Skinny On Real Estate

Mortgage Rates reach seven year highs – 20% increase over last year

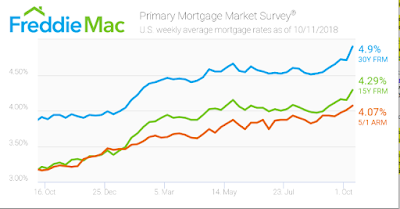

After weeks of climbing, mortgage rates have now risen to their highest level in seven years According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.9% for the week ending Oct. 11, 2018, increasing from 4.71% last week, and significantly higher than last year’s rate of 3.91%.

An initial mortgage payment on a $1M loan at last year’s rate of 3.91% was 4,721.41. The same initial payment at 4.9% is 5,307.21, an increase of over 20% at $600.00 per month or $7,200.00 over the course of a year.

The 15-year FRM averaged 4.29% this week, moving forward from last week’s 4.15%. This time last year, the 15-year FRM was 3.21%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.07% this week, moderately increasing from 4.01% last week. This is substantially higher than this time last year when it averaged 3.16%.

Sources- Housing Wire

Los Angeles Residents- Get to the polls- Vote NO on Proposition 10

What homeowners and investors need to know about Prop 10-

Prop 10: Repeals Costa Hawkins Rental Housing Act, which limits municipal rent-control ordinances. California suffers from a significant shortage of housing. In studies conducted by UC Berkeley, rental control has been shown to provide disincentives for new housing developments and also causes more units to become owner occupied which, in turn, reduces the number of units available for renters.

Prop 10 would make each city in California go through the process of passing new legislation before the repeal would have any effect.

California’s affordability crisis is a direct result of undersupply of housing. Addressing the underlying reasons for the high cost of housing would better serve Californians.

For a very thorough economic analysis on why this could possibly be the worst approach to California’s housing crisis, CLICK HERE.

Purple Line to extend to UCLA by 2028 – Long-term positive for real estate

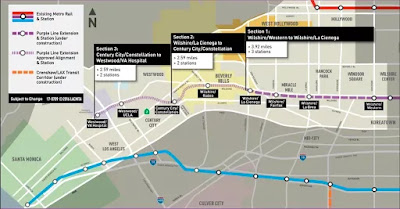

The Purple Line which currently only reaches Koreatown from Union Station, is being extended along Wilshire Blvd. The extension will bring the rail line 9 miles further west to the border of Westwood and Brentwood (see map below). The construction currently underway includes plans for stations at LA Brea Ave., Fairfax Ave., La Cienega Blvd. and Rodeo Dr. before shifting south towards Constellation Blvd. and Avenue of the Stars in Century City. It will then move north for the final two stops at UCLA and the Veterans Affairs Hospital.

The project, which began in 2014, is expected to be partially open to riders by 2023. With final sections opened before the Olympics in 2028. When complete the ride form the VA Hospital to Union Station will take 28 minutes.

Source- LACURBED- full article–

Also, here is a link to an article about Beverly Hills High students protesting since the subway will travel underneath the school.

(click on map to enlarge)

Pre-Market opportunities you should know about

We will be bringing the following properties to market in the next month-

Renovated 3+3, 1800+ sq. ft. Brentwood Condo- LP- Not established (high 900K range?): Centrally located in the heart of Brentwood, this Montana Avenue (just east of Barrington) condo is currently being renovated and should be ready by the end of September/Early October.

*We have two West Los Angeles Condos (2 bed/2 bath, aprox. 1,800 sq. ft.) located just south of Santa Monica Blvd. between Bundy and Barrington that are tentatively scheduled to come to market by early October and the price range for both will be in the $1M-1.1M range. Please reach out to us directly for more detailed information on any of these properties!

Thoughts on the current Westside market and what to expect in 2019

As I stated above, according to various title services, volume is down about 13-15%. We have definitely experienced some market softening with condos at all levels and single family homes above $3M. We have seen a little price depreciation but the softening is more along the lines of a normalizing market. Multiple offers are still common but not as plentiful. The entry and mid-level price points per neighborhood are still appreciating but not at the clip we have seen the past five years.

We are definitely at the end of a summer lull. Some colleagues feel this is a sign for a depreciating 2019 market and when you combine that with lower sales volume throughout the year, they have a point. However, we had a very slow July/August period the past two years and saw things pick up nicely in September and October and frankly, inventory has been dreadful since the beginning of this summer. We have buyers who are ready to go but they have very few properties to choose from.

Silicon Beach is continuing to grow at a very strong pace (ex: Google is in the process of purchasing the Westside Pavilion) providing plenty of high paying jobs; the stock market is still on a bull run and a day does not go by that I do not receive e-mails from agents looking for pocket listings.

Overall, I am expecting things to pick-up again over the next few months (many people are waiting to put their properties on the market after Labor Day weekend). 2019 should be stronger from a volume perspective and most economic forecasts call for a 5% appreciation in home values next year. If interest rates continue to float around the 4.5% mark, I agree with this assessment. However, if rates get to around 5%, I believe we will see a potential decline in values across all price ranges. Mortgage rates will have increased almost 25% in just two years. When you combine that with losing the ability to write-off your property taxes above the standard $10,000 deduction provided, it creates an affordability issue for most buyers.

Compass acquires Pacific Union – could the MLS become antiquated?

As little as two years ago, top independent brokerages such as Partners Trust, The Agency, Teles Properties, John Aaroe and Gibson International were big-time players when it came to residential real estate on the Westside. In 2017, the sale of Teles properties to Douglas Elliman and Partners Trust, John Aaroe and Gibson International being acquired by Pacific Union, signaled an end to those days.

In less than one year, the Amazon effect is hitting the residential real estate world. It was officially announced this week that Compass has bought Pacific Union, the third largest brokerage in California. Compass seems to have every intention (thanks in part to a $450M investment from SoftBank) to become one of, if not, the largest national brokerages and take the lead in a war that is developing between full-service/traditional brokers and industry disruptors like Zillow, Purple Bricks and Redfin. In the next few years, it would not be surprising to see the major full-service brokerages creating their own platforms outside of the the Multiple Listing Service. One way or another, CHANGE is coming.

Acquisition part II– It is personally frustrating to have three different company names in a one-year period while sitting in the same office in Brentwood. I saw this same industry consolidation happen around 2008, right before the last real estate downturn. With sales volume currently down about 13-15% for the year on the Westside, the economics are definitely tougher for brokerages right now.

However, it is sad to see the strong independents go away. Most of them were made up of strong and ethical agents that do things the right way and are appreciated by clients. It was nice to walk down the hall and grab the president when you needed something. We held ourselves to a higher standard and I truly hope that Compass can continue that. I hear very good things about them and like many of the agents I already know at the company…we shall see.

Articles on Acquisition-

Compass Acquires Pacific Union

Compass and Pacific Union CEO’s weigh-in on their mega real-estate merger

Quick-hitting real estate info you should know

*Jet traffic is down almost 85% since the Santa Monica Airport shortened its runway earlier this year…property owners in South Santa Monica and Mar Vista are definitely enjoying that.

* Mid-City is now a million-dollar neighborhood, with a median price point of $1,065,000

* More price reductions compared with last July were recorded in areas with a larger share of homes priced between $2 million and $3 million: Malibu, Silicon Beach, the Hollywood Hills, and Brentwood.

*With an average of $4,883 per month, the 90024 zip code of Westwood, ranked as the third-most expensive place to rent in the country, according to a new analysis by RentCafe. Westwood ranked higher then San Francisco!

*Nationwide home sales volume has dropped for seven straight months. The Western U.S. saw the biggest year-over-year dip by dropping 5.8%. The national association of realtors points to an over-heated housing market in which perspective buyers are just unable to afford homes and a ceiling of pricing could be developing…

*The value of all residential real estate in New York City is equivalent to the gross domestic product of France!

*More than 1/3 of the country’s $28.4 trillion in resi real estate is concentrated in ten American cities…New York and Los Angeles top the list, though Los Angeles is a distant 2nd

30-Year rates holding steady around 4.50%

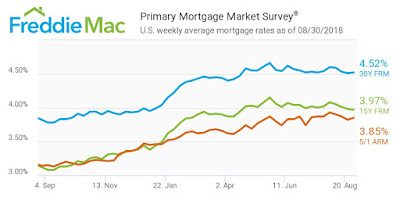

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.52% for the week ending Aug. 30, 2018, increasing from 4.51% last week, and is still a substantial increase from last year’s rate of 3.82%.

The 15-year FRM averaged 3.97 this week, down from last week’s 3.98%. This time last year, the 15-year FRM was 3.12%.

Source: Housing Wire

Skinny’s notes on the market

*Though overall sales numbers were up slightly in the first quarter of 2018 in comparison to last year’s first quarter, we definitely get the sense it was a slow start to the year for most Westside realtors. Things have really picked up in the second quarter but escrow closings are down around 7% compared to last May and inventory is starting to creep up across most price ranges. The majority of buyers are no longer jumping at everything that is on the market and not going after properties unless they feel the pricing is around the true market value. The market is still appreciating and in the seller’s favor with 47% of the listed homes that have sold in LA, selling over the asking price and homes selling at a faster pace than last year, yet the tempo does not feel similar to what we have been used to the past seven years. The one exception to this is the entry point market for zip codes which are still very hot.

*The major Chinese investment in single family housing that we saw between 2012-2016 has definitely died down. (article)— However, that void is being filled by an uptick in Middle Eastern wealth investing on the Westside as well as wealthy Westside families not afraid to purchase multiple homes in upscale neighborhoods either as homes for children or rentals. The explosion of wealth in the tech industry as silicon beach expands, is another key element.

*Based on what we have heard from multiple economists and what we are hearing from our buyers, we expect the Westside market to continue to appreciate at moderate levels through 2019. The new California tax reforms combined with increasing interest rates will start to stall out market momentum once people start feeling the tax hit in April of 2019. Pacific Union believes the market will power through that and not face much resistance till the end of 2020.

*The older single-story home in a great neighborhood might not be the tear-down everyone thinks it is. We have quite a few 60 year-old+ buyers out there that are looking to downsize from their bigger family homes. With amazing weather and all their social connections Los Angeles has to offer, those reaching the golden years want to stay put but prefer a stylish one-level home. The key in development is adding square footage and maximizing a lot’s value but it should be noted that a serious premium will be paid by this type of a buyer for a luxurious one-story in some LA’s priciest locations.

*According to a Redfin Survey, just 6% of Homebuyers would cancel plans to buy if mortgage rates surpassed 5%. 27% say it would cause them to slow the search for a home and 25% said it would have no impact and 21% would increase their urgency in finding a home. This was a national survey of more than 4,000 people. Another key takeaway is that in California, the tax reform and how it impacted taxes was the biggest concern.

* The median rental price for a one-bedroom apartment in the Marina del Rey/Playa Vista neighborhoods, was $2,900 this February, up 15 percent from 2015, according to Zumper.

Inside Dirt- 511 9th Street sells for almost $600K over asking– This 2+2 Spanish Hacienda with detached studio on a 7,500 lot hit the market for $2.895M. The house was a major fixer but has a nice charming feel. The $2.895M list price felt light. The market agreed. They received 16 offers and the vast majority of them were end-users. After a round of counters, it sold for $3.450M with strong rumors of back-up offers near $3.50M. The winner of the multiple apparently did a phenomenal job of standing out as the right buyer for the property in more ways than just price. Presentation matters!!

Pacific Union International Launches Private View – the ultimate online real estate marketplace

Private View, is the industry’s first online marketplace designed for both buyers and sellers to privately view exclusively-signed listings before they are widely marketed to the public. The platform launched in Southern California in late May, and will go live in Northern California this summer. The homes on Private View are not found on the MLS, Redfin or Zillow.

“With Private View, Pacific Union is building a revolutionary way for both the public and real estate professionals to view new listings long before they appear on the mainstream public listing services,” Pacific Union International CEO Mark A. McLaughlin says. “In essence, this creates a futures market for new listings, and with Pacific Union’s substantial market share in our respective markets. It gives our real estate professionals and their clients a powerful edge.”

Private View currently consists of 48 properties equaling close to $170 million in volume.

Check it out: