Skinny On Real Estate

How the Wine Country wild fires will affect its housing market

Even though this article has nothing to do with Westside real estate, we thought it would be good to share with you an economist outlook on the future of wine country after being devastated by one of the largest wildfires in California history, destroying 5,700 structures, charring 245,000 acres and ultimately claiming 41 lives.

It is nice to see a positive outlook coming out of such a heartbreaking event. Article: How the Wine Country wild fires will affect its housing market

*Update- Judge clears way for SM Airport runway reduction after court order had delayed it

After an abrupt turn of events and then a reversal, the City is back on track with plans to shorten the runway at Santa Monica Airport from nearly 5,000 feet to 3,500. A last-minute attempt by two local pilots to stall the project only managed to delay plans for a week – the City says construction will begin this week.

Check out the Santa Monica Daily Press article here- Judge clears way for runway reduction

Earlier this month-

For those South Santa Monica and north Mar Vista residents that were eagerly anticipating the runway reduction at the Santa Monica Airport, you are going to have to wait a little bit longer. A federal court has issued a temporary restraining order preventing the City of Santa Monica from pursuing the project. City Hall plans to remove 1,500 feet of runway in an attempt to discourage jet flights and the first phase of the project was set to begin on October 18th.

Check out the Santa Monica Daily Press article here- Court order delays runway reduction

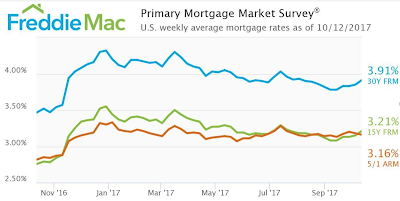

Mortgage rates increase for the second week in a row

Mortgage rates increased once again, edging closer to the psychologically important 4% mark, according to Freddie Mac’s latest Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage increased to an average 3.91% for the week ending October 12, 2017. This is up from last week’s 3.85%. Last year at this time, the 30-year mortgage interest rate was 3.47%.

The 15-year FRM increased to 3.21% this week, up from 3.15% last week and from 2.76% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage, however, decreased to 3.16%. This is down from 3.18% last week but up from 2.82% last year.

Source- Freddie Mac and Housingwire

Preparing your home for an earthquake – Get it done!

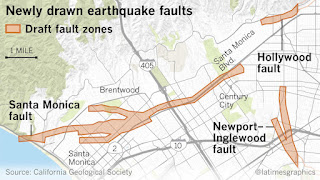

If you find yourself feeling tense about California’s San Andreas Fault, you’re not alone. The 3.6 magnitude earthquake that struck near Westwood Village earlier this month, followed by the devastating 7.1 earthquake in Mexico, has brought the issue of natural disasters closer to home for all of us. In a matter of seconds, one’s entire world can be turned upside-down, yet in just a matter of minutes, one can also take thoughtful actions to becoming the most quake-ready household on the block. Here are steps that you can take before an earthquake strikes.

One piece of uplifting information is that in recent years, Los Angeles and several other cities have required retrofitting of buildings that experts say are most vulnerable to collapsing in a major quake. It would be wise to take the same precautions by inquiring whether your home needs a retrofit—i.e. being bolted to the foundation so that it doesn’t slide off in an earthquake.

You can also consider earthquake insurance, which can give homeowners (and renters) the ability to have funds to repair their homes quickly after a massive disaster.

A simple action that you can do right now is go to your nearest hardware store and find the tools you need to strap or secure objects to the walls or floors that they rest on. Securing objects in and around the house will help limit property damage and reduce the risk of injury to you and your family. That means strapping bookshelves to the wall, televisions to their stands, and even microwaves onto the countertops. Don’t forget about your gas heater! You can also install safety latches on kitchen cabinets to keep blenders and plates from toppling on you during a quake.

Preventative Measures that can Save your Life

*Keep stored wine low to the ground—or in wooden boxes—as opposed to displayed up high.

*Affix a safety film to windows that will leave shattered glass in its place.

*Have a fire extinguisher (or two) on hand and keep them far away from the stove.

*Portable battery packs and emergency plug-in lights are extremely useful in an extended power outage.

*Keep the tank in your car three-quarters full as gas stations require power to pump gasoline.

*Don’t rely on data to navigate you around town post-quake…download maps of your city for reference now.

*Have cash on hand—ATMs won’t work without electricity.

*Tie a pair of sneakers together and store underneath your bed so that you can walk to safety after the earthquake.

Earthquake Kit

Lastly, experts highly suggest that each household prepare an earthquake kit. You can also make an additional kit to keep in your car and at your place of work for extra peace of mind. Place your stash on a shelf that’s easily accessible, and don’t forget about your pets! Pack food, water, medicine and anything else you’d need for at least 72 hours, but several weeks is a better bet. Key things to buy: canned proteins like fish (don’t forget the can opener), chicken or beans; canned fruit (which has sugar); and peanut butter. Don’t forget about replacing water jugs; they can degrade over time and leak.

During an Earthquake

If you find yourself experiencing an earthquake, take heed of this expert advice: Drop, Cover, and Hold On—always. Cover your head and neck with your hands and try to position yourself underneath a table to avoid being in a vulnerable position where something could fall and injure you. If you live near the shore, and severe shaking lasts 20 seconds or more, head to high ground in case a tsunami has been generated. Move inland two miles or to land that is 100 feet above sea level and don’t get in your car—start walking.

Source: Partners Trust Blog

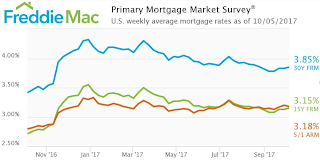

Mortgage rates continue upward trend

The 30-year fixed rate mortgage increased to 3.85% for the week ending October 5, 2017. This is up from last week when mortgage rates held steady at 3.83%, and from last year’s 3.42%.

The 15-year FRM also increase two percentage points from 3.13% last week to 3.15%. This is up from 3.72% last year.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage decreased slightly to 3.18%, down from 3.2% last week but up from 2.8% last year.

Source: Housing Wire

New Santa Monica listing- 954 20th Street #A- 2 bed/2.5 bath + den, 1,700 sq. ft. $1.449M – Open Sunday 2-5

Don’t miss an excellent opportunity to live in a truly charming, 1700+ sq.ft., north-of-Wilshire townhouse! This front-facing, 2-bdrm, 2.5-bath unit features an inviting living room with a high ceiling, gas fireplace and access to a patio; a large dining area overlooking the living room; a separate den/office; an eat-in kitchen; and a spacious master suite with a walk-in closet and a beautifully remodeled bathroom. Additional highlights include attractive hardwood floors, abundant light and volume, direct access from the private 2-car garage with plenty of storage, and only one common wall elevation. Monthly HOA dues of $425 include earthquake insurance. The coveted location is within the Franklin and Lincoln school boundaries, and affords easy access to shops and restaurants on Montana Avenue and Wilshire Boulevard.Please contact us if you would like more information or to schedule a showing.

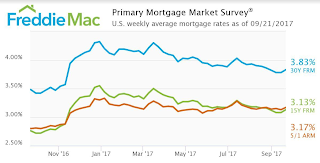

Mortgage rates increase for the first time in two months

Mortgage rates increased for the first time after two months of straight declines, according to the latest Primary Mortgage Market Survey from Freddie Mac.

The 30-year fixed-rate mortgage increased to an average 3.83% for the week ending September 21, 2017. This is up from last week’s 3.78% and from 3.48% last year.

The 15-year FRM also increased, rising from 3.08% last week and 2.76% last year to hit 3.13% this week.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.17%, up from 3.13% last week and 2.8% last year.

Source- Housing Wire

LA Times neighborhood spotlight- Cheviot Hills

Cheviot Hills is a highly sought after Westside community with a centralized location that is very popular with those that work in Century City and even Downtown LA. It has the perfect mix of great elementary schools and a diverse range of housing options. Check it out-Neighborhood spotlight- Cheviot Hills

A look at the pace of job creation and growth in California and L.A. County

The California economy started 2017 on a high note, yet how has the state—and Los Angeles in particular—been performing in more recent months?

Here to report on the subject is Partners Trust’s Chief Economist and Vice President of Business Intelligence, Selma Hepp. In Hepp’s latest Economic Straight Talk analysis, she points out that over the last 12 months, California has added about 265,000 jobs, which is a 1.8 percent increase and still outpaces the national growth rate of 1.4 percent.

Nevertheless, as this year’s numbers have indicated so far, overall job growth and creation has slowed from previous years. Regarding California’s unemployment rate, Hepp reports that the state has incurred a slight increase to 5.1 percent in August, which is largely due to a sizable addition to the labor force of 31,600 new workers. This is the largest monthly increase in the labor force since the spring of 2010. Sectors that lost jobs include leisure and hospitality, while sectors that gained jobs include services—which encompasses personal-care services and equipment and machinery care—manufacturing, retail, trade, and healthcare.

When focusing on Los Angeles County specifically, Hepp notes that L.A. has added 8,300 jobs with the largest increase occurring in the government sector. Professional and business services saw notable gains, as well as job additions in the trade, transportation, and utilities. The information sector also posted a strong increase. Similar to other metro areas, Los Angeles’ leisure and hospitality industry posted the largest month-over-decline, with 67 percent of the decrease in accommodations and food services.

Source- Partners Trust Blog