Skinny On Real Estate

Notes on a Realtor’s Scorecard

– Mortgage Rates: The typical rate being offered this week for a 30-year fixed-rate home loan was unchanged at 5.07%, with borrowers paying 0.6% of the loan balance in upfront lender fees, Freddie Mac said Thursday.

– Existing-home sales (National), which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 6.8 percent to a seasonally adjusted annual rate of 5.35 million units in March from 5.01 million in February, and are 16.1 percent above the 4.61 million-unit level in March 2009.Total housing inventory at the end of March rose 1.5 percent to 3.58 million existing homes available for sale, which represents an 8.0-month supply at the current sales pace, down from an 8.5-month supply in February. A normal market has under 6 months of supply and excludes some substantial shadow inventory.

– Playa Vista: Steve Soboroff is stepping as chairman and chief executive of Playa Capital Co. LLC, the developer of the 1,000-acre Playa Vista community near Marina del Rey.

Management responsibilities now fall in the hands of Patti Sinclair and Randy Johnson. His decision follows the Los Angeles City Council’s April 6 approval of the second and final phase of the development. A legal challenge from project opponents is expected.

Sinclair and Johnson both said their focus will be on selling the land for the final phase to developers. The 111-acre site is entitled for 2,800 homes, a shopping center and office buildings.

Playa Capital is in talks with potential developers of the property, including Rick Caruso, developer of the Grove and other Los Angeles-area retail centers. Caruso was slated to build a shopping center at the site before a delay in the entitlement process killed the deal.

– Commercial Note: As expected, Westside vacancies are up and Class A asking rents are down to $3.81, off from $4.21 from a year ago. Rates for Class B space actually increased six cents to $3.06, but were off more than 15 percent from 2009’s first quarter. The bright spot is that at a 10.5% vacancy rate, West Los Angeles has the lowest vacancy rate in the country.

In comparison, Downtown’s Class A asking rent is about $3.27.

– SM Foreclosures: According to Foreclosure Radar, there are 211 properties in some stage of foreclosure in Santa Monica. The breakdown by zip code is as follows: 90401 (8), 90402 (26),90403 (52),90404 (61), 90405 (64)

**For the foreclosure numbers for your specific area, please e-mail us.

– A measure (SB 401) signed last week by Gov. Arnold Schwarzenegger waives state taxes on mortgage debt forgiven in a foreclosure or short sale

Borrowers are required to be owner-occupants of the principal residence, show financial hardship and have a first lien mortgage originated on or before Jan. 1, 2009 with a principal balance that does not exceed $729,750. In addition, the borrower’s total monthly mortgage payment must be greater than 31% of his or her monthly gross income.

Manhattan Beach Update

The pace of Single Family Residence (“SFR”) sales slowed down a bit in the first half of this month, with 7 homes going into escrow. For comparison, in the whole month of March, we saw 24 homes go into escrow.

Inventory has hit the market at about the same pace as March, with 14 new listings in the first part of April – March saw 27 for the whole month. Please note this is just a two week look at SFR sales. Total inventory moved up by 4 listings over the end of March to 85 SFRs total at mid-month. Still pretty lean in comparison to Westside area like Santa Monica and Pacific Palisades. The Sand and Tree sections each have 35 listings while the Hill checks in with 15.

(*sources: Manhattan Beach Confidential, MLS)

Quotes from Industry Leaders on the $1M+ Home Market

“The traditional market weak spot – homes in the $1 million-$2.5 million range – has come back to life,” said Tom Dunlap, general manager at Prudential California Realty in Beverly Hills. “There is a lot of cash parked on the sidelines and the price is coming down now to where people who have been watchful are coming off the sidelines.”

Leslie Appleton-Young, chief economist at the California Association of Realtors in Los Angeles, sees the movement in luxury homes as the next phase in the recovery of the housing market, which started its collapse as subprime loans soured. The problems took longer to reach affluent home buyers, who had enough assets and income to wait out the market. But now even the owners in swanky neighborhoods need to sell and have dropped their asking prices significantly, especially as job losses have taken their toll on all wage groups.

“You’re seeing values at the high end,” Appleton-Young said. “Also, the spread of foreclosures starting a year ago has affected the high end. You’re seeing more nondiscretionary sellers now than earlier in the recession.”

*Sources: Los Angeles Business Journal

750K and Below Market Update

For homes selling for less than $670,000 that qualify for Federal Housing Administration-backed loans are seeing multiple offers and are being overbid by as much as 10% in some cases due to a lack of inventory.

This week, I submitted an offer on behalf of my clients for a 3 bed/2 bath remodeled house in the Holly Glen/Del Aire area with a listing price of $569,000. The offer was well over asking with short contingency periods and my clients didn’t get the property. They received 8 offers and only 1 of them was under the asking price. Many of the buyers were putting over 30% down. This type of demand will continue unless inventory significantly picks up and liberal FHA loan terms remain in effect.

Notes on a Realtor’s Scorecard

(i.e.- weekly neighborhood notes, school info, random real estate news, etc):

*In the ritzy 90402 Santa Monica zip code, the cost of buying a home (based on a 20% downpayment and 5.5% interest rate) is about double the cost of renting. . .

*The Santa Monica City Council unanimously approved St. Monica’s development plan which includes adding a new 27,500 sq. ft. community center, 7,700 sq. ft. of new classrooms, three levels of subterranean parking and renovating the auditorium and athletic facilities. They hope to begin the project sometime next year and should take three to four years to complete. Please read more at www.smdp.com . This will be great for the community and help St. Monica’s schools continue to improve their academic reputation. However, this project combined with the California Incline project means serious traffic issues for North of Wilshire residents.

*Manhattan Beach’s sand dune hill (extremely popular with fitness enthusiasts and sports teams) will finally re-open but with restrictions requiring people to reserve online and expected to pay a $3-5 usage fee. The fee will be used to help maintain the area and it will also cut down on usage by 70% to appease the neighbors…don’t be surprised if a similar fee is enacted at the Santa Monica stairs in the next few years…fitness enthusiasts beware.

*Prudential Southern California had 1700 transactions in March which is the best March the company has had since 2005. In fact, the company is already profitable for the year, two months earlier than last year.

* Foreclosure Radar reports that notices of default (NODs) recorded in California for February amounted to 31,004, a jump of 20% from the 25,904 in January. Notice of trustee’s sales (NOTS) filed in February increased by 4% to 28,195, from 27,220 in January. Both the increases in NODs and NOTS reverse the three-month trend of decreases seen since the November cyclical slowdown in foreclosures at the end of each year.

A Day At An LA County Foreclosure Auction…

If you’ve never been to an L.A. County foreclosure auction, it’s a sobering experience. The auctioneer, who would identify himself only by his first name (could be a flashpoint to anyone bent on revenge), first reads off a ton of addresses and why those properties’ auctions were either postponed (mutual agreement was often the reason) or canceled (bankruptcy was a common cause). That leaves about 20 properties on the docket for the day’s auction. The scenario is repeated five days a week both in Pomona and at the county courthouse in Norwalk.

The auction has a start time of 10:00 or 10:30 a.m. but it’s more like 10:50/11:10 before the action begins due to the cancellations. The regulars bring collapsible canvas chairs and carry cashier’s checks to make their purchases. Some read books during the wait or make phone calls as the day doesn’t usually end until about 4 pm.

In the pecking order of the auction, the front row is usually reserved for registered bidders and the order of the auction is determined by the auctioneer.

In less than a minute, ownership of a property can revert back to the lender. Successful bidders must have cashier’s checks ready in the amount they are willing to pay for the property. Most seasoned veterans bring a cashier’s check for the minimum bid and cashier’s checks in smaller amounts up to the amount they are willing to pay for the properties they want.

You must have cash to purchase the property and you are buying it without the right to rescind. A buyer can really get burned if they do not know what they are doing and understand the neighborhood they are buying in. However, companies and individuals that specialize in these types of purchases can make out like a thief and turn a 50% profit in as little as three months. Quite a bit of homework must be done by the purchaser. Don’t think this is your typical auction…

*Sources: Los Angeles Business Journal and Dan Gura

Looking Back at the 1st Quarter of 2010

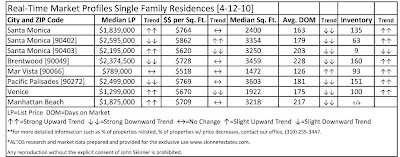

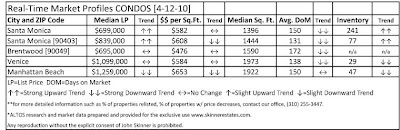

The first quarter of 2010 was the busiest 1st quarter in a long time for most of the Southern California market, especially the Westside and South Bay. As you can see from the numbers posted on this blog, activity is way up thanks to the convergence of three main factors:

1) Sellers pricing more realistically (at least 15% off market heights)

2) Low inventory

3) Low interest rates/fear of higher rates

Reminiscent of days in 2003-2006, we saw quick sales, multiple offers, cash buyers and people getting asking prices and beyond. The micro markets of the Westside/South Bay definitely did not match what was going on in other parts of the nation where sales were flat or down year-over-year. We are definitely seeing what the value of wonderful weather and having an international fascination with your city can do to stabilize housing prices.

What the Westside/South Bay saw in the first quarter did seem to be more typical of higher-end housing markets in several parts of the U.S., as reported by CNBC and others last week.

“People are not as uptight as they were a year ago,” says mortgage lending company exec Steve Habetz. “It seems as if they are more comfortable in thinking the high end housing market is not collapsing. Home values have stabilized and it’s been a matter of following the leader. One person sees others buy or sell and they join in. That’s been happening.”

Simply put, this confidence has created some stabilization in housing prices on the high end which has been struggling while other Westside/South Bay locales under a million dollars were recovering.

With realtors fielding quite a few calls from both sellers and buyers seriously inquiring about the market, activity should stay strong through the second quarter but the market will probably cool down some with the government beginning to quiet its involvement in the market (Federal Tax credit expires April 30th and no longer buying mortgage backed securities) and interest rates beginning to climb.

As the finance and economic blog Calculated Risk (I highly suggest book-marking this site- great source for constantly updated economic news) noted this Monday, a strong drop in refinancing’s is to be expected now: “With the yield on the Ten Year Treasury increasing to 4%, and the end of the Fed MBS purchase program last week, mortgage rates will probably rise and refinance activity will fall sharply.”

However, rates aren’t the only thing that drives the market. It might bring prices down but as long as the overall economy continues to recover, the market will probably not see a major double dip which some economists are predicting…Who knows, if I had a crystal ball I wouldn’t be writing this blog right now and would be playing golf at Pebble Beach:)

Remember, if you are thinking of buying or selling real estate you should call our office. More than ever it is important that you align yourself with a real estate professional that is trustworthy, hard working, covers the details and truly understands the market. We pride ourselves on exactly that.

LAUSD Rescinds Permit Change For Now

Some 12,000 students and panicked parents won a reprieve on Tuesday when Los Angeles schools Supt. Ramon C. Cortines said most students who attend schools outside of the district can continue to do so next year, a retreat from a recent, more restrictive policy that provoked an outcry from parents, other school districts and some members of his own Board of Education.

But whether students who live in the Los Angeles Unified School District will be allowed to continue to attend schools elsewhere after the 2010-11 school year remains unresolved. Cortines said he expects to return to the board in September with a new policy.

Last year, L.A. Unified released more than 12,200 students to 99 other Southern California school districts, including 945 to Beverly Hills, over 700 to Santa Monica, 1,700 to Torrance, 1,400 to Culver City and 1,400 to Las Virgenes.

Please see full articles below:

Daily Breeze

LA Times