Skinny On Real Estate

Ranking the Most Desirable Streets In Los Angeles

The golden triangle from Beverly Hills in the east to Santa Monica on the West and Mailbu to the north encompasses is considered one of the most desirable places to live in the world and encompasses a majority of the best streets in Los Angeles. Functioning as a playground for the rich and famous these streets comprise some of the best mansions in town and are the residences of some of the most influential people in the world. Thanks to growing up in the area and articles about the subject in the Los Angeles Times and Wall Street Journal, here is a rundown of the most desirable streets and my stab at ranking them.

The golden triangle from Beverly Hills in the east to Santa Monica on the West and Mailbu to the north encompasses is considered one of the most desirable places to live in the world and encompasses a majority of the best streets in Los Angeles. Functioning as a playground for the rich and famous these streets comprise some of the best mansions in town and are the residences of some of the most influential people in the world. Thanks to growing up in the area and articles about the subject in the Los Angeles Times and Wall Street Journal, here is a rundown of the most desirable streets and my stab at ranking them.

1- Mapleton Drive, Holmby Hills: Backing up to the fairways of Los Angeles Country Club, Mapleton Drive was ranked one of top streets West of the Mississippi by Wall Street Journal. The quality and size of the properties along with the views of Los Angeles make it extremely coveted. Home to the Playboy Mansion, high-end buyers feel very comfortable purchasing property where everything around it is established with at least a 10-20 million value and sometimes well beyond that.

2- Oakmont Drive, Brentwood. This private street at the end of Rockingham Avenue is very secluded and a perfect getaway from the hustle and bussle of Los Angeles. The street never has any traffic on it and is known for its secluded setting, large mansions and powerful residents. Another 10 million++ street.

3- Bellagio Road, Bel-Air: The highest-price home transaction ever in California took place on this street. The 2000 sale of an 8-acre estate by Dole Food Co.’s billionaire owner, David Murdock, to financial executive Gary Winnick in a $95-million deal. Most of the lots are flat and views of the Bel-Air Country Club and the ocean distinguish this leafy road paralleling Sunset Boulevard.

4- North Carolwood Drive, Holmby Hills. Just around the corner from Mapleton, North Carolwood has been the address of tons of celebrities. At 2 to 4 acres, these are some of the biggest parcels on the Westside and can sell in the $20-40 million range.

Gregory Peck’s longtime home was sold in 2004 for about $22 million. Michael Jackson rented here at the time of his death.

5- Malibu Road, Malibu. This coastal street is shielded from busy PCH to the east, offering ocean views and a relatively quiet neighborhood that celebrities love. Those who buy on this street tend to stay a very long time.

6- Napoli Drive, Pacific Palisades. Properties on the south side of Napoli are prized for their views overlooking the Riviera Country Club and considered the most desirable in ritzy Pacific Palisades. Having a backyard bordering a golf course is like having a park behind you.

7- La Mesa Drive, Santa Monica. Napoli’s neighbor to the North that borders Riviera Country Club, La Mesa is known for its homes of similar value and size and once you turn onto the street you feel you have ventured into a quiet city in another part of the country. Large trees help provide privacy and locals note a strong consistency despite each house being unique in its own way gives the street high marks. Homes “on the rim” side of Riviera can bring close to twice as much as south-side properties.

7- La Mesa Drive, Santa Monica. Napoli’s neighbor to the North that borders Riviera Country Club, La Mesa is known for its homes of similar value and size and once you turn onto the street you feel you have ventured into a quiet city in another part of the country. Large trees help provide privacy and locals note a strong consistency despite each house being unique in its own way gives the street high marks. Homes “on the rim” side of Riviera can bring close to twice as much as south-side properties.

8- Amalfi Drive, Pacific Palisades. North Amalfi has canyon views to Will Rogers State Historic Park, while some homes on the south end have ocean and Riviera views. Over the years it has been popular with such entertainers as actor Cary Grant, comedian Jerry Lewis and singer Bobby Vinton.

9- Maple Drive, Beverly Hills. Maple Drive, north of Santa Monica Blvd, boasts the largest lots among Beverly Hills’ flatland areas, and the homes have a continuity of design and landscaping. The street is quiet and traffic is light despite being right near Sunset. Homes usually value in the $10 million plus range

10- Bel Air Road, Bel-Air. Approached through the arch at the East Gate entrance of the community, this winding street has city and ocean views as it climbs. Tall, dense hedges create an air of inaccessibility and its location is close to Westwood Village.

Other Top Streets:

**Malibu Colony Drive, Malibu.

**Georgina Avenue, Santa Monica

**Cliffwood, Brentwood

**Carmelina, Brentwood

**Corona Del Mar, Pacific Palisades

–*Sources: Los Angeles Times; Wall Street Journal…various articles written in the past few years.

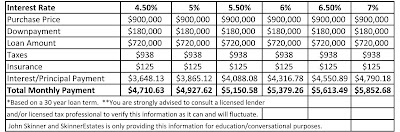

A Look at Buyer Purchasing Power with Rates at Historic Lows

One of the main factors in the recent surge in home sales is that mortgage rates continue to stay around historic lows keeping a traditional buyers purchasing power at high levels. At some point in the near future conventional wisdom leads one to think that rates will eventually have to rise for the benefit of the whole economy.

I thought this would be a good time to look at the difference in payment for a purchaser if interest rates escalate and how it could impact the market. It is also a great tool for those of you who are beginning the search for a home.

Some people feel this is an excellent time to make a long-term purchase due to these rates and also unload a property that you will be selling in the next 3-5 years. The record low interest rate not only aides the buyer but also the seller who has been saved in a further drop in property value during the great recession.

The economy is showing signs of rebounding and consumer confidence in the California home market is on an upward trend. However, will the market be able to sustain an eventual hike in interest rates when salaries are not increasing?

As you will see below, a purchaser’s payment is impacted quite a bit by even a half-a-percentage point increase and the banks are very strict in staying within the confines of the maximum amount a purchaser can qualify for based on a % of the purchaser’s gross income which is usually in the 36-41% range**. Please note that property taxes, insurance and other liabilities factor into this and you are strongly advised to speak to a licensed lender about the process since this information can and will fluctuate. I am happy to put you in touch with some of the best lenders in the business and we are happy to address any questions you may have.

*Click Image to Enlarge

No Rent Increases in Los Angeles?

Debate over the city’s Rent Stabilization Ordinance kicked into high gear May 7, when the council voted 8-6 to have the city attorney draft a moratorium that would prevent for up to six months apartment owners from levying the usual 3 percent annual rent increase at rent control units.

The Los Angeles City Council on Friday is scheduled to consider an ordinance preventing the owners of thousands of apartments from imposing an optional 3% rent increase between now and Oct. 31.

Notes on a Realtor’s Scorecard

*I have noticed quite a few out of area agents representing buyers when the final sales info comes into the MLS. Thanks to the internet and most of the MLS services in the state working together it allows agents to work almost anywhere. However, many of these agents seem to be representing buyers who are paying a decent amount more than what the local agents think its worth. . .Great for the neighborhood but not for the buyer. . .This is why I like to work with an area specialist when I wonder into communities I am not familiar with outside the Westside/South Bay to make sure my clients are completely plugged into everything that is going on.

*839 25th street in Santa Monica just hit the market for $2.875. It is a very nice remodeled 5 bedroom, 3,200 sq. ft. home situated on an 8,000 sq. foot lot just south of Montana. The home shows very well and is located a block from Franklin Elementary school (one of the best in the state). A perspective buyer might fall in love with it due to the condition of the inside and location of the home but I think they are overpriced by about 7-10%…It will be interesting to track what happens. It was quite the buzz on caravan since it has very little competition and would be very attractive for a family looking to get into the Franklin school district.

*14173 Alisal Lane in Santa Monica Canyon is a Ray Kappe designed modern architectural located on a fabulous 11K lot that came on the market in late April for $2,395,000. It was priced around land value as the home needs a ton of work. However, the buyers were undaunted due to the low price and the property received 8 offers with the majority of them being all-cash buyers. The frenzy of interest is rumored to have driven the sales price to around $3,000,000…A good design on a large lot will command interest in any market…

*14173 Alisal Lane in Santa Monica Canyon is a Ray Kappe designed modern architectural located on a fabulous 11K lot that came on the market in late April for $2,395,000. It was priced around land value as the home needs a ton of work. However, the buyers were undaunted due to the low price and the property received 8 offers with the majority of them being all-cash buyers. The frenzy of interest is rumored to have driven the sales price to around $3,000,000…A good design on a large lot will command interest in any market…

*Good article in the LA Times about new homebuyers reemerging in California. The $10,000 tax credit that goes toward the purchase of new construction that began May 1st will be a contributing factor…Article: New Homebuyers Reemerge

* Interest rates on mortgages have declined for a fifth straight week, with 30-year fixed-rate loans dropping below 5% to the lowest level of the year, Freddie Mac said in its weekly survey of lenders. The average rate that lenders were offering for 30-year fixed home loans was 4.93% early this week, down from 5.0% a week earlier, with borrowers paying 0.7% of the loan balance in upfront charges to the lenders.

* Having trouble making mortgage payments? If you have a mortgage with Bank of America, you may be in luck. The nation’s largest consumer bank says it has modified about 56,000 mortgages this year under a government program aimed at reducing the number of foreclosures. The program allows qualifying borrowers to temporarily reduce interest payments or modify mortgage terms in other ways. After a three-month trial period, the bank can then make such changes permanent. BofA, like many big banks, had dragged its feet on helping homeowners and are still extremely slow to react. Of homeowners who haven’t made a mortgage payment for over a full year, 23.6% haven’t been foreclosed upon.

*2.2% of all housing units in the US (1 in 45) received at least one foreclosure filing in 2009…Foreclosure filings were up 19% in March and up 8% year over year…that doesn’t sound promising for a full recovery does it?

*If home prices drop 10%, the percentage of underwater homeowners would increase 56%!

Quick Look At Specific Sales From Westchester to Pacific Palisades

I will continually update you regarding sales I am familiar with in certain areas which will be a great tool in helping you properly value properties. Please feel free to contact our office if you would like more specific information.

1319 Amalfi Drive- Pacific Palisades- 3 bed/4 bath 3,616 sq. ft. home on a 21,710 lot. Talk about a fall from grace. This home was essentially sold for land value since it is a rim view Riviera property. Talk about having a tough time pricing a property and coming to grips with the reality of the market. This property was listed in 2008 for $7.995 and after 4 reductions and approximately 18 months, it sold this week for $5.850.

1319 Amalfi Drive- Pacific Palisades- 3 bed/4 bath 3,616 sq. ft. home on a 21,710 lot. Talk about a fall from grace. This home was essentially sold for land value since it is a rim view Riviera property. Talk about having a tough time pricing a property and coming to grips with the reality of the market. This property was listed in 2008 for $7.995 and after 4 reductions and approximately 18 months, it sold this week for $5.850.

16578 Charmel Lane- Pacific Palisades- 3 bed/3 bath 3,176 sq. ft. home on a 15,110 lot. Tremendous view property that found the perfect buyer since it sold for about 10% more than what most realtors predicted. The house needed a lot of cosmetic work and a little re-working but once that is done it will be awesome. This is a house that someone could easily fall in love with so I am not completely surprised it sold for 2.535, just off the 2.595 list price.

939 20th Street #3- Santa Monica- 3 bed/3 bath, 1,853 sq. ft. New Construction Townhouse with sundeck. Listed for $1,395,000 and sold for $1,350,000. A total of 8 units in the building and I believe this is the fourth one to sell. The units are very nice and built to be the only LEED (energy efficient and high environmental standards) certified townhome community in SM.

6358 West 79th Street- Westchester- 3 bed/2 bath, 1,743 sq. ft. on a 10,880 lot! Basic North Kentwood home that immediately sold for the asking price of $879,500. It is a great family home that really doesn’t require much updating and features a double-sized garage

7100 Playa Vista Drive #314- Playa Vista- 2 bed/3 bath 1,689 sq. ft. built in 2007– Listed for $629,000 and Sold for $620,000. 3 story condo with bluff and mountain views. Good floor-plan with side-by-side parking. A property like this would have easily sold for over $800,000+ in 2007.

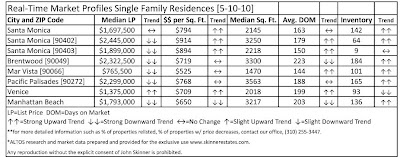

Some Westside/South Bay Neighborhoods Take Some Big Hits Since 2008…But Read The Fine Print

According to Dataquick (which tracks all sales in specific areas), we have seen solid price erosion based on price per square foot numbers over the last 2 years thru March 2008. Many people feel these numbers have signaled a bottom in the market prompting buyers to come off the sidelines. Despite tough lending standards, prices have begun to stabilize and even rise lately with buyers less fearful and inventory being limited.

Please be careful when looking at these numbers since the Westside and Manhattan Beach operate on a micro market level. The price drop for homes in good condition with a great floor plan is less than a home that needs to be remodeled. Furthermore, land is KING in coastal communities. Buyers pay a premium for a larger lot and it is a good investment as the average lot size in California continues to shrink (was over 7,500 feet in the early 1980’s and is now down to about 5,400 feet) along with stricter building codes limiting how big a home can be based on lot square footage. Keep these things in mind when valuing a home and why a discrepancy in price can happen between homes within a few blocks of each other.

That said, the overall numbers speak for themselves and it will be interesting to see where the market goes from here.

Beverly Hills 90210 (2008) $851 (2010) $516 (-39.4%) 17 sales

Manhattan Beach 90266 (2008) $826 (2010) $602 (-28.1%) 26 sales

Santa Monica 90402 (2008) $962 (2010) $724 (-24.8%) 10 sales

Brentwood 90049 (2008) $818 (2010) $632 (-22.8%) 17 sales

Major Traffic Advisory for Sunset Blvd and Church Lane!

Beginning this evening and through the entire weekend, the Sunset Boulevard Overpass between Sepulveda and Church will be closed. This is part of the I-405 Sepulveda Pass Widening Project. You can expect major delays on Sunset over the next several weeks/months, but this weekend should be especially challenging as they begin the demolition of the bridge. Here are two links to provide you more information:

http://www.metro.net/projects/I-405/sunset-bridge-demolition-reconstruction/

**Thanks to Tom Dunlap our Prudential Regional General Manager for the info!

Extremely Important: Los Angeles Wants To Limit The Size of Hillside Houses…

Please visit the link below for more information on an ordinance that could severely impact the value of homes in areas like the Pacific Palisades, Bel-Air, Brentwood and Sherman Oaks. After putting in a manzionization law in the flats of Los Angeles (you can’t build a home larger than 1/2 the size of your lot), this is the next step and in response to some hillside homes that were massively over-built.

In my opinion, this ordinance is unfair. They are proposing that home size regulations be 60% less than what they currently are. I think a more rational approach to this is having ordinances put in on a community/tract basis.

You should forward this to any friends or colleagues that own in the potentially affected areas. The goal of the regulators is to get something passed by early July. Activists’ believe that will probably get delayed but some type of regulation will happen by August. . .