be distorted. We found quite a few examples of that this month.

Overall, the high end seller still seems to be struggling with where the market is while more middle class areas like Culver City and Westchester have a very small gap between list and sale price. A few examples:

1415 Summitridge in Beverly Hills Post Office takes the cake for the largest gap between original list price and sales price with a 47.35% difference. It was listed for $3.799M and sold for $2.0M! Talk about an approved short sale…

10830 Chalon Road, is a lot sale overlooking Bel Air Country Club on over an ½ acre. It just sold for $1.850M…in 2005, it was bought for $3.750M! OUCH!

In Santa Monica, 304 14th Street (left) finally sold for $3.550 after being on the market for 158 days and originally listed at $4.3. The 5+4, 4,024 sq. ft. architectural was renovated in 2008. On the flip side, 460 23rd street, a 3+2.75, 2,804 sq. ft. home in decent condition sold in 18 days for $2.228M, 28K over its $2.2M asking price.

In Santa Monica, 304 14th Street (left) finally sold for $3.550 after being on the market for 158 days and originally listed at $4.3. The 5+4, 4,024 sq. ft. architectural was renovated in 2008. On the flip side, 460 23rd street, a 3+2.75, 2,804 sq. ft. home in decent condition sold in 18 days for $2.228M, 28K over its $2.2M asking price.

In Pacific Palisades, 15901 Alcima Ave  (right), a 5+4 project on almost a ½ acre lot finally sold for $2.4 after being on the market for 207 days and having an original list price of $3.499. This home will be torn down or extensively refurbished.

(right), a 5+4 project on almost a ½ acre lot finally sold for $2.4 after being on the market for 207 days and having an original list price of $3.499. This home will be torn down or extensively refurbished.

Culver City had a solid month with 3 of the 11 sales going for over asking. 4041 Huron Avenue, a 3+3, 1,468 sq. ft. home that needs some cosmetic updating sold over asking for $718K. It was listed for $649K and was on the market for 15 days.

After being on the market for  almost a year, 23360 Malibu Colony Road (left) finally sold for $14.95M after originally being listed for $21.5M! Located in the exclusive guard gated Malibu colony, the architectural style home is a 4+4 home with at least 3,500 sq. ft. of living space situated on a 8,708 sq. ft. lot right on the ocean.

almost a year, 23360 Malibu Colony Road (left) finally sold for $14.95M after originally being listed for $21.5M! Located in the exclusive guard gated Malibu colony, the architectural style home is a 4+4 home with at least 3,500 sq. ft. of living space situated on a 8,708 sq. ft. lot right on the ocean.

Open house this Sunday and Active Listings

Open this Sunday 2-5pm.

3-bed, 2.5-bath upper Marquez house has all the features of a great starter home in the Palisades and includes impressive city and mountain views. Come check it out!

4bed/4.5bath Dramatically and elegantly redone in 2007, this is truly one of the nicest homes on Promontory. No expense was spared in creating a comfortable and luxurious living environment. Great features throughout the home include extensive built-ins, a fully-equipped kitchen and exceptional master suite.

Link to virtual tour and photos.

756 North Bundy: $1,585,000

756 North Bundy: $1,585,000

If you’re looking for a 3-bedroom home in Brentwood, be sure to check out the virtual tour below. This 3 bed/2 bath, 1,993 sq. ft. this home was rebuilt in 2004. A large chef’s kitchen opening to the living room highlights the property. Located 1 mile north of Sunset.

Link to virtual tour and photos.

1st Time in 12 Weeks: Mortgage Rates Creep Up

After 11 consecutive weeks of record lows, the 30-year fixed-rate mortgage increased 3 basis points for the week ending Sept. 9 to 4.35% with an average 0.7 point, according to the Freddie Mac Market survey.

Last week’s 4.32% was the lowest rate the survey recorded since its inception in 1971. While the rate this week did increase for the first time in nearly three months, it remains below the 5.07% level seen last year.

The survey of large banks and thrifts reported the average rate for a 30-year FRM at 4.58%, a 5 bps increase from last year.

*Source: Housingwire

Culver City Retreating to 2003 Price Levels Despite Record Low Interest Rates and Inventory Moving

As we see prices continue to drop despite record low interest rates, one has to wonder what the correction would have been without the homebuyer tax credit and record low interest rates.

Even though the month of August saw 3 of the 11 sales in Culver City go for over asking price, prices are still sliding as a whole. Despite a vibrant downtown area, good city schools and its own police force, Culver City is also coming back down to earth from the real estate steroid era. Here are a few examples:

3972 Midway Ave- (Picture on left)

3972 Midway Ave- (Picture on left)

3+3, 1,943 sq. ft. built in 1980 on a 4,982 Lot

Sold 10/1/03 for $765,000

Sold 5/13/10 for $780,000

5208 Berryman Ave- 3+1, 1,020 sq. ft. built in 1951 on a 5,600 Lot

Sold 11/3/03 for $469,000

Sold 4/29/10 for $499,000

3818  Tilden Ave. (Picture on left)

Tilden Ave. (Picture on left)

3+3, 2,219 sq. ft. built in 1928 on a 5,850 Lot

Sold 7/16/10 for $680,000

The next 12-18 months will be a good time for a young family to purchase in Culver City and take advantage of everything it has to offer…but be ready to move on a place you like quickly. Buyers are still circling Culver City and willing to pay over asking if the price is right.