Skinny On Real Estate

Record Low Mortgage Rates Are Still Declining

According to Freddie Mac, lenders are offering 30-year fixed loans at less than 4.5% this week and 15-year loans at less than 4%.

Reporting a seventh straight week of declines, Freddie Mac said the 30-year rate averaged 4.49% for the week ending Thursday, down from 4.54% last week and 5.22% a year earlier. On home loans with rates fixed for 15 years, the interest rate averaged 3.95%, down from an even 4% a week earlier and 4.63% a year earlier.

Freddie Mac asks lenders about the rates they are offering on mortgages up to $417,000 to borrowers who are good credit risks. The borrowers would have paid 0.7% of the loan balance to the lenders in upfront fees and points, Freddie said.

In addition, solid borrowers who shop around often find slightly better rates than those published in the survey.

*Sources: LA Times, Housing Wire

Two Great Listings To Check Out

Both are open Sunday from 2-5. . .Come by and say HI! I will personally be at 1341 Duende Lane.

Check out the info and virtual tour link below:

1341 Duende Lane: LP: $1,365,000. Live Above It All! 3 bed/2.5 bath, 1,867 sq. ft. Upper Marquez home situated on a very private lot located on a cul-de-sac. Click on this link for the virtual tour/photos and listing info here.

756 North Bundy:LP: $1,585,000. Prime Brentwood living. 3 bed/2. Bath, 1,993 sq. ft. home rebuilt in 2004. A large chef’s kitchen highlights this home located 1 mile north of Sunset. Click on this link for the virtual tour/photos and listing info here.

756 North Bundy:LP: $1,585,000. Prime Brentwood living. 3 bed/2. Bath, 1,993 sq. ft. home rebuilt in 2004. A large chef’s kitchen highlights this home located 1 mile north of Sunset. Click on this link for the virtual tour/photos and listing info here. Notes on a Realtor’s Scorecard

Fortunately, our office has been very busy and along with the 4th of July holiday we have fallen a little behind on keeping you updated with the market. However, we are back and will continue to provide you with the straight and non biased info you have come to expect from the Skinny on Real Estate.

In our last update, we spoke about the Kathryn Grayson estate on La Mesa Drive being listed for $8.995. Despite the funky lot lay-out and potential historical preservation of the home the new owners will have to take on, the property went into escrow within three weeks of being on the market. The bottom line: When you have an acre+ of land with views on the Westside, the wealthy take notice and flock even in tough economic times.

In our last update, we spoke about the Kathryn Grayson estate on La Mesa Drive being listed for $8.995. Despite the funky lot lay-out and potential historical preservation of the home the new owners will have to take on, the property went into escrow within three weeks of being on the market. The bottom line: When you have an acre+ of land with views on the Westside, the wealthy take notice and flock even in tough economic times.

– Are the Biggest Mortgage Defaulters the Rich?: Check out this article…

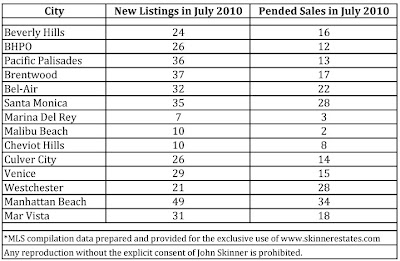

– Westside inventory continues to rise: Inventory has steadily been creeping up since hitting lows in late 2009/early 2010. In fact, inventory levels running at the second-highest since 2006.

– Commercial Note: With vacancies still on the rise in commercial properties in most parts of the U.S., construction of new buildings is expected to be rare this year and next, the American Institute of Architects reported.

Even with modest improvements in the economy, construction spending on hotels, office buildings, warehouses and malls is expected to decrease by more than 20% in 2010, followed by a marginal increase of about 3% in 2011, the architecture trade group said.

Real estate development should begin to turn around midway through next year with stores and hotels expected to see the strongest growth, along with new healthcare and amusement and recreation facilities.

– Lesson of the week: As you will see from my analysis of certain sales in Mar Vista and the Pacific Palisades, if you are going to sell, don’t chase the market. Be realistic about pricing otherwise you will sit on the market a substantial period of time while the property depreciates. Furthermore, realistic and aggressive pricing usually leads to favorable contingency periods and an escrow that will stick and not fall out. In this market, the most frequent word a buyer uses is “VALUE”. If they don’t see value, they don’t offer.

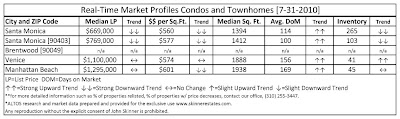

– Real Time Altos market research will be back in the next few weeks. We have had some technical issues with the reports that we are trying to get resolved. Overall, the Westside market is still favoring buyer’s and has cooled down from the hot spring selling period. We will see if the record low interest rates begin to put a charge into activity. My last few open houses have been strongly attended but no offers have come in.

Pacific Palisades Analysis: Reality Hits Some High-End Sellers’ In the Pocketbook

205 Chautauqua: Original List Price: $14M (2008) Sale Price: $10M Case Study #9, the Entenza house featuring 9,500 sq. ft. of living space situated on an acre of land with head-on views of the ocean. Also features a guest house and 4-car garage.

1425 Monaco: Currently in escrow below the recent $24.5M list price. The 13,143 sq. ft. home on 2 flat acres with a tennis court, outdoor kitchen, pool&spa, etc. was originally listed in 2009 for $29.9M.

1272 Corsica: This 8,078 sq. ft. home on a 17,293 sq. ft. lot right near the gates of Riviera Country Club finally sold for $6.5M at the end of June after being originally listed for $8.595M in April of last year. This beautiful home is a very good buy at $6.5M. The Cape Cod style home was built in 2007 and has an expansive back-yard, gourmet kitchen and 23 person movie theatre.

854 Napoli: Land value overlooking the rim of Riviera Country Club has a new comp. This tear down situated on a 17,946 sq. ft. lot sold for $3.8M about 600K off the $4.4M. list price. The property was listed for just over four months.

17731 Calle De Palermo: This 3,913 sq. ft. Palisades Highland home on featuring a full sized pool and private grounds was bought in 2007 for $2.195M and is now in escrow around the list price of $1.699M. It was originally listed earlier this year for $1.995M.

Analyzing Some Recent Sales In Mar Vista…Sales strong under a million but not above 1.3

While looking at completed and pended sales in Mar Vista since June 15th, Mar Vista definitely shows strength in the market under a million. 8 of the 43 completed sales under a million dollars went into multiple offer situations and sold above asking. Most sales sold near the list price and didn’t experience much more than two months on the market. On the flip side, sales above 1.3 typically stayed on the market twice as long and experienced some fairly dramatic price cuts. Here is a look at a sample of sales or pended sales:

3756 Moore Street: This 3+2, 1,352 sq. ft. Spanish style home north of Venice on a 5,474 sq. ft. lot went into escrow within 7 days of being on the market. It was listed for $825K. Rumor has it selling for around $800k. It did not go out in multiples.

12000 Stanwood Place: This 2+2, 1,393 sq. ft. home was listed for $749K and went into escrow about a month after being on the market. It is a strong remodel candidate on a 5,500 lot.

3741 Grand View: One of the largest lots in Mar Vista (19,090 sq. ft.), this was sold for land value and probably went above the 999K asking price. It was only on the market for six days.

(pic) 12106 Stanwood Drive: Rolling back to 2004? This 4+3, 2,278 sq. ft. home on a 8,320 lot was bought in 2004 for $1.217 and is currently in escrow with a list price of $1.249. It was on the market for only 11 days so probably went out around the asking price. The house is in great condition and features good views.

4250 Grand View: Can you say auction? Small 2+1 on a 5,540 lot was a short pay that had a ridiculously low list price of $529K. They received over 25 offers and arrived at a $836,500 sale price. The buyer paid a bit too much for this home.

3539 Mountain View: Part I of the high end drop: This updated and highly desirable 3+4, 4K sq. ft. home situated on an 11K lot originally hit the market in February for $2.485M and after being reduced to $1.999 it sold for $1.850M.

3539 Mountain View: Part I of the high end drop: This updated and highly desirable 3+4, 4K sq. ft. home situated on an 11K lot originally hit the market in February for $2.485M and after being reduced to $1.999 it sold for $1.850M.

3578 Grand View: Part II of the high end drop: This 5 bed/4 bath, 3,900 sq. ft. home with a pool and situated on a 9,296 lot sold for $1.5M after being originally listed in February for $1.980. It was bought in 2004 for $1.570M. . .hmm, below the 2004 sale price despite money being significantly cheaper…

Getting Cheaper Every Day To Buy A House or Refinance: Rates Continue To Inch Down

The average interest rate for a 30-year fixed loan in this week’s Freddie Mac survey was 4.57%, down from 4.58% a week earlier.

According to the big mortgage buyer, that was the lowest rate in the 39-year history of the survey.

The survey asks the lenders what rates they are quoting to well-qualified buyers who have a 20% down payment or 20% equity in their homes if they are refinancing.

The lenders said the borrowers would have paid 0.7% of the loan amount in fees to obtain the fixed rates.

Manhattan Beach Update Regarding June Sales Activity

June was the first month in awhile where new listings significantly outpaced pending sales west of Sepulveda in Manhattan Beach.

The web-site Manhattan Beach Confidential recorded 30 new listings and 20 pending sales (new escrows) for the whole month among Single Family Residences “SFR’s”.

When you look at the 2- week period from June 16-30, the imbalance is more noticeable with 17 new listings, and only 8 pended sales. It should be noted that during this period, many people were on vacation or preparing for the 4th of July weekend.

Total inventory was at 83 SFRs west of Sepulveda, up 4 from the end of May, a figure that would have been higher but for 5 cancellations in the second half of June.

Thanks to Manhattan Beach Confidential for being a great source of South Bay news.

Buy for $900K…Sell for $56 Million…Gotta love the value of real estate over time

The 112-acre Robert Taylor Ranch owned by concert promoter Kenneth J. Roberts, the man who built KROQ-FM (106.7) into a radio rock giant, is on the market for $56 million.

The 11,000-square-foot Brentwood home sits in the foothills of the Santa Monica Mountains on Mandeville Canyon.

Roberts paid $900,000 for the property in 1969 when he bought it from Taylor. Obviously, it has been updated and remodeled several times through the decades.

At one point, the 17-bedroom, 17-bath home was listed at $65 million. In 2002 and 2005, it ranked among Forbes’ Top Ten Most Expensive Properties list. It has four detached guest cottages, an office complex, a swimmer’s pool, horse stables and a championship tennis court. There is a wine cellar, and screening and game rooms.

(*Sources: MLS, LA Business Journal)